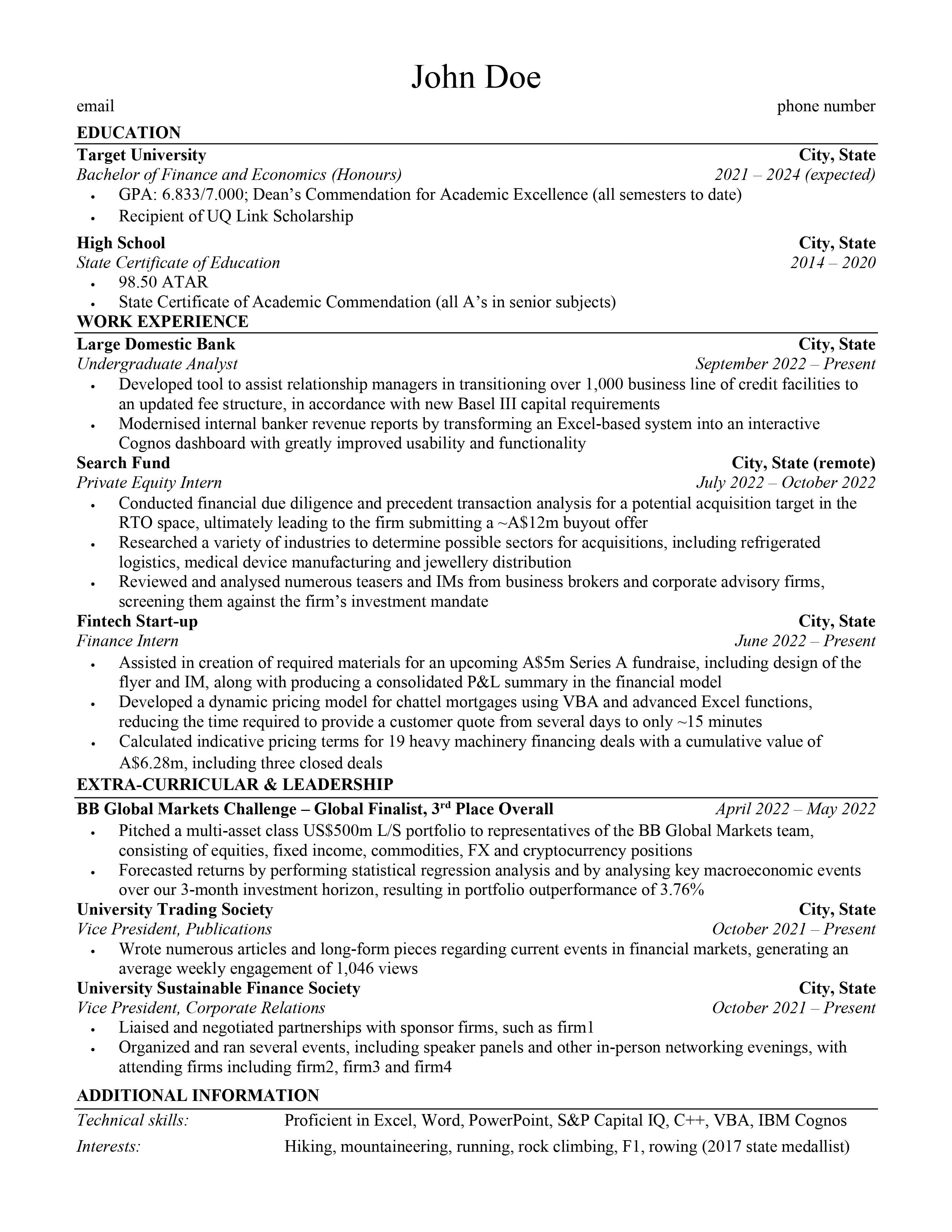

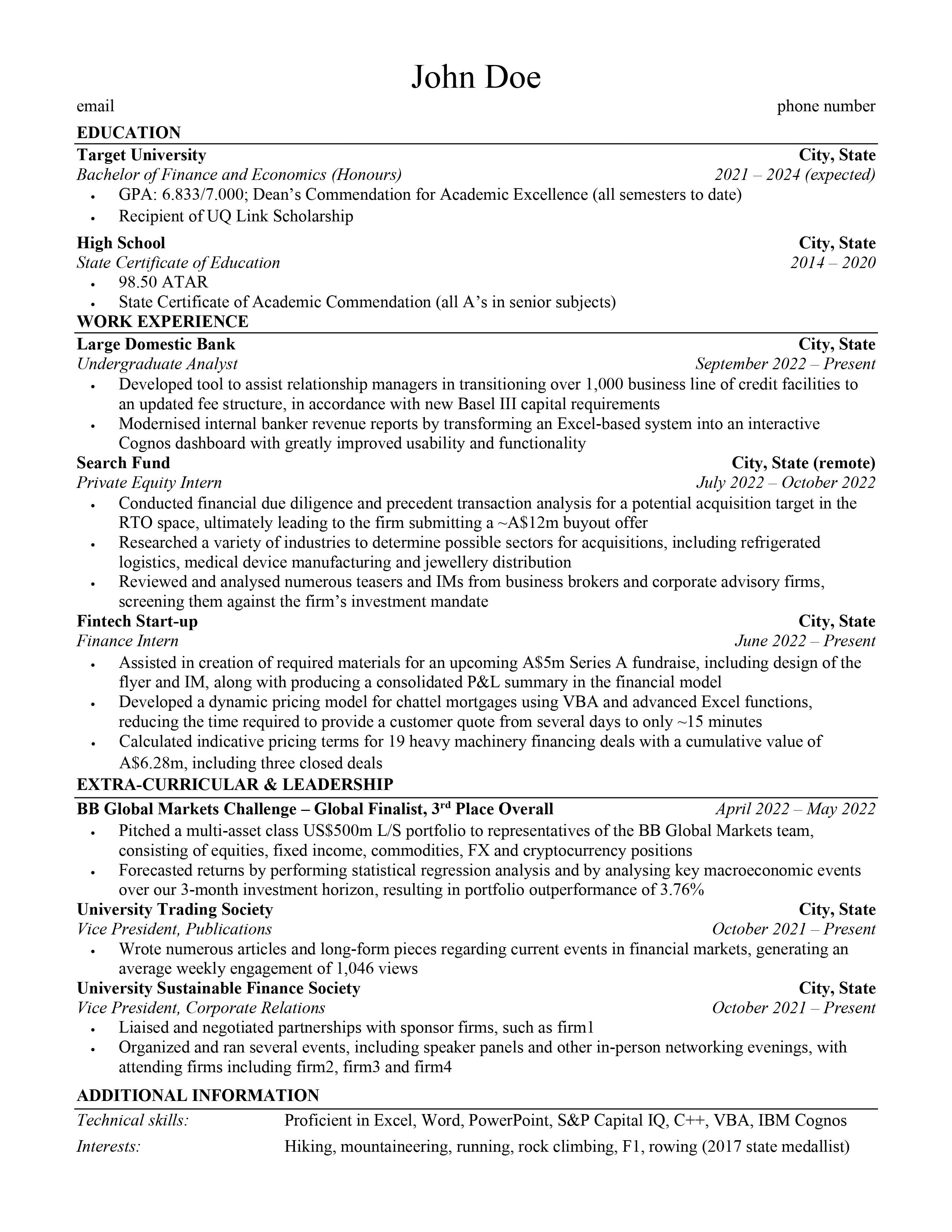

Obliterate My Resume - shooting for IB SA next year

Hi all,

I'm looking to hone my CV before applying for 2023 IB SA roles next year (I'm not in the US). Any feedback is greatly appreciated. Please be as critical as possible - don't hold back.

Hi all,

I'm looking to hone my CV before applying for 2023 IB SA roles next year (I'm not in the US). Any feedback is greatly appreciated. Please be as critical as possible - don't hold back.

Career Resources

bump

Slow day so 2 cent comments here:

I think I need to start an underwater basket weaving club

Nostrum suscipit repudiandae et possimus. Deleniti et iure magnam ut.

Nobis porro fugiat reiciendis. Recusandae eos dolore laudantium dolorem magnam molestiae iste. Dolorem ipsa neque voluptas asperiores quod accusantium aliquid fuga.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...