Universal Basic Income (UBI)

A proposed government-guaranteed payment to each citizen

What Is Universal Basic Income (UBI)?

Universal basic income is a government-guaranteed payment to each citizen. Its goal is to ensure that everyone has the means to buy necessities and improve their quality of life, and details include:

- Universal: It means that everyone gets paid, and there is usually no testing or work requirement.

- Basic: Program payments must be sufficient to meet an individual's basic needs. Economists typically recommend monthly payments ranging from $500 to $1000.

- Income: By definition, income must be continuous and recurring.

The terms universal basic income (UBI) and guaranteed basic income (GBI) are not interchangeable. GBI pays out to specific groups based on their financial needs, whereas UBI pays out to everyone.

It is a government-sponsored program that would provide a fixed monthly payment to every citizen or eligible resident.

The idea behind this type of government benefit is to relieve residents' financial stress, to allow them to focus on education, improving their job skills, or dealing with personal matters while still having enough income to meet basic living requirements.

There are no criteria for who receives the income because these programs are either experimental or in development.

Some supporters believe that all citizens, regardless of income, should receive it, while others believe that only those earning less than a certain amount should. Some argue that a government-sponsored income is neither necessary nor equitable.

Key Takeaways

- Universal Basic Income (UBI) is a government-provided payment to every citizen, ensuring financial support for basic needs.

- UBI aims to relieve financial stress, allowing individuals to focus on education, personal development, or dealing with personal matters while meeting basic living requirements.

- UBI differs from Negative Income Tax (NIT), as it provides a universal benefit to all citizens, while NIT is means-tested.

- UBI is funded through tax revenues and can vary in payment amounts depending on economic factors.

Universal Basic Income Vs. negative income tax

A negative income tax and a universal basic income aim to provide everyone with an income floor. However, if forced to choose between the two, a UBI is preferable because it establishes the income floor as a universal benefit, whereas a negative income tax would only provide an income floor to those in need.

