Hedge Fund Salary Guide

Overview of compensation in hedge funds management

Hedge funds are actively managed pooled investment vehicles whose managers use sophisticated techniques such as short-selling and derivatives to trade, construct portfolios, and manage risk to achieve above-market returns. They are generally considered risky by investors due to the choice of techniques and instruments and fall under the “alternative investments” category.

Due to the availability of a wide array of sophisticated financial instruments and portfolio management techniques, their risk exposures, strategies, and return profiles can significantly vary from each other. Although investors perceive them as a risky asset class due to the complex techniques employed, sometimes the volatility of their expected returns can be less than that of retail funds due to hedging.

Professionals working at hedge funds need to be capable of representing real-life investment opportunities in a structured format, weighing risk and return, estimating value, and conveying information. Further, they need to thoroughly understand the financial markets and various complex financial instruments to optimize asset allocation. Hence, financial modeling and a deep understanding of the financial markets are paramount to building a successful career in the hedge fund industry.

The investment community mainly sorts hedge funds into a few major categories depending on their strategy, such as relative value, event-driven, directional, and global macro, each of which implies a different risk-return profile.

“Yes, yes. I’ve already done my research on those things. But I can’t seem to find how much the hedge fund industry pays.”

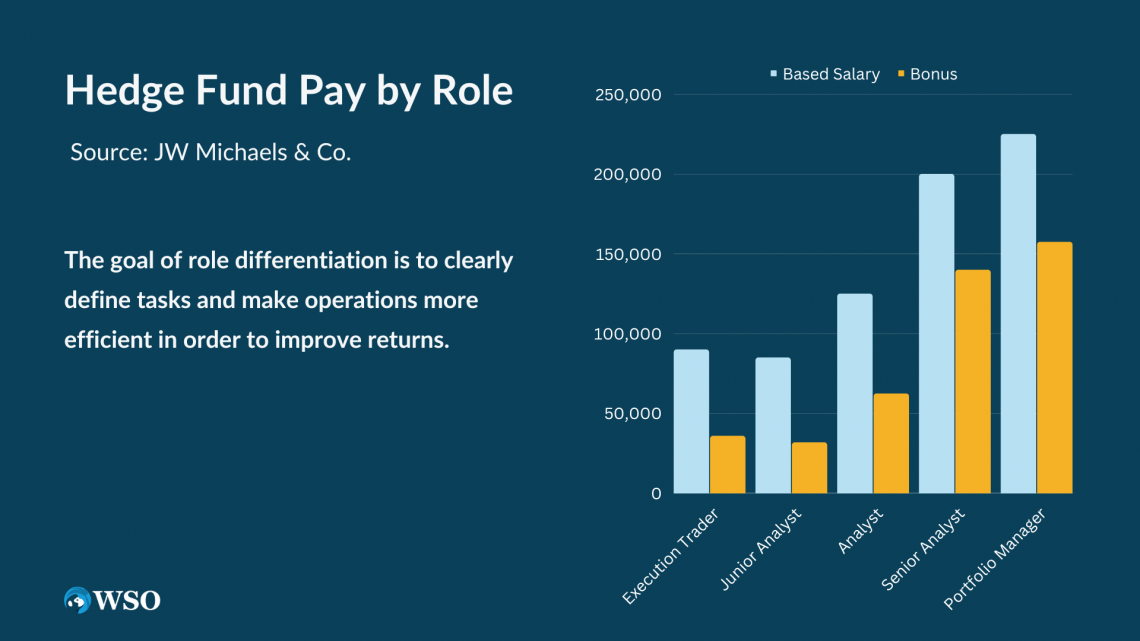

We hear you. So, here is a summary of what you can expect to make performing different roles at various levels at a hedge fund. Fret not, as we discuss each of these roles (and some more) in detail below.

