Financial Modeling Salary Guide

Guide to jobs that require financial Modeling

Modeling refers to building structured quantitative representations of real-life scenarios. The application of modeling in finance is called financial modeling, which analysts and higher-ranking professionals extensively use for evaluating data and developing actionable insights.

In the corporate world, financial models form the base for decision-making. Because of their ability to convert information to data, they can help decision-makers objectively make decisions based on the possible outcomes and the levels of risks associated with various alternatives. Consequently, they are the most crucial tools for optimal decision-making to obtain the best results.

Typically, in accounting and corporate finance, the objectives are to forecast the financial statements and evaluate investment opportunities. In contrast, its more sophisticated uses lie in quantitative finance in asset-pricing and determining market movements and portfolio returns, etc.

Due to their innumerable uses, we cannot strictly define financial models. Instead, it is an umbrella term that means different things to various users and encompasses a range of models. For instance, it could mean the basic three-statement model for some and the more complex leveraged buyout (LBO) model for others.

Although “Financial Modeler” is not a typical job title, it means every individual who practices financial modeling in their jobs every day, which is an indispensable skill in the finance world, as most employers seek professionals adept at it.

Some industries are primarily engaged in examining data and developing actionable insights to assist clients. In addition, jobs in finance are among the most lucrative when we consider the earnings potential.

This article gives an overview of how much the various financial modeling roles in different industries can potentially earn and job prospects reported by the Bureau of Labor Statistics (BLS).

Salaries for Financial Modelers in Investment Banking

Investment bankers require financial modeling for their wide array of services through which they facilitate mergers and acquisitions (M&A), underwrite securities, LBO, and other transactions. In addition, investment banks serve clients from government entities and institutions to corporates and nonprofits. As a result, they use various types of models daily. The most common types of models used by bankers are listed below.

However, before we dive into them, we would like to mention that we firmly believe that learning with a hands-on approach reinforces the concepts. So, finance experts at WSO have developed some financial model templates and offer them to you free of cost. Furthermore, these templates are plug-n-play, which means that you can enter your own numbers and start exploring them as you read our articles.

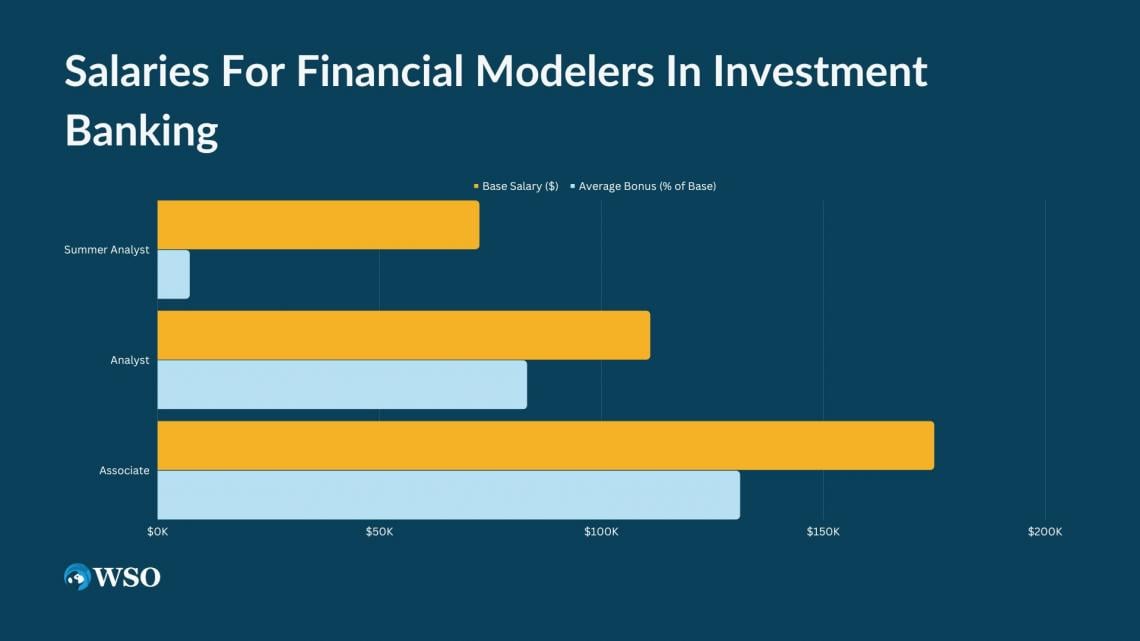

In IB, the grunt work involved in financial modeling is the responsibility of analysts and summer analysts. Although associates mainly supervise their work, they may also assist with the spreadsheets on complex assignments.