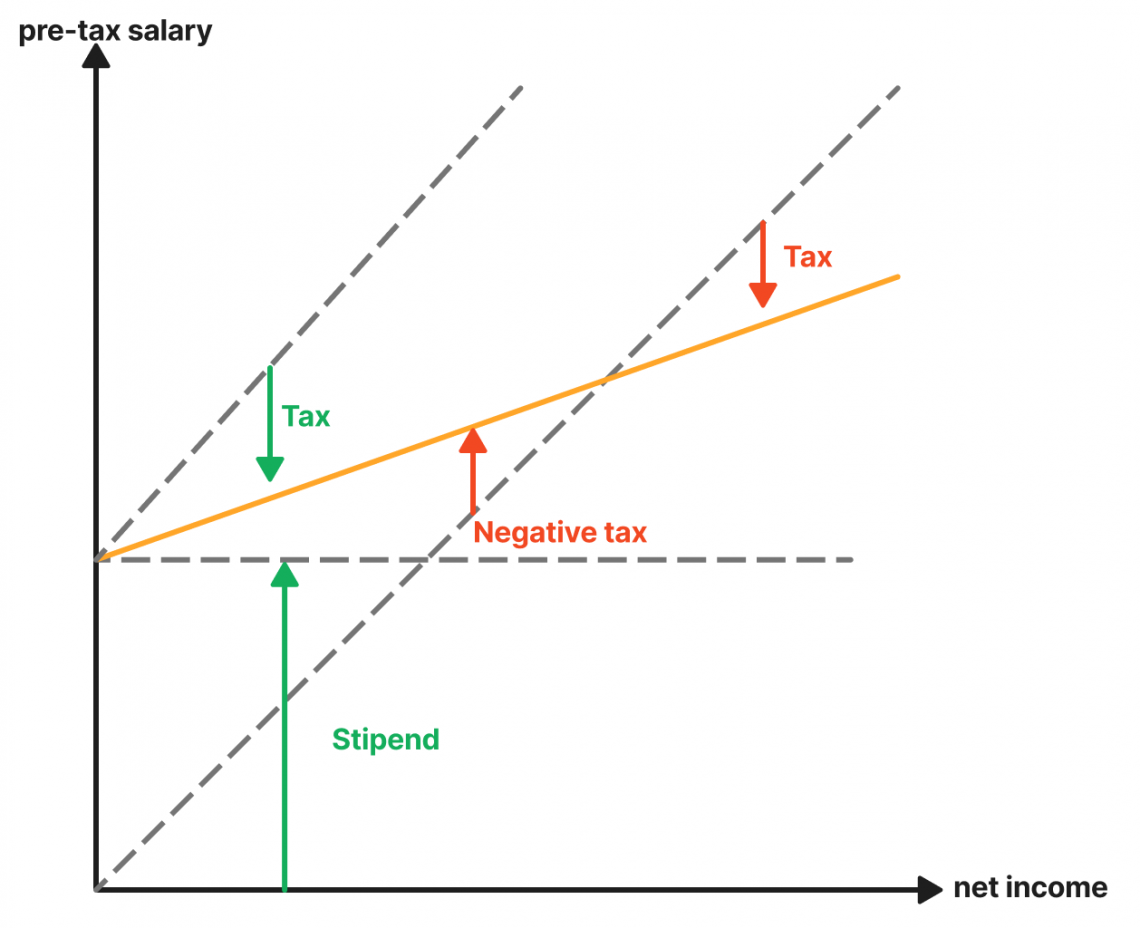

The graph depicts a basic income/negative tax system combined with a flat income tax (the same percentage in tax for every income level).

In the negative income tax system, there is no income tax for low-income individuals. They get money in the form of a negative income tax, but they don't have to pay any. Then, as their labor income rises, this benefit, this state money, gradually declines. This reduction is to be viewed as a mechanism for the poor rather than the poor paying taxes.

That is not the case in the diagram's corresponding basic income system. Everyone pays income taxes in that country. But on the other hand, everyone receives the same level of basic income.

However, as indicated by the orange line in the diagram, net income remains constant. Regardless of how much or how little money one earns, the amount in one's pocket is the same regardless of which of these two systems is used.

How does Universal Basic Income work?

The central idea of a universal basic income is to use revenues from taxes to fund programs that pay all people under the jurisdiction of that government.

The income tax system has been tweaked slightly to include a family size exemption. Only earnings above that threshold are taxed. If your income is less than the exclusion amount, you will receive a subsidy.

The size of the subsidy would vary depending on your income, as well as being subject to a subsidy rate.

A certain amount of tax revenue would be diverted to this program and distributed to residents by the state or federal government. For example, economists Karl Ove Moene and Debraj Ray propose a payment system based on a country's economic output.

They propose that 10 percent to 12 percent of gross domestic product (GDP) be allocated directly to universal income payments. This configuration would cause payments to rise or fall in relation to economic output.

A negative income tax was another approach developed by economist Milton Friedman in 1962. However, Friedman's idea is more in line with GBI, in which only certain people would benefit.

Those with incomes below a certain threshold, according to his proposal, would be eligible for a tax credit. It would be paid for with taxes collected from families earning more than a certain amount.

Universal Basic Income Purpose

There are various models, but at its core, it is a regular cash payment that every individual receives, regardless of their other income or wealth or any other conditions.

Payment amounts can differ based on broad demographic characteristics, such as working-age adults, children, and pensioners.

Some forms of UBI have the potential to reduce poverty while also improving recipients' mental health and well-being. However, it would be costly because it would require significant increases in tax rates, which many people may be unwilling to accept, even though many people on low- to middle incomes would be better off overall once their UBI payment is factored in.

The principle of providing payments without conditions may also face public opposition. It is important to differentiate UBI from a Minimum Income Guarantee, simply a set of policies designed to guarantee that no one falls below a certain income level.

This was demonstrated during the COVID-19 pandemic. Many people lost their jobs as their employers reduced operations to comply with mandated safety protocols. As a result, unemployment skyrocketed, and the federal government stepped in to help those in need by increasing unemployment benefits.

It has been suggested that a UBI would have reduced the government's need to support workers' incomes with unemployment insurance during incidents such as a pandemic.

Universal Basic Income difficulties

Passing a plan strong enough to have a real impact would be difficult in the United States. More than half of Americans are opposed to universal basic income. Many people would only support it if tech companies paid for it with higher taxes.

Despite its promise to reduce poverty and cut red tape, universal basic income faces a difficult road ahead. The most obvious disadvantage is the cost.

The nonprofit Tax Foundation estimates that Andrew Yang's $500 -per-month Freedom Dividend for every adult would cost $1.4 trillion per year (minus any offsets from the consolidation of other programs).

Yang proposed covering that high cost partly by reducing the size of other social programs and enforcing a 10 percent VAT on businesses.

He also proposes repealing the cap on Social Security payroll taxes and instituting a carbon tax to fund his guaranteed income plan.

However, whether that set of proposals is sufficient to fully offset the cost of the Freedom Dividend remains debatable.

According to the Tax Foundation, Yang's revenue-generating ideas would only cover about half the total impact on the Treasury.

