Unlevered Free Cash Flow (UFCF)

Used to value a firm in financial modeling

What Is Unlevered Free Cash Flow (UFCF)?

Unlevered free cash flow (UFCF) is the cash generated by a company before accounting for financing costs. This metric is most useful when used as part of the discounted cash flow (DCF) valuation method, where its benefits shine the most.

Another reason for its prominence is that most multiple-based valuation techniques, like comparable analysis, use enterprise value (EV) which includes both the debt and equity value of a company.

Hence, to have a comparable metric across the entire valuation process, using unlevered Free Cash Flow is preferred along with the weighted average cost of capital (WACC) to derive a company’s value.

The most prominent industries where this metric is used along with DCF are private equity and corporate finance as part of capital structure decisions which are very important to generate optimum returns to the equity shareholders.

In these industries, investors like to first look at the value of the entire business and then decide on the capital structure. It is always better to use more debt to finance a business, provided there is sufficient cash flow to meet the periodic repayments.

Hence, using unlevered cash flows helps predict how reliable cash flow can be expected to pay the debtholders.

Key Takeaways

- Unlevered Free Cash Flow (UFCF) represents the cash generated by a company before accounting for financing costs. It is crucial for discounted cash flow (DCF) valuations, providing a comparable metric across various valuation methods.

- UFCF is used in private equity and corporate finance, enabling investors to assess a business's true value irrespective of its capital structure. It avoids the distortions caused by varying debt levels, providing a clear picture of cash flows available to all investors.

- UFCF is calculated as:

- UFCF = (Net Income + Interest expense + Taxes + D&A) - Taxes - Changes in WC - Capex

- Effective planning, including revenue increase, expense reduction, strategic CapEx management, and efficient working capital handling, can enhance UFCF. These elements directly impact the cash available for investors.

- While UFCF ignores debt-related costs, capital structure optimization is vital in maximizing shareholder returns. UFCF provides a foundational understanding, but managing debt levels wisely ensures sustainable profitability and investor satisfaction.

What is Unlevered?

Before taking a deep dive into this topic, it is essential to illustrate what the term “unlevered” means and where it is used, to improve understanding of this concept.

When a business uses debt, it is considered “levered,” and the amount of debt used relative to equity is called “leverage.” The more the debt used, the higher its leverage. An “unlevered” firm then uses no debt capital and only equity.

In an unlevered business, all the cash flows generated by the business belong to the equity shareholders.

In contrast, in a levered business, cash flows generated by the business are used to pay debt holders their share of interest and principal first. The remainder then belongs to the shareholders.

While valuing businesses, investors generally like not to include the effect of varying capital structure as it distorts the actual value it generates. If a good value-generating business has too much debt, it can be reduced and vice versa.

Hence, using unlevered cash flow gives a much better estimate of the value a business generates by avoiding the effects of its capital structure.

Understanding Unlevered Free Cash Flow (UFCF)

UFCF is the free cash flow that belongs to all the investors of a company, including debt holders as well as equity holders. Leverage is another term for the usage of debt, so levered cash flows mean that they are net of interest costs.

The underlying assumption is that the company is unlevered, i.e., it has no debt on its books. One reason for its eminence is that most multiple-based valuation techniques use enterprise value (EV) which includes both the debt and equity value of a company.

Hence, using this metric along with the weighted average cost of capital (WACC) is the preferred way to value a company.

UFCF is calculated net of the cash required to sustain and grow the company's assets (working capital needs and capital expenditures) to generate revenue and earnings. Depreciation, amortization, and other non-cash expenses are added back to the earnings in calculating the firm's unlevered Free Cash Flow.

A highly leveraged company, i.e., with large amounts of outstanding debt, is more likely to report this metric because it provides a rosier picture of the company's finances. It shows how much free cash flow the assets are generating for all the investors.

However, because it ignores the cost of debt, which was incurred to obtain those assets, it does not show the impact of that cost on those cash flows.

Because highly leveraged companies are at greater risk for bankruptcy, investors must consider debt obligations.

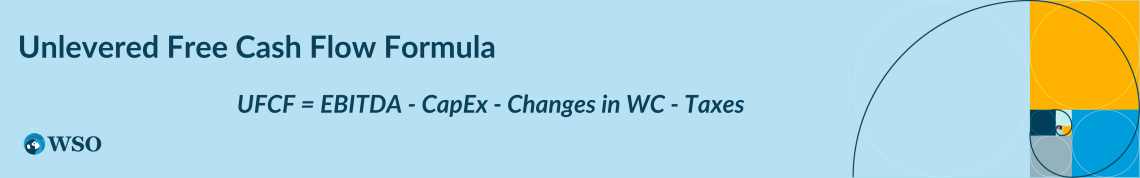

Formula for Unlevered Free Cash Flow (UFCF)

The formula to calculate UFCF is:

UCFC = EBITDA - CapEx - Change in WC - Taxes

where,

- UFCF = Unlevered free cash flow

- EBITDA = Earnings before interest, tax, depreciation, and amortization

- CapEx = Capital expenditures

- WC = Working capital

EBITDA gives us a good estimate of the operating cash flow of a company, which is the amount of cash generated from operations.

