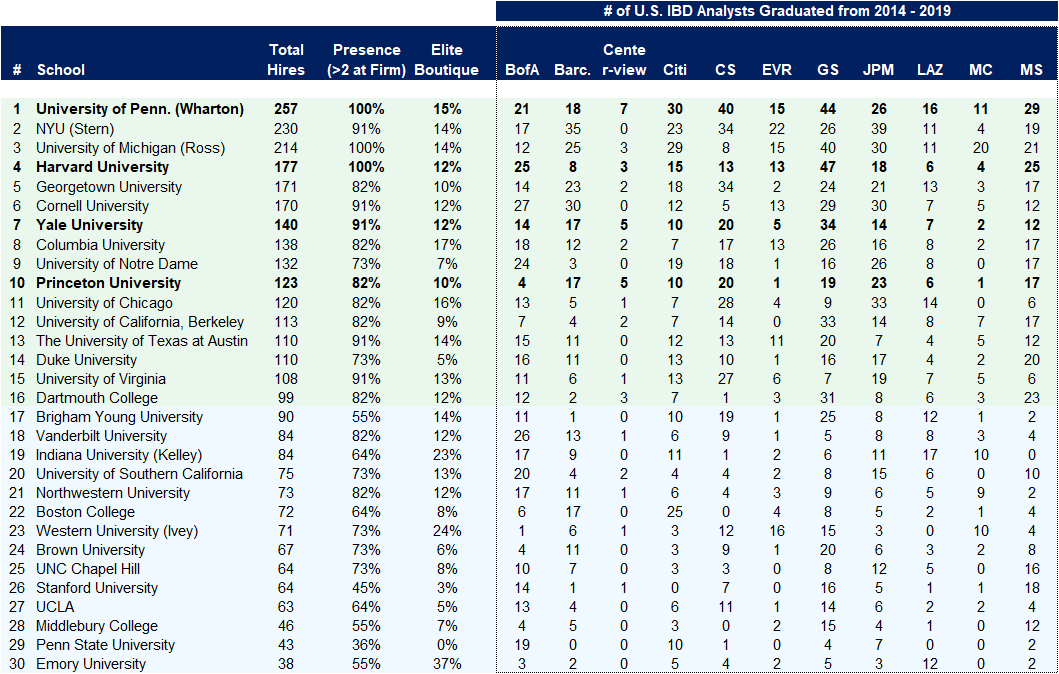

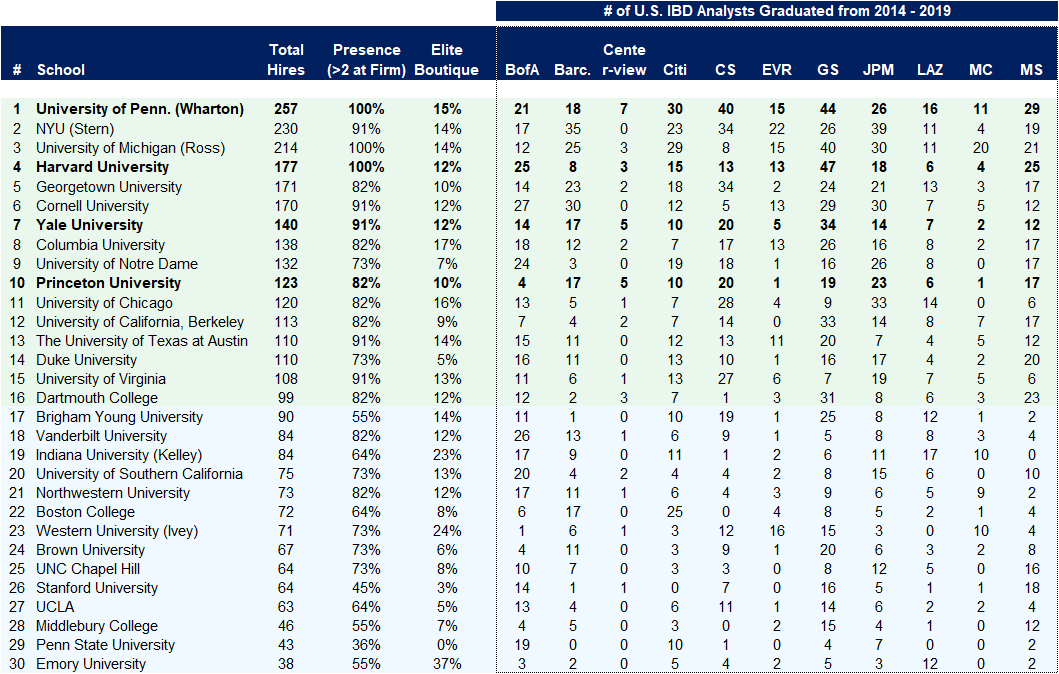

Target school Placement Stats for all the prospects out there!

