Sales Tax Decalculator

A tool to determine the original price of an item before sales tax was added. It works by removing the sales tax amount from the total to find out the pre-tax price.

What is a Sales Tax Decalculator?

A sales tax decalculator is a tool to determine the original price of an item before sales tax was added. It works by removing the sales tax amount from a total to find out the pre-tax price.

Sales tax is a common tax placed on the sale and consumption of goods and services. It is charged by the seller and eventually collected by the government. Sales tax rates can vary from state to state and tend to be within the range of 0% to 10%.

Sales tax calculations can be time-consuming and tedious work. However, with the laws and regulations around corporate financial statements, ensuring the figures reported are accurate is crucial.

Improper treatment of taxes and sales can increase the risk of being audited by the Internal Revenue Service or its equivalent in foreign countries.

Some multiple rates and exemptions need to be considered. Using a sales tax calculator can simplify any necessary calculations. In addition, many online platforms can perform all your calculations and provide additional data.

There are many different ways to use a sales tax decalculator. For example, some people may opt to perform all the calculations by themselves using an application like Microsoft Excel to keep their accounting in-house.

Most commonly, however, is using an external source, whether an accountant hired or less expensive online applications. Understanding how sales tax works is important to properly interpret any numbers given by any method chosen to de-calculate tax.

Key Takeaways

- A sales tax decalculator is a tool used to calculate the pre-tax sale price of an item or service. It is crucial for accurate accounting, tax compliance, and financial reporting.

- Several formulas can be used to decalculate sales tax, involving the total price with tax, sales tax percentage, and price before tax. Excel can be utilized to perform these calculations, and understanding the relationships between these variables is essential.

- Various online platforms like TaxJar, Avalara, Taxify, and TaxCalcUSA offer sales tax decalculation services. These platforms can save time, ensure accuracy, reduce costs, and provide convenience for businesses.

- Using a sales tax decalculator can save time, improve accuracy, reduce costs associated with hiring professional accountants, and offer the convenience of accessing calculations from multiple devices and platforms.

Sales Tax Decalculation Methods

The sales tax decalculator is a tool used to calculate the sale price of an item less the tax applied to it. This is very useful for accounting purposes; you may want to know the pre-sale price of an item or the accuracy of sales tax calculation.

There are many ways to reverse calculate sales tax. Of course, using Excel to perform sales tax calculations is much easier. Still, you can very easily reverse-engineer multiple related formulas depending on your given information.

The relevant arithmetic formulas to reverse-calculate the sales tax are

Price before Tax = Total Price with Tax - Sales Tax

Sales Tax Rate = Sales Tax Percent / 100

Price before Tax = Total Price with Tax / (1 + Sales Tax Rate)

Sales Tax = Price before Tax * Sales Tax Rate

Excel has no dedicated formula for decalculating sales tax, so it is important to know how to use these formulas. In addition, they will help you understand the fundamentals of sales tax, allowing you to translate those skills into Excel and perform large calculations.

Sales Tax Decalculation online applications

Many online applications can perform sales tax decalculations.

Some popular ones include:

- TaxJar: An online sales tax decalculator that allows you to calculate the sales tax for any jurisdiction in the USA. TaxJar has features that allow you to input custom tax rates, multiple tax rates, and tax exemptions.

- Avalara: Another online sales tax decalculator with features allowing you to include custom tax rates, multiple tax rates, and exemptions. Avalara also integrates with e-commerce platforms, so it is easy to calculate the sales tax for online transactions.

- Taxify: A mobile tax decalculator with many of the same features as the previous platforms.

- TaxCalcUSA: It has the features of all the platforms above but includes a comprehensive database of tax rates across the United States.

All of these platforms have useful features for businesses with different budgets. However, you must do your due diligence when researching sales tax calculators to find a platform that can provide the right services for your company.

Examples of the sales tax decalculator

Understanding how sales tax is calculated is important before you can “de-calculate” it. This way, you can properly interpret the meaning behind the numbers you get.