Nonetheless, investment banks rewarded bankers for their efforts handsomely. To illuminate, entry-level analysts can earn a base salary of around $100,000 and a bonus that can fall between 50% and 100% of the base. On the other hand, associates can earn a base salary starting around $150,000 and a bonus percentage like analysts.

|

Role |

Base Salary ($) |

Average Year-End Bonus (% of base) |

|---|---|---|

|

65,000 - 80,000 |

10% |

|

|

Analyst |

100,000 - 120,000 |

50% - 100% |

|

Associate |

150,000 - 200,000 |

50% - 100% |

Salaries for Financial Modelers in Private Equity

Private equity (PE) firms primarily use LBO models to evaluate the risk-return profiles and, thus, the attractiveness of business acquisitions financed using debt. An LBO transaction is funded 70-90% by debt and the balance through equity.

Since the chain of command in PE is less rigid than IB, associates and senior associates share many responsibilities. Apart from managing and monitoring investments, they also handle most financial modeling and due diligence work for incoming opportunities.

Because PE accepts professionals with some, preferably IB, experience, the compensation is higher than in IB. In addition, there is also a slight chance of earning a share in carried interest (“carry”) at the senior associate level.

The salaries for modelers in PE, including bonuses, are summarized for your reference below.

|

Role |

Compensation Excluding Carry ($) |

Share In Carry |

|---|---|---|

|

Analyst |

100,000 - 150,000 |

Unlikely |

|

Associate |

160,000 - 300,000 |

Unlikely |

|

Senior Associate |

200,000 - 400,000 |

Unlikely/Small |

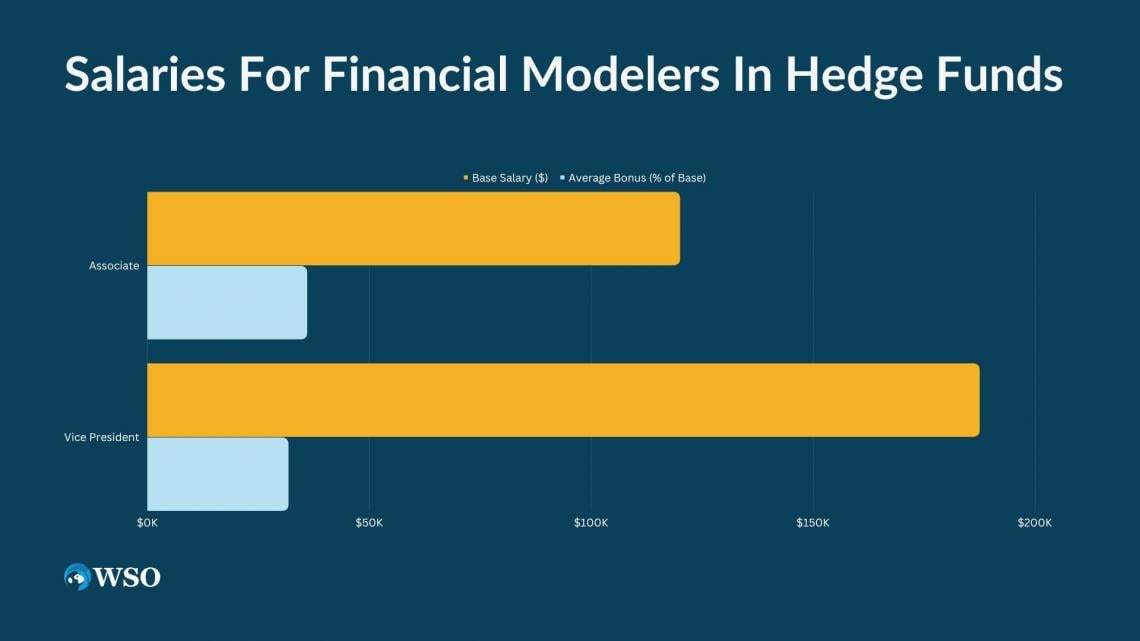

Salaries for Financial Modelers in Hedge Funds

Hedge funds (HF) are actively managed pools of funds where fund managers use complex techniques like short-selling and derivatives to manage portfolios and earn above-market returns. As a result, they employ various financial models, such as the DCF model and sensitivity and scenario analyses, to analyze the risk-return characteristics of different investment ideas.

