Direct Cost

Costs that can directly be traced to the cost object, which is typically a tangible product or a specific service provided

What Is A Direct Cost?

Direct costs are those that can directly be traced to the cost object, which is typically a tangible product or a specific service provided.

In management accounting, the costs are sometimes classified based on different measures. For example, the costs can be classified based on their traceability, whether they are manufacturing or non-manufacturing, or even based on capitalization.

Based on traceability, the costs can be divided into direct and indirect costs.

Direct costs can often be variable, meaning they fluctuate with production levels, but they can also include fixed costs that remain constant regardless of production. For example, the amount of almonds needed in a cake factory is decided by the number of cakes produced.

So, we can say that the money is spent when the cost object exists and is produced. The other significant business cost is indirect costs, which are the costs that can't be traced to one specific product, such as administrative costs.

Again, let's use the cake factory as an example. The cost of electricity can not be allocated to one of the products and does not depend on the production of one product.

Key Takeaways

- Direct costs are directly attributed to a specific cost object, such as a product or service. These costs are typically variable and fluctuate with production levels but can include fixed costs.

- In management accounting, costs are classified based on traceability, with direct costs being those that can be traced directly to the cost object, while indirect costs cannot.

- Direct costs are allocated to a specific cost object, change with production levels, and include expenses like direct materials/raw materials and direct labor costs. Indirect costs, on the other hand, cannot be directly linked to one cost object and include expenses like rent, utilities, and administrative costs.

- Direct costs contribute to the cost of goods sold (COGS) or cost of sales on financial statements, while indirect costs are recorded as operating and overhead expenses.

- Direct costs can indicate a business's operating efficiency, influence pricing decisions, and aid in tax compliance. They are calculated by summing up all costs directly associated with production, including material and labor costs.

Direct vs. Indirect Costs

Direct costs are relatively straightforward in management accounting. They are significant to businesses as they can be directly attributed to specific cost objects, including various aspects beyond just the manufacturing process.

Other expenses are usually categorized as indirect costs, which cannot be linked to one cost object.

An analysis of these two costs will allow managers to determine the efficiency of the operation and make improvements. So, what is the difference between direct and indirect costs? Here are some valid comparisons.

| Direct Cost | Indirect Cost | |

|---|---|---|

| Cost allocation | To a specific cost object | To several cost objects |

| Change with production | Varies depending on the nature of the cost; some direct costs increase with every unit of production, while others may remain fixed or change differently | It doesn't increase with unit production |

| Examples | Direct materials/raw materials, direct labor cost, freight paid for delivering. | Rent and utility of plant, electricity, advertising, administration expense, office cost |