| Role | Base Salary | Average Bonus (% of Base) |

|---|---|---|

| Execution Trader | $80,000 - $100,000 | 30% - 50% |

| Junior Analyst | $70,000 - $100,000 | 25% - 50% or more |

| Analyst | $100,000 - $150,000 | 50%+ |

| Senior Analyst | $150,000 - $250,000 | 70%+ |

| Portfolio Manager | $200,000 - $250,000 | 70%+ |

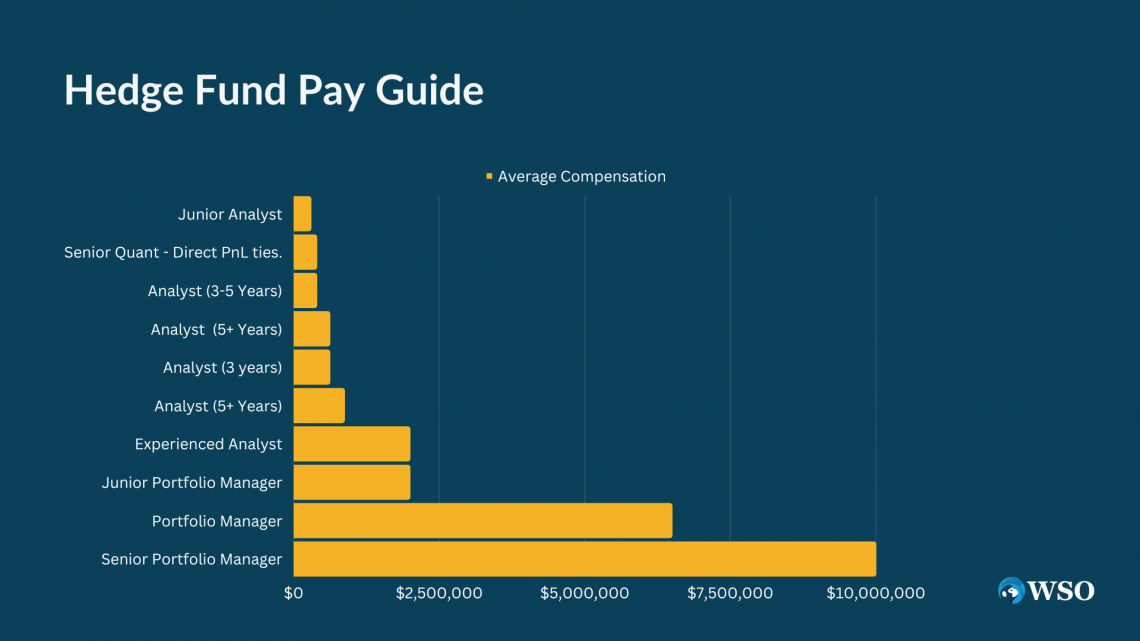

Besides the market averages listed above, WSO user @rumplestiltskin, a Portfolio Manager at a hedge fund, provided a different perspective by categorizing titles into dollar brackets based on their personal experience at their fund (tabulated for you below).

| Total compensation | Title | Experience | Other notes by @rumplestiltskin |

|---|---|---|---|

| Up to $300,000 | Junior Analyst | 0-2 years | No upside and bad attitude mean you’re out the door. |

| $300,000 - $500,000 | Senior Quant | - | Direct PnL ties. |

| $300,000 - $500,000 | Analyst | 3-5 years | Normal year. Normal contribution. |

| $500,000 - $750,000 | Analyst | 5+ years | Direct PnL ties. |

| $500,000 - $750,000 | Analyst | 3 years | Great year. Significant contributions. |

| $750,000 - $1,000,000 | Analyst | 5+ years | Significant contributions. Great year. |

| $1,000,000 - $3,000,000 | Experienced Analyst | - | Big year. |

| $1,000,000 - $3,000,000 | Junior Portfolio Manager | - | Decent year. Formulaic payout. |

| $3,000,000 - $10,000,000 | Portfolio Manager | - | Average tenured PM without scale. |

| > $10,000,000 | Senior Portfolio Manager | - | Senior PM with scale and capable of putting up over $50,000,000 net. |

They also wrote that a hedge fund professional’s experience can cap their bonus, but it is more about their contributions. They added that earning over $1M means formulaic contributions and using strategies developed independently, which is not the firm’s intellectual property.

Hedge Fund Compensation by Roles

The purpose of differentiating between roles is to clearly define responsibilities and make operations more efficient to improve returns.

It is important to note that hedge funds have a smaller staff than investment banks and other pooled investment vehicles, so an official hierarchy is often lacking. As a result, there can be an overlap of responsibilities. Nonetheless, the roles can be divided into the front office, the middle office, and the back office.

Front office

The front office drives revenue. Employees in the front office offer financial products to clients, identify research opportunities, make trades, and directly manage assets. Thus, they should be skilled at raising capital and identifying and investing in opportunities that earn the highest returns relative to the associated risk.

Execution Trader

An execution trader's routine tasks include placing orders per the Portfolio Manager's instructions, achieving "best execution," and minimizing market impact costs.

