Analyst Budget Thread Follow Up--Actual Expenses For An Analyst & Associate In Chicago

I rarely check WSO these days, but there was a thread the other day on personal finance that caused me to go back and ask the question--"How did my budget actually perform?" Figured I would post the results for those more personal finance geared individuals. I also think it highlights and gives an accurate picture of analyst expenses and early budgeting that is missing on this forum. A note for individuals starting out:

"Young people care about their salary, wise people care about their burn."

A few facts, that could dox me, but I don't know if I care much since this should just be helpful for people. I also think my expenses are pretty responsible.

- I graduated in 2019, lived at home from Jan 2020 to May 2021, and lived in Chicago after that.

- Worked as an IB analyst at a MM bank and after in PE both in Chicago.

- I would describe myself as moderately budget conscious. Generally speaking, If I want something online I will buy it and I have had a few large purchases and travel expenses. I also spend a great deal at like whole foods & a once a week doordash. However, generally I tend to be pretty simple as a person and have had a roommate in every place I have lived. I also don't feel the need to flex on others with my apartments and am not getting tables at clubs or taking extravagant international trips every quarter. Put another way, I know people way more frugal than me that did IB & PE, but I think a majority were spending more than I did.

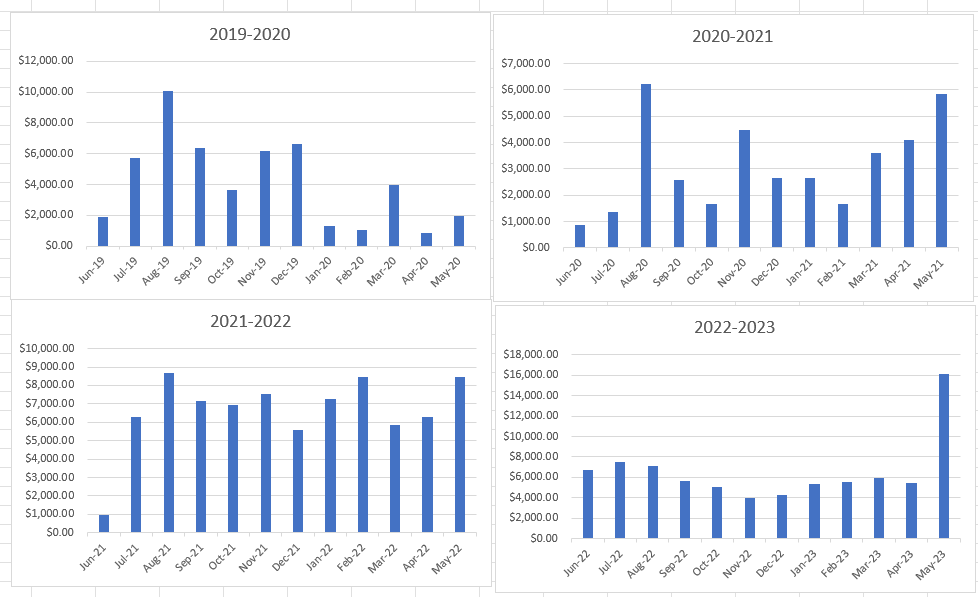

Important Information & Monthly Breakdowns:

- My rent when not living at home has been about $~2000 throughout the period. I prioritized being close to my office early on which I would highly recommend and it made my rent higher than I likely could have had. However, I have held the line on lifestyle increases through finding good deals and discipline. Places I have lived are certainly nice, but not top of the line or fancy buildings analysts or PE associates brag about. Few people in finance or consulting type careers see my apartments and are wowed by it.

- I averaged about ~$5,250 in terms of all expenses in the period. But once adjusting for year, it becomes obvious about $6,500 is more accurate especially factoring out when I was living at home. I am sure people could have higher or lower expenses, but think this gives a good baseline.

- For 2021-2022, this tracked my roommate and my rent, so it’s about ~1.5k too high each month.