However, to increase the scale of operations, a business must increase both its investment in fixed assets and working capital (exceptions to these are businesses operating in a low capital-intensive space like tech).

Also, note that the effects of taxes are not considered as part of EBITDA.

As these metrics lead to a cash outflow, which reduces the amount of free cash flow generated by the business, it is very important to account for their effects. This leftover amount then represents the cash available for the company’s investors (both debt and equity).

Planning effectively for each element in the above formula can help increase unlevered Free Cash Flow.

- EBITDA can be increased by increasing revenue and cutting back on expenses.

- Delaying CapEx can improve UFCF in the short run but may negatively affect the long-run returns and vice versa.

- Reducing working capital requirements can free up cash. Current assets in which cash is unnecessarily tied up should be reduced, like accounts receivables, inventory, and prepaid expenses. On the other hand, current liabilities should be increased as that allows us to make use of the cash that would otherwise be used to pay them off.

- Effective tax planning can reduce tax expenses, not only temporarily due to timing differences but also in the long run.

Example of Unlevered Free Cash Flow (UFCF)

UFCFs are used in the private equity industry, specifically venture capital and leveraged buyout spaces.

The use of unlevered free cash flow is limited to companies that have a well-defined market exit strategy. It helps investors determine the value of a company when considering investing in it since it calculates what the company would be worth if it had no debt.

Let us assume you are considering investing in a company with the following particulars.

| Net income | $250,000 |

|---|---|

| Changes in WC | $10,000 |

| 8% Debt | $500k |

| Capex | $70,000 |

| Depreciation and Amortization (D&A) | $6,000 |

| Tax expense | $50,000 |

Unlevered free cash flow would be calculated as:

UFCF = (Net Income + Interest expense + Taxes + D&A) - Taxes - Changes in WC - Capex

= EBITDA - Taxes - Changes in working capital - Capex

= ($250,000 + $40,000 + $50,000 + $6,000) - $50,000 - $10,000 - $40,000 = $246,000

The company has an unlevered free cash flow of $246,000, which can be distributed to investors (including debtholders) or reinvested.

Why Is Unlevered Free Cash Flow Used?

The DCF method of valuation is based on the theory that the value of a business is the sum of the discounted cash flows it generates. Hence, using this method requires the analyst to forecast the future free cash flows generated by the business.

Predicting the cash flows a business will generate from its operations for a few years into the future is a hard task.

Adding another layer of complication for accounting for the level of debt in the capital structure and the related costs into the future (highly dependent on interest rates which are hard to predict very long into the future) makes the model less reliable.

Also, the present value of debt is already known and does not need to be accounted for in the payment structure.

Hence, it is both more accurate and easier to forecast the unlevered cash flow that a business will generate to arrive at the value of the entire business today. We can then reduce the debt portion from it to arrive at the equity value.

To determine the value of the business, the unlevered free cash flow is generally discounted at the weighted average cost of capital.

Below is a video from our DCF Modeling Course that demonstrates the objectives of the DCF-based valuation in the context of corporate finance transactions. It is one of the methods that finance professionals often use to determine the values of private and public companies.

Levered Vs. Unlevered Free Cash Flow

Levered free cash flow is the amount of cash left over from the cash generated by the business from its operations after paying its financing costs like interest and principal repayments on its debt.

Unlevered free cash flow is the amount of cash a company generates from its operations without accounting for its finance costs, such as debt-related payments. UFCF is calculated as EBITDA minus CapEx minus working capital minus taxes.

LFCF is the cash flow that belongs to the equity shareholders of the business, while UFCF is the cash flow that belongs to both its equity shareholders and debtholders.

Levered free cash flow is considered the more important figure for equity investors (like those who invest in the stock market) to watch as it’s a better indicator of a company’s profitability and the competence of its management from their perspective.

Increasing UFCF combined with reducing LFCF can mean that the management is not managing its capital structure optimally to maximize shareholder returns.