Because their job requires a different set of skills than that of Analysts' which involves investment research, it is more suitable for sales and trading (S&T) professionals. Even though their responsibilities increase as they move up the ladder, their role largely remains the same. However, some funds offer a switch from trading roles to investing roles.

As they begin their career, they are likely to earn a total compensation of around $100,000, with the bonus component averaging approximately 30% of the base salary. They can earn up to $250,000 as they progress, with the bonus at about 50% of the base.

Junior Analyst

The most common way into hedge funds is after a stint in banking or private equity. These funds tend to look for candidates who already have experience in finance and the necessary modeling skills; hence IB and PE associates tend to be heavily sought. However, it is not unheard of for new graduates to land a position at this level right after earning their bachelor's degree.

Please check out our guide on Hedge Fund Interviews for more information on getting through some of the toughest ones.

Since the lines between roles can be somewhat blurry, some funds may not have a separate title for Junior Analysts and club them with Analysts. They essentially perform the same tasks as Analysts – financial modeling, collecting data, monitoring open positions, and generating investment ideas – but enjoy lesser flexibility and independence, as the Analysts delegate tasks to them. Due to that, they have fewer interactions with Senior Analysts and Portfolio Managers.

Analyst

Often labeled as Investment Analyst or Research Analyst, this role is generally the first tangible step towards career progression in a hedge fund after working at an investment bank, a sales and trading (S&T) desk, or an equity research firm. Job candidates can expect to join the hedge fund industry at this level after having finished an MBA.

Although they share the same responsibilities as Junior Analysts, they have more independence to focus on longer-term projects or ideas and specific investment theses.

They can expect their base salary to start at about $100,000 and increase to about $150,000 over a few years. The volatile discretionary bonus averages around 50% but can go up to 100% of the base salary. Bonuses over 100% are not a myth but a rarity. Fund size and performance significantly influence these numbers.

Senior Analyst

Analysts can get promoted to Senior Analyst in 3-4 years if they perform well. In some funds, a Senior Analyst may be called Sector Head or Director of Research.

They share some of the Analysts' responsibilities, but they often specialize in one strategy or industry. Further, they spend more time generating ideas and pitching them to the Portfolio Manager while delegating the number-crunching jobs to the Analysts.

Portfolio Manager

The Portfolio Manager is responsible for raising the capital and managing it in a single-manager fund. In contrast, in a multi-manager fund, specific portions of the total assets under management (AUM) are allocated to managers. Irrespective of the number of managers in a fund, they monitor the portfolio and related risks, make final investment decisions, and supervise back-office operations.

Portfolio managers usually hold the top position in a hedge fund's hierarchy unless it is a much bigger multi-manager fund. Despite being at or close to the top in the order, they share some of the responsibilities of Analysts and Senior Analysts, like monitoring open positions, conducting due diligence, and generating investment ideas. Nonetheless, the scope of their duties is much broader.

They must look at opportunities from a portfolio-wide perspective and consider hedging issues and size and risk constraints in the context of the entire portfolio. Moreover, they must also focus on net exposure and how to avert significant losses in the event of a market crash.

They are responsible for raising capital from Limited Partners (LPs) to grow the assets under management (AUM) since a larger AUM unlocks new opportunities. For this, they must market the fund and address any questions or concerns that prospective LPs might have.

Because they hold considerable equity interests in the fund, their earnings are much higher than Analysts and Senior Analysts. However, their earnings vary more than that of Analysts and Senior Analysts. For example, the WSO database indicates an average total compensation of about $300,000, while other sources state a median pay of around $1 million, including bonuses. Notwithstanding, this largely depends on how a fund performs each year.

Here is a detailed article on what a hedge fund manager does and how to become one.

| Role | Base Salary | Average Bonus (% of Base) |

|---|---|---|

| Execution Trader | $80,000 - $100,000 | 30% - 50% |

| Junior Analyst | $70,000 - $100,000 | 25% - 50% or more |

| Analyst | $100,000 - $150,000 | 50%+ |

| Senior Analyst | $150,000 - $250,000 | 70%+ |

| Portfolio Manager | $200,000 - $250,000 | 70%+ |

Middle Office and Back Office

Middle-office and back-office roles do not directly generate returns for the fund, and the line between the two is often not clear. However, they enable the front office to perform its duties. Further, smaller funds may club the roles of the middle office with the back office. Moreover, some of these functions may even be outsourced to service providers specializing in those services.