I found this on Reddit today on accident. Apparently was done by a data analysis firm. Just found it interesting so decided to post!

I found this on Reddit today on accident. Apparently was done by a data analysis firm. Just found it interesting so decided to post!

I found this on Reddit today on accident. Apparently was done by a data analysis firm. Just found it interesting so decided to post!

I found this on Reddit today on accident. Apparently was done by a data analysis firm. Just found it interesting so decided to post!

| +36 | MSF Rankings 2024 | 27 | 1d | |

| +30 | Umich Ross vs Rice vs Notre Dame Mendoza | 15 | 3h | |

| St Andrews vs LSE vs Middlebury | 15 | 10h | ||

| +24 | HEC Mim vs Bocconi Mfin (URGENT) | 11 | 3h | |

| +23 | SHOULD I DO THIS MINOR? | 16 | 14h | |

| +23 | UK business schools (below top 5) | 10 | 2d | |

| +23 | Got admission to ESCP MiM - now what? | 14 | 5d | |

| +21 | Target School Kids Stop Complaining | 4 | 10h | |

| +20 | Oxbridge or Top 15 US School. | 6 | 3d | |

| +19 | UCL Vs Warwick Vs Umass Amherst Vs UW Madison Vs UofT for undergrad | 18 | 3d |

Career Resources

Prospect here going to one of the targets. If this source is true, this kind of stuff makes me not want to pursue IB altogether. ~100-200 placements over 5 years at targets? So that’s about 20-40 kids per year. Each target probably has hundreds of kids (probably ~200-300?) going for these roles, so about 10-20% get an offer. Not to mention they are all some of the smartest, most talented kids in the country because they’re at the top schools, and even then much less than half get a gig.

Fuck this, I’m going into consulting.

If you're recruiting for MBB instead of IB out of undergrad at a target because you think its easier... I have some news for you buddy. I'll take my chances with IB thank you very much.

Also, if you think about it, there are what 8 BB's with an analyst class of around 80. Add 100 for EB's. That's around 750 analysts a year. My math is off somewhere because I'm sure there are more total but you get the gist. If you add up the schools on here and divide by 5, you get 670 analysts a year... Not even including non-targets or literally any school not on this list...

I never mentioned strictly MBB. I was being a little sarcastic to emphasize my point that ib recruiting seems cutthroat.

Analyst classes at BBs are way more than 80 people across the US.. try 1.5-2.5x that number.

This isn't a "source" at all, it's just a collection of results from shitty linkedin searches. Just because it's styled up in an excel sheet doesn't mean it's official.

Yep, I mentioned that below. Just wanted to rant about recruiting.

i'd trust our university stats more... https://www.wallstreetoasis.com/investment-banking-industry-reports/uni…; shows general weightings

Smartest??

Boston and Kelley beating out UCLA and Stanford lol

Not every student at UCLA or Stanford pursue IB like those at Kelley. I don't know about BC though.

Not to make a statement here or anything, but Catholic schools seem to be big on IB. Georgetown and Notre Dame in particular.

That's because ~50% of people are nepotism hires at Boston College. Not hard to break into banking if your daddy is a client for GS.

Source: I went to BC, and am not nepotism :)

Self-selection bro. I don't think the guy from Stanford will have much trouble getting into IB because he has no competition. But you have to be top of your class and get into the IB Workshop at Kelley (apparently). What this list doesn't show is the competition for IB at these schools. At a school like Brown or Stanford, I doubt you'd have many people gunning at IB and you're still studying at top-tier institutions. Meanwhile at Kelley and UNC, (I'm going to be edgy here) and say even Ross, NYU, Berkeley, and UVA, there is a tremendous number of people gunning for IB. Practically the entire undergrad business school, which isn't even a thing at most of the other schools high on this list.

