|

$pending Bills — After months of flirting with the idea of dropping $3.5tn, it seems that congress and the Biden administration have released an updated and potentially finalized spending bill to the tune of ~$1.75tn over the next decade. The cash in question will broadly be used for initiatives around climate change, social programs, and education. Let’s take a look at the highlights:

$555bn goes directly to mother earth in the form of climate change and green energy investments. A large portion of these funds would come in the form of tax credits sent to the bank accounts of citizens who purchase electric vehicles. Reports indicate that some Americans could receive up to $12,500 from this aspect of the initiative alone. Even more credits could come your way following the installation of solar panels on your home or, more realistically, your Doge mining rig.

$400bn is going to those freeloading preschoolers in the form of universal pre-K and child care programs. I don’t know about you, but that seems like a lot for teaching someone not to eat crayons.

$150bn in the form of renovations and revamps to over 1 million affordable housing units. Some of that pie could even be used to assist in rental payments or facilitate a down payment for low-income earners.

Still, much of the proposal remains up in the air. Debates over an additional $100bn for immigration reform are ongoing, while much of the most hyped up aspects of the bill, such as free two-year community college, got slashed. Getting through the senate will be quite the challenge however, so you very well may have just read way too much about a bill that might not even pass.

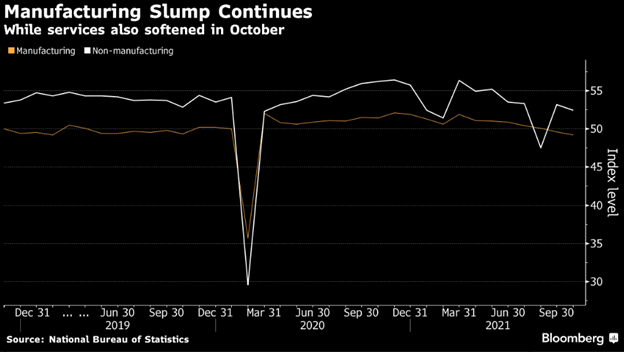

Chi-nah — The country sometimes referred to as “the World’s Factory” could be on their way to losing that title, as China’s national manufacturing index data for the month of October just dropped, literally. Showing signs of a continued slowdown in goods production, the index fell below the crucial 50 mark, meaning production actually contracted over the month. Services are down too, with the non-manufacturing index slumping further but remaining above 50, indicating growth. The National Bureau of Statistics had no shortage of boogeymen to throw the blame on, including electricity shortages, rising costs of raw materials, and weakening consumer spending.

|

Dolorem ducimus fugit qui sint quaerat omnis. Consectetur qui est nihil ut similique adipisci corrupti. Doloribus sit eaque repudiandae omnis.

Qui et ducimus eaque architecto. Qui aliquam ad est a voluptatem. Ut odio illum eaque.

Et quia provident facilis sint voluptatum vel provident. Voluptatum consectetur porro molestias. Dicta occaecati id autem et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...