Commitments and Contingencies

It is a vow made by a business to stakeholders and/or parties outside the company

A commitment is a vow made by a business to stakeholders and/or parties outside the company as a result of legal or contractual obligations. A company's obligation to meet a contingency, on the other hand, is based on whether a future event will occur or not. An entity may not lose money as a result of a contingency.

An entity must fulfill contracts and obligations, just like every other organization, in order to maintain its operational viability.

Regardless of other operations or events, obligations and contracts are regarded as commitments for an entity that may cause a cash (or funds) inflow or outflow.

Contingencies are uncertain events or operations that could cause an entity to experience a cash inflow or outflow. Situations of contingence depend heavily on the occurrence or non-occurrence of uncertain future events and are not guaranteed.

In contrast to contingencies, which may or may not subject the relevant entity to liability, commitments by an entity must be kept regardless of outside circumstances.

Commitments

An obligation arising out of an existing contract, agreement, or legislative enactment or regulation becomes a legal liability upon fulfilling certain conditions. A purchase order usually starts with a commitment.

These are a crucial components of the budgetary control and expenditure planning processes. Its controls must be in place to ensure compliance with Sections 32 and 46.

The Financial Administration Act (FAA) confirms the availability of funds before entering into a contractual arrangement. And record Commitments or obligations in the System for Accountability and Management (SAM).

Commitment accounting is the process of identifying and reserving funds for future payment obligations. Subsections 4(1)(c) and 12(2)(b) of the FAA outlines the Financial Management Board's and Comptroller General's respective authorities and responsibilities for Commitment accounting.

This policy outlines the commitment accounting requirements for departments in this regard. FAM 1802, Approval Authorities, specifies the approval requirements for Commitment authority responsibilities.

It can be recognized at any of the stages listed below:

-

When goods or services are formally requisitioned internally. But no contractual obligation is created;

-

When the actual contractual obligation is entered into; or

-

When funds must be set aside to meet a future obligation, such as grant or contribution payments.

It should be recorded as early as possible in the process. Commitment accounting entails recording obligations to make future payments at the time they are anticipated rather than when services are rendered, and billings are received.

Such obligations may represent a department's contractual liabilities when purchase orders or contracts for goods or services are issued. Alternatively, they may represent conditional liabilities when an agreement is made.

That may necessitate the expenditure of funds if certain conditions specified in the agreement are met. Contracting for goods or services is the most common type of commitment once the contract between the department and the supplier is signed.

The department commits to performing its part of the contract, which is generally to pay the supplier. The commitment exists until the supplier has fulfilled their contractual obligations (i.e., delivered goods or services of a specified nature and/or quality, etc.).

When a department receives the goods or services, the commitment ends, and an obligation or liability to pay the supplier begins.

Contingencies

A contingency is a condition, situation, or set of circumstances that involve a potential loss and will be resolved when one or more future events occur or fail to occur.

Audit disallowances, adverse litigation, actual or potential claims or assessments, and guarantees of indebtedness to others are all examples.

Loss contingencies are those that could result in the creation of a liability or the depreciation of an asset.

Considerations for determining it include the following:

-

Whether a liability must be documented;

-

When the obligation is paid; and

-

Appropriate note disclosures.

The treatment of loss contingencies by the state is determined by two factors:

1. Whether the likelihood of the underlying adverse event occurring is probable (likely to occur). The measurement point for all situations of contingency other than non-exchange guarantees. It is more likely than not to occur (a likelihood greater than 50%).

And the measurement point for non-exchange guarantees; is remote (unlikely). Or possible (between probable and remote),

2. Whether the loss is calculable.

These determinations are frequently difficult to make and necessitate the state's informed judgment based on the best information available before the release of the financial statements.

Information to be considered in making these determinations includes the opinions of legal counsel and other experts, the state's or others' previous experience in similar situations, qualitative factors relevant to the entity that issued the guaranteed obligations, and the state's intentions (whether, for example, an appeal of an adverse court decision will be made).

For instance,

Armani Industries has been informed that a third party may file a lawsuit against it as a result of environmental damage to a former Armani property.

Armani will likely have to pay $8 million to settle the litigation. Based on the experiences of other businesses that have been involved in this type of litigation.

The resolution of a different issue in the litigation, which is still subject to wide interpretation, could cost an additional $12 million.

For that portion of the situation where the outcome is likely and where the amount of the loss can be reasonably estimated, Armani should record a loss of $8 million based on the current circumstances.

Types of Contingencies

Contingencies and how they are recorded depending on the nature of it:

1. Loss Contingency

A charge or expense to an entity for a potential future event is referred to as a loss contingency. Relevant stakeholders can be informed of any potential impending payments for an anticipated obligation by the disclosure of a loss contingency.

An organization may decide to disclose the item in the notes to the financial statements at its discretion. Whether or not the value of the loss can be estimated.

Loss contingency, on the other hand, should, if probable, be reported by debiting a loss account and crediting a liability account. Reporting the contingency's nature and the approximate amount of money involved is required.

An example of a loss contingency is an unfavorable verdict in a lawsuit.