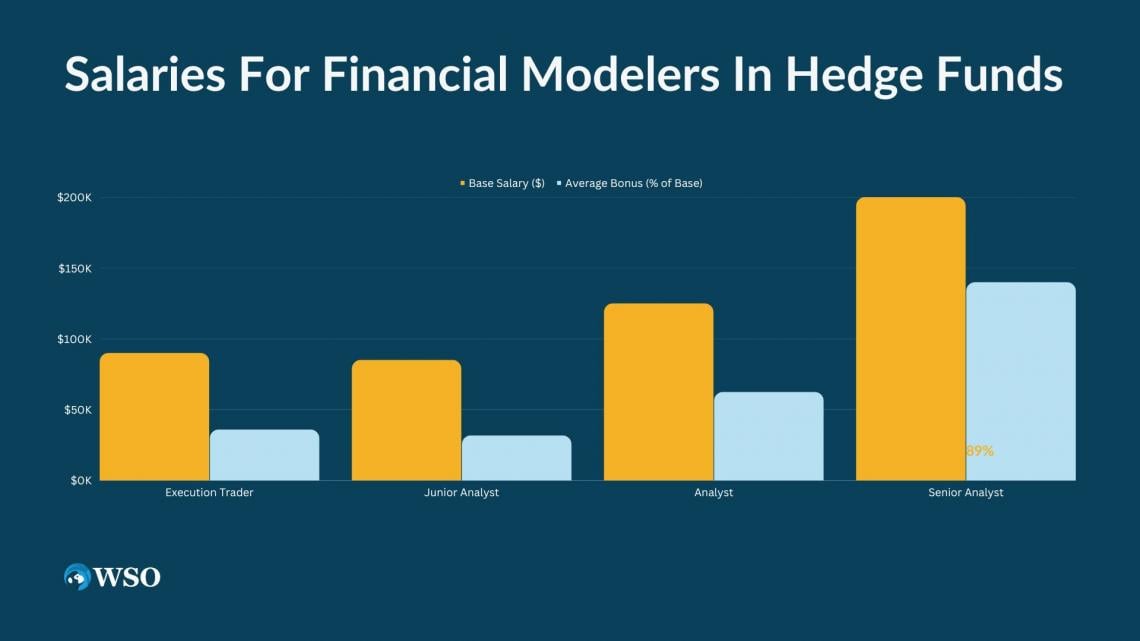

Because HFs are much smaller than investment banks, people in different ranks can share many responsibilities. As a result, the lines separating duties at an HF can be unclear. For instance, junior analysts, analysts, and senior analysts all engage in financial modeling, albeit for different purposes.

Although junior analysts perform financial modeling, they are primarily tasked with collecting data, monitoring current investments, and generating ideas. However, as analysts assign them their tasks, they do not have the leeway to see investment ideas through from start to end. At this level, professionals usually receive a base salary between $60,000 and $80,000 and a bonus averaging around 25% of the base salary.

Compared to associates, analysts enjoy more independence to evaluate longer-term ideas and certain investment theses after delegating other routine tasks to their subordinate junior analysts. Further, they can earn a base salary of $60,000 to $90,000, with a discretionary bonus of about 50% of the base on average.

Senior analysts use financial models too to evaluate ideas, though they specialize in specific sectors or strategies. They spend a significant part of their time pitching their ideas to portfolio managers while delegating the grunt work to their subordinates. They can earn a base salary of over $100,000, going up to $180,000. In addition, their bonus averages around 70% of the base.

|

Role |

Base Salary ($) |

Average Bonus (% of Base) |

|---|---|---|

|

Execution Trader |

80,000-100,000 |

30% - 50% |

|

Junior Analyst |

70,000100,000 |

25%-50% or more |

|

Analyst |

100,000-150,000 |

50%+ |

|

Senior Analyst |

150,000-250,000 |

70%+ |

Salary for Financial Modeling in Equity Research

Professionals and aspirants alike often view Equity Research (ER) as an underwhelming version of IB that pays less. Nonetheless, reality begs to differ.

Equity researchers evaluate stocks to assist portfolio managers in making informed decisions. They put on their thinking cap and put their problem-solving, data analysis, and other tools to use to forecast a security’s return outlook.

Their work comprises quantitatively assessing statistical data on stocks and considering the effects of recent market activity on them. Additionally, they develop investment models that identify trading opportunities and help monitor portfolio risk.