Now, let us apply these formulas to some fictional problems to understand better how these formulas work. But first, we use all these formulas to determine a transaction's pre-tax sale price.

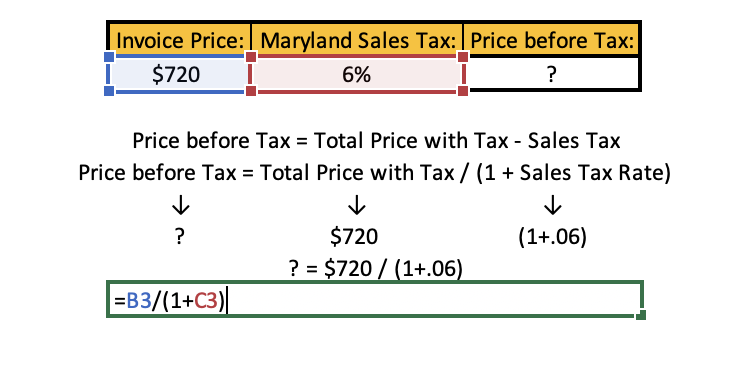

As stated, Excel has no dedicated formula for performing sales tax-related functions. This makes it very important to understand the relationship between the variables in the formula so you can create formulas in Excel that can perform these calculations for you.

In this section, we will be recreating various sales tax formulas in Microsoft Excel to help provide insight as to how one would perform sales tax calculations in Excel.

If you want to improve your Microsoft Excel Skills, check out the Wall Street Oasis’s Excel Modelling Course, where you can enhance your data table analysis and formula auditing skills to create powerful formulas to perform sales tax calculations.

Price Before Tax

If you can recall from before, there are 2 formulas to calculate the Price before Tax.

Price before Tax = Total Price with Tax - Sales Tax

Price before Tax = Total Price with Tax/ (1 + Sales Tax Rate)

The Price before Tax formula is the most relevant way to perform sales tax decalculation.

A crucial piece for both formulas is the knowledge of the total sale price and the state's tax rate. Most times, your state's tax rate can be found online, while the total sale price can be found on the transaction receipt.

