Six-Figure Salary

Strategies for Earning $100,000 or More

What is a Six-Figure Salary?

A six-figure salary means your yearly income is above $100,000. It means different things to different people. But in the lens of corporate America, it is among the most desired possibilities and is seen as a sign of success.

The figures in six figures refer to the digits in the number. By that logic, a five-digit salary is a salary above $10,000, and a seven-digit salary is one above $1,000,000.

A five-digit salary is considered the average in corporate America, and a 7 digit, above average (and almost impossible for most).

Hence, six-digit pay hits the sweet spot, which most individuals aspire to achieve and is actually a possibility.

Working hard, making the right decisions, and being in the right place at the right time are all important things to keep in mind to get to that salary level. And it is not impossible, especially in today’s corporate world.

Key Takeaways

- A six-figure salary refers to earning over $100,000 annually and is considered a significant achievement in corporate America.

- Various professions, such as investment bankers, financial analysts, and lawyers, offer six-figure salaries with the right qualifications and experience.

- Cost of living can significantly impact the value of a six-figure salary in different locations.

- Investing savings can be a strategic way to boost earnings and work towards a six-figure income.

- Networking and continuous learning are crucial for career advancement and potential salary increases.

Understanding a Six-Figure Salary

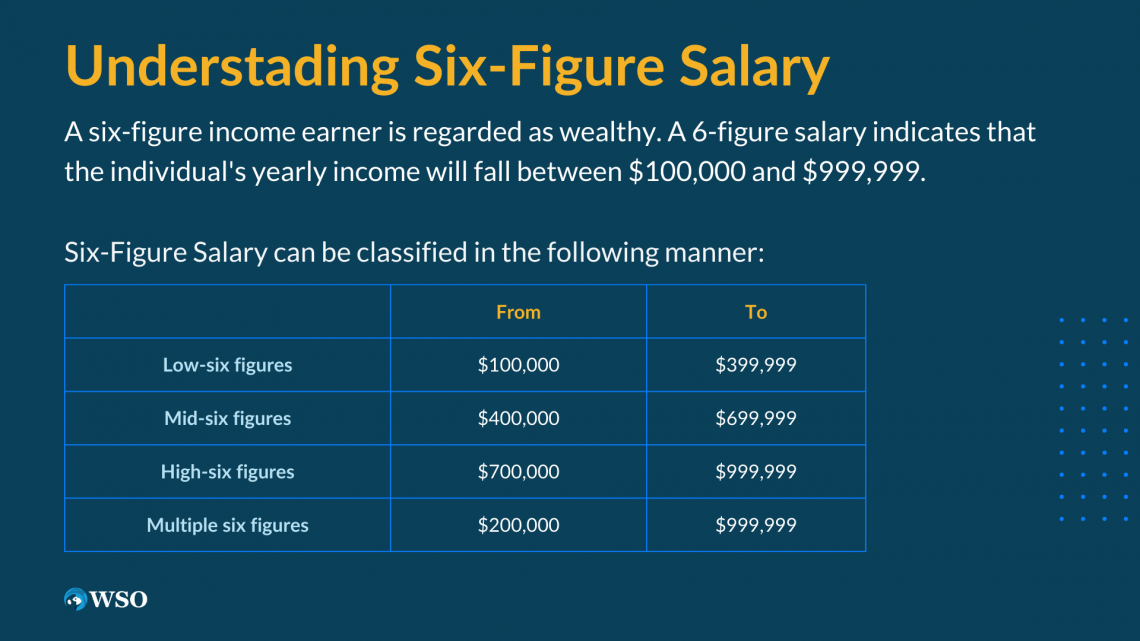

Simply, a six-figure salary is any salary that surpasses $100,000 and less than $999,999. In 2019, the U.S. average salary was 53,490, meaning if you have a salary of six figures, you are likely earning at least double the average U.S. salary. This level of salary is difficult to get and requires lots of work and qualifications.

However, it is important to remember that a six-figure is achievable in the right professions, with enough hard work and dedication. A seven-figure salary, however, is incredibly hard to achieve and hence, will not be a subject of this article.

Finance Job Titles With Six-Figure Salaries

Here are some finance professions that pay six-figure salaries:

- Investment Banker - Works with corporations to raise capital by issuing stock or borrowing money. Also, advises clients during the process of a merger or acquisition. After bonuses, almost all investment bankers will clear the six-figure mark.