2. Gain Contingency

A potential gain or inflow of funds for an entity resulting from an ambiguous scenario likely to be resolved later is referred to as a gain contingency.

Gains acquired by an entity are only recorded and recognized in the accounting period. In which they occur, according to accounting principles and standards.

The notes to the financial statements can be used to record and disclose a potential gain contingency to avoid misleading stakeholders about the likelihood of realizing the gain care should be taken when disclosing information.

The potential gain from a gain contingency is not recorded in accounting because the exact amount is unknown. If the gain is anticipated to be significant, it might be disclosed in the financial statement's notes.

Concerning the implications of a likely gain contingency, businesses must take care not to make misleading statements.

Receiving money from donations, bonuses, or other gifts are a few examples of gain contingency. Another illustration of a gain contingency is a future lawsuit that will be won by the company. This might include anticipated government refunds related to tax disputes.

Types of Losses

a) Loss Probable

When there is a reasonable basis for estimating that a loss, whether asserted or unasserted, has been incurred as of the balance sheet date, the loss (net of probable recoveries) should be accrued.

The best estimate within the range should be accrued if only a range of losses can be calculated; if none of the estimates within the range are superior to one another, the lowest amount of the range should be accrued. Loss estimates need to be supported by logic.

If a loss contingency has been accrued, the nature of the contingency, the amount of the accrual, and, if appropriate, the possibility of additional losses should be disclosed if doing so is required to avoid misrepresenting the financial statements.

The government-wide financial statements account for and report the entire amount of the loss contingency.

The government should record a liability and an expense for the discounted present value of the best estimate of the future outflows anticipated as a result of the guarantee in the Government-wide financial statements.

When qualitative factors and historical data indicate that it is more likely than not that a government will be required to make a payment related to the non-exchange financial guarantees it extended for the liabilities of other entities.

For all contingency, including non-exchange guarantees, the portion of the loss contingency that will be paid within a 12-month window following the reporting period's end will be accrued and reported in the government funds following GASB Interpretation 6.

The same disclosure as for possible losses should be made when it is impossible to estimate the size of a probable loss and, as a result, no accrual can be made.

b) Loss Possible

When a loss is possible but not likely, the following information should be disclosed:

-

The nature and status of the contingency;

-

The estimated amount (or range) of the possible loss; or

-

Other potential effects, if not otherwise obvious.

c) Loss Remote

Unless there is extreme materiality or unusual circumstances involved that warrants the disclosure of such. Disclosure is typically not required when the likelihood of a loss is remote.

However, if an event does not indicate that a liability had been created or an asset had been depreciated. As of the balance sheet date, then no adjustment should be made.

For instance, a building's uninsured loss from a fire after the fiscal year's end shouldn't be accrued. It is necessary to disclose material losses or loss contingencies of this nature.

Despite the remoteness of a loss. Some situations of contingence need to be disclosed in the financial statements. This category also includes state commitments and guarantees of debt.

These commitments include accrued unpaid time off, mandated assistance, assets pledged as collateral for loans, receipts for abandoned property, disallowances of Federal grant funds, and commitments, like those for the purchase of property or a duty to pay off debts.

A formal system to identify and monitor such has been established to ensure that reporting commitments, contingencies, and litigation likely to result in a loss is disclosed.

In compliance with GAAP, the main source of accurate information about litigation and related situations of contingence are the Attorney General's Office.

The Agency Financial Reporting Package (AFRP). Includes a section for disclosure of new contingencies. Commitments along with confirmations of the status of previously reported matters should also be consulted for additional information.

Cross-referencing commitments and contingencies reported to OSC through the AFRP with other sources will help to prevent duplication of accruals.

Regardless of whether payment is necessary, disclosure is required regarding the type, timing, and scope of non-exchange financial guarantees.