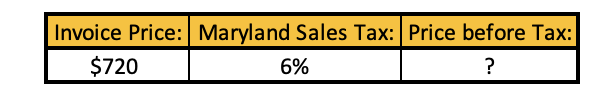

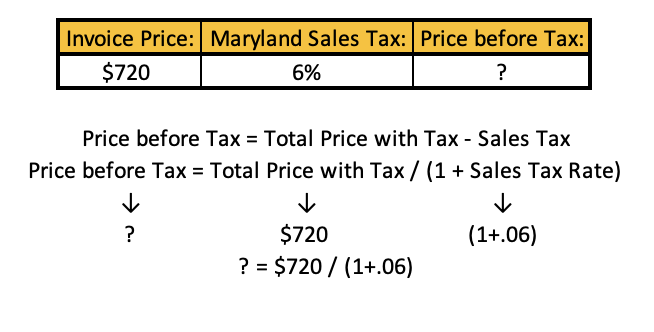

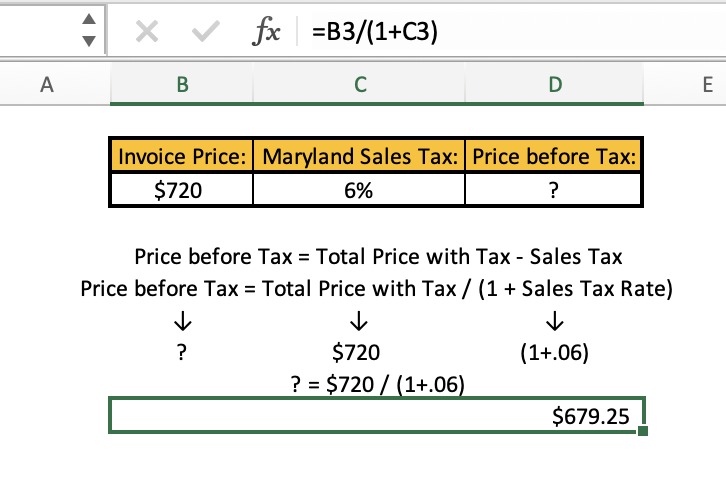

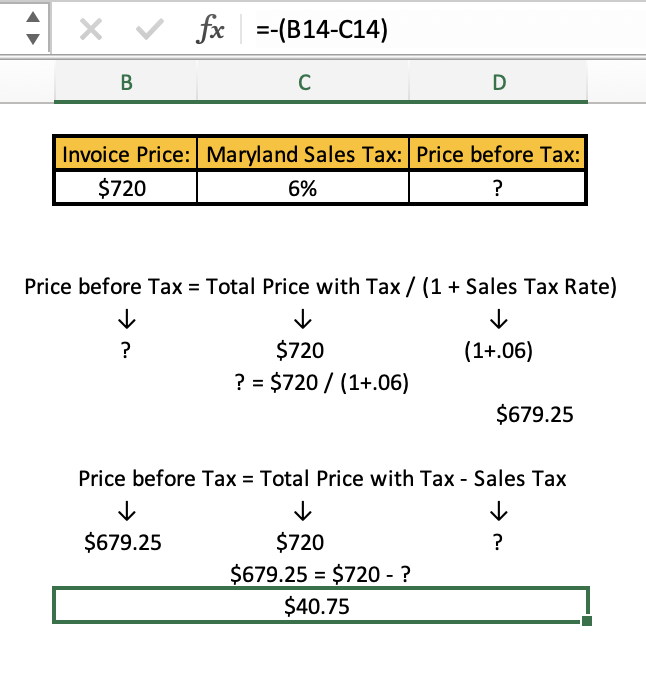

Let’s pretend you are a firm that has recently charged an invoice to a customer in Maryland. You charged the customer $720 in total and want to figure out the total amount the customer is paying extra in taxes.

Based on the prompt, we know the total price with tax is $720. Knowing that this is in the state of Maryland, we can do a quick google search to know the sales tax rate, which is 6%.

We do not know the value paid in taxes (sales tax), so we will try to solve our problem using our 2nd Price before Tax formula.

Thus our formula with the numbers substituted in would be

We can perform this calculation in excel by substituting the numerical values with the cell value to get:

This gives us our price before tax:

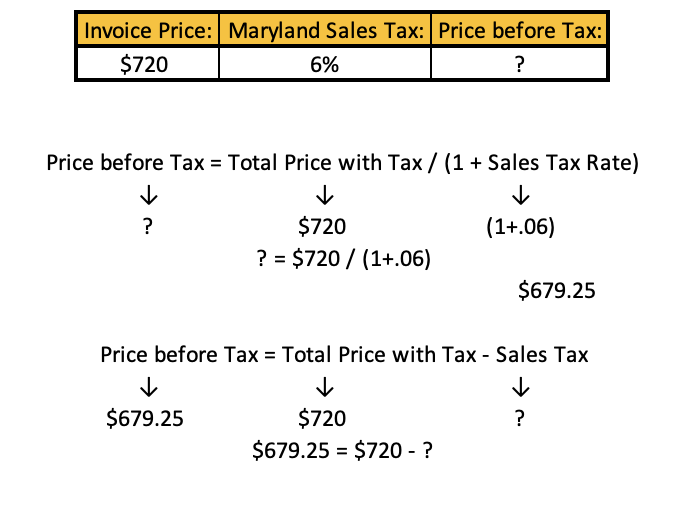

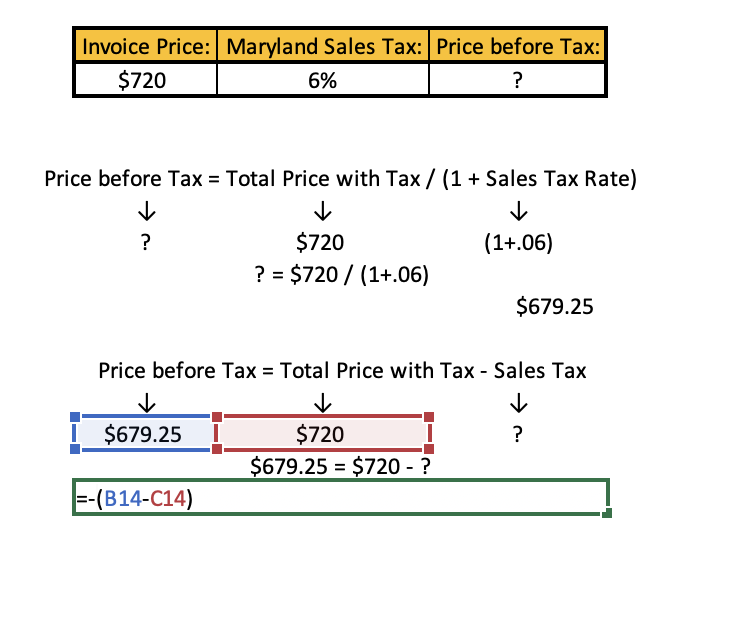

Now, let’s use this information to determine the amount paid in taxes. First, we can substitute our numbers into the 1st formula to get:

For this formula, we will have to do some manipulation. Substituting the cell values for our numerical values, we get:

This formula gives us our total amount paid in tax:

Now we know the amount paid extra in sales tax on this transaction was $40.75. This is an example of how we can use the Price-before-tax formula to perform sales tax-related calculations.

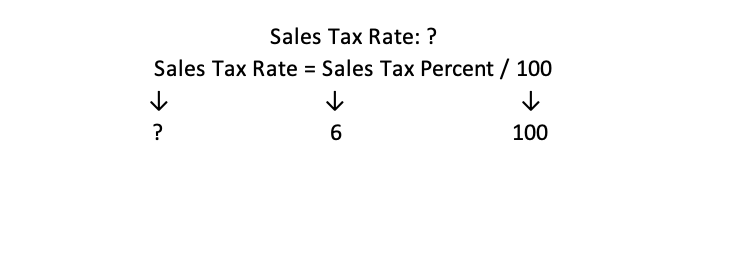

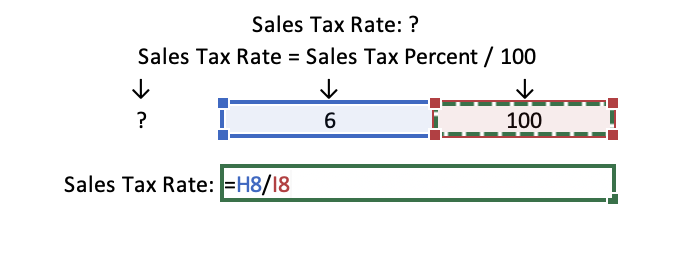

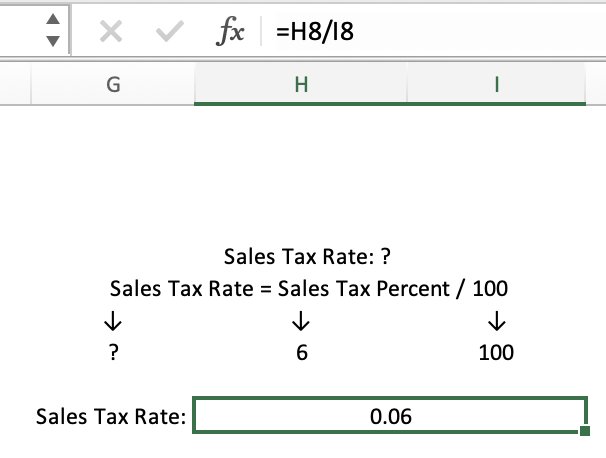

Sales Tax Rate

Another method to find the pre-tax sale price is to use the Sales Tax Rate formula.