- Financial Analyst - Working for a corporation to determine investment strategies for the organization. An entry-level analyst usually does not make six figures. But after a few years in the role, six-figure salaries are common.

- Chief Financial Officer (CFO) - Leads the entire financial aspect of a company. To be appointed to a CFO position requires a lengthy amount of time in the finance industry. All CFO positions surpass the 6 figure salary mark. CFOs at large corporations receive 7 or 8 figure salaries.

- Financial Advisor - Works with individuals to manage their assets to meet their financial goals. Pay varies based on your experience level and the firm you are employed with. But, many financial advisors bring home six-figure salaries.

- Portfolio Manager - Responsible for investing funds assets and day-to-day portfolio management. Most portfolio managers work at investment management firms and bring in over six figures.

Non-Finance Job Titles With Six-Figure Salaries

There are many other jobs with a six-figure salary.

Some of the most common include:

1. Lawyers: Represent clients before government agencies and private legal proceedings. Must spend around 6 to 8 years in higher education to become a lawyer. But the starting salary for lawyers is almost always over $150,000

2. Physicians: Must maintain, promote, and restore health. Done by studying, diagnosing, and treating injuries and diseases. Must complete a four-year undergrad degree, a four-year medical school program, and three to seven years in residency.

However, extensive schooling pays off, as most entry-level physicians make over $200,000.

3. Nurses: Caring for patients, communicating with doctors, and administering medicine are some of the many jobs nurses do. To become a registered nurse, you can complete an accelerated program within eighteen months or a part-time program in three years.

The median salary for a registered nurse is around $85,000. However, with overtime work and experience, this salary can easily reach six figures.

4. Airline pilots: Operate aircraft and transport customers or cargo. A bachelor's degree and around one year of training are needed. The median salary for airline pilots is $102,000.

5. Engineers: Simply, engineers design and develop a variety of products and systems. A bachelor's degree is required in most engineering fields. While pay varies on the type of engineering and experience, the median salary was $92,000.

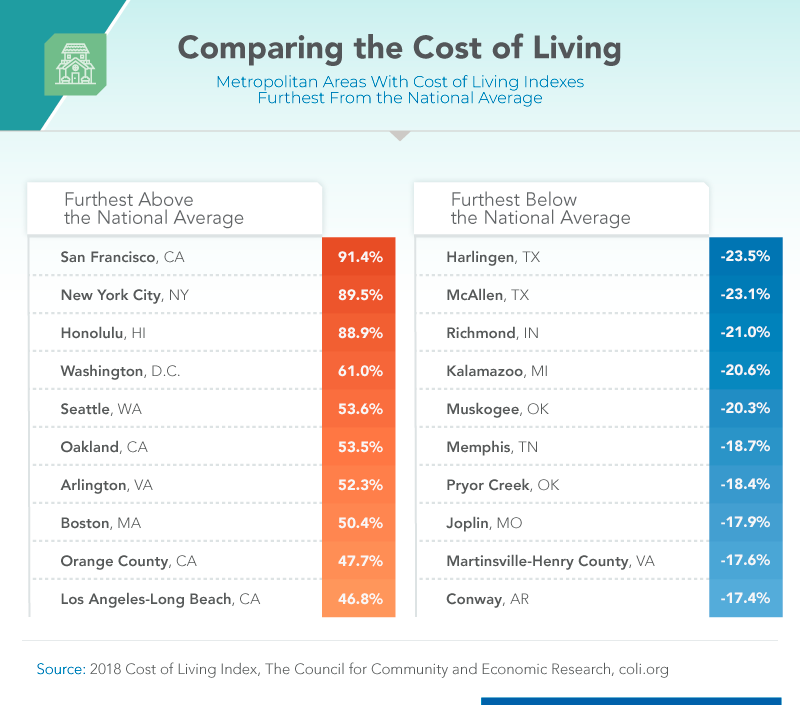

Not all Six-Figure Salaries are Equal

A six-figure salary in Manhattan is not the same as a Boise, Idaho. The cost of living varies based on where you live. For instance, the average cost of a home in Manhattan is $1.4 million.

In Boise a home averages around $365,645. Where you are located impacts your cost of living. The main determinants of the cost of living are:

- Housing

- Transportation

- Food Cost

When valuing a salary, looking at where the job is located is important. Sometimes taking a lower salary role in a cheaper area is better than a higher salary role in a relatively expensive cost of living place.