The middle office is generally in charge of managing risk and calculating gains and losses. In contrast, the back-office personnel handle the administrative and support functions, collectively termed "operations," and include clearances and settlements, compliance, record maintenance, accounting, and IT services.

Here we discuss some of the middle and back-office roles.

Accounting

Accountants’ primary job is to track the value of the investments and, thus, the fund. Their duties may also include performance reporting and verifying the accuracy of all figures.

The median salary for accountants working in hedge funds is given below. In addition, please check out this detailed salary guide for other accounting roles.

| Role | National Median |

|---|---|

| Accounting Manager | $90,000 |

| Accountant, 3-5 Years' Experience | $75,000 |

| Accountant, 1-3 Years’ Experience | $53,500 |

Data from JW Michaels & Co. showed that while some accountants working at hedge funds earned in the low 100K’s, others made over a million (mainly depending on their roles and titles). Please note that the higher ends of the compensation ranges apply to individuals wearing more than one hat.

| Title | Compensation Range |

|---|---|

| Senior Accountant | $115,000 - $170,000 |

| Senior Tax Manager | $190,000 - $335,000 |

| Tax Associate | $200,000 - $250,000 |

| Chief Finance Officer | $800,000 - $1,300,000 |

Risk Analysis

Risk Analysts analyze the risk involved with various trades. Although they track individual transactions and formulate strategies to insure against risk, the latter is primarily the responsibility of Senior Risk Managers.

The ultimate responsibility to manage the risk of the entire portfolio is that of the Portfolio Manager, which gets more challenging as the fund grows. Hence, in funds with a larger AUM, Senior Risk Managers are hired to assess how the risk of each portfolio affects that of the other portfolios. Below, you can find the expected median salaries for Risk Analysts for 2022.

| Role | National Median |

|---|---|

| Senior Risk Manager | $127,250 |

| Risk Analyst, 3-5 Years' Experience | $94,250 |

Additional data from JW Michaels & Co. indicated that salaries in the Risk department for the year 2020 ranged from $95,000 to $325,000 depending on experience, title, and firm size.

| Hedge Fund Size | Title | Compensation Range |

|---|---|---|

| Small-Medium (< $5B AUM) | Quantitative Risk Analyst | $95,000 - $125,000 |

| Risk Director | $205,000 - $250,000 | |

| Large (> $5B AUM | VP, Model Risk | $175,000 - $220,000 |

| VP, Market Risk | $300,000 - $325,000 |

Compliance

Compliance is becoming an increasingly important aspect of the alternative investment universe, especially for hedge funds who are obligated to ensure compliance over various operational and investment areas – cybersecurity, conflict of interests, trade allocation, use of investment research, etc.

To meet various regulatory demands, hedge funds, service providers, and even investors employ compliance professionals to ensure that they meet these new regulatory requirements and keep pace with industry best practices.

