|

Earnings Solstice — It’s official, apes — as of yesterday, earnings season is certified back. After years of downpouring cash all earnings season, you might think the typical climate this time of year is high profit margins and higher stock prices. But not always, and in fact, meteorologists this time around expect a much drier season and have even begun to warn of potential wildfires.

Of course, that’s not what happened yesterday. Banks have some of the largest Napoleon complexes the world has ever seen, and as a result, they have to report first.

Like the kid in elementary school who just had to be the line leader, JP Morgan rushed to the front of the pack early yesterday. Reporting for Q1’22 on Wednesday morning (holy sh*t, is Q1 over already??), the US’s largest bank was swinging for the fences with a ~$100mn revenue beat, raking in $31.5bn, but it missed the cut on earnings, registering only $2.63/sh. vs. estimates of $2.74/sh.

That’s a 42% decline in annual profit, not to mention the 5% revenue drop. But considering that the switch has been flipped hard from a macro perspective compared to a year ago, things weren’t complete garbage for Dimon & Co.

For starters, $524mn that would’ve padded the states a bit was whisked away by Putin’s march into Ukraine, while another $120mn disappeared thanks to the LME nickel fiasco. And as the rest of the macro picture continues to fall apart, JP’s loss provisions more than doubled to $1.5bn, including a disgustingly high $902mn charge taken in anticipation of further loan losses.

And if you listened to the earnings call, you heard a much less optimistic Jamie Dimon than we were used to last year. The King of Banking said, “We remain optimistic,” which is pure cap, as it was followed with, “but see significant geopolitical and economic challenges ahead due to high inflation, supply chain issues, and the war in Ukraine.”

But JP wasn’t the lone big dawg of the financial world to report yesterday. BlackRock joined with an early morning release that painted a slightly different picture.

The world’s largest asset manager reported a revenue miss and an earnings beat, but literally no one cares because with BlackRock, it is all about fund flows. Clearly, the firm isn’t familiar with the deadly sin of gluttony because despite already posting well over $9.4tn in assets, BlackRock funds still raked in a massive $114bn in net flows last quarter.

That means that despite Putin’s bullsh*t in Ukraine, inflation, supply chain, and all those talking heads on Bloomberg trying to scare you out of the markets, investors couldn’t get enough $IVV and $ICLN. Investors believe, even if no one else does.

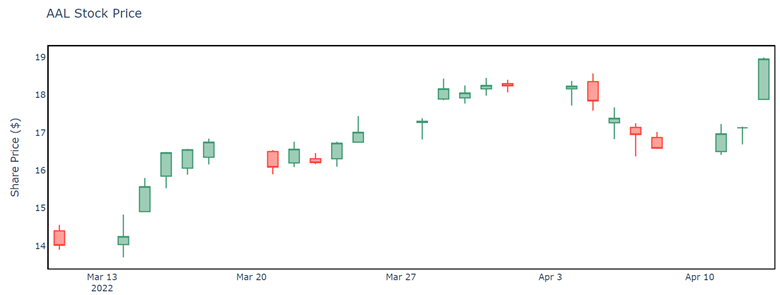

There were some other big names dropping their latest figures yesterday, too, like Delta Airlines beating the hell out of expectations and seeing a 6.21% gain on the day. On the other hand, JP fell 3.22%, while BlackRock held up slightly better and only lost 0.15%.

Most importantly, though, earnings season is back, so now I have a reason to live again. We’re excited.

|

Eligendi eum accusantium dolor possimus nisi voluptatem. Voluptas velit ad hic quidem voluptatem sed fugit. Sapiente dolorem minus quibusdam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...