WeIPO

MARKETS

- U.S. markets: The S&P and the Nasdaq both hit all-time highs. But a tidal wave of earnings and economic data this week still has some investors sweating.

- Trade: There could be progress on the U.S.-China trade front. Treasury Secretary Steven Mnuchin said officials will know this week or next if a deal is possible—or if it’s time to “move on.” Classic third date stuff.

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

IPO

What Is WeWork?

The co-working company told employees yesterday that it has confidentially filed paperwork with the SEC to go public.

WeWork reportedly hasn’t picked bankers yet, and an offering wouldn’t happen until the third or fourth quarter of this year. But there’s more you should know about 2019’s latest mega-offering.

It’s as meaty as a WeWork company card will allow

A WeWork IPO would likely be the second-biggest offering in the U.S. this year behind Uber. WeWork was last valued at $47 billion and has 400,000 members in 100 cities.

- Still, it’s burning through cash. Though WeWork’s revenue doubled last year to $1.8 billion, its losses more than doubled to $1.9 billion.

It’s not just WeWork

It’s the We Company after a rebranding earlier this year to focus on more than just the short-term office space rental service that (along with its notorious tenant Morning Brew) made it famous. Now, it’s diversified into businesses like housing, a children’s school, and a coding academy.

Wherefore the rebrand? Fend off skepticism over WeWork’s ability to withstand a market downturn, when fewer D2C birdseed startups will look for low-commitment office space. But we may always need apartments for “modern-day nomads.”

And speaking of skeptics...there are plenty. WeWork is a “love it or hate it” company, writes Axios. A “person close to the company” told Axios WeWork could become the second-most shorted stock after Tesla.

But as for believers...

WeWork is no mere co-working company. It serves a higher purpose.

From CEO Adam Neumann: “As one of the world’s largest physical networks, it is our responsibility to help lead the way and set the global example for people and corporations on how we should take care of each other and of our planet.”

HOSPITALITY

For Marriott, the Student Becomes the Master

Marriott (-0.35%) is expanding its home-sharing service and will soon take reservations for 2,000 luxury properties across 100 markets.

Like One Direction, Marriott’s home-sharing business began as an experiment in Europe before coming to the U.S. But after seeing strong results (guests stayed more than 2x the typical hotel length), Marriott will likely be the first major hotel group to operate a home-sharing platform here.

- What makes you beautiful: The rise of Airbnb exposed a huge new market for home-sharing in the hospitality industry, and Marriott wants a piece. Plus, including home-sharing listings in its loyalty program makes them more enticing.

- Drag me down: Across its dozens of brands, Marriott’s core pitch is in its uniformity—a room in Paris, France, should look similar to a room in Paris, Texas. Dealing with a diverse array of properties (and the new regulations they put into play) won’t make this easy.

Airbnb has officially completed the disruptor

- Find something to disrupt

- Call yourself a disruptor until no one remembers otherwise

- Have the legacy company you disrupted copy you

MUSIC

A Lot of People Pay for Spotify

Spotify’s most recent earnings report was like if someone started playing “I Can’t Make You Love Me” in the middle of a pregame. Weird vibe, but you’d probably still sing along.

After growing subscribers 32% since it went public about a year ago, Spotify (-0.14%) topped 100 million paid users globally in Q1. Rival Apple Music, which doesn’t offer a free version, has about 50 million subs.

But...while Spotify’s revenue climbed 33% annually to about $1.7 billion, it also weathered a net loss of about $158 million and saw margins shrink following some big bets that have yet to pay off.

- Bet #1: Spotify has invested a ton in India, where 1 million users signed up the week it became available in February. But Spotify’s India strategy is facing pressure from two separate licensing disputes.

- Bet #2: So far in 2019, Spotify’s spent $400 million on podcast startups. While the margin-friendly pod is cheaper to stream than music, Spotify will need to wait longer to see the benefits.

2020

Beto Makes a $5 Trillion Entrance

2020 hopeful Beto O’Rourke began his quest yesterday for the title of “climate candidate,” because even Vanity Fair spreads lose their color in a field of two dozen contenders.