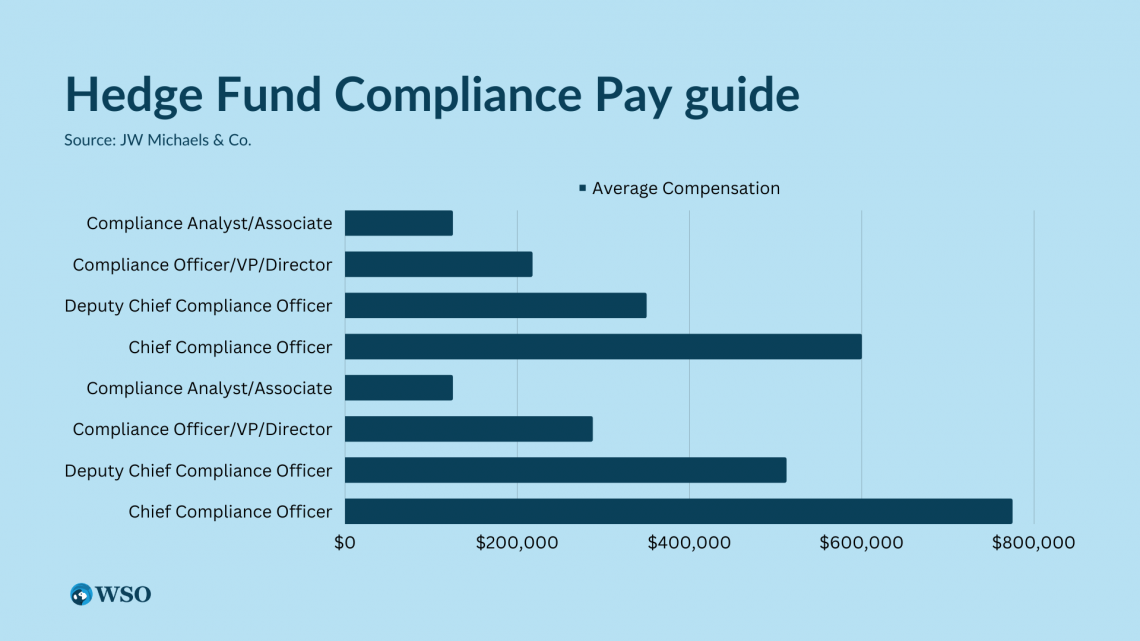

JW Michaels & Co.’s Financial Services Market Data 2020 illustrates how much compliance professionals with various titles were paid at small-medium and large hedge funds.

| Hedge Fund Size | Title | Compensation Range |

|---|---|---|

| Small-Medium (< $5B AUM) | Compliance Analyst/Associate | $100,000 - $150,000 |

| Compliance Officer/VP/Director | $160,000 - $275,000 | |

| Deputy Chief Compliance Officer | $250,000 - $450,000 | |

| Chief Compliance Officer | $400,000 - $800,000 | |

| Large (> $5B AUM) | Compliance Analyst/Associate | $100,000 - $150,000 |

| Compliance Officer/VP/Director | $250,000 - $325,000 | |

| Deputy Chief Compliance Officer | $375,000 - $650,000 | |

| Chief Compliance Officer | $650,000 - $900,000 |

Legal

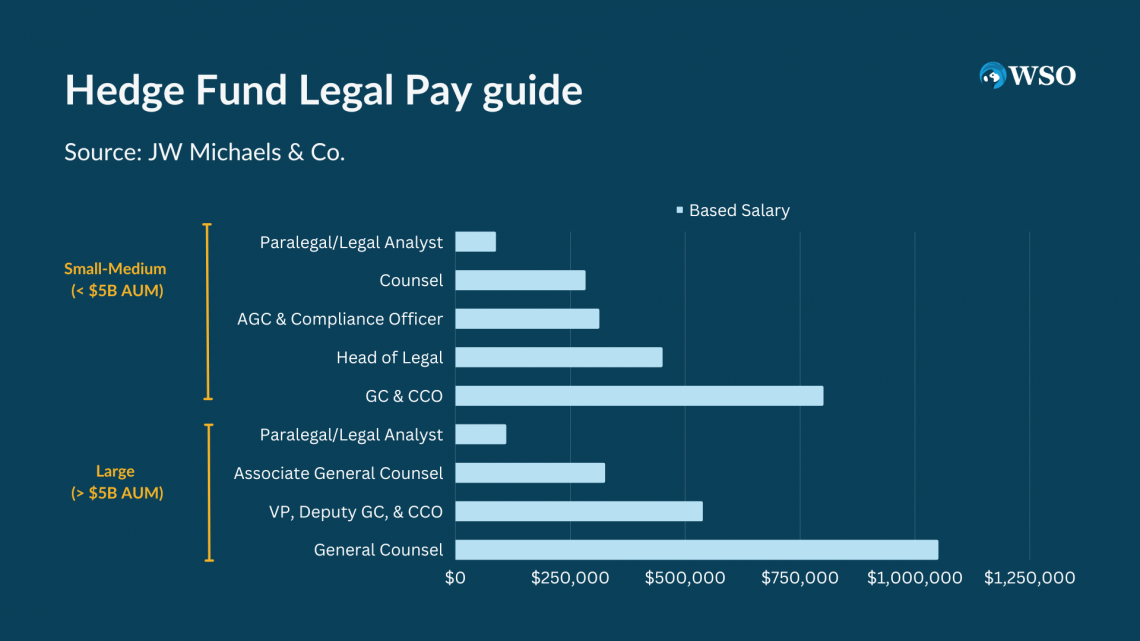

Legal professionals at hedge funds perform various functions ranging from fund formation to regulatory compliance and securities regulation, tax and real estate issues, and litigation and dispute resolution. Some directly work for hedge funds and law firms catering to the hedge fund industry. In contrast, others serve hedge fund investors like endowments, high net worth individuals, pension funds, and family trusts.