How to Get Your Salary To A Six-Figure Amount

Many professions can bring in a salary of six figures. Doctors, engineers, pilots, and lawyers are just a few of the people who can make this kind of money. Often, though, you need to be in specific industries or have a higher level of education in a specific niche to make a six-figure salary.

The way to get your salary to a six-figure amount is different for everyone. There is no tried-and-true formula for success. But there are some things that you can do to at least give yourself the best chance of making it.

You need to work hard and make the right decisions and be in the right place at the right time.

For example, if you're not already in an industry that pays well but want to go into it. Consider going back to school and getting the appropriate degree or certification. In some cases, this will require extra years of schooling as well as paying tuition.

But, it could be worth it if it means earning more money in the long run. You also want to keep learning about your profession so that you can progress to making more money by staying ahead of the competition.

Finally, do not forget about networking opportunities. Networking means meeting new people, making connections, and building and maintaining new relationships. Investing time into it could lead to big opportunities down the line.

The Importance of a Degree

One of the most important things to remember if you want to earn a six-figure salary is your education. It doesn't matter what profession you are in, most companies prefer those with a degree.

A degree is often necessary for entry-level positions and it shows your employer that you are dedicated.

Many jobs that pay six-figure salaries need additional training or education to qualify for these positions. When pursuing a career in a high-paying field it is important to understand what qualifications are required to enter the field.

Obtaining extra education can be costly and time-consuming, hence it is very important to do your research before committing to it.

The Importance of Networking

Networking is a great way to land a six-figure salary role. It is essential to develop relationships with people in the professional world and find common ground.

Networking allows you to make connections that may lead to new projects, job offers, or other opportunities.

WSO Real World Example:

Let's say you want to work for Company A and your friend works for Company B. Your friend happens to come across an open position in company B.

As almost 90% of roles are filled up before it gets to the public, chances are that your friend will bring it up at some point, especially if you had kept the relationship going.

By just networking, you would have put yourself ahead of most competition out there when it comes to landing a role.

And it is no less important to land a six-figure role. Other than networking with friends and family, cold networking can be effective. Cold networking means reaching out to people you do not already know.

Connecting to people in the desired industry is a great place to start.

Try finding alumni from your university or someone who shares common interests. While difficult and sometimes awkward, cold networking is effective in breaking into new industries.

Investing Your Savings

If you are not looking to change professions or are set on a career that does not bring in six figures, investing is a great way to boost your earnings. Depending on your ability to save money, you can put that extra income you receive to generate passive income.

WSO Real World Example:

Let’s assume that your yearly earnings are $80,000 and you can save $12,000 from it. If you were to invest this amount each year you would be able to generate a yearly return of 10% on it.

Assuming no changes to your base earnings, your yearly earnings by the tenth year would reach $99,125. Every year after that, you would earn a six-figure income.

Below is a table illustrating the investing effect mentioned above:

Increasing Salary Without Changing Jobs

Due to the pay scale of certain jobs, landing a six-figure role may not be possible always. Many people resort to the Gig Economy to increase their take-home pay.

Popular Gig Economy jobs include:

- Drive for Uber or Lyft - If you have a car and are comfortable sharing with strangers, ridesharing is for you. Platforms such as Uber and Lyft allow drivers to use their cars for ridesharing. Rideshare driver's pay varies but it usually falls between $15 and $22 an hour.

- Freelance on Fiverr - Fiverr is a platform that allows users to offer their services in exchange for payment. Services range from resume creation to voice actors. On Fiverr, you can upload any skill you have and set the price for your skills.

- Babysit - Providing care for children or pets has become a lucrative job in the Gig Economy. Depending on the location and difficulty of the job, babysitters can make up to $30 an hour.

- Grocery Shop for Instacart - Handling grocery shopping for customers is possible through Instacart. Instacart workers are responsible for grocery shopping for customers. Instacart workers should expect $13 to $17 an hour.

- Rent your Home on Airbnb - If you have a spare bedroom or travel often, listing your home on Airbnb is a great way to enter the Gig Economy. Airbnb is useful to generate extra income for renting your home.

- Deliver Food with DoorDash - DoorDash is a simple side hustle. The only responsibility you have is picking up food and delivering it to homes and businesses. Hourly pay ranges from $12 to $17.

