|

Mortgage Rates Moon — Living is expensive. At this rate, they’re gonna start charging us by the breath pretty soon. For now, it’s just shelter overall. And if you thought homes would get cheaper anytime soon, think again.

Sure, homebuyers over the past few years have had it rough. But unfortunately, conditions look to only be worsening for the next generation of people who don’t want to be homeless.

The big news around this last week was not about homes prices, however, but mortgage rates. With the Federal Reserve’s first rate hike in nearly three years last Wednesday, the benchmark mortgage rate (aka the 30-year fixed rate for premium borrowers) has risen to 4.27%, the highest level since May of 2019.

Compared to this time last year, mortgage rates have vaulted 107bps, or close to 34%, more than doubling the S&P 500’s 12-month return. And while MBS traders and realtors are hyped, customers are not, reversing a multiyear trend in this economically crucial market.

Given the portion of a person’s budget that goes into housing, homes tend to be highly price elastic in respect to both sale value and borrowing rate. And, given how essential shelter is outside of simple economic theory, the chain of reactions this cost increase could induce is anything but bullish for the U.S. economy.

But, if we look at this like your conspiracy theorist friend would, rising rates could be good for the housing market in the long term. Higher rates mean every supplier in the home building and selling markets is incentivized to build and distribute more homes to end consumers.

As we’ve spoken about previously, America’s trauma from the GFC has stunted years of home construction, leading to a supply shortage and driving up prices. So basically, there’s a chance, no matter how slight, that rising costs now could spiral into lower costs down the line. At least, older Gen Z certainly hopes so.

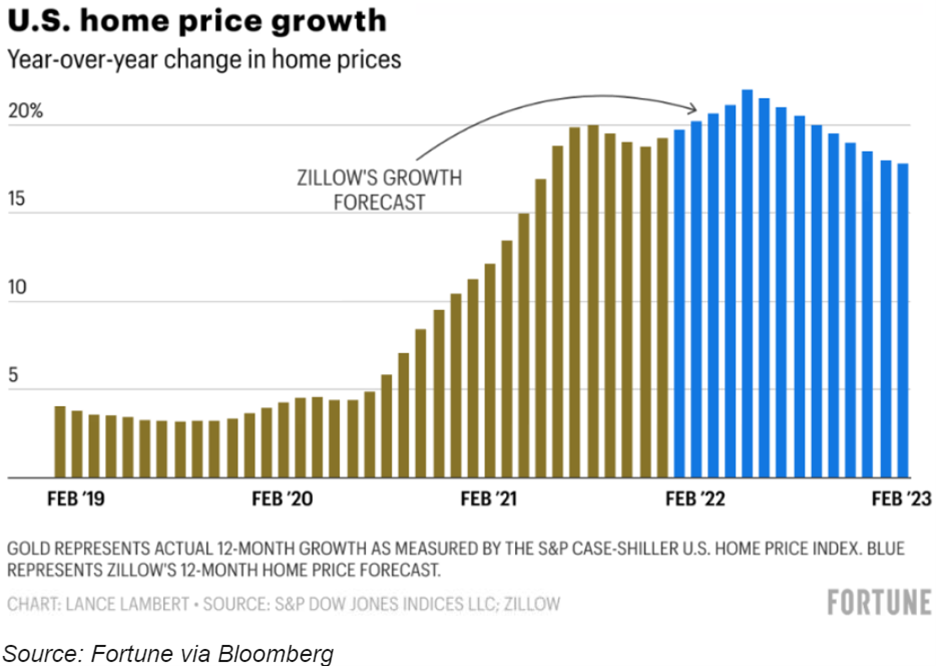

According to Zillow, however, this theory is bunk, at least in the short term. The housing experts over there predict a YoY homes price change of 22% in May, up from the current 18.8% annual surge. Judging by the chart below, this slowdown in growth is a long way away.

|

Aperiam consequatur iste dicta hic. At enim expedita eum molestiae.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...