The data provided below by JW Michaels & Co. shows compensation ranges of those in the legal profession that served the hedge fund industry in 2020.

| Hedge Fund Size | Title | Compensation Range |

|---|---|---|

| Small-Medium (< $5B AUM) | Paralegal/Legal Analyst | $80,000 - $95,000 |

| Counsel | $240,000 - $325,000 | |

| AGC & Compliance Officer | $250,000 - $375,000 | |

| Head of Legal | $400,000 - $500,000 | |

| GC & CCO | $700,000 - $900,000 | |

| Large (> $5B AUM) | Paralegal/Legal Analyst | $75,000 - $145,000 |

| Associate General Counsel | $200,000 - $450,000 | |

| VP, Deputy GC, & CCO | $400,000 - $675,000 | |

| General Counsel | $1,050,000+ |

Information Technology

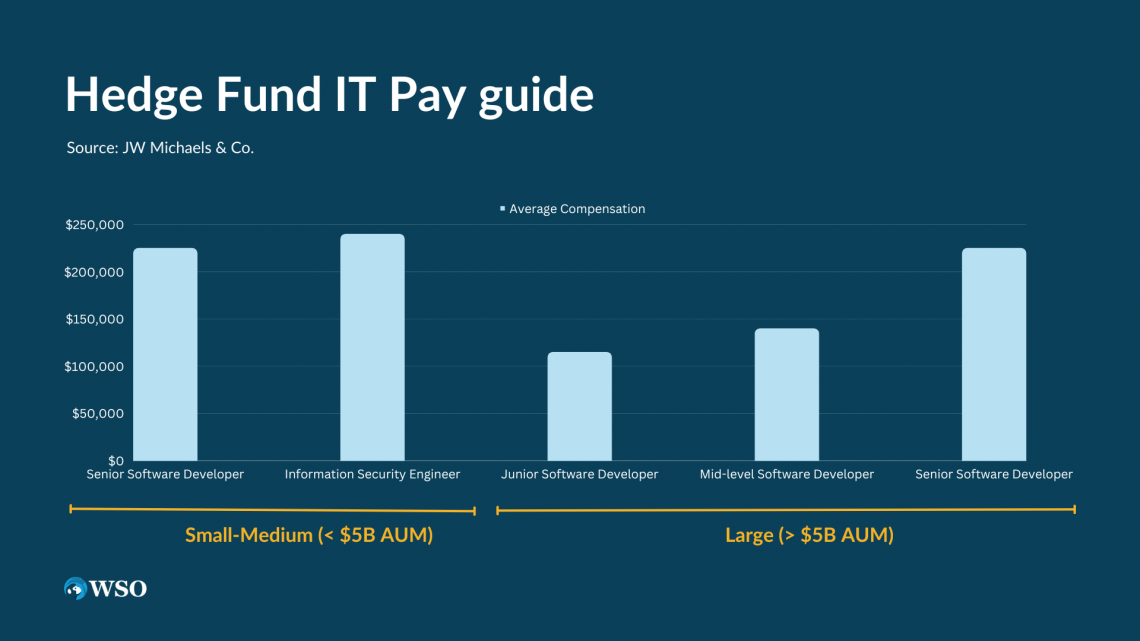

IT professionals build the necessary software platforms and systems customized to various trading strategies and even individual traders. Support staff members must be a call away if systems break or don't behave as expected.

See the table below to find out how much they bagged in 2020.

