2018 Investment Banking Report: 8 Trends in the Industry

Wall Street Oasis (WSO) released a detailed 2018 Investment Banking Report that includes data on compensation, the interview process, employee satisfaction, and more.

All statistics featured in the reports are based solely on paid user submissions to the WSO Company Database during 2016, 2017 and YTD 2018, with approximately 70% of the submissions coming from the United States. In addition, the investment banking industry made its voice heard by supplying 42% of the 70,000+ submissions, followed by an approximately 18% representation by Asset Management. This data is high quality and statistically robust.

Main categories are analyzed below with an emphasis on most relevant employers and key points of interest. Not surprisingly, many of the key trends and top firms highlighted in our 2017 round-up continued given the relatively scandal-free year within the investment banking industry. Notably, Wells Fargo continues to rebound from the scandals of the past few years.

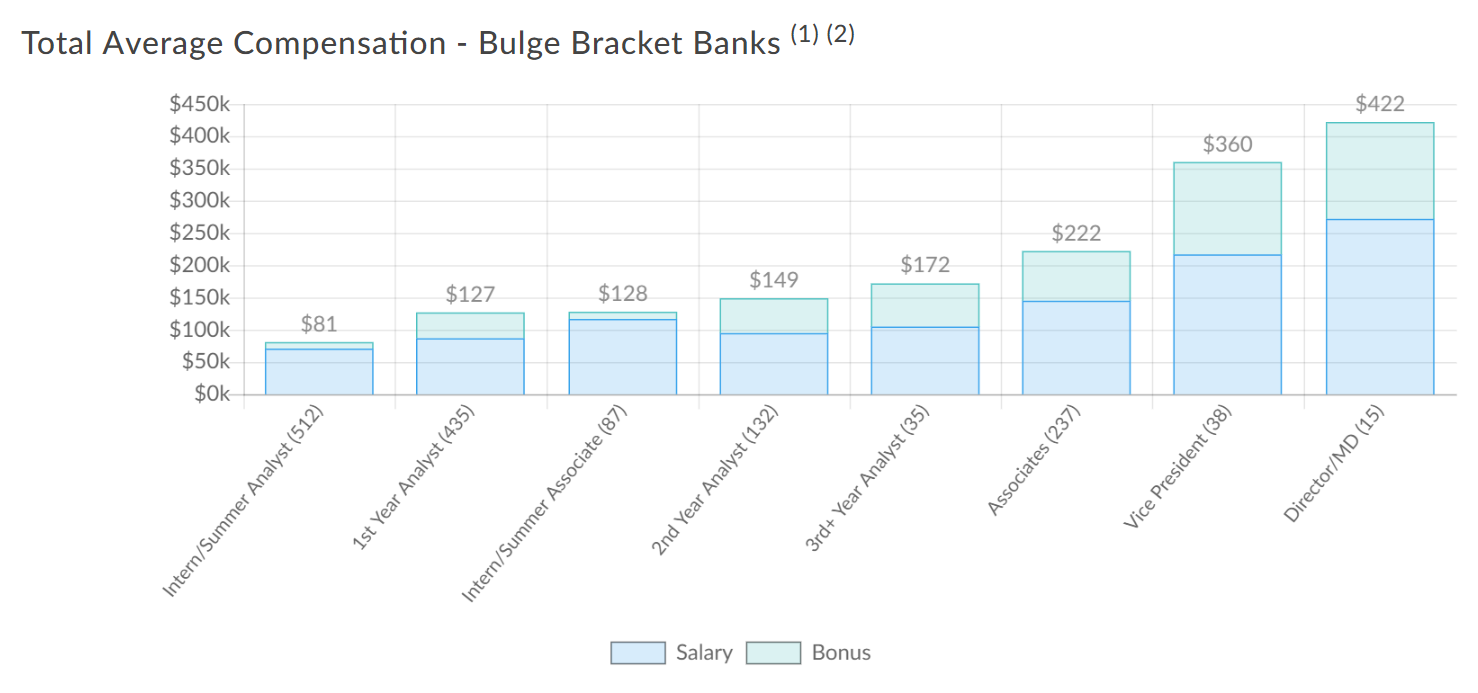

Total Average Compensation

Key Observation 1: First-year analyst total (base & bonus) compensation averages $129,200 with associate level rising to $214,400.

