No shrinkage

MARKETS

- U.S. markets: Stocks inched higher thanks to a handful of strong earnings reports. Guess all those calls for diminished earnings growth were a bit exaggerated, huh?

- Wait and see: Most of Wall Street spent Tuesday playing Nostradamus ahead of President Trump’s State of the Union (more below). Jitters sent gold a little higher and Treasury yields lower.

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

BIZ IN DC

President Trump: “I’m in Love With the State of U”

President Trump had weeks of preparation, multiple teleprompters, and 82 minutes to deliver his State of the Union address. We’ve got instant ramen, six Monster drinks in the fridge, and 330 words to recap what he said...and what it means for business and the economy.

Economy

"The U.S. economy is growing almost twice as fast today as when I took office, and we are considered far and away the hottest economy anywhere in the world."

Well, GDP growth is technically higher in places like China and Poland, but the U.S. economy is definitely hot. January marked 100 straight months of job gains, and wages—rising 3.2% annually—are also a pretty sight.

Trade

"We are now making it clear to China that after years of targeting our industries, and stealing our intellectual property, the theft of American jobs and wealth has come to an end."

Top on the president’s economic policy to-do list is pressuring China to level what the U.S. considers an unfair playing field. China has agreed to some concessions but the U.S. wants more. If the two sides can’t shake hands by March 1, this battle will escalate with higher tariffs.

In trade news closer to home, the president also used the speech to trumpet a revamped NAFTA.

Drug pricing and infrastructure

"Both parties should be able to unite for a great rebuilding of America’s crumbling infrastructure" and "It’s unacceptable that Americans pay vastly more than people in other countries for the exact same drugs, often made in the exact same place."

These are two issues that have bipartisan support but besides that...it’s mostly crickets on the *actually becoming policy* front. We’ll keep tabs.

Shutdown

"So let’s work together, compromise, and reach a deal that will truly make America safe."

The 35-day partial government shutdown forced 800,000 federal workers to miss paychecks, pinched small businesses, and wiped $3 billion off the economy permanently.

The three-week spending bill expires next Friday.

TECH

Uh...How Did This Happen?

Well you see, when two people love each oth—oh you mean that massive jump in Snap’s stock price after the bell? Pin that one on record revenue and considerably smaller losses last quarter.

Snap reported a better-than-expected $389.8 million in revenue, up 36% annually for the December quarter.

- Remember, the final quarter is typically when advertisers splurge. Snap’s strong sales followed similar trends from its biggest competitors—like Facebook and Alphabet—which both reported killer year-end revenue.

Snap lost $191.7 million, which was peanuts compared to the $350 million loss it reported a year earlier.

- Still, it was another quarter for CEO Evan Spiegel’s least favorite Snapstreak: His company hasn’t yet scored a quarterly profit since going public.

And what’s the story with user growth? No shrinkage. It ended 2018 with 186 million daily global active users, the same amount it had a quarter earlier. While it isn’t what you’d call growth, it also isn’t the 2 million users Snap hemorrhaged back in Q3.

WEALTH

It’s Tough Out There for a 1 Percenter

First, you’ve got likely presidential candidate and current senator Elizabeth Warren proposing a “wealth tax” on households with a net worth of at least $50 million (a policy supported by 61% of Americans, in a recent poll).

To make matters worse, some 1 percenters are forced to hire art historians to come aboard their superyachts to help restore multimillion-dollar paintings damaged by cornflake shrapnel and champagne corks.

But we shouldn’t generalize

Since income standards vary widely throughout the world, you can attend a 1 percenter convention and find people across a range of income levels. Bloomberg crunched the numbers...

Annual pretax income threshold to be in the top 1% of earners:

- India: $81k

- China: $105k

- UK: $290k

- U.S.: $478k

- Singapore: $694k

- UAE: $891k

Zoom out, per the WaPo: Wealth inequality is already a major theme of the 2020 election, “as the recent financial crisis and a distrust of big institutions has fueled a populist surge in both parties.”

STOCKS

“The Money Doesn’t Vanish”