| Hedge Fund Size | Title | Compensation Range |

|---|---|---|

| Small-Medium (< $5B AUM) | Senior Software Developer | $150,000 - $300,000 |

| Information Security Engineer | $180,000 - $300,000 | |

| Large (> $5B AUM) | Junior Software Developer | $100,000 - $130,000 |

| Mid-level Software Developer | $120,000 - $160,000 | |

| Senior Software Developer | $150,000 - $300,000 |

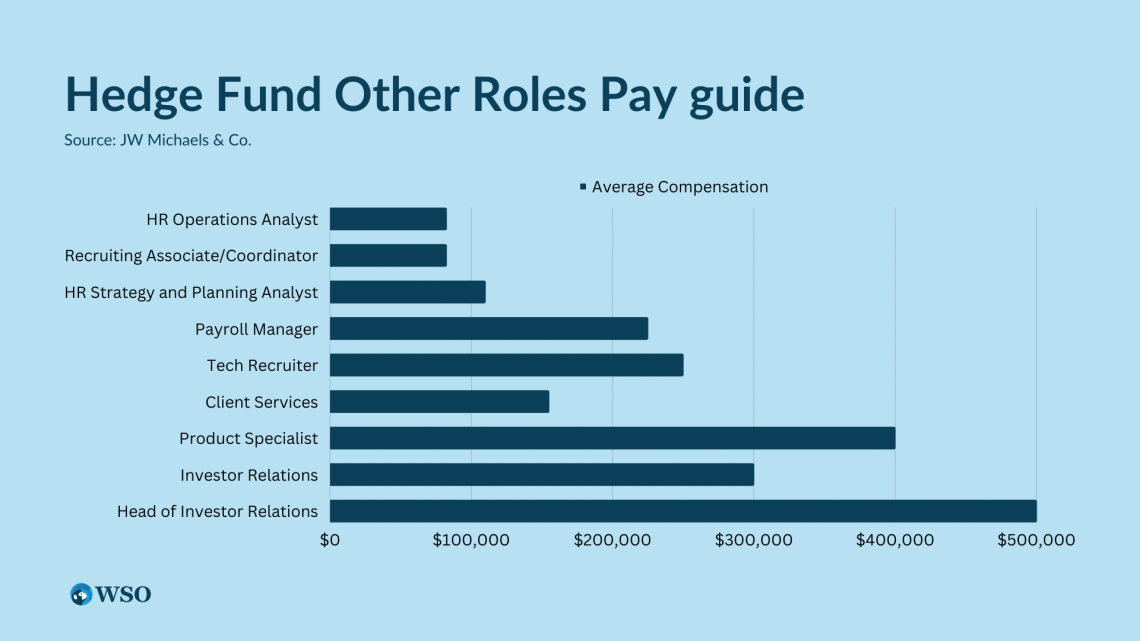

Other roles

The marketing team manages client services, investor relations, and fundraising activities. Effective marketing goes a long way in the success of investment pools, even for well-established funds with respectable managers.

Initially, entry-level employees are tasked with taking notes during meetings, assessing client needs, and acting as a point of contact (POC) for high-net-worth individuals (HNWI). Over their tenure, their responsibilities grow to include fundraising and related functions.

Client Service Representatives with little to no experience can earn between $45,000 and $60,000; those with 3 to 5 years of experience can earn between $55,000 and $75,000; those with over 5 years' experience can expect to earn between $70,000 and $100,000.

Average compensation ranges for other roles in hedge funds are given below.

| Title | Compensation Ranges |

|---|---|

| HR Operations Analyst | $70,000 - $95,000 |

| Recruiting Associate/Coordinator | $70,000 - $95,000 |

| HR Strategy and Planning Analyst | $95,000 - $125,000 |

| Payroll Manager | $150,000 - $300,000 |

| Tech Recruiter | $150,000 - $350,000 |

| Client Services | $60,000 - $250,000 |

| Product Specialist | $300,000 - $500,000 |

| Investor Relations | $200,000 - $400,000 |

| Head of Investor Relations | $400,000 - $600,000 |

Hedge fund compensation by Fund Strategy

It is challenging to define compensation ranges based on fund strategy, as strategy and individual fund performance can significantly influence total compensation. So, we have put together a brief list of anecdotal compensations provided by WSO users for you.

| Fund Strategy | Years of Experience | All - In Compensation |

|---|---|---|

| Equity | 4 | $500,000 |

| Equity | 10+ | $950,000 |

| Equity (Long/Short) | 1 - 2 | $290,000 |

| Equity (Long/Short) | 2 - 4 | $475,000 |

| Equity (Long/Short) | 6 | $700,000 |

| Event - Driven (Distressed/Specialist) | 2 - 3 | $600,000 |

| Event - Driven (Distressed/Specialist) | 3 - 4 | $650,000 |

| Event - Driven (Distressed/Specialist) | 3 - 4 | $1,500,000 |

| Event - Driven (Distressed/Specialist) | 4 - 5 | $975,000 |

| Relative Value | 2 - 4 | $475,000 |

Hedge Fund vs. Investment Banking salaries

Compensations in the IB-PE-HF trio are highly relative. If IB raises the bar, HF and PE stay competitive by following suit.

HFs typically seek IB analysts with 2-4 years of experience. In the current environment, an IB analyst with some experience can expect a base salary of $100,000-$200,000 depending on their experience with about 50% of the same amount in bonus. This is for analysts working in bulge bracket investment banking. Middle-market analysts would take home slightly less.

