Step Costs

Costs that remain constant for an activity level but change and tend to increase or decrease once a preset threshold is crossed

What Are Step Costs?

Step costs remain constant for an activity level but change and tend to increase or decrease once a threshold is crossed. When a manufacturer's production levels or the activity levels of any enterprise change, these costs change disproportionally.

These expenses will appear as a stair-step pattern on a graph when shown. Understanding such costs is crucial at times of demand spikes or traffic jams.

To reduce costs, businesses might modify their products to run below this threshold. Then, in a step-like fashion, step costs rise and fall—first horizontally over a range, then vertically, then horizontally, and so on.

A business will have a fixed cost for a certain activity level. Still, once it reaches another level, the cost to accommodate the extra business rises disproportionately (i.e., not marginally), with a step up higher.

In contrast, if business activity slows down, a significant portion of costs will decrease with a step-down. As a result, it is not uncommon for a company to choose not to take action to increase volume to keep profitability at current levels.

When a business is about to reach a new activity level, these costs are crucial to take into account. They can prevent a business from making money if they are ignored.

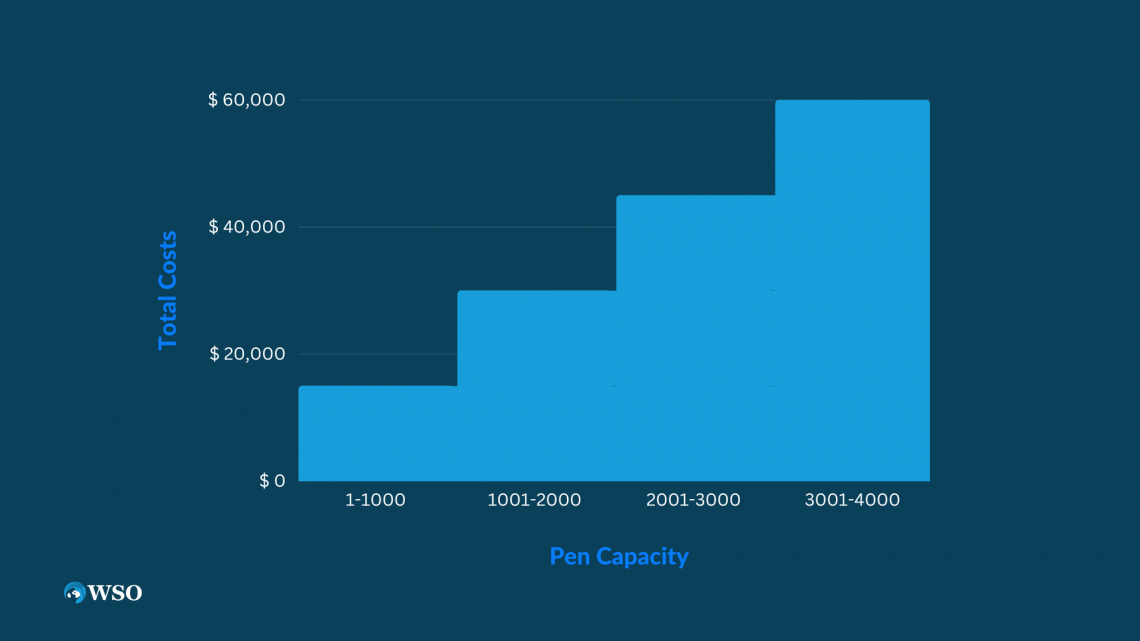

Jackie owns a business that manufactures pens. A $15,000 machine can produce up to 1,000 pens. Assume there are no additional costs associated with pen production (no raw materials, labor, etc.).

As a result, one example of a step cost is the price of the machinery. The details are demonstrated below:

In the illustration, the price of a machinery is similar to how much steps cost. However, only one machine is needed to produce 500 or 750 pens. Therefore, the overall expense is $15,000.

However, the company needs to buy an additional machine to increase its production capacity to the production level of 1,500. It will cost $30,000 to produce 1,500 pens ($15,000 multiplied by 2 machines).

As a result, it illustrates a step cost, which are expenses that remain constant at a given activity level and change when that activity is reached.

How to calculate steps costs:

- Determine the costs related to each level of activity.

- Determine the level of activity that the company is currently experiencing.

- Determine the price associated with that level.

- Calculate the variation between costs and activity level.

Key Takeaways

- Step costs refer to costs that remain constant for a certain activity level but change abruptly once a threshold is crossed.

- Understanding step costs is crucial during periods of changing activity levels, such as demand spikes or traffic jams.

- Step costs can significantly impact profitability and should not be ignored in decision-making.

- Businesses can reduce step costs by modifying products or operations to stay below the threshold, minimizing the disproportionate increase in costs.

- Analyzing step costs helps businesses make informed decisions about increasing or decreasing activity levels based on the balance between increased revenue and higher step costs.