Utilizing the Gig Economy is a great way to boost your income towards six figures.

WSO Real World Example:

Let's assume your base salary is $85,000. To increase your income, you decide to begin driving for Uber. Assuming you can average 20 hours per week, you can anywhere from $15,600 to $22,880 to your yearly income.

How to Obtain Salary Information

Salary information for various jobs is available by the U.S. Bureau of Labor Statistics. The Bureau of Labor Statistics is a unit of the United States Department of Labor. It provides information about the U.S economy.

Corporations and governments use the information to make economic decisions.

Included in the Bureau of Labor Statistics, is wage and earnings data on professions in the United States. Using the data from the Bureau of Labor Statistics, you can obtain information about various professions that pay in six figures.

7 and 8 Figure Salaries

For many, a salary of six figures is the highest achievable goal. To earn seven and eight-figure salaries requires more than a tried and tested method, and is largely left to luck. To earn a seven or eight-figure salary, you must have a long track record of high performance and work in a high-paying industry.

The highest earners in corporate America are:

- Investment Bankers

- Lawyers

- C-level executives

Entrepreneurs, professional athletes, and actors are other high earners outside of traditional corporate America. Most people don’t achieve salaries of this level, but it is a goal many have.

Non-Salary Benefits

Salary is not the only way companies pay their employees. Companies will offer other forms of payment than salary. Certain benefits include:

- Fringe Benefits: Perks given to employees that are not direct compensation. Some perks include health insurance, tuition repayment assistance, fitness center access, and free meals.

- Development Training: Training is offered to employees as a form of compensation. This means helping to pay for a degree, certification, or another training program.

- Flexibility: Allowing employees to work unorthodox hours is a flexibility benefit. This allows employees to attend to child care or other such activities to reduce their expenses. Allowing employees to work from home is another flexibility benefit that cuts their transportation costs and time spent commuting.

- Stock Options: Stock options are a benefit to employees, especially at larger corporations. It gives employees free shares in the company or the ability to buy shares at a discount. Not only does this incentivize employees to grow the company but it also increases overall compensation for employees.

- Retirement Benefits: 401Ks and pension plans are common retirement benefits that employees receive. Employers usually commit to helping their employees plan for retirement.

While non-salary benefits will not lead you to a six-figure income. They can help increase your job’s overall value. A job that pays $80,000 but has great non-salary benefits can be better than a job with a $100,000 salary with no benefits.

Taxes on a Six-Figure Salary

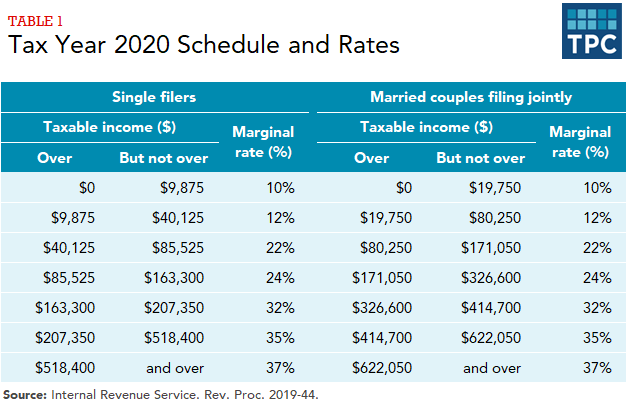

For single filers, the federal tax rate for those who make between $85,525 and $163,300 is 24%. The federal tax rate for earners between $163,300 and $207,350 is 32%. The federal tax rate for earners is between $207,350 and $518,400 is 35%.

Finally, $518,400 and above are taxed at 37%. Other than federal income tax, you may also be subject to state income tax. This amount will vary depending on the state.

As you work your way up the income ladder, taxes increase. Knowing tax laws may help you reduce the tax burden. But high taxes are an inevitable consequence of a high income.

Continuous Learning

One of the most important things for continuous progress in your career is to be open to continuous learning. In a world where technology brings about changes almost every day, It is important for employees to engage in continuous learning. Otherwise, they will be left behind.

Continuous learning goes hand in hand with continuous improvement, which is the principle that people and businesses must chart a course of continually improving themselves to survive and thrive.

Free Resources

Thanks for reading our salary guide! Please check out the following additional resources to help you advance your career:

or Want to Sign up with your social account?