DAYS360 Function

A powerful tool that can simplify financial calculations

What is the DAYS360 Function?

The Days360 function in Excel is a powerful tool that can simplify financial calculations by providing an easy and efficient way to find the number of days between 2 periods of time.

This function can be used in a variety of scenarios, like:

- Calculating interest on loans or bonds

- Determining the length of an accounting period

- Analyzing cash flow projections

The Days360 function performs calculations using a 360-day year, which assumes that each year has 12 months of 30 days each.

This method is often used in financial calculations because it simplifies the process by providing a consistent number of days for each month, regardless of what the calendar dictates.

One of the main benefits of the Days360 function is that it can save time and reduce errors in financial calculations. In addition, by automating the process of counting days, this function can help ensure accuracy and consistency in financial models and projections.

In this article, we will cover the DAYS360 syntax and arguments, including how to use different methods of calculation, such as the US (NASD) or the European method.

We will also provide examples of how to use the function in different scenarios, including calculating interest on loans or bonds and determining the length of an accounting period.

To help you use the Days360 function effectively, we will also provide some tips and tricks, such as handling leap years and adjusting the function for different regional settings.

Key Takeaways

- The Days360 function in Excel calculates the number of days between 2 days.

- This function assumes each month had 30 days, performing its calculations for a 360-day year.

- This is mainly used for calculations like interest on a loan, length of an accounting period, and bond yields, as they normally use a 360-day year.

- You can nest other Excel functions in Days360 to improve the function’s effectiveness!

Understanding the Days360 Function in Excel

The Days360 function in Excel calculates how many days exist between 2 dates.

This function is often used in financial calculations where a 360-day year is used to simplify interest calculations. Therefore, understanding how the Days360 function works is essential to using it effectively.

To use the Days360 function, you must provide the start and end dates as arguments and an optional third argument specifying the calculation method.

When hitting enter, the function will return the number of days between the two dates based on the specified calculation method.

The Days360 function uses a simple calculation to determine the number of days between two dates based on a 360-day year. For example, the calculation will assume each month has 30 days even if the actual number of days is 28 or 31.

For Example: Pretend the start date is the 31st day of a month (January 31st), and the end date is the 1st day of the next month (February 1st). The Days360 function will recognize this as one day, note 2.

NOTE

It's important to note that the Days360 function only works with dates and does not consider any time information. Additionally, the function assumes that there are 12 months in a year, each with 30 days.

This is not true in all cases, so the function may not always provide accurate results for all financial calculations.

In terms of limitations, the Days360 function is unsuitable for calculating the actual number of days between two dates, especially when calculating interest over several years.

It's also unsuitable for countries with a 365-day year or different rules for calculating interest.

Regardless, for those who need to perform financial calculations quickly and accurately, the Days360 function is a valuable tool.

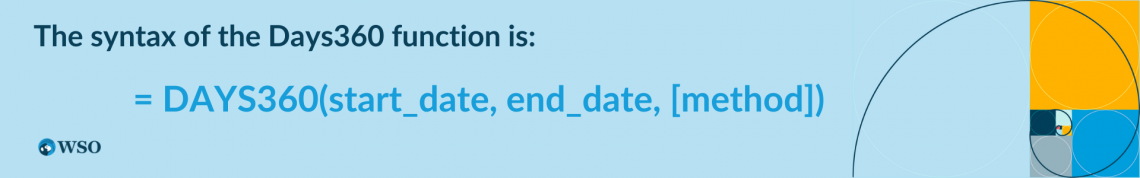

Syntax & Arguments of the Days360 Function

The syntax of the Days360 function is as follows:

You must enter the start_date and the end_date argument in the format of a valid Excel date. The function will then calculate the number of days between these two dates using the 360-day year assumption.

The optional third argument, method, specifies the method of calculation to use. There are two methods of calculation that can be used with the Days360 function:

- US (default method)

This method assumes every month has 30 days and calculates the number of days between the start and end dates based on this assumption. - European

This method assumes that the first and last months have 30 days and all other months have 31 days.

