|

Now That's What I Call Inflation — While we give economists a lot of heat for being wrong so damn always, and rightfully so, we have to give it to them this time: their CPI estimate beat a random number generator. Great jobs guys!

The Daily Peel’s random number generator predicted a CPI reading of 5.48% annual growth. Economists put it at 6.7%, and with a reading of 6.8%, they took the W. Much more importantly, however, is the fact that this inflation observation is the highest since 1982, aka, 39 years ago.

This, in short, isn’t great. With this fresh record high reading, we can almost definitely expect the Fed to announce a speeding up of the tapering process at their meeting on Tuesday and Wednesday this week. Analysts expect the asset purchase tapering speed to be doubled, ending in March 2022, which would allow the Central Bank to start raising rates sooner than expected.

It seems, however, that the market is already pricing these factors in. Growth stocks that won the title in 2020 have slumped all throughout 2021. It seems like the long-duration focus that incredibly loose monetary and fiscal policy allowed for is coming to a close, as investors no longer appear to be prioritizing cash flows 10 years down the line. Even crypto is feeling the heat, falling precipitously from recent highs despite the attempted comeback this weekend. Isn’t BTC supposed to protect against inflation??

Anyway, sentiment appears to be shifting back to some semblance of rationality. All of a sudden, things like cash flows, profitability, and dividends have stepped back onto the seen as investors realize once again that those factors do actually matter.

What Do Steve Cohen, Bill Gates, and Jeff Bezos Have in Common?

These three financial titans are pouring billions into an overlooked market that the Wall Street Journal just called among the hottest on Earth. But this market isn’t what you think it is.

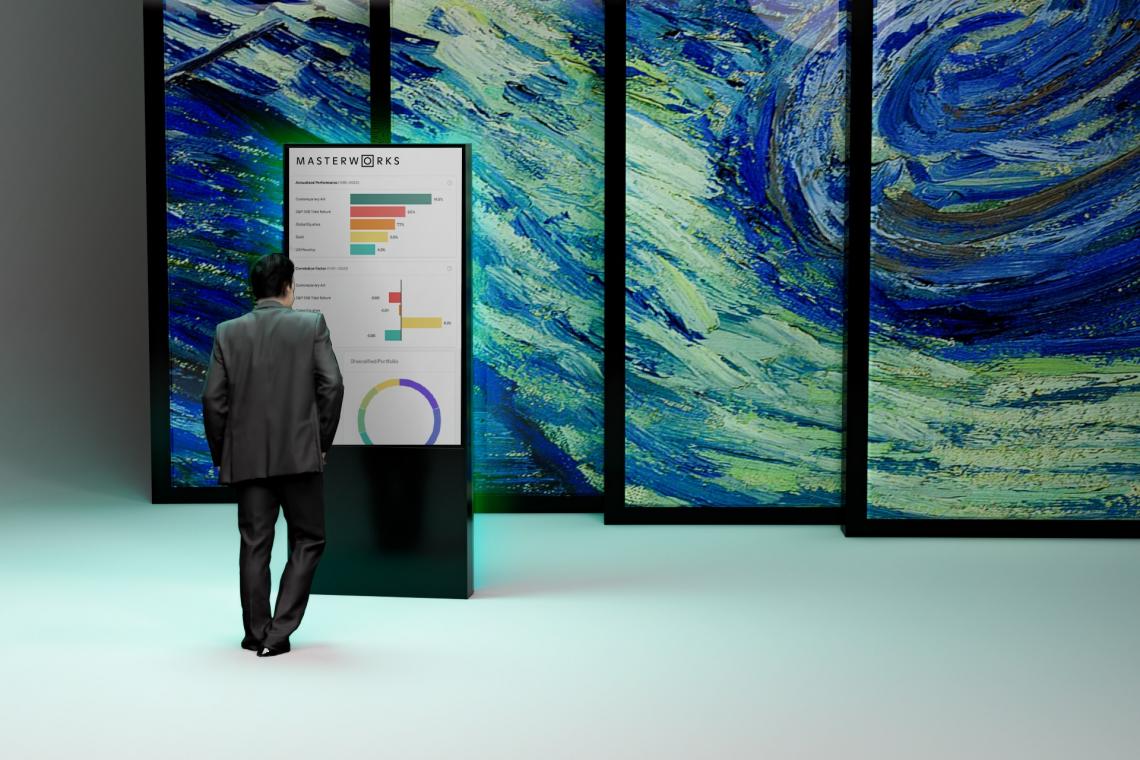

So what’s this overlooked investment billionaires love? Blue-chip art. And we don’t mean the kind of art you’ll find at your local yard sale. We’re talking about Picassos, Basquiats, and Warhols.

Deloitte estimates the global value of art to be worth $1.7 trillion—more than the market capitalization of every cryptocurrency combined according to Goldman. That’s a whole lotta canvas.

How can you join this billionaire club? Well, with quality paintings going for $10,000,000+, you’d need to be comic book supervillain rich. But, there’s a new investment platform called Masterworks that lets you invest in the very same types of paintings collected by billionaires.

Now, you can access the asset class that’s far outpaced the S&P 500 in a few clicks.

Special Holiday Bonus: Get Free Secondary Market Trading For Life Today

|

Ea ex expedita sapiente voluptatem autem ducimus quasi. Praesentium ea voluptas ab non. Autem voluptate sunt omnis dolorem. Amet laboriosam quod eius harum consequuntur officiis.

Qui doloremque id fugit sequi rerum sit et. Reprehenderit aut incidunt ut aut quia natus blanditiis. Est a et earum quis voluptate mollitia.

Autem itaque dolor deleniti et enim. Qui ut aut molestiae sunt. Ex facere ut molestiae.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...