In his first major policy proposal, the former Democratic congressman suggested 1) slashing carbon emissions to net zero by 2050 2) spending $5 trillion on making U.S. infrastructure more climate-friendly and 3) rejoining the Paris climate agreement.

To answer your first question, that $5 trillion investment would come c/o tax code changes to “ensure corporations and the wealthiest among us pay their fair share.”

- Beto’s camp calls the proposal the “single largest investment in fighting climate change in history.”

- Beto also floated “limited-duration, performance-focused” tax incentives to get climate-friendly tech out in the wild faster.

The business POV: Under Beto’s proposal, public companies would have to measure and disclose climate risks in greater detail. While that might’ve raised eyebrows years ago, today’s friendlier attitude toward climate activism (even within the GOP) has made environmental accountability a mainstream idea on Wall Street.

TECH

Japan’s Tech Wrestles With an Ancient Tradition

TECH

Japan’s Tech Wrestles With an Ancient Tradition

Outside of Internet Explorer, it’s not often modern technology comes into contact with developments from the year 701. But when Japan’s Emperor Akihito abdicates the throne today, computer systems in the country will face an ancient test.

Each new Japanese emperor marks the beginning of a new era, which means the introduction of a new calendar. The problem is that many Japanese computers use that imperial calendar instead of the Gregorian calendar. And given Akihito’s been on the throne since 1989, before IT really took off, computers have never had to deal with the issue until now.

The good news: Because Akihito submitted his two years’ notice in late 2017, companies have had time to prepare for the transition. Nothing’s expected to go spectacularly wrong, but there’s still a high degree of uncertainty. Even Microsoft wrote a blog post comparing it to Y2K.

+ Pro tip: Next time your boss tries to fire you, just say “You can’t fire me...I abdicate!”

WHAT ELSE IS BREWING

- lphabet (-7.34% after hours) reported a rare revenue miss for last quarter. Some investors are wondering if digital ad buyers are taking their wallets elsewhere.

- Chewy.com, PetSmart’s online retailer, filed docs to go public.

- Anadarko Petroleum (+0.39%) said it’ll consider Occidental’s (-1.86%) $38 billion “superior” buyout bid. Your move, Chevron (+0.53%).

- Burger King plans on taking the meatless Impossible Whopper nationwide after less than a month of testing “went exceedingly well.”

- Music festival Woodstock 50 appeared to be canceled by its biggest investor, but organizers are vowing the show will still happen. It's a mess.

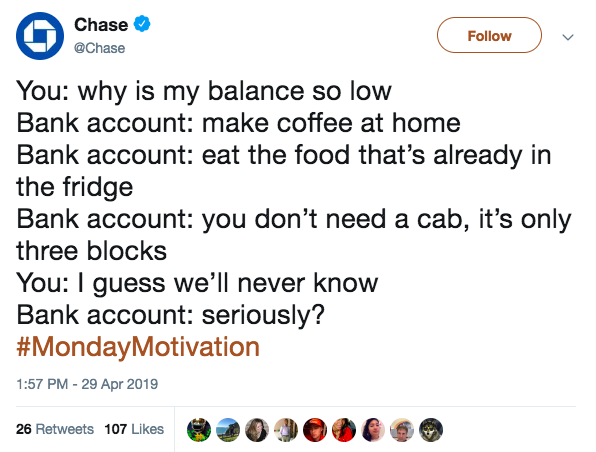

- Chase apologized after this (now-deleted) tweet drew the wrath of Twitter for being insensitive.

BREAKROOM

The Brew's Monthly Quiz

The Japanese abdication means this is a perfect time to quiz you about the origin of month names in our own calendar. We'll give you the month, you determine the person (or deity) it's named after.

- January

- March

- June

- July

- August

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

Breakroom Answers

The Brew's Monthly Quiz

1. Janus, the Roman god of beginnings 2. Mars, the Roman god of war 3. Juno, the Roman goddess of love and marriage 4. Julius Caesar 5. Augustus, the first Roman emperor