ER analysts build financial models for investments that they cover, usually a particular industry. The models heavily focus on quarterly results, compare them with earnings guidance, and comprise historical and forecasted financial information. Then, they issue recommendations to buy, sell, or hold certain investments using a target price.

The hierarchy in ER is much like IB. However, a stark difference is that while analysts are at the bottom of the ladder in IB, analysts can be at different levels in ER, such as VP- or MD-level analysts. Teams usually consist of 1 analyst and 2 to 3 associates, each with 8-10 investments under their coverage. The equity researchers’ headcount at all the banks in the US is merely in hundreds, which makes the industry quite exclusive.

It is challenging to advance in ER without switching banks. First, however, they must typically build a reputation beyond their spreadsheet skills. People seldom care about the workings of a financial model, albeit they do care about the assumptions and insights used to build it.

Associates in financial hubs tend to earn between $125,000 and $200,000 in total, with about one-fourth forming the bonus. Further, VPs can bag $200,000 to $300,000 in total with bonuses as high as one-fourth of the total salary.

|

Role |

Base Salary ($) |

Average Year-End Bonus (% of base) |

|---|---|---|

|

Associate |

90,000 - 150,000 |

30% |

|

150,000 - 225,000 |

25% - 30% |

Salaries for other financial modeling roles

Hierarchies of firms in different industries, like investment banking, private equity, and real estate, differ from each other, and the job titles may vary as well. To avoid using multiple designations, we will use “financial analyst” as an umbrella term in this article to include all positions that engage in financial modeling in their respective industries.

Their primary duty is to examine data and identify opportunities or assess possible outcomes to support decision-making. Although they can work in both junior and senior positions in a firm, it is common for juniors to gather data, build financial models, and manage spreadsheets. On the other hand, seniors mainly develop decision propositions and interact with internal and external parties.

Here are some of the duties that financial analysts perform.

- Recommend investments and portfolios

- Evaluate present and historical data

- Study market trends

- Study companies’ financials and determine their value

- Meet company officials to gain insight into growth prospects

- Assess the management team

- Prepare and present reports

The finance industry is highly competitive and challenging to enter. Therefore, gaining work experience as a financial analyst is often the industry’s premier stepping stone to landing dream jobs.

Many financial analysts identify and evaluate investment opportunities in capital markets, while many companies hire them also to analyze internal data and improve divisional performances. Likewise, others may research economic conditions and company fundamentals to forecast future performance. Regardless of their responsibilities, they must stay abreast of all developments in their area of specialization.

Companies offer $55,000 to $75,000 in median salary for most junior financial analyst roles, although those with slightly more experience can earn $80,000 to $100,000. Further, senior ranks receive well over $100,000.

In addition, certain regions are well-known for their generosity towards finance professionals. For example, New York offers 40.5% more pay than the national median, followed by Los Angeles and Washington, DC, paying 33% higher compensation. Below is a summary table for different financial modeler roles and the median pay (rounded to the nearest hundreds) across the US and in cities that provide higher digits.

Tax

Tax consultants are financial experts with knowledge of tax law and tax accounting. Their services are usually retained to minimize taxes payable while complying with the law. They may include tax attorneys, Certified Public Accounts (CPAs), enrolled agents, and other financial advisors.

|

Role |

Median Salary ($) |

|---|---|

|

Senior Tax Accountant |

93,250 |

|

Tax Accountant, 1-3 years experience |

76,000 |

|

Tax Accountant, 0-1 years experience |

56,500 |

Source: Robert Half finance and accounting salary guide 2022

Corporate Accounting

A corporate accountant usually reports to the finance manager and plays a critical role in an organization by performing various duties, including periodically producing financial statements and management reports, many-a-time at the group level.

|

Role |

Median Salary ($) |

|---|---|

|

Vice President of Finance |

192,750 |

|

Accounting Manager |

99,000 |

|

Senior Accountant |

84,000 |

|

Staff Accountant, 1-3 years experience |

66,750 |

|

Staff Accountant, 0-1 years experience |

51,000 |

Source: Robert Half finance and accounting salary guide 2022

Business Analysis

Business Analysts bridge the gap between information technology and the business using data to evaluate processes, ascertain requirements and communicate data-driven suggestions and reports to stakeholders.