Importance of Steps costs

When a business is about to reach a new activity level, these costs are crucial to take into account. They can result in a company losing unnecessary profits if they are ignored.

Continuing with the earlier illustration.

Suppose Jackie initially predicted that 1,050 pens would be needed in the coming year. Take into account that each pen can also be sold for $20. They might suggest getting two machines to meet the demand for 1,050 pens to someone who doesn't understand step costs. 1,050 pens for $20 each bring in $21,000 in revenue.

However, the combined cost of the two machines is $30,000.

The company would become much less profitable if it bought a second machine that would only bring in money from the sale of 50 more pens.

A person aware of these costs would advise getting one machine and producing 1,000 pens rather than 1,050. One machine costs $15,000 in total, but 1,000 pens generate $20,000 in revenue (1,000 x $20).

At the specified production level, the company would be making a profit of $5,000.

As was demonstrated above, purchasing an additional machine would result in the business losing money. Therefore, it is crucial to consider whether adding a step cost would increase profits.

In the aforementioned example, a second, $15,000 machine would produce an extra 50 pens, yielding $100 in revenue.

It would not be cost-effective for the business to produce an additional 50 pens in such a situation.

Businesses should avoid steep costs, especially when they are about to cross a threshold (reaching a higher level of activity than the maximum capacity).

Step costs can drastically change.

Increasing the activity level is counterproductive if the additional revenue it generates is insufficient to offset the cost.

It might eliminate the profits the company would have made if it maintained its current level of activity. Even worse, it might lead to a loss.

To maintain the same level of profitability in such a situation, it might be preferable to forgo accommodating the increase in activity.

On the other hand, when activity levels drop low enough to trigger the decrease, step costs can also go down.

For instance, a company may decide to close one of its branches because it is consistently underperforming. This results in a sharp drop in expenses (such as lower rent, salaries, property taxes, etc.), but it can also increase profitability.

There could be an increase in profits overall if the decrease in costs is greater than the decline in profits. Some companies use management techniques to reduce costs (including step costs).

Step Costs vs. Variable Costs vs. Fixed Costs

Many of your expenses are instances of such costs, as you'll see if you examine your company's financial records.

Business owners will need to take into account the additional step costs in employee salaries and equipment when opening a new production facility. In addition, health and pension contributions may also change when staffing levels rise or fall above a predetermined level.

Numerous jails and prisons use annual prisoner cohort figures to analyze these costs. Because there are fewer people to feed, clothe, and monitor, step costs decrease as cohort sizes decrease. Additionally, this results in a decline in the need for workers for those kinds of jobs.

| Step Costs | Variable Costs | Fixed Costs |

|---|---|---|

| Costs that are constant for a range of workload or output change abruptly when they go above or below that range. | Costs fluctuate immediately in absolute terms in response to changes in workload or output. But constant on a per-unit basis. | Costs are constant in absolute terms, despite changes in workload or output. Changes on a per-unit basis. |

| Examples include salaries, perks for employees, and software subscription plans. | Examples include extra work, contracted services, travel, fuel, and supplies. | Paying rent, utilities, and loans, as examples. |

- These costs are expenses that don't change until a certain level of activity is reached.

- These costs may abruptly increase or decrease in response to changes in work output.

- When depicted on a graph, the abrupt rise or fall in such costs reveals a stair-step pattern.

- Business owners can decide whether incurring a jump in step costs would be a profitable investment or result in a loss for the company by having a better understanding of step costs.

Examples of steps Costs

A few of the examples are:

Example 1: Consider a business that produces widgets with the following cost structure:

Assuming that the company currently uses three machines, sells 125 widgets, and the product's sale price is $30.

Would you advise the business to use three machines or to reduce the number to two and sell only 100 widgets (the production capacity of two machines)?

Three M's (Machines) with 125 widget sales

The three machines cost $3,000 altogether. (125 x $30) The revenue from 125 widgets is $3,750. The profit is, therefore, $750.

100 widgets sold by two M's (Machines)

The two pieces of equipment cost $2,000 in total. One hundred widgets at a price of $30 each result in sales of $3,000 (100 x $30). The profit is, therefore, $1,000.

As a result, the business should only run two machines and make 100 widgets.

Example 2: Steps with an example. It is determined by the level of activity in which a business is engaged.

As a result, you must take the following actions if you need to calculate something related to any company or division:

- First, determine the expenses connected with each activity level.

Assume, for instance, that the cost of electricity is $10,000 for producing up to 5,000 units and $12,000 for producing more than 5,000 units.

When enough units are produced to reach the next activity level, 10,000, the price rises to $15,000.

It would be beneficial to accurately define the costs associated with the various activity levels. - Based on the activities being performed, ascertain the activity level at which the business operates.

- Determine the cost associated with the level of activity the company is currently operating at.

- Let's say you want to calculate the incremental step cost. The cost differential between the company's current activity level and its previous activity level can then be calculated.