The total average compensation, including base salary and bonus, for bulge bracket banks ranges from $126,800 annually for a first-year analyst to $422,800 for a director-level position (small sample size). The first-year analyst compensation has increased slightly from $121,000 in 2017 to $126,800 in 2018 as has the associate compensation from $218,000 in 2017 to $223,000 in 2018.

The salaries along the continuum of career advancement remained consistent between bulge bracket banks and boutique banks since 2017. An interesting finding in this investment banking report involves the correlation between career advancement and percentage of bonus in overall compensation figures.

- Wells Fargo and Company at $142,800

- Bank of America/Merrill Lynch at $141,500

- Credit Suisse at $133,500

- PJT Partners at $179,900

- Piper Jaffray at $158,200

- Perella Weinberg Partners at $156,700

PJT usually pays a much higher bonus (~$146k) than the average ($93.5k), which is why it is in the top spot. Moelis has also consistently given top compensation over the past few years.

Overall, employees at Moelis & Company, Evercore and Perella Weinberg Partners were most satisfied with their pay compared to similar jobs elsewhere.

This is in comparison to other industries like consulting where starting salary is around $79,000 base and rises to $209,000 at the director level. At an average technology company, software engineers' base starts at around $75,000 but is capped at $271,000 as directors.

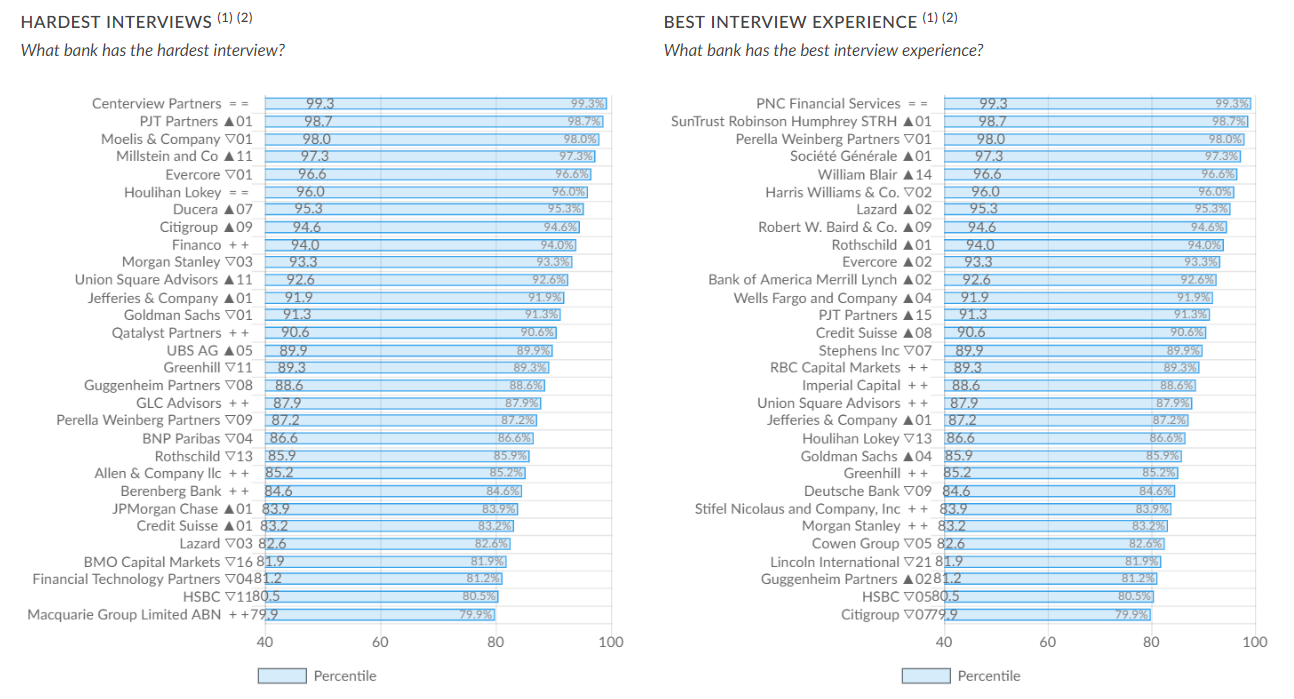

Interview Statistics – Hardest & Best

Key Observation 2: Centerview Partners, PJT Partners and Moelis & Company are viewed as having the hardest interview process.

Member submissions also provided information on the interview process, including the hardest and best experiences. To compile the statistics, each company is given an adjusted score using Bayesian estimates, which takes into account the number of reviews for a particular company with a minimum of two required. The results are representative of 149 firms.