Here are some examples of using the Days360 function in different scenarios:

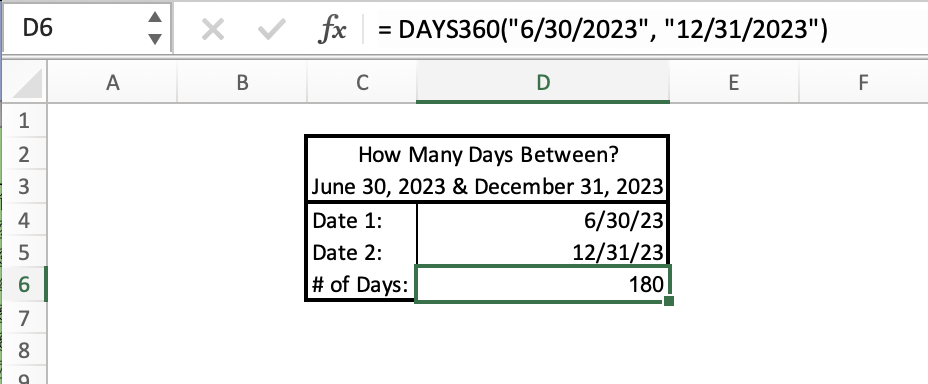

Example 1: Calculate the number of days between two dates using the default US method.

To calculate the days between two 2023 dates, June 30th and December 31st. You can use the following formula:

= DAYS360("6/30/2023", "12/31/2023")

This will return a result of 180, which is the number of days between the two dates using the US method.

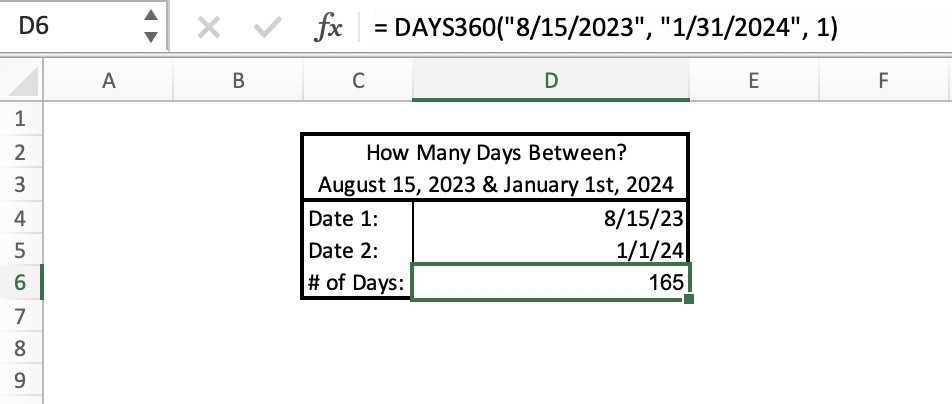

Example 2: Calculating the number of days between two dates using the European method.

To calculate days between two dates, August 15th of 2023 and January 31st of 2024, using the European method. You can use the following formula:

= DAYS360("8/15/2022", "1/31/2023", 1)

This will return a result of 165, the number of days between the two dates using the European method.