- By year averages:

- 2019-2020: $4,134

- 2020-2021: $3,338

- 2021-2022: $5,100

- 2022-2023: $6,553

Some Additional Insights:

- The thread mentioned people not budgeting for life style increases and/or extraneous things that really throw a budget off. Listing a few things that are very obvious when examining the trends:

- During IB, I was more reckless with my spending and frankly was just less budget conscious. I truthfully didn't lean into personal finance or really being very conscious with spending at all until I got past the IB learning curve, during that time I was trading cash for convenience on almost everything. There also were some really large purchases to get going in life once I moved like work clothes, a suit, kitchen supplies, etc. I didn't have time to problem solve, so if something broke or irritated me I just bought it.

- There is cyclicality in my spending where I save more during the holidays

- COVID & living at home lowered my expenses. Even aside from rent, there clearly are some major savings I gained by chilling in my childhood bedroom with my batman sheets turning comments.

- Big Purchases:

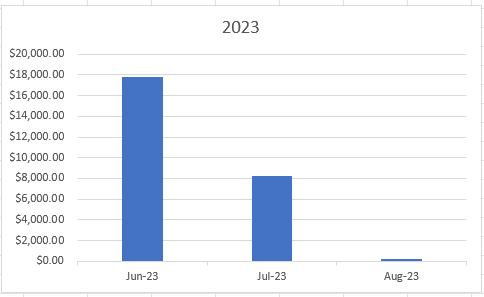

- Aug 2019, I purchased a squat rack after getting my signing bonus, Aug 2020, I think I bought a bed, May 2021 I moved, May 2022 I moved, May 2023 & June 2023 I moved, and purchased a great deal of furniture & "Adult" things like a couch, TV, coffee table, new sheets, towels, etc. I'm feeling confident I'm done with big purchases for quite some time now. So, I expect things to average out much lower going forward. However, these guys really do bring the averages up a significant amount.

- Weddings and other plane flight things seem to happen every month. It's easy to not budget them, but I'm telling you once weddings and trips start it will inflate your budget way more than you think. As mentioned in the other thread, given you are in a finance role, you likely shouldn't be the person not going to a wedding or trip due to the cost and I personally think if you don't go because you are "busy" you will likely lose friends eventually. This isn't to say you go to everything, but bailing on all trips in your 20s is pretty lame.

- Eating rent happens more often than you think. I'm sure others avoid it, but if you find a place that has everything you are looking for, you might decide eating ~$2k-4k is worth it in order to be with the ideal roommate or in the ideal location--this is like a whole additional month of expenses. Having roommates ends up saving a lot of money, but they get married, move, you could fight or not mesh well etc, and this creates a large expense. I recently double paid rent for 2 months because I found a place where I could sign a multi-year lease that had everything I wanted at a very low price. May and June of 2023 are outliers that I expect to pay dividends over the next 2 years, but boy is that a lot of cash to spend in a month.

- As others mentioned, the big spending in May and June was definitely prompted by "An add on Acquisition" Sig Others will likely change your spending whether through increasing travel or stuff you have or think you need.

- Live off your base, bank your bonus is a pretty solid guideline. Taking $6500*12=78,000 divided by combined federal and state taxes of roughly ~30% gets you to about 110k. Add in 401k contributions of ~23k and you are at ~133k and you should be able to bank the spread between that and your all in comp which will probably end up with you banking 20k-70k post tax roughly.

- Lifestyle creep is real. Coming out of college everyone has a huge advantage of living in relatively not fancy places. As a result, you don't mind living in comparable places. Once you make the jump to a nice place it is really hard and painful to go backwards. If you can, hold off on increasing lifestyle for a few years or gradually make lifestyle increases. I know a lot of people who out of the gates got nice places and they have likely paid 30k-50k more in rent than I have which is nearly a year of saving.

- As someone post my analyst days, I'm still playing the game of pretending I have a $120k salary and I need to live below it--others may disagree, but I have found this strategy to be all I need and then some. It's easy to get lost in comparing yourself to how much others are spending, but gratitude goes a long way for keeping expenses reasonable and keeping you happy.

Good luck to the budgeters!