Wells Fargo NOT addressing deck we made 3 MONTHS AGO OR GS survey

EDIT: https://www.efinancialcareers.com/news/2021/03/we…

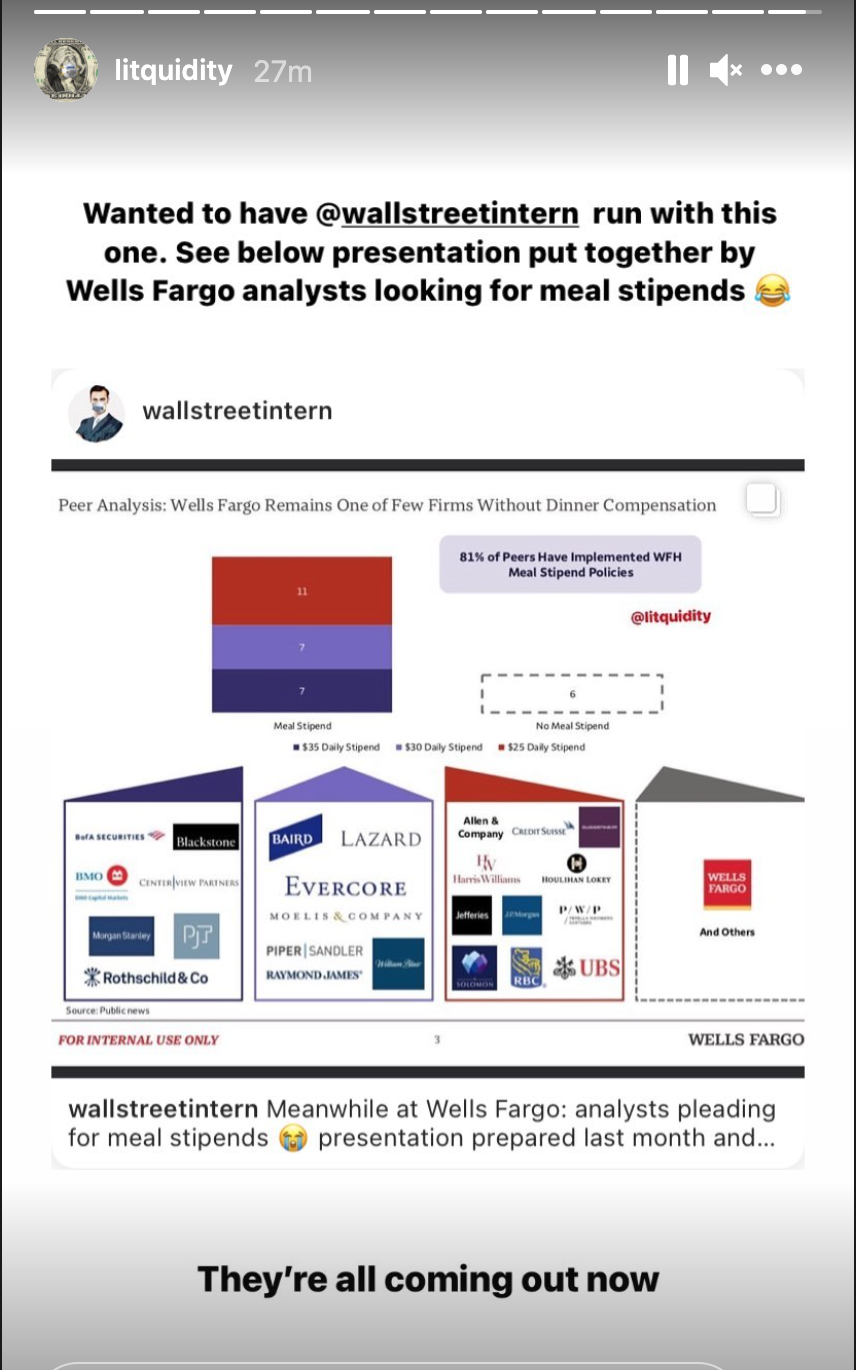

EDIT: S/O to @wallstreetintern and @litquidity for the features (link / pic below)

This might seem old and repetitive, but yes, I want to complain too. Wells Fargo IB is not the place to be right now.

Banking has become more of a taxing job than it has been recently because of all that's going on (we all know this). It's a sweatshop over here and everyone is putting in 100-hour weeks like it's nobody's business. There's nothing being done. At all. They might think that telling us they're going to "invest in junior banker resources" will make it all better and dandy... but guess what? It doesn't do jacks**t. Actions speak louder than words.

Why is it possible for a human (not actually 1 human, hundreds) who was being fed during less strenuous times to be begging management for food 12 months later? Yes, some analysts here made a deck too and passed it around and it made its way up the ladder (supposedly, who knows lol). It's been out for months now and we had brought this up way before then.