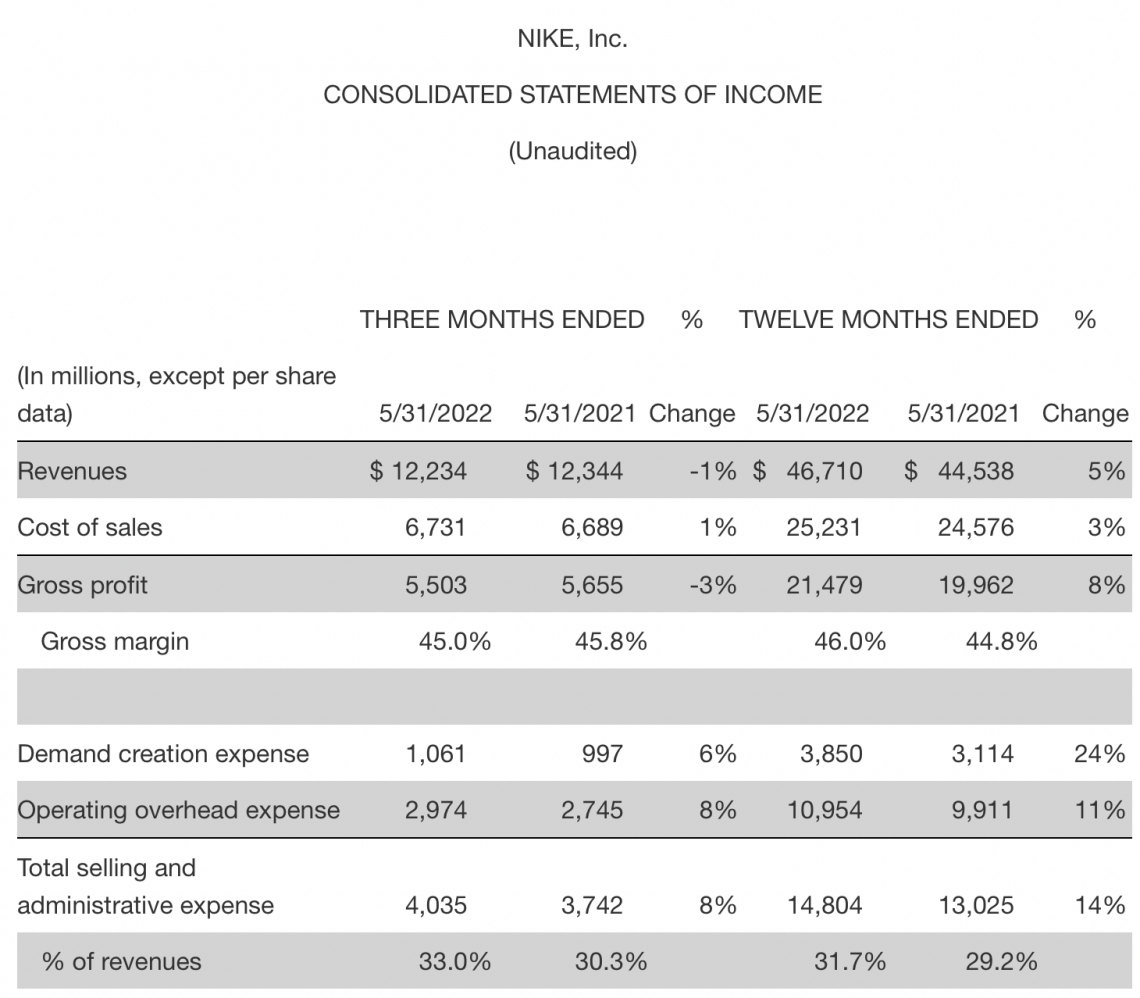

These costs can also be found on financial statements. Take Nike's income statement for 2022 as an example; cost of goods sold (COGS) or cost of sales are generally direct costs that contribute to the products sold.

Indirect costs are recorded as operating and overhead expenses, including examples like selling and administrative expenses, though not all operating and overhead expenses are necessarily indirect costs.

Direct Cost Interpretation

As we mentioned, this cost can indicate a business's operating efficiency by comparing its cost structure to that of other companies.

Higher direct costs may prompt managers to re-design the supply chain, look for new suppliers, or re-negotiate with suppliers to reduce costs and potentially maximize profits, though outcomes can vary.

Besides indicating cost efficiency, direct cost is also valuable for other functional business areas. Specifically, it influences a product's pricing decisions. Imagine being a product manager and needing to price a new product.

What pricing strategy would you choose?

Business operators often consider essential direct costs associated with production when setting prices to ensure profitability, although pricing decisions may involve additional factors beyond direct costs.

However, the price needs to cover the cost of making it, or the company is losing money.

Understanding direct and indirect costs properly is also helpful for tax compliance. For example, some companies can capitalize on the costs of certain expenditures, such as equipment/building purchases, and may incur tax benefits or obligations.

Calculating Direct Cost

Direct cost is calculated by summing up all costs directly associated with producing a product or service, including direct material, direct labor, and other relevant costs. Material cost typically has two parameters: price per unit and units needed.

Labor cost depends on hourly wages and hours worked on products. Use the following example for practice!

Direct Cost Practice: Making Popcorns

The popcorn company XYZ. Inc. is launching a new product: chocolate popcorn. It uses corn, butter, sugar, and chocolate syrup. The prices are in Table 1. Each packet of popcorn is made after 30 minutes of work, and the wage is $20 per hour per worker.

What is the direct cost of one packet of popcorn?

| Ingredients | Unit Price (per pound) | Amount in 1 packet of popcorn (in pounds) |

|---|---|---|

| Corn | $3 | 0.5 |

| Butter | $3 | 0.3 |

| Sugar | $4 | 0.4 |

| Chocolate Syrup | $5 | 0.3 |

Direct cost = Direct Material Cost + Direct Labor Cost

= ($3 * 0.5 + $3 * 0.3 + $4 * 0.4 + $5 * 0.3) + (0.5 * 20)

= $5.5 + $ 10 = $15.5

Therefore, the total direct cost is $15.5.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?