Among the other criticisms at UBI is the claim that an income stream not dependent on employment would create a disincentive to work.

This, too, has been a source of contention. Yang has stated that his plan to provide $6000 per year will not be sufficient to live on. As a result, the vast majority of adults would have to support the payment with other sources of income.

UBI in the United States

There have been several attempts in the United States to get UBI off the ground. For example, President Johnson's administration launched an NIT test in New Jersey in 1968.

It discovered that welfare recipients received more money from that program than from the standard income tax. In Seattle and Denver, a higher-paying program was trialed. Both studies found a decreased incentive to work.

The earned income tax credit is now a type of guaranteed income. It provides a tax credit in the form of a percentage of earned income up to a maximum credit.

Because credit grows in tandem with income, it increases the incentive to work. However, as income reaches a certain level, the tax credit phases out and decreases.

Critics argue that the earned income credit disincentivizes people to work harder, which is also an argument made against universal basic income. Stockton, California, launched a two-year GBI pilot program in 2019.

It provided $500 monthly to 125 local families. Among other findings, the experiment discovered that GBI enabled many recipients to find full-time employment, provided food for many, and reduced income volatility in some low-income households.

Where has UBI been set up?

Trials and pilot programs have been conducted all over the world to test some of the fundamentals of UBI, with many of these experiments taking place in recent years.

Most do not fully meet the requirements for a pure UBI: in many cases, cash payments have been restricted to a specific demographic in a geographic area, such as those already receiving specific social welfare benefits. This includes trials in:

- Finland, where 2,000 unemployed people were given €560 per month.

- Ontario, Canada, where 4,000 low-income people were given an annual salary of $16,989 in Canadian dollars for participants; $24,027 in Canadian dollars for spouses.

- Stockton, California, where 125 residents living at or below the median income line were given $500 per month. (The Economic Security set up one million dollars for this program)

However, there are a few places where a form of UBI has been implemented without a work requirement.

In response to cuts in certain subsidies, such as gas and bread, that individuals were previously receiving, Iran launched a nationwide cash transfer program in 2011.

In addition, as stated in Zuckerberg's Facebook post, the state of Alaska has provided all residents with a yearly check (typically around $1,000 or $2,000) funded by mineral royalties investments since 1982.

Universal Basic Income Eligibility

The qualifications for UBI payments differ depending on the proposal. To be "universal," all permanent residents must be able to participate.

Similar to UBI, programs such as guaranteed basic income and Milton Friedman's negative income tax would exclude citizens once their income exceeded a certain threshold.

As in California, they are implementing their new guaranteed income program, which will see 1,000 dollars per month distributed to 1,000 randomly selected residents over the next three years.

The Universal Basic Income Program (UBI) payments will be included in the Fiscal Year 2021/22 budget, which has been approved by both the Governor and the Legislature in California.

The requirements for Universal Basic Income payments differ depending on the proposal, and to be eligible for the payments you should meet certain requirements as the following:

- You must be over the age of 18

- Have a household income of fewer than 56,000 dollars for a single citizen or 96,000 dollars for a family

- Have suffered hardship as a result of the COVID-19 pandemic

UBI Benefits and Drawbacks

UBI helped many people during the pandemic and made life easier for citizens, at least in terms of necessities, but it also had unintended consequences for the country's economy.

If you want to learn more about universal basic income and how it helped people during the Covid-19 times, there are UBI benefits:

1. Workers could save up for better opportunities

An unconditional basic income would allow workers to save up for a better job or higher pay.

2. Freedom to return to school or to stay at home to care for a relative

Workers with more financial stability may be able to return to school. They would feel less pressure to work if they needed to take time off to care for family members.

3. Traditional welfare programs may benefit from the removal of the "poverty trap."

Many current welfare programs have been chastised for keeping people in poverty. When welfare recipients earn too much, they frequently lose their benefits, even if their income is still insufficient to cover the cost of living. A basic income could be viewed as a stepping stone rather than a tether to the welfare system.

Individuals benefited greatly from the UBI, but it was difficult and risky for countries. So let's see how it goes with the drawbacks of UBI:

1. Free money may not motivate people to work

According to Oren Cass, a senior fellow at the Manhattan Institute, UBI would make work appear optional. 13 Many recipients may prefer to live on their free income rather than learn new skills or build a resume.

2. Could perpetuate a falling labor force participation rate

Some people may choose to accept only the payments rather than work to avoid ever getting a good job in a competitive environment, lowering an already-falling labor force participation rate.

3. Money for the comfortable

Universal income applies to everyone, regardless of wealth or income.

or Want to Sign up with your social account?