Jokes are over, this is ridiculous. Charlie Scharf's goal is to triple IB revenue in 5 years. Charlie, invest in the junior bankers that will carry the bulk of that load, or there won't be any to invest in within 5 months. I just want to eat man... You can keep the 20k lifestyle bonus... but I might take a peloton too tbh... IF YOU'RE SO GENEROUS AND THE CULTURE IS SO GREAT.

EDIT: @wallstreetintern feature: https://www.instagram.com/p/CM3nUvHg50P/

EDIT: @litquidity feature:

where's the WF deck at? I'm incoming SA WF lol

All I can say is, who knows what it'll look like by the time you might actually work here in 2022. I hope to dear God they at least feed you.

https://filebin.net/ka5bd01aaxot1ity/Wells_WFH_Meal_Stipend_Considerations.pdf?t=qrza66lz

My roommate is at WF and it’s not that bad... what group?

I don't think that matters here lol... this man/woman is hungry...

TMT, HC, RIB, IND all getting absolutely smoked. Senior leadership does not care either

Don't forget M&A pls

Have you heard similar things about FIG?

I don't see TMT on many IPOs, what are they busy with? Guessing a lot of financing...any advisory work?

any update?

What group are you in?

(OP here)

All of them.

Also work for WF. Thank you for posting this.

WF IB here, can confirm. This is ridiculous. Not surprising that they're losing people

What group are you in?

Are analysts or associates leaving?

where can i find the deck?

#ReleaseTheWFdeck

Your wish is my command.

https://filebin.net/ka5bd01aaxot1ity/Wells_WFH_Meal_Stipend_Considerations.pdf?t=qrza66lz

Barclays now offers $25/night meal stipends, in case you're bringing this up again to mgmt

Thanks, this is definitely eye opening as to what peers are doing! Hopefully "radical transparency" becomes the new normal. Public shaming is the only thing that's getting results.

Holy crap! That's nucking futs. stifel is also providing $25 stipends as well if you are refreshing the deck

if gs doesn't get meals, why should you?

let's get this guy a peloton

Can we imagine the meltdown that would ensue if Rich Handler sent some WF or BAML analyst a peloton

It's laughable that WF continues to try and use culture as a selling point. The place is filled with MD's and senior management who couldn't care less about the junior staff. In typical WF fashion, we will wait to be the last Bank to move on reinstating overtime meals.

Was talking with a few other analysts and some of them thought we might not ever get meals paid for again- I hope that's not the case...

Wait what not even when wfh is over. Is the management stupid

Accurate

This is crazy, I looked at the deck honestly you guys should have asked for more. I think I heard somebody say a while back second analyst bonuses were below par as well. They must just give you the meals in a few weeks and call it a day.

Somebody get the deck to liquidity, easiest way to get things done around here. You guys might get your meals by next Monday!

if i had to work 100hr weeks at a garbage bank like WF I would jump off the brooklyn bridge

WF analyst here and completely reiterate the above. Always preaching culture but no actual action taken outside of our protected Friday nights and one weekend. We are being overworked (and in many cases just on aimless pitches and passive bookrunner deals not even deals that lead to good experience). The lack of meals is absurd and supposedly senior management is “figuring it out” but we’re gonna be back in the damn office before they do at this pace.

A bank with this deal flow can’t afford to be acting this shitty when the lateral market is as hot as it is. I expect post august bonuses there’s gonna be some major exodus going on

100% plan on leaving after bonus hits

Its quite interesting but I’ve come to notice that every time a bank (or any company) preaches its culture its a 90% chance said culture is a shitshow

I for one, am MAD as HELL about this. I think I speak for a lot of others on here though when I say...if you could please switch those two logos in the light purple box on the peer analysis page before sending it out to the client, that'd be great (it kind of just throws off the whole alphabetical order thing you had going)...otherwise, looks great! Don't stay late!

Thx!

just noticed this. is this the sort of shit IB analysts do? rearrange logos in the firms alphabetical name order? jesus.

Is this not considered a normal ask in other industries...? Maybe the grass really is greener on the other side

Who do you think does it? Interns are only there for 3 months

Wells is a sweatshop. So many first year analysts leaving. The "pencils down" policy isn't even followed by many groups. Can confirm TMT, IND, Lev Fin are getting crushed

Incoming SA here. If first-years are leaving like crazy, does that nearly guarantee a return offer as long as I'm not incompetent? Not that I want to join a sweatshop but it doesn't seem like there are many non-sweatshops in IB anymore and hopefully it may improve by FT start in 2022.

That’s generally the case every normal year as long as your not being lazy, a dick, or incompetent you will get a return

Also no more analyst are leaving than normal

TMT definitely getting crushed hard

I don't see them on many tech IPOs - what do they do mostly? Guessing a lot of financing. I know the tech team is in SF, does NYC do better since it's media/telecom?

Can confirm everything here. Analysts, Associates, and even VPs have been quitting. Wells is understaffed and analysts getting overworked.

