Looking to Transition from Engineering to Finance (IB, PE, VC, etc)

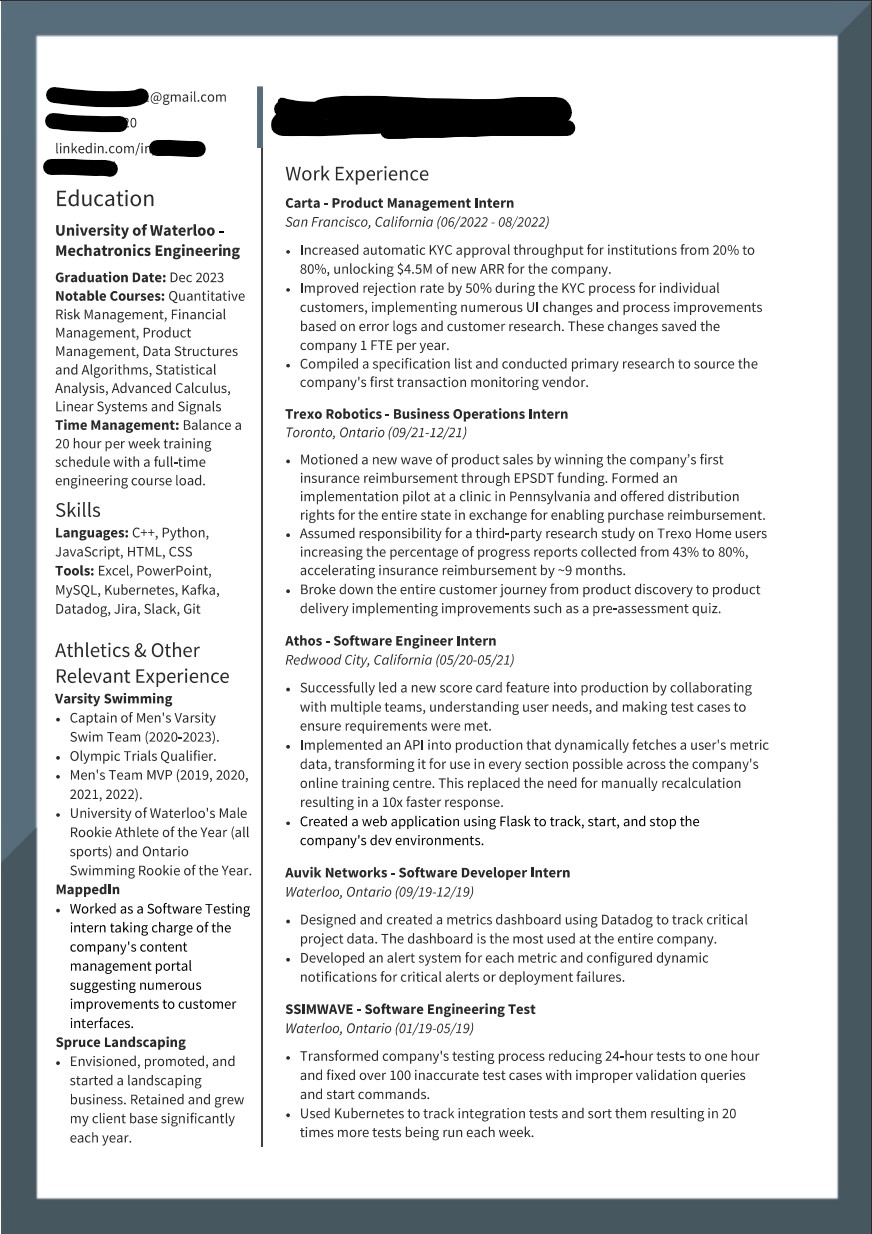

I am currently in my 4th year (5 year program) of Mechatronics Engineering at the University of Waterloo. The program is quite challenging and my class average is ~70-75%, my grades are decent but not amazing. I'll attach my resume below but I have worked software developer jobs, BA, and Product at a Fintech before. Anyway, I realized I don't like programming enough to be a Software Engineer. I'm ideally hoping to break into IB, PE, VC, or honestly anything finance related. My program has very few electives but I managed to take 1 finance course and have absolutely loved it.

I have an offer for a product management internship for this summer, but I'm still hoping there is a chance I can get a finance one. Unfortunately, I have faced a lot of rejections and only 1 interview. I am wondering what a good strategy is for getting interviews, what places to apply to, etc? I still see a bunch of places with applications open - is it worth messaging recruiters on LinkedIn? Any advice would be much appreciated!

You need to work with your strengths to minimize your weaknesses. You are technical and have experience with coding, but you don't want to be a SWE. You are new to finance. IB is recruiting for summer 2024 so finding a role there is going to be tough and I am not sure if you'd be technically equipped to actually beat out other candidates anyway judging from your single finance course. PE, VC is a bit less structured and you might be able to find something at a small firm but the chance it leads to a Ft offer is slim. There is also the lack of financial knowledge relative to your peers. I would focus on internships that you could actually convert to FT in this market. That is something I would ask in interviews because it'll make your senior year a lot more enjoyable if you got something in the back pocket.

The content of your resume looks pretty good. Formatting is iffy but only because Finance prefers traditional, boring resume formats. This site has template if you search for it. Use that. A potential in that may work for you is investment data analytics or portfolio analyst or quant analyst type roles at an asset manager/bank/S&T. Now every shop is different but this is (in AM) sometimes a front office adjacent role working closely with traders, research and PMs to uncover insights about portfolio holdings and the markets. You can highlight your technical skill set (value-add) while committing to learning more about finance to be of use.

Maxime voluptas enim autem explicabo autem voluptas vitae ea. Maxime recusandae dolores iure dolores. Tenetur incidunt quidem et omnis sint enim.

Fugit nam et qui facilis corrupti. Omnis et est et consequatur qui illum. Ea delectus omnis sed rem eos harum. Nostrum dolorum sunt eos cupiditate pariatur inventore. Voluptatem eveniet ducimus voluptatum. Aliquam dolorum dicta dolores iure odio.

Nihil voluptatem maxime qui in rerum modi atque. Sint voluptatibus omnis ad perspiciatis nisi.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...