Neumann out

MARKETS

- U.S. economy: Consumer sentiment for September came in under expectations, with trade and oil market issues likely to blame.

- Trade: President Trump had strong words for China at the UN General Assembly, saying he won’t accept a “bad deal" on trade.

- Bitcoin: The cryptocurrency was not prepared for summer to end and dropped below $8,000—its lowest level since June.

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

STARTUP

Neumann’s no Longer a Royal We

Adam Neumann is stepping down as CEO of The We Company, the parent of WeWork. He’ll remain with the office rental company as non-executive chairman, aka a pilot who doesn’t get to touch the controls.

The main instigator: Masayoshi Son, CEO of major WeWork investor SoftBank.

- Masa was gaga over Neumann as recently as this January, when he plugged $2 billion into WeWork at a $47 billion valuation.

But WeWork aged as gracefully into fall as the New York Mets

As it prepared for a monster IPO this summer, WeWork filed regulatory documents that left people who write words for a living “at a loss for words.” Convoluted financials, incomprehensible corporate governance structures, billions of dollars in losses...it’s all there.

As Masa and other investors watched WeWork slash its valuation from $47 billion to $15 billion to salvage the IPO, their collective blood pressure climbed. When WeWork delayed its public offering last week, they’d had enough.

First there was Adam, then came We

Neumann co-founded WeWork in 2010, and with the right mix of charisma, capital, and shrewdness, he turned it into one of the most valuable startups in the country.

- Don’t forget how big WeWork is. Last September, the company topped JPMorgan to become the largest tenant of office space in Manhattan.

- WeWork has over 800 locations in cities as far-flung as Xi’An, China, and Columbus, Ohio.

But unflattering media reports in recent weeks showed that Neumann's eccentric leadership style and cozy financial relationship with the company had turned WeWork’s IPO radioactive on Wall St.

Where does WeWork go from here?

CFO Artie Minson and Vice Chairman Sebastian Gunningham will take over as co-CEOs, but don’t expect them to ring the bell at the Nasdaq this morning. Heavy job cuts could be on the horizon, and WeWork has a long way to go to resolve its governance, financial, and reputational issues.

POLITICS

Pelosi Says It’s Go Time

Speaker Nancy Pelosi announced yesterday that the U.S. House of Representatives will begin a formal impeachment investigation into President Trump.

There have been impeachment rumblings in the past. But last week, reports surfaced (courtesy of a whistleblower) that Trump allegedly pressured the president of Ukraine to investigate presidential rival Joe Biden and his son. The accusation that Trump tried to enlist a foreign power for his own political benefit changed the impeachment equation.

Markets dipped early in the day, then recovered a bit after Trump said he plans to release a transcript of his call with the Ukrainian president today. Still, the S&P had its biggest one-day drop since August from all the political uncertainty.

Looking ahead...Rep. Adam Schiff, chairman of the House Intelligence Committee, tweeted that the whistleblower intends to testify, possibly as soon as this week.

BIZ LAW

Two U.S. Firms Escape Europe With Legal Victories

It won’t make up for the 2018 Ryder Cup, but...

No. 1: Google

Europe’s top court ruled yesterday that Google doesn’t have to extend the “right to be forgotten” outside the EU. That right = the ability to request that search engines remove personal information that’s outdated, false, or reputationally damaging.

- France’s privacy regulator pushed Google to apply it globally, but Google has said it’s not that easy because the tool lies at the delicate intersection of privacy and freedom of speech.

After years of regulatory probes in Europe, Google’s lawyers are just happy to have gotten a W.

No. 2: Starbucks

The court also ruled in Starbucks’s favor yesterday in a tax case. In 2015, the company and the Dutch government got into hot water over a cozy deal the European Commission ruled as illegal state support. The court said there wasn’t proof Starbucks got a leg up.

- But...the same court is making Fiat pay Luxembourg ~30 million euros in a similar tax case.

- Nike and Ikea are facing ongoing tax investigations in Europe and probably wondering if they’ll get the Bucks or the boot treatment.

LABOR

U.S. Labor Department Raises the Roof

Yesterday, the U.S. Department of Labor announced it had finalized a new rule on overtime pay.

What it does: Expands the pool of workers eligible for at least time-and-a-half overtime pay, from those who make under $23,660 per year to workers who make less than $35,568 per year.

- Because of the new rule, an estimated 1.2 million workers will qualify for overtime.

That’s great, right? Depends on who you ask. Some labor advocates were disappointed the department didn’t raise the ceiling more.

It’s hard to accept a Grande when you were offered a Venti. In 2016, the Obama administration tried to jack the salary ceiling up to $47,476. But later that year, a federal judge blocked the move following legal challenges from 21 states and over 50 business groups.

- Their counter-counterpoint was that Obama’s proposed rule would have been too costly for firms.

Zoom out: Consider this acting Labor Secretary Patrick Pizzella’s parting shot. Yesterday, a Senate committee narrowly voted to advance the nomination of Eugene Scalia to helm the DOL.