Sales Tax Rate = Sales Tax Percent/ 100

This is especially useful when figuring out what sales tax rate to use if you do not know how percentages work. Looking back at our example from the last section, we know that the sales tax percentage in the state of Maryland is 6%.

Putting that into this formula gives us the following:

Our Excel formula for this would be:

Which would give us our answer:

A general rule of thumb when converting between decimals and percentages is to move the decimal point two places over to the left. This can make calculations by hand faster.

If you want to pursue a career in IB, your mental math skills must be up to par, so you can do mental calculations on the fly. In addition, you can familiarize yourself with mathematical relations with any of the WSO’s financial modeling packages!

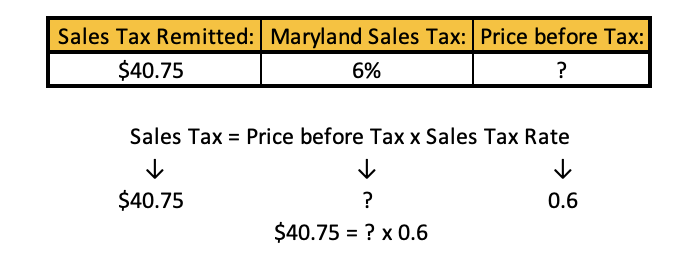

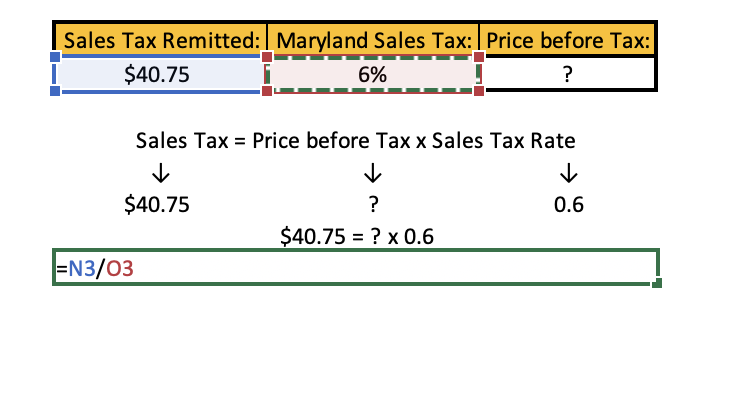

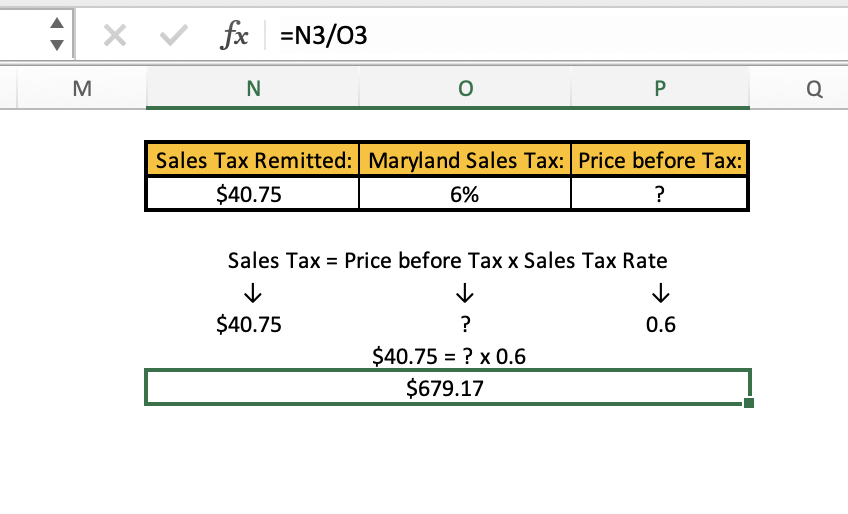

Sales Tax

Depending on the available information, you can reverse engineer the pre-tax transaction price using the sales tax formula.

