|

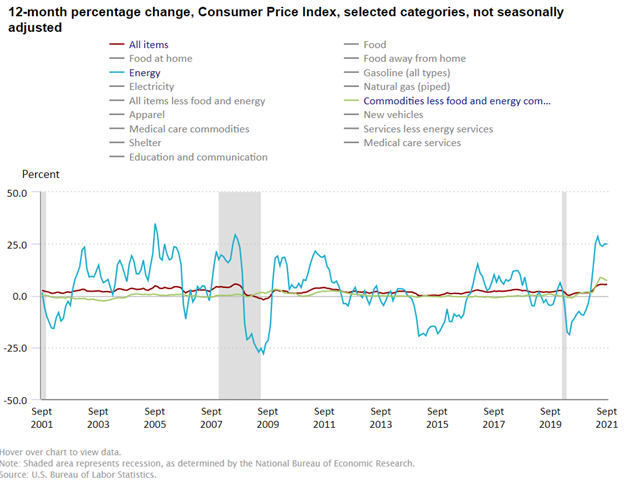

Inflated Inflation — Congratulations - that $46 in your checking account is worth less than it was last month! That’s right, September CPI data was released yesterday morning, and numbers came in higher than economists had anticipated, increasing by .4%. Normally, here is where I’d make a joke about economists being wrong all the time, but it seems like their predictions do a good enough job of that already.

Rising wages and labor shortages, high commodities prices and materials shortages, and laughably horrific shipping issues were the culprits behind the theft of your purchasing power. Starting with wages, making more money sounds great, but inflation-adjusted earnings rose just 0.2% month-over-month and declined against September of last year. Even despite drastic labor shortages and wage hikes, real earnings are down over the last year.

As for high commodity prices, factory producers are constrained by labor shortages and other effects from COVID while demand races higher, leaving material shortages and transportation issues as the biggest challenges. And what a great segue, because speaking of transportation difficulties, it seems like everyone who has a cargo ship lying around is just vibing off the California coast right now, jacking up shipping rates.

All in all, this report, if anything, will only fire up JPow and the bois even more to begin tapering soon. I guess the idea that all this was transitory has turned out to be, well, transitory.

|

Quitters Always Win — Just like greed is good, quitting is cool. Nearly 3% of the entire American workforce quit their jobs in August. That’s 4.3mm quitters, now take a second to let that sink in. 3% doesn’t sound huge, but holy sh*t that blows the previous record out of the water. Much of the quit-gang came from leisure jobs like hotels, bars, and restaurants while plenty of others came from retail, and over 700,000 from professional business services. This is, in a word, WILD. I mean, it’s not like there isn’t plenty of other jobs to choose from - the imbalance in job seekers and job openings is still fatter than Buffet’s bank account - so many are attempting to upgrade their lifestyle (and, I’m guessing) their pay with new opportunities. Land of the Free, Home of the Quitters, has a nice ring to it, no?

|

|

Quis nostrum sint veritatis explicabo. Sequi quis aut neque aut libero omnis iusto. Veritatis id nihil rerum tempore harum. Omnis laudantium sint quaerat. Velit facilis minima ea sed praesentium fugiat omnis. Exercitationem occaecati ut itaque.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...