TRANSPORTATION

TRANSPORTATION

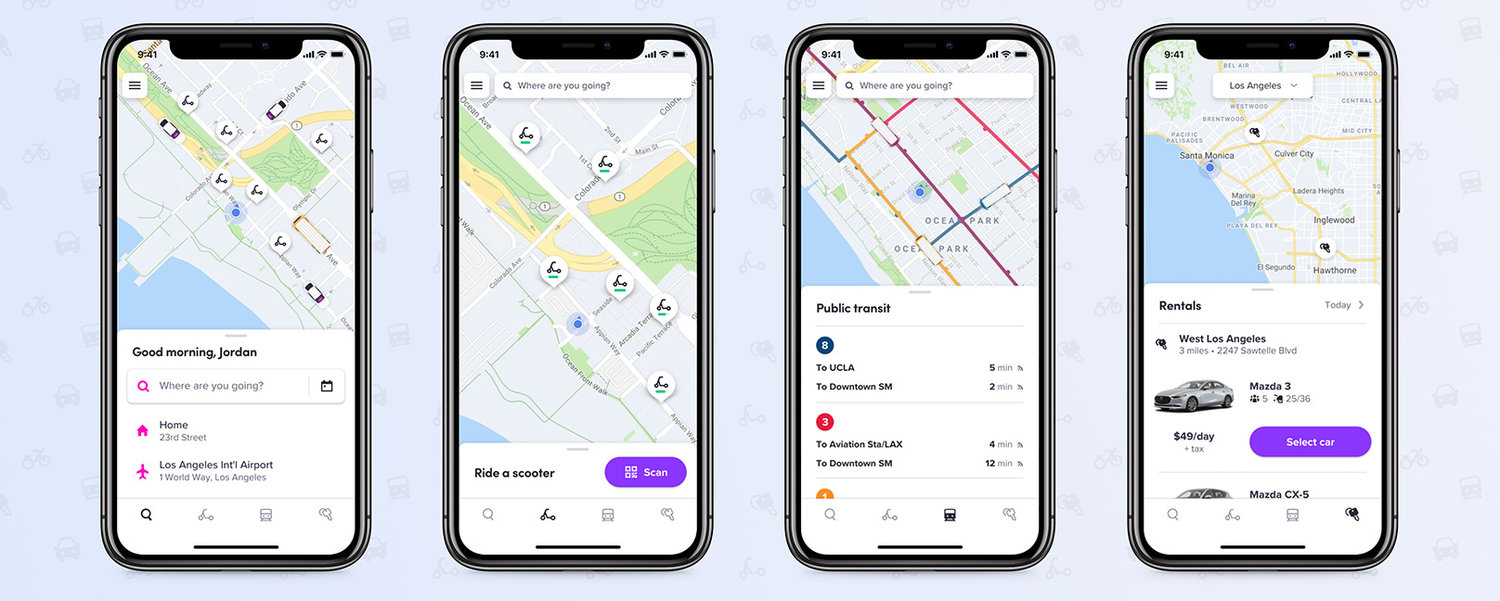

Lyft’s a simple company. All it wants is to destroy personal car ownership, gain on a certain ride-hailing competitor, and serve all your transportation needs. So yesterday, the company released a significant update to its app.

In some North American cities, users can check scooter, bike, car rental, and public transportation options on Lyft’s home screen. It plans to roll out cost and travel time comparisons between transportation modes in the coming weeks.

The strategy: Lyft (-7.57%) knows you check five apps before finding your preferred travel method, but it’s guessing you want to check fewer than that. It also knows how freeing it is to not be in a car. In cities with micromobility options, every eighth Lyft ride this summer took place on a bike or scooter.

- Lyft's a little late to the game. Uber rolled out a suite of integrations with alternative transportation options last year.

Bottom line: By making it easier to choose non-car options, these companies are trying to keep users within their ecosystems and address their impact on city congestion.

WHAT ELSE IS BREWING

- Vox Media agreed to acquire the owner of New York Magazine in an all-stock deal. Terms weren't disclosed.

- Juul is downsizing its staff in the face of a possible ban on certain flavors and unsolved vaping-related illnesses. A CDC official told a congressional committee the agency has discovered hundreds of new cases of vaping-related lung injuries.

- German prosecutors said they'd filed charges against Volkswagen executives for allegedly misleading shareholders in the run-up to the 2015 emissions scandal.

- Nike reported a smashing fiscal Q1, citing product innovation and e-commerce. Shares shot up over 5.5% after hours to a record high.

- Chipotle (-2.23%) employees from five NYC stores filed complaints over labor practices with the city two weeks after it sued the chain.

BREAKROOM

Open Mic

Let’s keep the one-hit wonders rolling. We’ll give you the name of an artist and the year, you tell us the song—the only one they’re famous for.

- The Buggles (1979)

- A Flock of Seagulls (1982)

- Europe (1986)

- Eagle-Eye Cherry (1997)

- Macy Gray (1999)

- Fountains of Wayne (2003)

- Yellowcard (2003)

- Yael Naim (2008)

- Cali Swag District (2010)

- Gotye feat. Kimbra (2011)

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

Breakroom Answers

Open Mic

1. Video Killed the Radio Star

2. I Ran (So Far Away)

3. The Final Countdown

4. Save Tonight

5. I Try

6. Stacy’s Mom

7. Ocean Avenue

8. New Soul

9. Teach Me How to Dougie

10. Somebody That I Used to Know

Laudantium voluptatibus consectetur et deleniti voluptatem et sequi. Vel quia aperiam adipisci voluptas voluptate deleniti. Autem nobis et et distinctio. Dolorem ducimus dignissimos sunt voluptatem ut et itaque. Neque eveniet omnis qui ex dolores. Maiores neque ea veritatis dolores aut commodi repudiandae.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...