(Plan) B Student

Here’s the thing. If you’re going to break into a house you don’t ring the doorbell. You’ll need to try a side or back door. Shit you might even need to pry open a window and slide through. But the Financial World security system is tight. I’m talking infrared motion detectors and lasers, real life Mission Impossible stuff. You need someone who knows how to disarm the alarm… someone who knows the code.

In other words, YOU NEED TO MEET PEOPLE, people who own some kind of influence in your desired profession. Even if you don’t know anyone who works on Wall Street, or wherever you want to work for that matter, if you look hard enough you have to know someone who knows someone. I don’t care… become friends with a stripper, I’m sure she could make some great introductions for you. The second thing you have to know is, once you meet someone of influence in your desired profession, don’t immediately ask for a job or even an interview. Just tell them you want to come in and sit on the desk, that you want to learn as much as you can. Plant seeds, water when needed and then watch it grow.

I was a B student from Ohio University with a journalism degree and a 970 SAT—impressive I know—sitting in conference rooms all over Wall Street. In the interest of full disclosure, my uncle worked in the business and got me the meetings. But what I quickly realized was that my uncle could get me interviews, but not necessarily employed. What I also realized was that the most important factor to all of these auditions was not if I was right for the job, but did they want to spend twelve hours a day sitting next to me. Was I annoying? Was I a know-it-all? Would I be someone they’d want to get a drink with after work? Oh and was I capable?

Another thing I learned along the way is what I call “the diminishing degree.” With each year you’re in the business, where you went to school becomes less and less important, even if you went to Harvard (Harvard alums are the last to realize this). But once you get your seat, whether it’s in the back office or on the desk, no one gives a shit what it says on your college ring. On the desk or at the desk you’re judged solely on performance. Sure there are a lot of politics and bullshit that comes along with Corporate America, but your diploma is about as relevant as what you were for Halloween in the 5th grade (I was a Killa Klown if you were wondering.)

Another thing you have to know is the interview, audition, or whatever you want to call it, is never over. From my first introduction on Wall Street, I maintained and cultivated every relationship I ever made. I took the time (and it wasn’t a lot) to follow up and thank people who were willing to try and help me. I kept people in the loop. It’s that sweet spot between annoying and forgettable. But I didn’t stop there. Once I got settled into my first job at Morgan Stanley I reached out to everyone I interviewed with across the street and let them know where I landed. Some appreciated my update and took interest in my new career and others just said congratulations and have a nice day. A year later or so I reached out to all of them again just to say hi and update them on my career, but always remaining grateful for what they had done for me in the past. Though the press and Main Street would like you to think otherwise, honor, integrity and gratitude is rewarded on Wall Street. Even five years after I left Morgan Stanley, and went over to the Galleon Group, I reached out to everyone at my first banking job and let them know of my big move. And at a certain point in my career I was even able to return the favors.

And I’ve seen it from both sides. I’ve had countless people contact me and sit by my side on the desk looking to get in. You’d be shocked at the number of them who disappeared when they didn’t get immediate gratification.

I don’t know this for sure, but my presumption is the six or seven students who came up to greet me after my talk at Marist College are already ahead of the rest of the room, even if they’re just B students like I was. Because guess what? If they reach out to me in a few months looking for help or an introduction I’m going to do my best to help them.

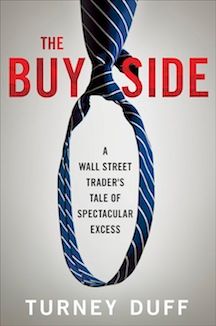

Turney Duff, New York Times bestselling author of The Buy Side