Moreover, since the difference between the two is only that of the debt payment obligations, a widening gap would indicate an increasing level of debt and its related interest expense. To understand it better, let's take a look at the table below:

| Criteria | Levered Free Cash Flow | Unlevered Free Cash Flow |

|---|---|---|

| Definition | Cash flow available to equity and debt holders after interest. | Cash flow available to equity holders without accounting for debt. |

| Calculation | Deducts interest payments from operating cash flow. | Excludes interest, focusing solely on operational cash generation. |

| Focus | Reflects the cash available to all capital providers. | Reflects cash available only to equity shareholders, ignoring debt. |

| Debt Impact | Accounts for debt-related costs and obligations. | Ignores debt, providing a pure measure of business operational cash. |

| Purpose | Useful for investors interested in overall cash available to all. | Useful for comparing the core operational performance of businesses. |

| Use in Valuation | Often used in discounted cash flow (DCF) models. | Preferred in multiples-based valuation, focusing on core operations. |

| Risk Consideration | Accounts for the financial obligations and risk due to debt. | Focuses solely on operational risk, excluding financial obligations. |

Please see the below video from the DCF Fundamentals section of our DCF Modeling Course that walks you through the differences between UFCF and LFCF.

Unlevered Free Cash Flow (UFCF) to Enterprise Value

UFCF is the cash flow that a business generates as a whole. Suppose we follow the idea that the value of a business is equal to the total of all discounted cash flows it generates. In that case, the enterprise value can be calculated by adding the discounted projected UFCF for the future.

However, it is impossible to project the cash flows and profitability of a business forever; hence most projections are created for a 5-10-year period at a maximum depending on the industry.

UFCF is used in valuation models to reflect all of the firm’s operations without taking debt or financial obligations into account. The primary use of this calculation is to determine the enterprise value using the Discounted Cash Flow (DCF) method of valuation.

To determine the enterprise value (EV), UFCF is projected for 5-10 years, and a terminal value is determined at the end of the forecasting horizon. These projected figures are then discounted to arrive at the total present value of all free cash flows that the company will earn in the future.

The weighted average cost of capital, which is the blended cost of capital from all sources, is the appropriate rate to discount future cash flows as these cash flows belong to all sources of capital (equity, debt, and mezzanine financing).

It is most prominently used in areas where investors first look at the value of the entire business and its ability to generate cash in the future before deciding on the capital structure.

Then, the capital structure decision is taken later to optimize the returns for shareholders. Such areas include private equity and corporate finance, among others.

Why do we ignore the Capital Structure?

Though capital structure is a very important aspect of corporate finance and private equity, its weight in determining the value of a company is often ignored. While valuing businesses, investors generally like to exclude the effect of varying capital structure as it distorts the actual value generated by the business.

Most valuation techniques utilize enterprise value (EV) which includes both the debt and equity value of a company. Hence, to have a comparable metric across the valuation process, using UFCF is preferred along with the weighted average cost of capital (WACC) to derive a company’s value.

If a value-generating business has too much debt, it can be reduced to optimum levels and vice versa. Using unlevered cash flow gives a much better estimate of the value a business generates by avoiding capital structure effects.

However, this lack of attention does not make the capital structure less important in finance. On the contrary, optimizing the capital structure plays an integral role in maximizing returns on investment for shareholders.

Ignoring capital structure would be like purchasing stocks without realizing that different dividend yields correspond to different price-to-earnings ratios. Ignoring the effect that capital structures play will lead one to purchase stocks at higher prices than they deserve, which will lead to lower returns on investment.

Unlevered Free Cash Flow (UFCF) FAQs

Unlevered free cash flow is the cash flow generated by a company before accounting for financing costs.

To calculate UFCF from net income, add interest and non-cash expenses like depreciation to net income. Then subtract Capex and changes in working capital. Please note that since taxes are added and subtracted, their effect gets negated.

UFCF = (Net Income + Interest expense + Taxes + Depreciation and Amortization) - Taxes - Changes in working capital - Capex

To calculate UFCF from EBITDA, subtract taxes, CapEx, and changes in working capital from EBITDA.

UFCF = EBITDA - Taxes - Changes in working capital - Capex

UFCF can also be calculated from LFCF by adding financing obligations (interest and principal repayments).

Unlevered free cash flows tell investors how much money the business has left before accounting for debt payments. UFCF is net of working capital needs and Capex – money required to sustain and grow the assets to generate revenue and earnings.

A highly leveraged company (one with a large amount of debt in its books) is more likely to report UFCF since it would provide a rosier picture of its financial health by ignoring the debt obligations. However, investors must consider debt obligations because highly leveraged companies are at greater risk for bankruptcy.

More about financial modeling

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?