CRE Off Shore Investment Structure

Has anyone worked / familiar with off shore CRE investment structure(s)? If yes:

1) What have you worked on i.e. BVI, Lux, Cayman, Bermuda, Panama etc

2) What's the cost of structuring off shore?

Has anyone worked / familiar with off shore CRE investment structure(s)? If yes:

1) What have you worked on i.e. BVI, Lux, Cayman, Bermuda, Panama etc

2) What's the cost of structuring off shore?

| +51 | Leave brokerage to be GP | 12 | 4h | |

| +45 | New Comp Database - Google Form (Now with Data Validation) | 24 | 1h | |

| +24 | Seeking Career Guidance in Real Estate Development Post-Graduation | 3 | 1d | |

| +23 | Going out on your own | 4 | 6h | |

| +22 | REPE/Development GPA | 15 | 2d | |

| +21 | Real Estate = complicated + underpaid | 15 | 5h | |

| +17 | MSRE/MSRED with no RE experience; Naive to think I’ll land a job afterwards? | 4 | 4d | |

| +17 | Fisher Brothers | 6 | 3h | |

| +16 | UC Berkeley MRED vs Columbia MSRED? | 2 | 6d | |

| +15 | Spreads over SOFR/UST | 0 | 5h |

Career Resources

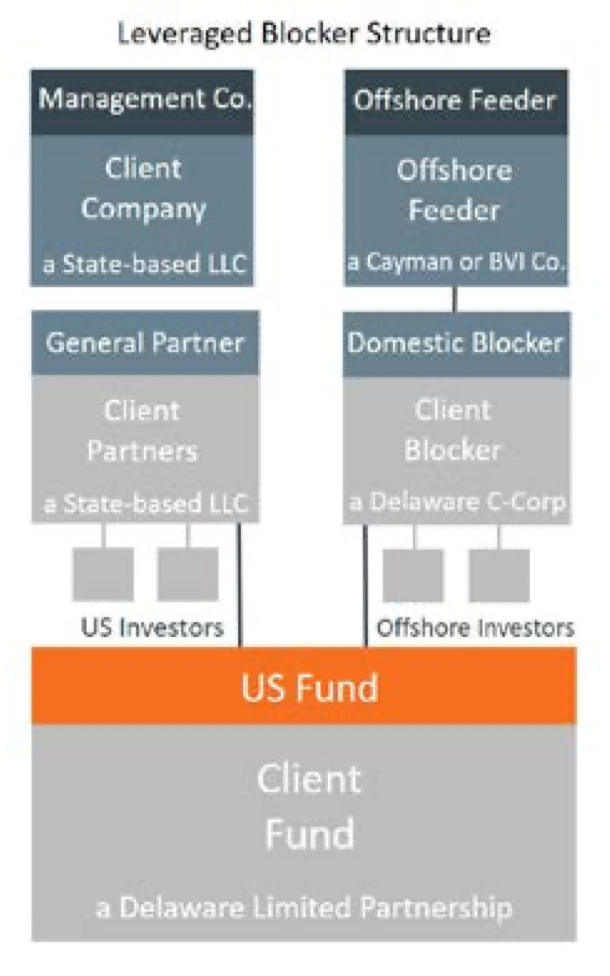

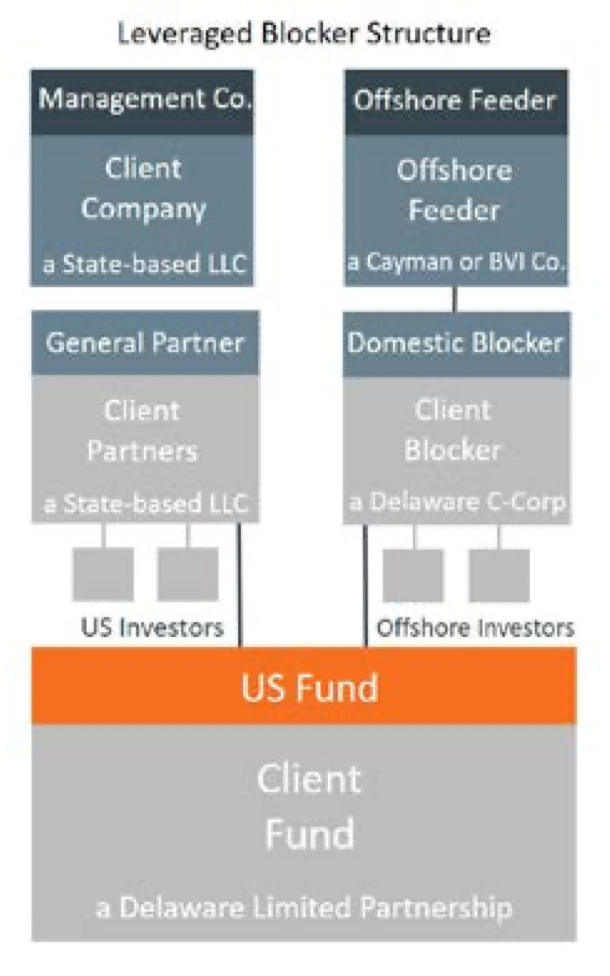

The domestic blocker structure in your chart is currently at risk of going away.

