|

Rising from the Dead — Economic theory is a lot like trying to plug in a USB; it almost never works on the first try, but you kinda just keep turning it around and forcing it in until something clicks. The problem is, you never know which way to start. And right now, a key part of economic theory that was widely pronounced dead in 2018 is coming back with a vengeance.

The Phillips Curve, first hypothesized in 1958, is an economic theory arguing that inflation and unemployment have a “stable and inverse” relationship. Basically, it means that as the economy grows, inflation tends to pick up, which leads to job and wage growth, thus reducing unemployment, and vice versa.

Prior to the onset of a certain viral outbreak, the U.S. economy saw its lowest unemployment rate in half a century with basically zero inflation and steady economic growth, a.k.a., not what the Phillips Curve says is supposed to happen. This caused many-an-economists to pronounce the curve dead. But now, especially after January’s jobs report, it appears to have arisen from the grave.

In April 2020, unemployment mooned all the way to 14.8%, the highest level since the Truman Administration back in 1948. Meanwhile, April 2020 registered a CPI print of -0.8%. Unemployment spiked, and inflation fell. Since then, that trend has gone exactly in the opposite direction. Unemployment has fallen to 4% while inflation spiked to 7%, indicating that the Phillips Curve just might be back from the dead.

If you’re a normal human being, you’re probably thinking to yourself, “Dude, who the f*ck cares? Don’t you bully economists and economic theory all the time?” Well, yes I do, and yes they deserve it, but allow me to explain what this could suggest.

We’re all well aware the labor market is about as tight as it could be right now. This leads economists to believe that wages, or more broadly, the cost of labor is the primary driver of inflation. Technically known as “wage-push inflation,” it turns out the inflation that we’re seeing might not be all it’s cracked up to be.

When labor productivity is factored in, which the BLS reported came in at a huge 6.6% increase last month, we can offset much of the dramatic 6.9% increase in the overall labor cost to a unitary increase of just 0.3%. So that would suggest the headline inflation numbers we’re seeing may be offset by a productivity boom.

So, what’s the key takeaway here? Well, if inflation is being offset by rocketing productivity, then the Fed has reason to raise rates less dramatically. I don’t need to explain how much that matters for financial markets, and this section of Macro Monkey has gone on for way too long, so let’s wrap. JPow and crew might take this as a sign to be less aggressive in raising rates, but then again, you never, ever know.

Over It — The United States, home of giant gaps in public restroom stalls and roughly 78mm COVID-19 cases, is getting over the virus. It has been 699 days since the WHO declared a global pandemic and after months of fear, confusion, bickering, toilet paper brawls, and much more, citizens of the U.S. are ready to move on.

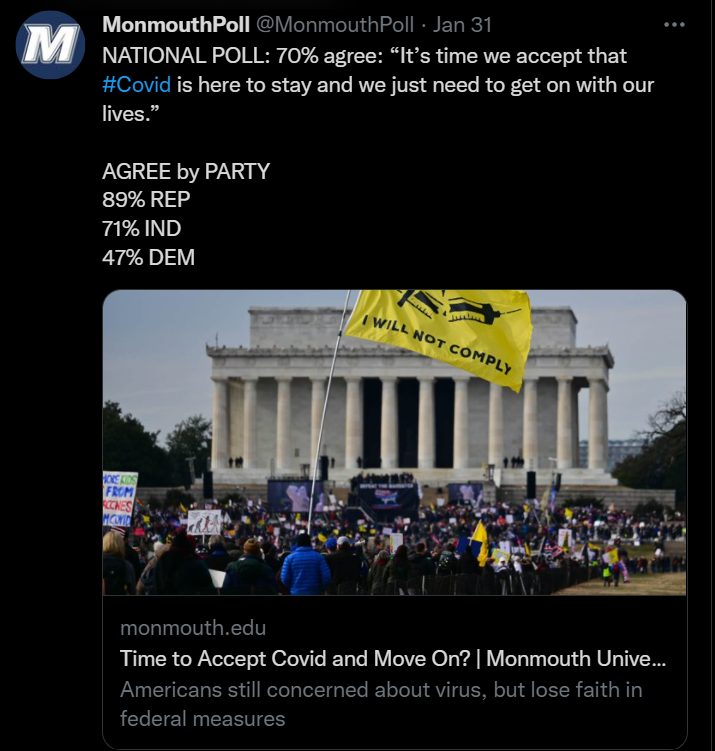

Like a bad breakup, Americans are telling the virus, “it’s not us, it’s you.” Not only have cases declined 57% in the past two weeks nationwide, last week, a Monmouth Poll registered 70% agreement with the statement, “It’s time we accept that Covid is here to stay, and we just need to get on with our lives.”

This is quite the change of pace from months past when similar polls indicated a majority of Americans believed C19 was the nation’s single most important issue in 2021 or, even more extreme, back in mid-2020 when 44% of American’s said they talk about the outbreak “most or almost all the time.”

So what does this mean? Well, from a macro perspective, the answer, as always, is unclear. Experts anticipate that the relaxing of public health fear and confusion will play a role in easing economic constraints like supply-chain conundrums and worker shortages in public-facing roles.

Some even say that inflation could relax in response as intermediate costs like raw materials and transportation gradually return to Feb 2020 levels. For now, however, all we can really do is keep our fingers crossed that we don’t see another outbreak.

|

Eligendi quos et incidunt dolor culpa incidunt odit. Necessitatibus sapiente quaerat sit sit recusandae omnis nihil. Id doloremque fugiat illum natus veritatis id reiciendis eligendi. Animi eos nostrum ipsam voluptatibus qui. Placeat deleniti velit possimus commodi quo.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...