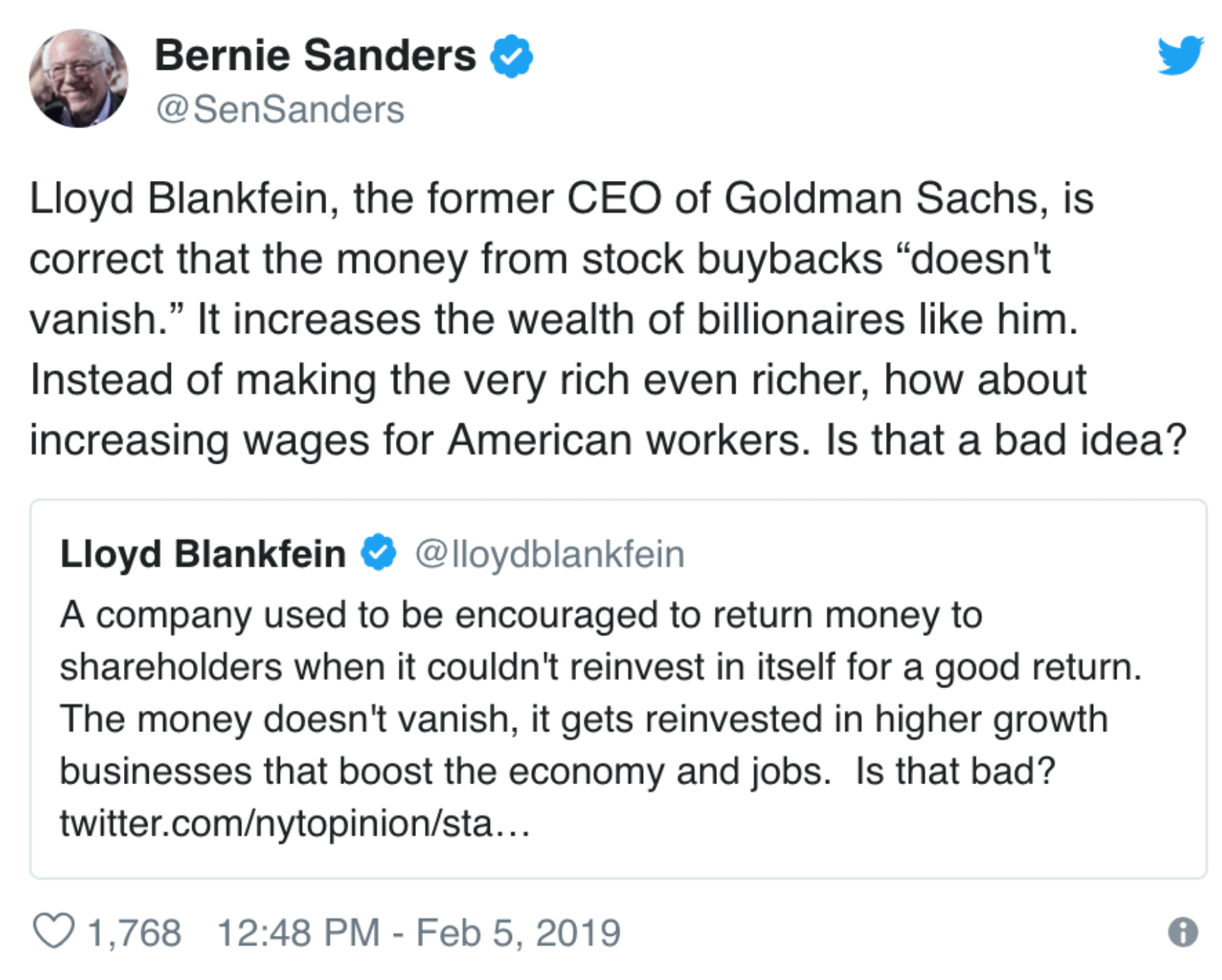

Great Twitter battles of this decade: Cardi B vs. Tomi Lahren, Chrissy Teigen vs. anyone, and Bernie Sanders vs. Lloyd Blankfein.

The ex-Goldman Sachs CEO ended his seven-month Twitter hiatus to challenge the idea that corporate stock buybacks divert resources away from workers or reinvestment (an argument Sen. Sanders and Sen. Chuck Schumer spelled out in a NYT op-ed two days earlier).

The world according to Blankfein: Share buybacks in 2018 (which totaled more than $1 trillion among large companies) helped keep afloat a market that fell about 6% for the year.

- FYI, Goldman bought $3.3 billion of its own shares last year. But that’s nothing compared to, say, Apple, which launched a record-breaking $100 billion buyback plan.

Blankfein drops the gloves, takes out Twitter fingers

“Someone get me my phone”—Bernie

In his view, buybacks unfairly reward execs who own stock in their companies by boosting share prices instead of investing funds back into the business.

Looking ahead: The senators said they’ll introduce a bill that’ll force companies that want to buy back stock to increase workers’ pay and benefits.

TECH

In Smart Speakerville, Alexa's the Mayor

The number of “Alexa, _____” jokes on Twitter is proof smart speakers have politely greeted their way into our everyday lives, and new data from research firm CIRP backs that up:

- The U.S. installed base for smart speakers grew to 66 million units in December 2018—up from 53 million a quarter earlier.

Who’s winning? Amazon Echo devices lead the domestic market with a 70% share. Google Home takes second place at 24%, and Apple’s HomePod claims 6%.

But that market dominance means something different for everyone, per smart speaker whisperer Benedict Evans.

- Google and Facebook are in it for your data.

- Apple wants to a) sell you expensive devices with serious margins and b) make sure you never leave its ecosystem.

- Amazon, though, has less black-and-white ambitions for Alexa…

For many users, it’s still a “glorified clock-radio,” Evans writes. But if Amazon can convert the 100 million Alexa-enabled devices that've been sold into glorified clock-radios that can get you to actually buy more things from Amazon...Alexa could unlock its “deeper strategic value.”

WHAT ELSE IS BREWING

- Disney’s (+0.52% after hours) got a lot of plans for 2019, but first things first: it beat expectations on both the top and bottom lines last quarter. Revenue came in at $15.3 billion (even without a “Star Wars”

- Tyson Foods (-0.10%), the very hungry parent of Jimmy Dean and one of the largest U.S. food companies, has reportedly held talks to buy Foster Farms for about $2 billion.

- Reddit is said to be prepping for a Tencent-led fundraising round of between $150 million and $300 million, per TechCrunch. Looks like the front page of the internet could soon be worth $3 billion.

- Super Bowl ratings were the lowest they’ve been in a decade this

- Fiat Chrysler (+1.17%) is recalling 882,000 pickup trucks worldwide in two separate recalls to address steering and pedal problems.

BREAKROOM

Guess the Logo

What do these four logos have in common?

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

Breakroom Answers

Guess the Logo

These logos have all been replaced with more recent versions

In et dolorem accusantium consequatur sequi esse hic. Facilis porro nihil officiis est ut et aut. Esse et saepe perferendis aut. Quod ex ratione sapiente omnis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...