|

*Gasp* — After months of ridicule by various groups of haters, from Twitter trolls to fellow government officials, the Fed has finally woken up to the fact that current inflation may not be as transitory as hoped. Speaking before a Senate panel early yesterday, JPow asserted his belief that it’s probably a good time to retire the transitory label.

If that wasn’t groundbreaking enough for your taste, Powell also indicated that the Central Bank will be discussing an acceleration in the timeline for asset purchase tapering at the upcoming December meeting. JPow made clear that he and his companions at the Fed would be more than willing to wrap up the tapering process a few months ahead of schedule.

Never one to leave us guessing, JPow said that the current economic conditions are much like a quote from famed American poet Ke$ha - “hot and dangerous.” Actually, what he said was - “At this point, the economy is very strong and inflationary pressures are higher”, so basically the same thing. The market, in a word, was disappointed. Although JPow hinted at strong economic conditions now, financial markets are forward looking mechanisms, so hearing that inflation might run too hot is like telling a dog he can’t have his treats.

The Great Reassessment — Americans may be becoming quitters at higher rates than ever, but they’re also becoming founders just south of record levels too. As many have termed labor market activities this year as the “Great Resignation”, many such as Heather Long of WaPo and Kara Swisher of the NYT have applied their own term: The Great Reassessment.

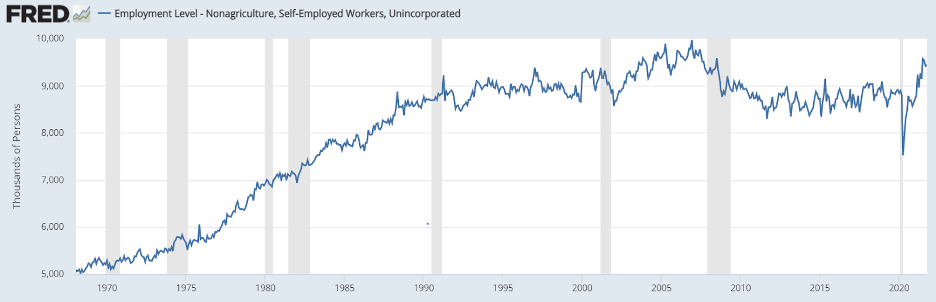

Never let a crisis go to waste. That is the philosophy driving many Americans to quit their jobs and risk it all with an entrepreneurial venture. Crises often shake up the lives of those involved to such a degree that they begin to evaluate opportunities that may not have been seriously considered before, like starting a business. As seen in the chart below, during and immediately after broad economic recessions is very often a time in which new business formation speeds up or peaks. The COVID crisis is no different.

Growth in self-employed workers is a powerful signal for the overall economy. In order to be willing to try to be an entrepreneur, you have to have the financial resources and self-confidence that you will succeed. That doesn’t come if the average citizen is in a bad economic position, so the fact that we’re seeing staunch growth right now is a clear indication that we’re full steam ahead.

Of course, many ventures will fail. It will be interesting to follow labor market dynamics over the next few years to see any underlying structural changes in employment. Living in the time of content creation where dancing on TikTok can be enough to support a family, Charli D’Amelio might just be Gen Z’s Steve Jobs.

|

Laudantium expedita voluptatem dolores dolorum rerum. Consequatur provident qui eos aperiam. Vero rerum dolorem dolor doloribus itaque. Delectus dolorem rerum error numquam.

Dolores nesciunt culpa qui aut. Laboriosam molestias quisquam quam blanditiis ex excepturi. Qui debitis sit molestias qui quia. Aliquam molestiae ab quisquam.

Explicabo vero nisi hic rerum. Non nemo quia occaecati sed doloremque vero.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...