They engage with decision-makers and other users to understand how data-driven changes to various facets of the business can improve efficiencies. They must communicate those ideas while striking a balance between the feasible and the reasonable.

|

Role |

Median Salary ($) |

|---|---|

|

Senior Business Intelligence Analyst |

100,750 |

|

Business Intelligence Analyst, 1-3 Years' Experience |

78,250 |

|

Entry-Level Business Intelligence Analyst |

56,500 |

|

Senior Business Analyst |

95,250 |

|

Business Analyst, 1-3 Years' Experience |

73,750 |

|

Entry-Level Business Analyst |

53,500 |

Source: Robert Half finance and accounting salary guide 2022

Financial Planning and Analysis

FP&A teams are crucial to all organizations as they perform budgeting, forecasting, and analysis that support all vital decisions of the top executives and the Board of Directors. Hardly any organization can consistently generate profits and grow without thorough financial planning and cash flow management. Mainly the FP&A team manages a corporation’s cash flow.

|

Role |

Median Salary ($) |

|---|---|

|

FP&A Analyst, 3-5 Years' Experience |

83,000 |

|

FP&A Analyst, 1-3 Years' Experience |

72,000 |

|

Senior Financial Analyst |

88,500 |

|

Financial Analyst, 1-3 Years' Experience |

72,000 |

|

Entry-Level Financial Analyst |

55,500 |

|

Senior Budget Analyst |

87,000 |

|

Budget Analyst, 1-3 Years' Experience |

71,000 |

|

Entry-Level Budget Analyst |

54,750 |

Source: Robert Half finance and accounting salary guide 2022

Risk Analysis

Risk analysts identify and evaluate various areas of potential risk that may hinder the success of organizations. They predict changes and future trends and forecast costs. There are several specializations within the risk analysis profession. They may work in origination, sales, marketing, trading, financial services, or banking. Furthermore, they may specialize in market, credit, regulatory, and operational divisions.

|

Role |

Median Salary ($) |

|---|---|

|

Manager, Market Risk Analysis |

127,250 |

|

Market Risk Analyst, 3-5 Years' Experience |

94,250 |

|

Manager of Credit Risk Analysis Financial Services |

105,750 |

|

Credit Risk Analyst, 3-5 Years' Experience |

89,000 |

Source: Robert Half finance and accounting salary guide 2022

Salaries by city

The annual mean wage for financial analysts in the US is $96,630, with the mean hourly wage being $46.46. At the same time, the median salary (the midpoint) stands lower than the mean at $83,660, with the median hourly wage being $40.22. Those in the bottom quartile (25%) earn below $30.61 per hour, while those in the top quartile make over $54.07. Moreover, the top 10% earn over $76.71.

However, some states pay financial analysts higher than others. For instance, the mean wage in New York ($62.82) is about 56% higher than the national mean, while it is 30% higher in the District of Columbia ($52.44) and around 25% higher in Massachusetts ($50.81) and Connecticut ($50.49).

The BLS also reports data divided based on metropolitan areas, according to which financial analysts in the New York-Newark-Jersey City region earn the highest ($62.51), followed by those in Bridgeport-Stamford-Norwalk, CT ($60.62) and Medford, OR ($60.12).

Although the mean wages in Medford are the third highest in the country, the employment number is far tinier (90) than the San Francisco-Oakland-Hayward, CA area, which pays slightly lesser ($57.89) but employs over 13,000 financial analysts.

For more information on the region-wise distribution of salary data for financial analysts, please visit the BLS.

Job Outlook

The Bureau of Labor Statistics (BLS) stated that it expects the employment opportunities for financial analysts to grow at 6% p.a. during the decade starting 2020, which is less than the 8% projected growth for all occupations collectively. It projects close to 41,000 job positions to open for financial analysts each year, many of which will result from workers leaving the workforce or transferring to other roles.

As per the BLS, the need for extensive knowledge of various geographic areas due to increasing globalization and innovation in financial products will lead the growth in their employment. Moreover, the economic growth in other countries is also a determinant of the said innovation in financial products. As a result, those with expert-level knowledge of specific regions may see more demand.

Experts have observed that the demand for financial analysts typically increases in line with overall economic activity. The markets increasingly demand their skillset to evaluate prime opportunities as many businesses establish or expand in a growing economy.

The other factors that fuel the demand for financial analysts are technological advancements and big data. There is more organized data than ever before and the capability to analyze and process it. They can utilize it to conduct quality analyses that can help entities manage finances, develop new and better offerings for clients, and identify superior investment opportunities.

Additional Resources

Thanks for reading our salary guide! Please check out the following additional resources to help you advance your career:

or Want to Sign up with your social account?