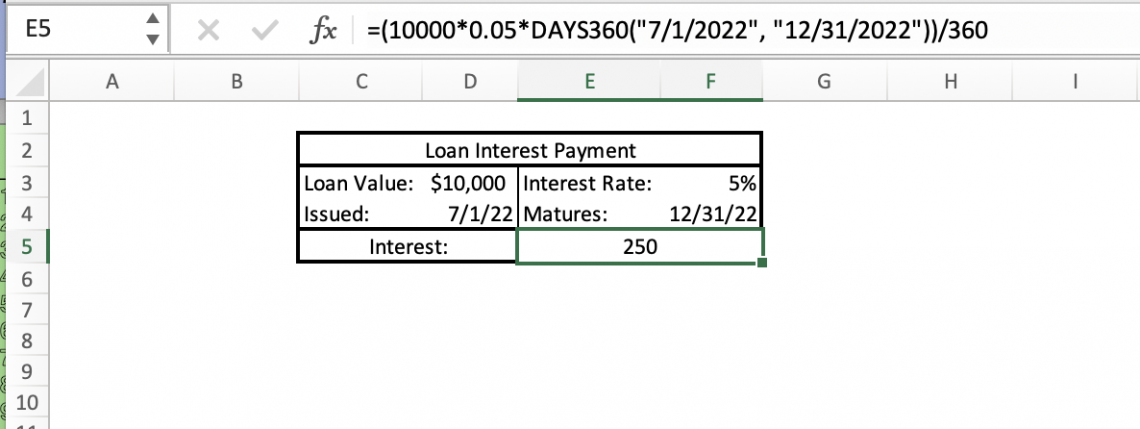

Example 3: Calculating interest using the Days360 function.

Suppose you want to calculate the interest on a loan that has a 360-day year. $10,000 was loaned at an interest rate of 5%. The loan was issued on July 1st, 2022, and will mature on December 31st, 2022. You can use the following formula:

=($10,000*5%*DAYS360("7/1/2022", "12/31/2022"))/360

This will return a result of $250, which is the interest on the loan using the Days360 function.

The Days360 function in Excel is a powerful tool for simplifying financial calculations. By understanding its syntax and arguments, you can use the function to perform various financial calculations quickly and accurately.

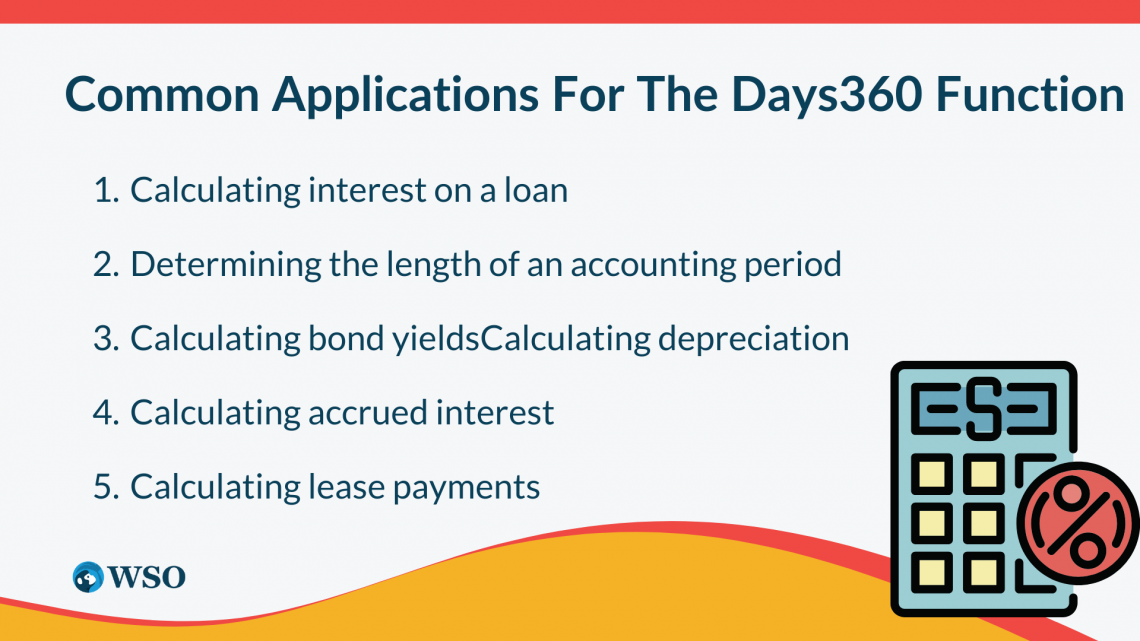

Common Applications for the Days360 Function

The Days360 function in Excel is a versatile tool used in various financial calculations. Here are some common applications of the Days360 function:

1. Calculating interest on a loan

Loans often use a 360-day year to simplify interest calculations. By using the Days360 function:

- You can easily calculate the days between the loan issuance and maturity dates,

- Use this information to calculate the interest due.