Sales Tax = Price before Tax * Sales Tax Rate

Using numbers from our example from earlier, let's pretend we know the amount paid in sales tax is $40.75, and we know that the sales tax in Maryland is 6%. Substituting numbers into our formula gives us the following:

Substituting numerical values for cell values after performing some algebraic manipulation gives us the following formula:

This gives us the following value:

As we can see, using simple algebra skills, we can reverse engineer one of our formulas to figure out how much was charged minus taxes.

Benefits of Sales Tax Decalculator

There are many reasons why understanding how sales tax works is beneficial. First, especially in accounting, it is important to understand how much of your revenue is being remitted to the government.

Using a decalculator platform can provide the following benefits

- Save time: Calculating the sales tax by hand can be tedious and cumbersome work to do by hand. Using a sales tax decalculation platform can reduce redundancies and allow you to allocate your time to other aspects of your business.

- Accuracy: With sales tax laws varying by state and county, it is important to ensure you comply with the tax codes, GAAP (Generally Accepted Accounting Principles), and other federal laws to avoid the risk of an audit by the IRS.

- Save Costs: A sales tax platform is normally less expensive than a full-time professional accountant. If your business accounts are simple, this can mitigate hiring a salaried professional, potentially saving thousands of dollars annually.

- Convenience: Many platforms for sales decalculation can be accessed from multiple devices and platforms because they are internet-based applications. This means you can easily calculate pre-tax sales for a transaction while you are on the go.

Summary

Sales Tax is a tax on consumption where the tax burden is placed on the buyer. After the seller receives the sales tax, they remit it to the government. However, some jurisdictions may have exemptions for certain products like groceries or medicine up to a specific value.

The Sales Tax Decalculator is a method used to determine the pre-tax sale price of an item or service. This is important to know for accounting purposes to reconcile the cost of the amount sold and the revenue received from the sale.

Because the government requires corporations to pay taxes on earnings, calculating the exact number of pre-sales tax earnings you receive is important for creating accurate financial statements.

There are many ways to perform a sales tax decalculation. The most commonly used method is finding an online application that can perform the decalculation for you. These online platforms are much more convenient and efficient to use.

To ensure that you are using the sales tax calculator properly, you should understand the relevant basic formulas for calculating sales tax:

Price before Tax = Total Price with Tax - Sales Tax

Price before Tax = Total Price with Tax/ (1 + Sales Tax Rate)

Sales Tax Rate = Sales Tax Percent/ 100

Sales Tax = Price before Tax * Sales Tax Rate

All four formulas can be used to obtain pre-sales tax transactions, depending on the information you are given.

Knowing the relationship between sales tax, transaction price, and sale price can help you better interpret the numbers you will use and receive in a sales tax calculator.

Sales Tax Decalculator FAQs

The sales tax decalculator calculates how much of a transaction price is attributable to sales tax.

You can perform sales tax decalculations through excel or one of the many online platforms that exist.

There are four formulas that you can use in your sales tax calculations. Those formulas are:

Price before Tax = Total Price with Tax - Sales Tax

Sales Tax Rate = Sales Tax Percent / 100

Price before Tax = Total Price with Tax / (1 + Sales Tax Rate)

Sales Tax = Price before Tax * Sales Tax Rate

You will need to do some algebraic manipulations to the formulas to find the variable you are interested in finding.

There is no dedicated formula for sales tax in Microsoft Excel. However, you can still use the algebraic formulas with relative referencing to perform sales tax calculations in Excel.

Multiple online platforms can perform sales tax calculations while providing extra information. Here is a condensed list of S.T decalculators that we highlighted in this article:

- TaxJar

- Avalara

- Taxify

- TaxCalcUSA

These platforms provide a variety of features at different price points for your sales tax decalculations. Many more platforms exist with other features.

These platforms can save you time and money, ensure accuracy, and are convenient to access. If you are an entrepreneur with little time, these platforms can be very helpful for you and your business.

or Want to Sign up with your social account?