|

Russia’s Ripple Effect — That whole Ukraine thing, yeah. It’s still going on in Eastern Europe.

Aside from the budding humanitarian crisis and rampant destruction & death, the West still stands more or less united against Russia in all categories, with a slight exception when it comes to Energy.

Just like kickin’ your habit of a pack a day of cowboy killers, going cold turkey when it comes to Russian Energy is tough. It looks like Europe can’t quite get there, and if they could, it would be painful. We’re talking about economic hardships, potential recession, the shakes… you get the idea.

All of that pain aside, the Europeans are still considering a ban on all energy imports from their vodka-chugging, bear-wrestling neighbors. This could make an interesting situation even more… interesting.

There are two other anomalies that are worth mentioning. Global commodities markets are still a mess, and the world could be on the brink of a global food crisis. Yeah, so like, only good news.

We’re seeing a significant scarcity in commodities like nickel, copper, and zinc. Low inventories and high demand can mean excessive volatility, which is exactly what is happening.

Turns out, this volatility might even become an inherent characteristic of commodities’ prices in the immediate future, as market makers are on the struggle bus trying to determine fair and accurate prices for commodities trading.

Even without conflict in Ukraine and bans on Russian metal exports, demand for these commodities has grown in recent years. Thrash in Eastern Europe and bans on Russian everything is just another exacerbating factor in this weird new normal.

Wheat prices are at an all-time high. Corn and beans are close behind, near their peaks. You’ve probably been to the bodega or a grocery in the last few weeks – nothing is getting cheaper.

Even in the US, consumers have already started to experience hiccups in supply chains for pantry items and foodstuffs. In January this year, Americans saw something they aren’t used to seeing: bare shelves at the grocery store. It was so bizarre someone even wrote a song about it.

Russia is a world leader in grain production. Ukraine is called the breadbasket of Europe. Together, they traditionally export about 55 million tons of wheat annually.

This year, there will be a different story. Ukraine is upside down, war-torn, and economically crippled – smack dab in the middle of planting season for one of their primary exports. Russian grain is the ag-equivalent of a persona non grata. Only the rogue states of the world will touch it openly.

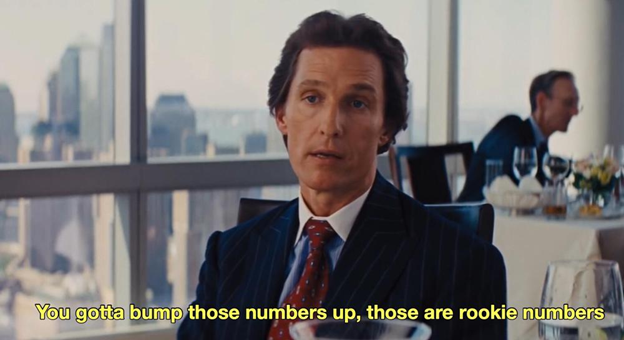

To make things worse, Russia, Ukraine, and Belarus produce a good chunk of the world’s fertilizer supply. So even if someone in Europe wanted to bump up those rookie numbers of their own ag production, they’re likely to stumble when sourcing fertilizer.

There is likely enough supply in the system to make sure the world doesn’t starve. But in a world where supply chains are already totally f*cked, who wants to rearrange the planes, trains, and automobiles to move grain around?

Prices will rise, and those parts of the world not fortunate enough to be bestowed with good farmland by mother earth will fare the worst. Looking at you, Middle East.

Food prices are already up like 10% in the last year. That’s probably going to persist. Consumers can probably get used to seeing higher and higher prices both at grocery stores and in restaurants because of fertilizer and grain ripple effects of Russia’s War in Ukraine.

|

Corrupti aliquam iusto corrupti sint dignissimos occaecati. Quam omnis qui itaque quo. Sed dolore ducimus suscipit mollitia assumenda natus. Voluptatem illo tempore quia aut voluptatem in.

Est neque doloremque quibusdam harum saepe saepe. Voluptatem consequatur inventore quas aut.

Magnam animi magni debitis. Rem vero hic qui doloremque provident saepe autem. Ducimus dignissimos rerum autem eum illum maiores.

Necessitatibus similique laboriosam nulla ab voluptas aut impedit. Quo assumenda explicabo aliquam assumenda. Hic ipsa enim veritatis facere amet. Nostrum qui dolore adipisci ut est similique.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...