2. Determining the length of an accounting period

In some accounting systems, a 360-day year is used to simplify calculations. By using the Days360 function:

- You can easily determine the number of days in an accounting period, which can be useful for financial reporting.

3. Calculating bond yields

The Days360 function can be used to calculate the number of days between coupon payments on a bond. This information can then be used to calculate the bond yield, a key metric for bond investors.

4. Calculating depreciation

Some accounting methods use a 360-day year to simplify depreciation calculations. By using the Days360 function:

- You can determine the number of days in a given accounting period, which can be used to calculate depreciation expenses.

5. Calculating accrued interest

Accrued interest is any interest that has been earned but not paid out or received by the individual. By using the Days360 function:

- You can determine the number of days between the last interest payment and the current date, which can be used to calculate the accrued interest.

6. Calculating lease payments

Some lease agreements use a 360-day year to simplify lease payment calculations. By using the Days360 function:

- You can determine the number of days in a lease period, which can be used to calculate the lease payments.

NOTE

The Days360 function in Excel is a powerful tool for performing financial calculations. By understanding its common applications, you can use the function to simplify financial calculations and improve your financial reporting.

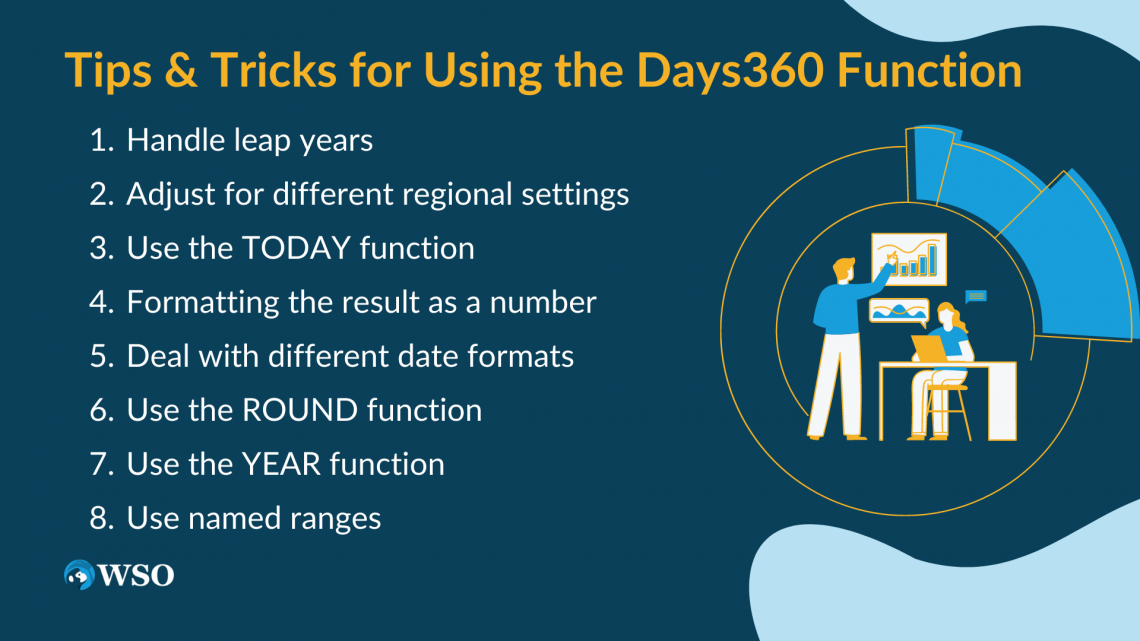

Tips & Tricks for Using the Days360 Function

While the Days360 function in Excel is a powerful tool for financial calculations, some tips and tricks can help you use it more effectively. Here are some useful tips to keep in mind when using the Days360 function:

1. Handle leap years

The Days360 function doesn't take leap years into account. You may need to adjust the function to account for a leap year. To account for leap years:

- Use the YEARFRAC function to calculate the fraction of a year that each date represents and then

- Multiply the result by 365 or 366 (depending on whether it's a leap year or not)

2. Adjust for different regional settings.

The Days360 function uses the 30/360 method by default, which assumes that all months have 30 days and that a year has 12 months.

