|

Falling Home Prices? More like Rising Affordability

Having a house is pretty important. Not only for, like, you know, a place to sleep and everything, but for most Americans, their home is their largest and most important financial asset.

Anticipated price appreciation and the ability to borrow against it make housing a pretty damn important industry in this country.

But now, some experts are warning of a 20% nationwide drop in home values. The last time something like that happened? Well, let’s just say they made a movie about it.

Let’s backtrack. Since the pandemic emerged, U.S. home values saw an increase of nearly 45% in just over 2-years. For context, that’s generally how much home values increase in more than a decade. To say this market has performed anomalously since 2020 is the understatement of the century.

But now, with the tide of rising interest rates set to slowly crash over U.S. housing, most experts anticipate a fall in home prices and a drastic one at that.

According to Ben Carlson at A Wealth of Common Sense, only three other times since 1987 has the index for national home prices (the Case-Shiller Index) fallen on a year-over-year basis. The first was seen in the early 1990s. For the second and third, please see the above-referenced movie.

If, in 2021, you predicted home prices might just mill about at these rooftop levels, people probably would’ve said, “yeah, that’s a fair take.” But, in 2022, if you were to make that claim in the face of 6-7% mortgage rates, you’d be forced to surrender your degree and maybe even your high school diploma.

Already since June, we’ve seen a nearly 3% drop in the Case-Shiller U.S. home price index. With rising rates, this is expected. As you have to pay marginally higher rates on any given asset, the principal value of that asset will fall in tandem, reflecting decreasing demand in the face of rising interest payments.

This decline is likely to continue in 2023. Rates look poised solely to continue to rise, and home prices will fall alongside. But given starkly superior credit profiles of buyers and stronger balance sheets at banks and homebuilders, don’t be calling yourself the next Michael Burry just yet.

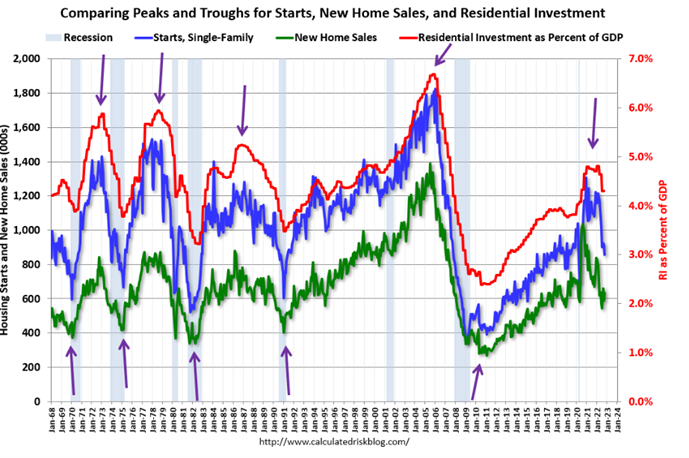

But downturns in housing have historically been a leading indicator for overall economic downturns. Housing is about as sensitive to macro elements like rates, supply chains, inventory levels, and a whole lot more as they get. Just take a look at this:

Source

Now, to wrap up: all of this may seem scary. Since 2008, any whisper of falling home prices sends traders up in arms. But most of you out there are hella young and still in college. This could be a great sign for you, as falling home prices simply mean greater affordability for buyers. The question of if sellers will be willing to meet that demand is a valid one, but people gotta move, and builders gotta sell, eventually.

|

Eos voluptatem sit asperiores illo aut delectus et. Sequi consequuntur quae sed quo qui expedita recusandae. Nam dolorem voluptatem vitae deleniti voluptatem.

Non fugit velit iusto magnam modi et. Et ipsum aut porro harum facere. Illo corporis voluptas quia iste qui consequuntur sed.

Rerum nihil dolorum odit. Aut et sunt tenetur aliquid. Facilis est consequatur rem ut minima et non. Aperiam omnis reprehenderit perspiciatis rerum. Suscipit quo quae et autem omnis nam qui. Quos vitae modi aut provident omnis dolor qui id. In rerum quam voluptatem.

Excepturi consequatur ipsa deleniti perspiciatis alias similique. Laboriosam dolores occaecati quae cum quia placeat qui temporibus. Est mollitia tempora sed veritatis qui sint minus neque. Atque eligendi deleniti delectus. Quo suscipit quis labore nostrum. Temporibus et vel ut quae nihil deserunt.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...