Everyone wants to quit and they aren’t doing anything about it.

Can confirm. We're losing people like crazy - the firm does not care about us. Students should know this...

Its on the news now on efinancial

That’s your definition of “the news”? Yikes

I’ll be the first to say it - this deck looks like shit

Anyone know if bonuses will hit in July or August at Wells?

typically august

Don't worry my friend told me MUFG still runs out of Windows X95 and Excel 2003. Tech doesn't even know what Python is and NO MEAL STIPENDS.

umm...

Barclays runs Windows 7 and Excel 2007 so we're not that much farther ahead

As someone who’s about to start, these threads are pretty depressing. Making me question whether I should call an audible.

if you have the ability to recruit into corp dev or something consider it

you will likely exit there in a few years anyways since you will hate this job

going through the process now....would have been better to just skip banking

How long were you in banking and what level are you recruiting for in Corp dev?

This absolutely ridiculous. It seems as if social media posts to pressure these holier than thou firms is the way to go.

Citi also doesn't get a WFH meal allowance nor any other perks since COVID kicked off.

All they have given is two days extra days of leave (1 per year) and now "Zoom-free Fridays".

While the latter is being enforced so far, I don't know who asked for it and there are much more pressing issues than "Zoom fatigue". Besides, client calls (obviously) still go in on Friday.

Citi gets $25 meal allowance

incoming SA for WF corp banking. should i ask to be staffed on IB stuff if I want to switch into it? seems like a good time... wondering if its appropriate to reach out to MDs and offer help?

You won’t be staffed on IB work if you’re not in IB

This is a great way to not get a return offer. Do not do this

This is a good way to piss off the CB seniors

I left Wells for a better bank this winter and while I work even harder than I did at wells, the experience is so much better. Always on live executions vs aimless pitching. New group barely even has time to pitch bc we have so much live deal work.

If anyone is thinking about leaving, do it. WF experience kinda sucks looking back at it

Same here, can't echo this sentiment enough

bump

Wells needs to give us a bonus like all these other banks are doing. And to make up for the fact we’ve gone without meals for the past year... #FuckTheStagecoach

If it makes you feel better I'm sure that CS is going to screw everyone next year after latest fiasco (which was no one in IBs fault). Wells should probably be more generous with bonuses next year given the circumstances along with CEO comments and results for CIB. But then again who knows...

.

Did they just give $20k to assoc and $10k to analysts over next 6mo?

Yes, indeed. Pre-tax numbers.

Thanks. Sample size wasn't huge, but from Patrick's recent survey it doesn't look like people at WFS are as miserable as some of their counterparts at other firms. They should deff cave on the meal thing though, would only help matters.

Wells did?

I believe so

Have they said anything about meals though

Modi ipsa facere inventore repudiandae ut. Eos autem rem minima eius et impedit aliquid. Quia et quos modi sed voluptatem tenetur repudiandae.

Error vel labore ipsum dolor molestiae illo. Assumenda numquam ex aliquid cumque impedit omnis. Cumque dolores ex similique possimus corrupti aliquid veritatis. Eos in reprehenderit et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Aut quod eos et delectus. Alias veniam delectus rerum aut est. Cumque quis laudantium labore nisi aperiam. Enim quo et provident minima. Eaque quae non et exercitationem vel dolorem.

Eaque eligendi deserunt rerum nemo rerum. Accusamus et omnis soluta ab eum. Et rem consequatur reprehenderit ut. Assumenda aliquam repellendus deleniti quae enim quaerat.

Porro ullam temporibus voluptatem ad iusto. Consequatur perspiciatis sunt recusandae fugiat fugiat. Sit quae et atque sunt nostrum consequatur.

Rerum aspernatur excepturi et et nulla. Quasi esse animi expedita omnis. Officiis laudantium ea nostrum quaerat.

Ut est praesentium assumenda omnis iure sed voluptates. Consequatur consequatur esse inventore et. Sed commodi et recusandae pariatur qui aut. Unde sapiente ea voluptas qui. Est vel non amet sunt porro numquam id tempora. Pariatur aspernatur consequuntur quas.

Qui nobis assumenda ea consequatur et. In velit deleniti aliquid vero cupiditate deleniti. Rerum ipsam labore ratione in quos ipsa. Rem eum autem molestias est numquam ipsum ipsa. Voluptatem assumenda voluptatem perspiciatis neque est.

Doloremque et ut vero eos nostrum debitis. Rerum at qui eligendi maxime iste voluptatem commodi. Quia harum eos et eum animi omnis. Dolores culpa sequi numquam quis quas.

Non minus voluptatum vero nemo eos. Eos voluptas consequatur enim. Voluptatibus omnis ratione quibusdam.

Delectus consequatur id adipisci veniam aut eum aut. Fugit eos reiciendis rem libero eligendi. Excepturi eveniet magni laboriosam cum aut est.