Those are decent figures for someone with 2 years of experience out of school. But you must be highly motivated to do better, which is why you wish to learn more about the HF and PE industries. To further help you jump ships, HF salaries tend to be slightly higher than IB. HF analysts at decent funds can expect to take home $110,000 to $120,000 in base salary with up to a 100% bonus.

Besides the differences in compensations, the work is different. Investing is more intellectually stimulating and comes with more responsibility. Furthermore, HF offer more upside in the later years as you climb up the ladder. You can expect faster salary bumps in HF than in IB since you get paid for your performance.

Please check out our Investment Banker salary guide to know more about compensations in that industry.

Hedge Fund vs. Private Equity salaries

Overall, hedge funds’ compensations are higher but vary more than in PE. The differences between HF and PE compensations at the initial levels are insignificant. However, the gaps grow as we move up the ladder. At the top levels, a hedge fund portfolio manager who has a great year could easily earn more than a managing director in private equity – depending on the fund size and structure.

Please check out our Private Equity salary guide to know more about compensations in that industry.

Frequently Asked Questions (FAQs)

Hedge fund compensations are much more volatile, unlike investment banks where performance determines bonuses, but there is not much variation in them.

In hedge funds, the fund size and performance are the main determinants of bonuses. As a result, they can range from nothing at all to enormous multiples of the base pay. For instance, $1bn AUM would fetch the portfolio manager a base salary of around $250,000 with a bonus between $500k and $3mn based on performance.

Some hypothesize that a fund’s location matters and that analysts in New York and San Francisco have higher compensations and make about 25-30% more than their counterparts in Boston and Washington DC, and 40% more than those in Chicago.

On the other hand, others reject the notion and say that geography does not contribute to variation in compensation at hedge funds in the US.

In short, making seven figures at a hedge fund is closer to myth than reality unless you are a portfolio manager – even if you call all the right shots. The entire purpose of starting a hedge fund is to make money. So if a fund manager can pay you less, they will.

@Bondarb, a hedge fund partner and a member of the WSO community, reported that they worked at one of the top macro funds, and it was uncommon for analysts to earn million-dollar salaries even in the years when the fund grew by hundreds of millions of dollars. They added that people start hedge funds to get rich and try to retain as much money as possible. Furthermore, the more renowned a fund is, “the more they can squeeze the analysts.”

They stated that analysts are considered fungible resources compared to portfolio managers, who are considered more valuable and rarer because they know how to manage risk and reward. As a result, they may receive bonuses below par with their contributions to the fund. Even worse, they can get pre-emptively fired before they can dispute the little bonuses.

In conclusion, you cannot make seven figures by merely funneling ideas to the fund manager; you must be managing the assets.

Generating investment ideas only for someone else to act on them is certainly not going to be the turning point in your rags to riches story. Hedge fund analysts see the most significant jump in their salary when they make portfolio managers. Before that, they witness smaller yet significant jumps each time they are promoted and climb up the ladder.

Be it IB, PE, or HF, the bonus is what drives compensation at higher levels. The higher you are on the ladder, the more significant the increments and the bigger the proportion of bonus in your total compensation. Besides, you also have a more direct impact on the investments and contribute more to the portfolio.

However, other factors may affect your compensation too. First, the fund’s location. For example, many insist that New York and San Francisco funds pay rather handsomely than funds in Boston, Washington DC, and Chicago.

Next, fund size. Although your compensation may not grow parallelly with fund size, a larger AUM does provide slightly better job security.

It is incredibly rare for hedge funds to hire fresh graduates because they typically seek Analysts with a few years’ experience under their belt.

The compensation significantly depends on the Analyst’s duties within the firm and the fund’s performance, size, culture, manager, etc. Mostly, base compensation is between $60,000 and $80,000 with a 0-40% bonus.

One WSO user, @Tonytonitone, described that the first-year salaries at their fund fell between $60,000-$100,000, where the trading and bonus-receiving staff earned towards the higher end of that spectrum, and that the IT team and the back office earned between $60,000-$75,000.

It is unlikely that working at a bigger hedge fund will have a higher earning potential. As the assets under management grow, so do the staff and other expenses. Moreover, bigger funds can negotiate lower salaries with new employees.

Additional Resources

Thanks for reading our salary guide! Please check out the following additional resources to help you advance your career:

or Want to Sign up with your social account?