Accounting of Commitments and Contingencies

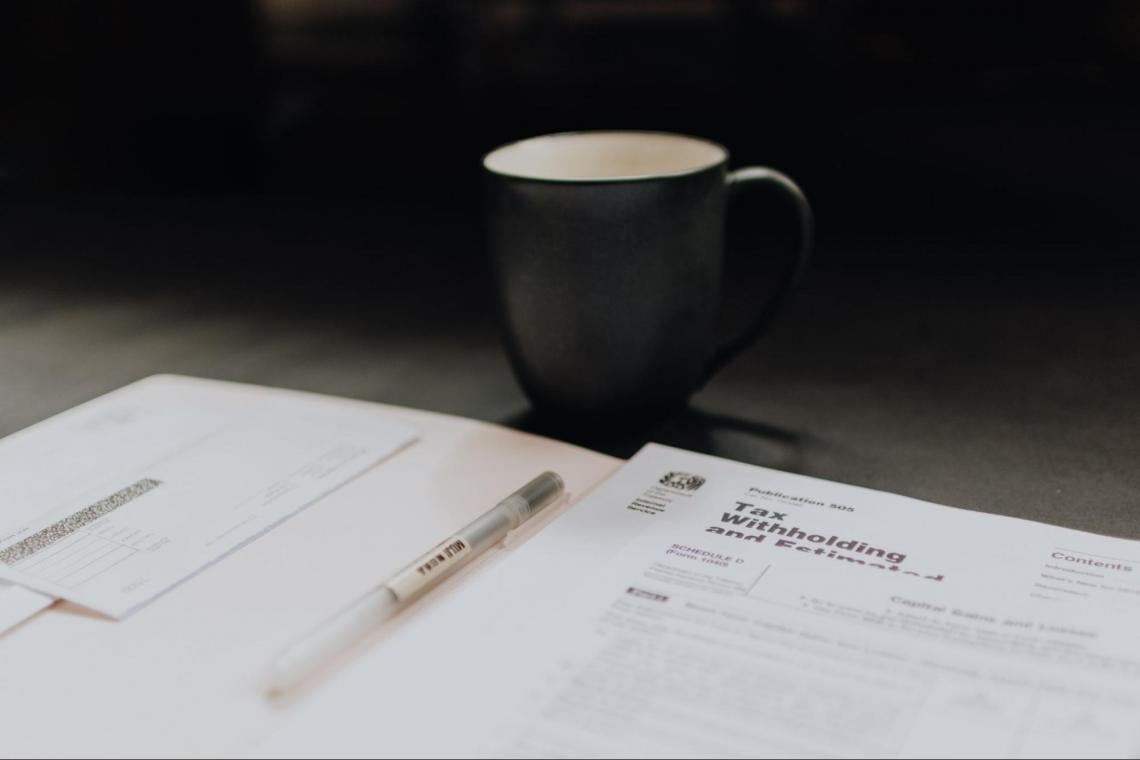

1. As per GAAP (Generally Accepted Accounting Principles)

According to generally accepted accounting principles, commitments should be recorded as they happen. In comparison, contingencies should be recorded in notes to the balance sheet if they relate to the outflow of funds.

The balance sheet must include footnotes for any commitments that do not belong to the reporting period. In footnotes, all commitments and contingencies must be disclosed to provide a clear picture, adhere to accounting standards, and meet disclosure requirements.

A company that is supposed to enter into a lease is an example of a commitment. That must be disclosed in the footnotes because transactions may not take place, and there may be a chance that the lease agreement will be terminated.

In which case, the company would be required to pay the penalty following the agreement's penalty clause. This is a type of contingency. If the amount is determinable, the amount of the contingency must be disclosed.

2. As per IFRS (International Financial Reporting Standards)

The main goal of IFRS 37 with commitments and contingencies is to globally set the principal. According to IFRS, if a commitment is fulfilled in the reporting period as well as in the notes, it must be recorded as a liability.

To show that the organization is successfully fulfilling its obligations, the notes must include information about the nature, timing, and extent of the commitment as well as the reasons why it might not be met.

Financial instruments, insurance contracts, and construction contracts are not covered by IFRS. IFRS requires that all situations of contingence, regardless of whether they cause a fund to flow in or out, must be disclosed in the notes to the accounts.

If the contingency amount is quantifiable, the amount must also be disclosed.

-

As per Notes to Financial Statements

If a commitment does not relate to the reporting period, it must be disclosed in the financial statement notes.

The items that must be disclosed in notes to accounts are listed below:

-

Contractual obligations for upcoming purchases, both short- and long-term.

-

Commitments for capital or revenue expenses.

-

Lease agreements (Commitments).

-

Assurances are provided as guarantors.

-

Other obligations under the contract.

-

Total of everything mentioned above.

The items listed below must be disclosed in the notes:

-

Contingency's Nature.

-

Probability of Occurrence.

-

If there is a quantifiable amount involved.

-

The court case is still pending.

Conclusion

Terms used in the presentation of financial statements include commitments and contingencies. Contractual obligations that are independent and certain are referred to as commitments if the commitments are related to the reporting period.

They must be disclosed as liabilities on the balance sheet. Otherwise, they must be disclosed in the notes to accounts. According to generally accepted accounting principles, accounting standards and disclosure requirements must be followed.

They are by nature reliant. In the disclosures that follow the balance sheet, uncertainties must be disclosed.

If measurable, the number of situations of contingence must also be disclosed. The major difference between commitments and contingencies is commitment is the certain obligation non-fulfillment, which results in a penalty.

Additionally, a contingency is an uncertain occurrence that might or might not result in an obligation for the organization.

The benefits are as follows:

-

Provides more open disclosures.

-

Results in winning over stakeholders' trust.

-

Attracts investors because they can learn about the company's profitability from upcoming transactions.

-

Disclosure requirements encourage adherence to the law.

To operate successfully and survive in the market, a business organization must fulfill certain obligations and contracts. The contracts or obligations are described as certain business commitments, i.e., they cause money to flow in or out regardless of other events.

There are also some hazy circumstances. The occurrence of which may cause a loss of funds. Contingencies are based on the occurrence or non-occurrence. Of uncertain future-based events and are uncertain.

The obligations that must be fulfilled in the future. Under a commitment to stand apart from all other business events. Because they are based in the future, contingencies might or might not result in liabilities.

or Want to Sign up with your social account?