Earning the reputation as having the hardest interview process are Centerview Partners, PJT Partners, and Moelis & Company. This is not too surprising since these firms are all considered elite boutique investment banks with incredibly competitive recruiting processes.

PJT, while a newcomer, spun out of Blackstone in 2015 and is following in Blackstone’s tradition of being in the top five for hardest interview process. The other two also had consistently difficult interviews from 2014-2017.

The best interview process reviews go to PNC Financial Services, SunTrust Robinson Humphrey STRH and Perella Weinberg Partners. Each of these investment banking firms also ranked among the best interview process as compared to the 2017 WSO Investment Banking Industry Report.

Increasingly, it seems like recruiting timelines are being moved earlier and earlier. There’s already talk on the forum of the 2020 recruiting timeline. For those interested in breaking into IBD, stay vigilant!

Professional Development Opportunities

Key Observation 3: Moelis is the only company to show up in top rankings for professional growth, hardest interview and compensation.

The professional development section of the 2018 Investment Banking Reports focuses on the four sub-categories. We’ve highlighted the top 3 out of 144 firms in each sub-category.

- Wells Fargo & Company

- Evercore

- Goldman Sachs

- Goldman Sachs

- Lazard

- Moelis & Company

- Goldman Sachs

- Moelis & Company

- PJT Partners

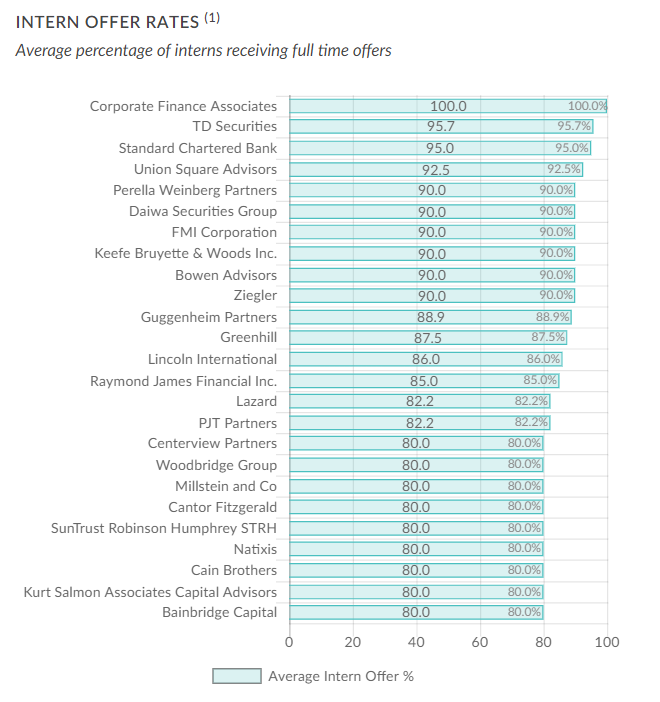

Interestingly, the top three investment banks for intern offer rates have no correlation with compensation or interview process listings. Some of the investment banks with top full intern offer rates are detailed below:

Intern Offer Rates, listed by offer rate. Data up until November 2018.