Some regions use different methods for calculating the number of days between two dates. You can specify different methods in the function by using the "method" argument.

3. Use the TODAY function.

If you need to calculate the number of days between a specific date and the current date, enter the TODAY function for the end date argument in the Days360 function.

To calculate the number of days between January 1, 2023, and the current date:

=DAYS360("01/01/2022",TODAY()).

4. Formatting the result as a number.

The default Days360 function returns a value in the format "DAYS360(start_date,end_date,method)," which may not be useful for all applications.

You can wrap the function in the VALUE function to format the result as a number:

=VALUE(DAYS360(start_date,end_date,method)).

5. Deal with different date formats.

The Days360 function works with various date formats, including text strings, date serial numbers, and cell references.

NOTE

You may encounter issues if your dates are stored in a different format than what the function expects. Use the DATE function to create a valid date from separate year, month, and day values.

The Days360 function can return a decimal value if the start and end dates don't fall on exact month boundaries.

Use the ROUND function to round the result to the nearest whole number, like this:

=ROUND(DAYS360(start_date,end_date,method),0).

7. Use the YEAR function.

The YEAR function will return a year from a date for use in another calculation you can.

To calculate the interest due on a loan in a given year:

=DAYS360(start_date,end_date,method)interest_rateloan_amount/(YEAR(end_date)-YEAR(start_date)).

8. Use named ranges

If you frequently use the Days360 function in a specific part of your workbook, you can create named ranges for the start date, end date, and method arguments to make your formulas easier to read and manage. To create a named range:

- Select the cell(s) you want to name

- Click in the Name Box

- Type a name for the range

By keeping these tips and tricks in mind, you can use the Days360 function in Excel more effectively and efficiently for your financial calculations.

Days 360 Function in Excel Summary

The Days360 function considers a 360-day year in financial calculations, simplifying the process and providing more accurate results.

This function can be used in a variety of applications, like:

- Calculating interest on a loan

- Calculating bonds

- Determining the length of an accounting period

- Analyzing cash flow projection

It's important to note that while the Days360 function can be a powerful tool, it may not be the best tool for all situations. There are similar functions that Excel offers that can be used with Days360 for more effective results, like:

- TODAY

- ROUND

- YEAR

You should consider your unique circumstance and need before using the function.

We hope this article has provided you with a solid understanding of the Days360 function in Excel and how to use it effectively. Don't be afraid to experiment with the function and explore its various applications.

Incorporating this tool into your financial calculations can save time and improve accuracy, making your work more efficient and effective.

Days360 Function In Excel FAQs

Yes, the function can handle leap years, but you must use the correct calculation method.

- The European method assumes that all months have 30 days, so February is always considered to have 30 days, regardless of whether it's a leap year.

- The US (NASD) method, on the other hand, counts actual days, so February in a leap year is counted as 29 days.

By default, Excel uses the US (NASD) method for the Days360 function. You can change the default method by:

- Going to the "File" menu,

- Selecting "Options,"

- Then "Advanced,"

- Finally, scroll down to the "When calculating this workbook" section.

You can change the default calculation method to US (NASD) or European.

No, the Days360 function doesn't have the option to exclude weekends. However, you can use the NETWORKDAYS function for working days and multiply that result by the number of days in each accounting period.

The Days360 function assumes that the month and year are specified in the same order as your computer's regional settings.

- If your region is the United States, the function expects dates to be specified in the "mm/dd/yyyy" format.

- If your region is the United Kingdom, the function expects dates to be specified in the "dd/mm/yyyy" format.

No, the Days360 function is designed to work with standard calendars only. If you need to work with a non-standard calendar, you'll need to use a custom formula or VBA macro.

Yes, the Days360 function can be used for financial projections, but you need to be aware of any limitations or assumptions of the function.

Using the European method, you'll assume all months have 30 days. This may not be accurate for long-term projections. It's always a good idea to check your calculations against other methods and sources to ensure accuracy.

or Want to Sign up with your social account?