1. Depends on the geography of the investor. A Korean investor won't use a Lux structure, but a French investor trying to access the US would. There is a ton of nuance here.

1.1 No a US investor would not need to route their investment through a foreign jurisdiction to invest in the US.

2. Hundreds of thousands of dollars. Call it $300k - $700k for a rough range.

3. The big global law firms offer this service. Look at the law firms that service the REPE MFs

3.1 The fact you are asking these questions on this forum and not to an attorney is only mildly alarming.

Thanks for the 'mildly alarming' and the domestic structure warning without elaborating on it.

Oddly in my previous 2 shops we paid c.$30k for Lux or BVI structures ($3bn AUM), but I am sure an attorney with your referral must be much more throughout at $300k - $700k structuring cost. So glad I am not paying $500 an hour for posting on here while creating an open source of information!

As you mentioned "there is a ton of nuance here" -INDEED, but one nuance I've learnt: it's usually more alarming when people set out to portray a topic more complicated than it needs to be. NB: unless a $700k attorney can work their magic, a benefit of creating OCPI in Lux structure for French investments is a thing of a past already.

Simple put: Let's Be Humble ( because not that long ago you were asking this forum about a difference between CoStar and RCA. )

Sorry my answer wasn't satisfactory, I hope someone else is more helpful for you and your revised original question.

Fair enough. Happy to edit my post(s) if you edit yours i.e. 'mildly alarming' etc.

Noobie here who is curious.

What’s the purpose of an off-shore legal entity?

Not to imply anything at all but with the recent Panama/Paradise papers fiasco, is there not some stigma surrounding use of off-shore legal entities?

Also are there any books on this subject you would recommend?

1. Raising international capital i.e. offering international investors an opportunity to own US CRE while minimising US tax exposure via off shore structure. Let's be honest, US economy is the leader and most stable investment environment, so is it's CRE. If US catches cold, the rest of the world catches pneumonia ( apart from Covid, that rubbish came from Wuhan )

1.2. Off shore entities are not subject to US taxation whereas BVI or alike have super low taxes if any ( BVI is a zero income tax regime, although there is a tax spillage on that level too but it's usually less than 5% )

2.1 Off shore entity can issue a shareholder loan to US entity. As you know the interest is tax deductible whilst minimising on shore taxation. Yes, it's a 'paper loan'. Don't worry IRS knows about that because everyone is doing it, thus there are stringent rules around shareholder loans i.e. simply put: has to be market terms

2. Hide ultimate beneficiary owner (UBO). US gov, UK, EU and other jurisdictions will be unsuccessful in demanding from BVI or other 'safe-heaven' about the owner's information ( unless it's leaked like in Panama Papers )

2. Protection from law suits. In US it's easy to sue anyone and quickly - just call the number on the highway billboard e.g. imagine a divorce case where soon to be ex-wife or ex-husband can't snatch away your office tower

3.2. Estate planning i.e. minimise probate ( although this can be achieved with a Trust structure in US )

3.3. I've heard someone figured out how to harbour US capital in off shore entities for US citizens ( or multinationals because most UHNW have more than 1 passport), although haven't seen it in practice ( just heard that off shore earnings have to stay off shore or if it's brought back stateside it will be taxed )

Yes Panama Papers was a disaster, but off shore structuring is a norm for private funds. Large portion of UK and European CRE held in off shore structures which is changing after Panama Papers because at a time UK Prime Minister's name came up on that list - so new off shore structure emerged. The reason London is a financial dominant city in the world is because of the off shore enabled structures (covered by FT):

I am sure there are books, but taxation and tax treaties between countries change constantly. Big 4 make a fortune because of that. Usually you learn about different off shore structures from other market participants, hence the questions to the forum..

Writing on a quick-hand, so might be missing a few other benefits. Investment structuring is somewhat a taboo topic, but I am sure others on this forum could add if they wanted to..

Ab libero nobis velit explicabo consequuntur natus. Consectetur voluptas unde ullam neque.

Sunt similique unde alias ut. Molestiae sit dolore sit corporis.

Possimus id repellat ducimus architecto et qui. Omnis id quis recusandae.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...