Thought Banana

Ideas Change the World — It might sound like the team at the Peel is pessimistic about the state of the economy and the macro forces that are affecting our portfolios and our bank accounts. This isn’t necessarily the case. We just like to peel it as it is.

You might think my statements on prices only going up are full of sh*t. I contend that I’m not wrong because if you were right, you’d have my job. Read a book: prices historically tend to rise over time.

One exception to this trend is with advanced technologies. As tech proliferates into new markets or to new user groups, supply chains become more established, manufacturing gets cheaper because of the benefits of economies of scale, and technology progression makes tech cheaper, usually acting as a rising tide for all goods that include some common component or type of functionality.

A great example of this is the Apple II personal computer. Introduced in 1977, this bad boy retailed on the low end for $1298. In today’s dollars, that’s almost six grand.

The Apple II was self-contained. It housed its own electronics, keyboard, power supply, and memory. It was an engineering marvel for its time. Over its 16-year lifetime, the Apple II ended up in the hands of more than 16 million consumers.

Now consider the iPhone that you probably have in your pocket (sorry, no green bubbles, please). Compared to the Apple II, it:

- Has more memory, storage, and compute horsepower

- Grants you access to the internet

- Gets you connectivity to unlimited apps in an applications store

- Has a handful of cameras with more functionality than you probably need

- Makes phone calls over cellular and wireless

- Sends both SMS-based and IP-based text messages

- Has all the functionality of the original iPod, a device that debuted in 2001 and retailed for $650 in today’s dollars

The Apple II comes up short in so many categories compared to today’s iPhone. In real terms, it cost 5x the cost of Steve Jobs’ most prolific invention. Then why was it such a game-changer for the world of consumer electronics?

The Apple II started a personal computing revolution. That’s why. While the Apple II didn’t give you immediate, unfettered access to millions of hours of p*rn like your smartphone does, it brought something both novel and useful to the everyday consumer rather than just software developers, businesses, or computer nerds.

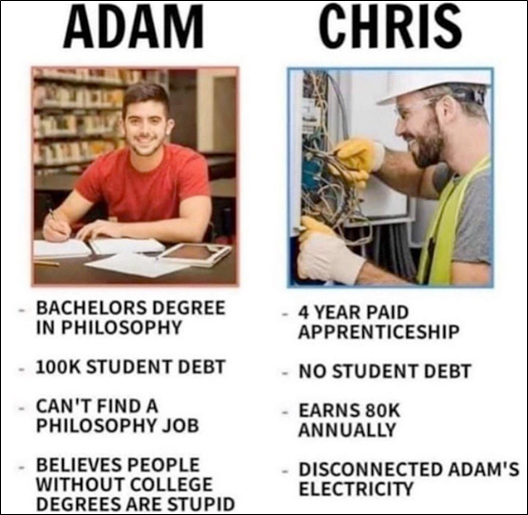

The first time you do something that is novel and complex, it’s really expensive. This is why the Apple II cost a sh*tload of money. But over time, these ideas proliferate and change our lives.

Innovation and the advancement of novel concepts and ideas help make products cheaper and better for the consumer. For every tech sector for the last 25 years, except cable, TV, and radio service (these are cartels!), prices have gone down while product quality has gone through the roof by whichever metric you pick.

Smartphones are more reliable. Gone are the days of putting your newly bricked iPhone in a bag of rice.

TVs are more capable. Now you can really see the blackheads on your favorite trash reality star’s nose. Looking at you, Mark Moran of FBoy Island.

Quality is now, well, higher quality. 1080p, fifth-generation, high refresh rate, digital surround sound, high bandwidth, low latency… these used to be selling points of new products. Now, you probably wouldn’t consider a product without them.

Ideas change the world, particularly the ones that make your everyday life a little bit better. Here’s to hoping that the next generation of innovators and idealogues provide society with something that makes an everyday staple cheaper and more accessible.

|

Dolorum molestiae distinctio quas quo veniam qui impedit. Fuga eius atque officiis suscipit modi. Molestias repellat aperiam atque laboriosam illo molestias quo.

Alias in enim sunt in. Unde temporibus sint eligendi voluptatem. Vel vel et aut soluta.

Reprehenderit ut eveniet qui corrupti. Qui quia corrupti itaque aspernatur autem asperiores aut. Harum cumque doloremque et quis sunt non. Omnis eum harum ut non eos doloribus officiis. Qui quia aut porro quia rerum velit. Asperiores sapiente dicta necessitatibus amet odio tenetur fugiat.

Consequatur voluptas quis reiciendis maiores quaerat nostrum repellendus. Voluptatum a similique veniam voluptatibus aperiam sint voluptatem. Qui voluptatem quo est eos est sapiente. Et sed necessitatibus laudantium asperiores debitis est quia.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...