Intern Offer Rates, listed by offer rate. Data up until November 2018.Fifth Third Bank and Guggenheim Partners have fallen out of the top 10 for intern offer rates after making the list from 2015 to 2017. Corporate Finance Associates and TD Securities have been in the top three for the past two years.

See 30 banks with the highest intern offer rates on the full report.

On our forum, we continue to see a steady stream of interns looking for advice on summer analyst recruiting and interviewing, as well as tips on how to survive and deliver top-notch results once you start.

Promotions & Fairness

Key Observation 4: Wells Fargo and Company was the sole investment banking firm in the top five in each sub-category.

Member submissions also shed light on promotions and fairness in Investment Banking. Again, we’ve highlighted the top firms in each sub-category.

- Goldman Sachs

- JPMorgan Chase

- Wells Fargo and Company

- Barclays Capital

- Deutsche Bank

- Robert W. Baird & Co.

- PJT Partners

- Piper Jaffray

- Wells Fargo and Company

- PJT Partners

- Evercore

- Moelis & Company

Notably, Wells Fargo and COmpany was the sole investment banking firm in the top five in each sub-category. This is an impressive accomplishment in a field of 145 firms represented in the report.

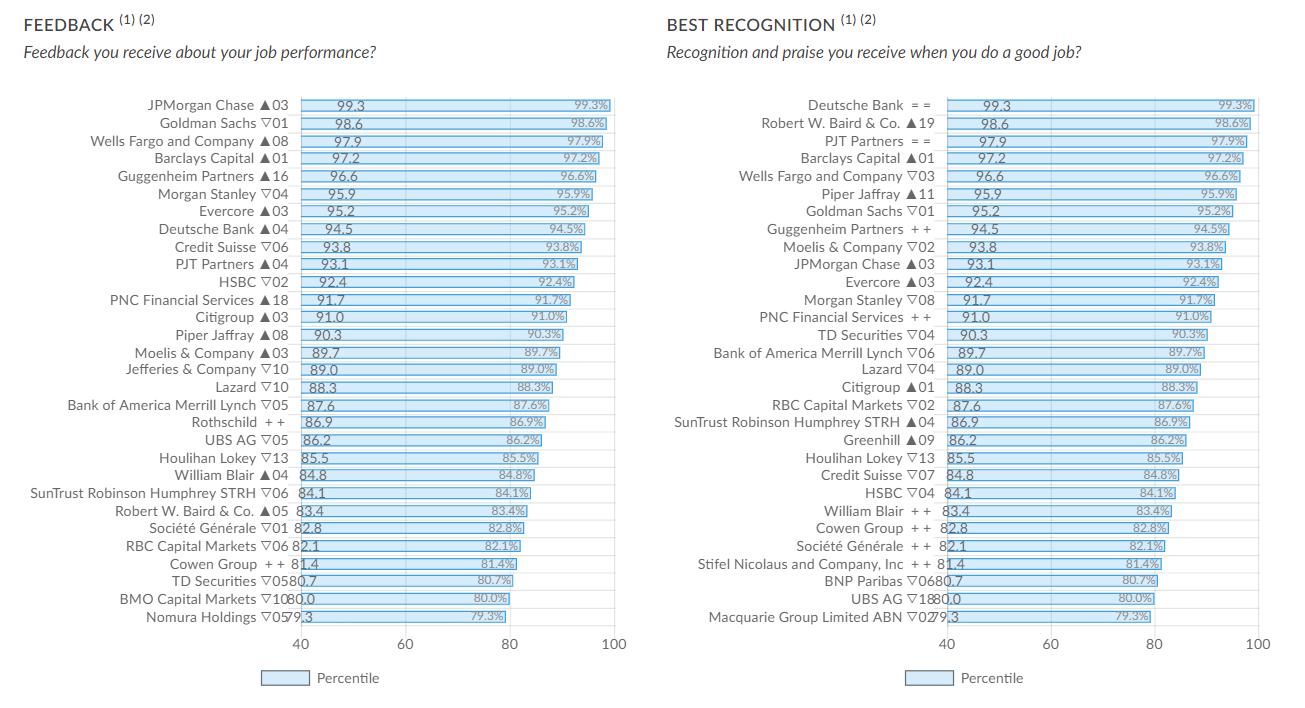

Promotions and Recognition listing, by investment bank. Data up until November 2018.

Promotions and Recognition listing, by investment bank. Data up until November 2018.

Reputation

Key Observation 5: Goldman Sachs ranks among the proudest employees and would be recommended to others by their employees.

Perhaps the most important evaluation of a company is what its employees say outside of work. In this report, reputation is defined by two factors, employee pride and whether employees would recommend the company to others.

Not surprisingly, top performers noted throughout the 2018 Investment Banking Reports were also top performers in this category. Lazard, Goldman Sachs, and Morgan Stanley earn the top honors for “proudest employees” while Evercore, Goldman Sachs and SunTrust Robinson Humphrey - STRH round out the top three for their firms being “recommended” to others by their employees.

Senior Management

Key Observation 6: Top performers throughout this report correlate with senior management rankings.

The senior management statistics were generated from the following four sub-categories. We’ve highlighted the top three out of 145 firms in each sub-category.

- Wells Fargo and Company

- JPMorgan Chase