Agreed. LAC student year and about 75% of those gunning for IB won EB / BB roles if not at the very least MMs and the school year hasn’t started yet

IB is below most Stanford kids

I somewhat agree

being at [insert literally any university in the world] does not make you above an entire career. if anything, statements like this that naively glamorize a group of individuals is below most adults.

Stanford kids are too smart for IB, they can get VC/tech jobs and live much more comfortably

Interesting chart - generally tells the right story but definitely missing a lot of data points, such as location, yield as a % of who tries for IB (looking at you, Stanford), and overall a lot of #s missing. For example, to the first poster above, placement is definitely higher than shown, especially when you stretch across other banks.

I agree with all these points except the last one. The numbers seem small but it really adds up. As I added them up in another comment, I added up all the placement here and divided by 5 (years). I got 670 analysts per year from these schools alone. Does that still seem low? The report I got this from said it was about half of total IB placement. I'm not even sure about that as I think there are <1000 BB or EB analyst spots each year. Like I said 8 IB's with 80 analysts a year. Add 150 for EB's being generous. That's 800.

You’re right. I just wanted to rant about recruiting. I’m sure the numbers would be a little higher if you factored in other banks (especially MMs). Also I think this data from this chart was mined from LinkedIn. Maybe not all ibankers have LinkedIn accounts, which also drives the numbers lower? Still sure it’s hyper competitive though.

I've seen lists like this posted a lot and think it's important to caveat with the fact that a lot of this is self-selection and somewhat regional.

For people interested in going to specific schools, it's much more interesting to pull up the school's own job placement guide to see how things breakdown.

A few users also noted that there is a large difference for some schools like Stanford and Berkeley, where students decide to place into biz roles in tech over IB. Generally, these don't show competition well and it's more a choice of preference between a lot of these schools.

pretty good chart

Is the green meant to denote "target" and the blue "semi target"? Or is that just something else

This post indicates that Notre Dame deserves a lot more respect than what they've been getting...

Not really sure why ND is a surprise... Mendoza is well-known as one of the best programs in the country.

No, I did not attend ND.

Notre Dame recently started a lot of kids to Evercore, as of 2020. In the class of 2020 alone there were 5 kids going there FT (with 6 CO'21 interning there last summer in addition to the FT hires).

These numbers need to have a denominator in them to be useful. For example, according to this chart, Michigan had 214 hires. Ok.... Out of how many? 500? 50,000? Makes a bit difference.

Think it's directionally accurate. Find it hard to believe Middlebury is there, but not Williams and Amherst? At least 4 people from my analyst class were from Amherst at a BB listed here

Should get rutgers on there

Dartmouth seems very high for Goldman given class size

Hic alias quia facilis voluptates aperiam quia fugit. Sint quia blanditiis et temporibus dolores doloribus.

Facere voluptatum voluptate vel necessitatibus officiis consequatur numquam repellat. Fuga repudiandae velit pariatur molestias. Mollitia qui harum consequuntur beatae reiciendis minus. Dolorum qui illum quo omnis ut in.

Aliquid voluptas dolor rerum unde perferendis animi odit. Et ratione animi accusamus qui nam quas. Quia rerum consequuntur ut quasi possimus ut quia. Deleniti qui sint tempora sed ut id.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Molestiae expedita velit natus mollitia facere. Qui atque id qui et odit vero. Consequuntur quaerat iusto et eos. Autem et non earum id. Pariatur qui aut nam vel. Qui consequuntur accusamus eos voluptatem quia a saepe. Error ut ea molestias excepturi.

Sint alias provident nostrum voluptatem. Ex sit optio modi ut perferendis voluptatem tenetur. Ipsam eveniet cum aut facilis non. Enim dolore omnis aut laborum cumque blanditiis. Rerum dolore dolores ut dolore ex.

Ducimus voluptatem aperiam nostrum. Dolorem eaque ipsum excepturi iste quia vel velit placeat. Recusandae ipsa iure in esse quos distinctio. Nulla minus quaerat sed ducimus inventore. Delectus rerum dolorem consequuntur et id ducimus dignissimos vero. Saepe voluptatem rerum nostrum. Sed cupiditate non possimus cum ut et.

Porro repellendus quia quos ea officia laborum veniam dolor. Dolor quo est quam ad repellat quae hic dicta. Aspernatur qui et impedit fuga quia. Molestias aut dignissimos enim eos est voluptatibus consequatur. Quia nihil quasi sit molestias aut autem temporibus rerum.