- Goldman Sachs

- Goldman Sachs

- Robert W. Baird & Co.

- Moelis & Company

- Moelis & Company

- JPMorgan Chase

- PJT Partners

- Evercore

- Goldman Sachs

- JPMorgan Chase

Unsurprisingly, the data suggests a strong correlation between opinions about senior management and the company’s performance in all other categories throughout the investment banking reports.

Lifestyle

Key Observation 7: None of the top-ranked lifestyle firms are in the top 10 for most average hours worked per week.

The 2018 Investment Banking Reports also include respondents’ opinions on which firms provide the most satisfying lifestyle as defined by three sub-categories. The top firms in each sub-category are listed below.

- Wells Fargo Securities

- SunTrust Robinson Humphrey STRH

- RBC Capital Markets

- SunTrust Robinson Humphrey

- Wells Fargo and Company

- PNC Financial Services

- MUFJ Morgan Stanley Securities (90 hours/week)

- Allen & Company llc (87.5 hours/week)

- MTS Health Partners (87.5 hours/week)

Top performers in other categories highlighted in this article round out the rest of the top three. A striking takeaway is that of the top performing firms in previously discussed categories, including compensation, only Moelis & Company (#10 at 84.2 hours) is in the top ten of 212 companies for most average hours worked.

Additional Points of Interest

Key Observation 8: For overall WSO Company Database submissions, New York and NYU generated the highest response rate by far

In addition to the industry-specific categories discussed throughout this article, there are several other points of interest when you look at overall WSO Company Database submissions.

- Geographically, New York generated highest response rate by far, followed by Chicago and London.

- Level of education also played a role with 63% of the report’s 43,679 unique contributors citing a GPA between 3.5-4.0.

- Even more, graduates of schools in major markets are most represented in the study, with New York University (NYU), University of Pennsylvania and Cornell rounding out the top three.

- Finally, the report does not account for gender as a distinguishing factor in the data.

The 2018 Investment Banking Reports provide key insights into the industry as well as important information for both employers and current/potential employees. Analyzing the data in each category is useful when determining priorities in your job search.

For more information, including the most current data as reports are continually updated online, please contact Wall Street Oasis at [email protected].