Let's use an example to understand the calculation thoroughly.

Continuing the previous discussion, suppose that the company's electricity costs for various activity levels (i.e., production levels) are as follows:

| Activity Level (Units Produced) | Cost (In $) |

|---|---|

| 0-5,000 | 10,000 |

| 5,001-10,000 | 12,000 |

| 10,001-15,000 | 15,000 |

| 15,001-20,000 | 20,000 |

This illustration mentions the price associated with different levels of activity (i.e., units produced). For example, consider that the business can produce 18,000 units per day.

Since the activity level falls within the last threshold range of 15,001-20,000 units, the step cost for 18,000 units is $20,000.

Additionally, the incremental step cost is determined as follows for each activity level:

| A | B | C | D | |

|---|---|---|---|---|

| 1 | Activity Level (Units produced) | Cost (In $) | Incremental Step Cost (In $) | |

| 2 | 0-5,000 | 10,000 | 10,000 | B2-0 |

| 3 | 5,001-10,000 | 12,000 | 2,000 | B3-B2 |

| 4 | 10,001-15,000 | 15,000 | 3,000 | B4-B3 |

| 5 | 15,001-20,000 | 20,000 | 5,000 | B5-B4 |

Example 3: In an eight-hour shift, a high-tech equipment manufacturer produces 400 virtual reality headsets with 25 workers and one supervisor. There is no inventory because every headset has been shipped. These workers receive $6,500 in pay and benefits per shift.

After that, demand goes up by one headset. The company must add another shift to produce 401 to 800 units because the production line is at capacity. The price of labor to make 401 units increased from $6,500 to $13,000.

Example 4: A coffee shop can serve 30 customers in an hour with just one employee. So the shop only needs to pay the cost of having one employee, say $50 ($20 for the employee and $30 for all other fixed and operating expenses), if it gets anywhere between 0 and 30 customers per hour.

The shop must hire a second employee if it starts to see 31 or more customers per hour, raising its costs to $70 ($40 for two employees and $30 for others).

Applications of Steps Costs

The step cost concept is particularly relevant when a company is on the verge of reaching the next higher activity level. In this situation, management must conduct a cost analysis to determine the additional costs the company will face if it advances to the next level of business activity.

The company's anticipated increased revenue is then contrasted with this incremental cost.

In light of this, a choice is made regarding whether it is practical to advance to the subsequent activity level.

The management makes the required investment of incremental cost if the incremental revenues are higher than the incremental costs.

However, the activity level is not raised if the returns are less than the incremental cost.

Based on the incremental benefit that the decision will bring, step cost is a crucial consideration when determining whether the business's activity level can be increased or not.

Taking into account the additional step costs that the company will incur, the company can decide whether it is profitable to advance to the next activity level.

Thus, it aids the business in determining whether to increase or decrease the level of business activity.

In the news: Step costs are frequent; they include the price of a new production facility, the price of a new machine, the price of supervision, the price of marketing, etc.

For instance, FortisBC announced on July 17, 2019, that a $400 million expansion project had been completed, boosting the company's capacity from 35,000 to 250,000 tonnes. As a result, FortisBC's project to expand its facility is a step forward.

Special considerations: When a company is about to reach a new and higher activity level where it will be necessary to traverse a large step cost, understanding step costing is crucial.

In some circumstances, the step cost may completely wipe out any profits that management had anticipated with higher volume.

If revenue is sufficient to cover the higher cost and provide an acceptable return, it might make sense to incur higher step costs. Profits may decrease if a volume increase is only marginal but still necessitates incurring step costs.

Instead of stepping up costs if there is only a slight increase in volume, management might try to squeeze out more productivity from current operations.

When activity levels drop below a predetermined threshold, management may need to step down just as much as they may need to step up costs. In such circumstances, management may decide to lower or do away with the related step fixed cost.

Conclusion

You need to consider two things when dealing with step costs.

- You must first determine which costs behave like step costs. These are typically expenses that appear to remain constant for a range of activity levels.

It's likely a step cost if the cost is fixed, and you believe it will change if the level of activity changes and crosses a certain threshold. - The next factor to take into account is the levels of activity at which these step costs rise or fall.

Determine whether a planned increase or decrease in the level of activity improves profitability by understanding when these step costs change.

The company might want to reconsider moving forward with the increase or decrease if neither produces more profits.

An increase in revenue does not always accompany profit growth. A larger increase in expenses could overshadow the increase in revenue. But managing step costs doesn't always entail "stepping up."

The company may need to "step down" on costs if activity levels decline due to a drop in demand or production. This indicates that some costs may need to be decreased or eliminated.

For instance, when production slows down, it might be necessary to let go of some employees in order to reduce labor costs. Or perhaps two branches need to be combined in order to reduce the cost of maintenance and rent.

It's crucial to keep in mind that any change in step costs shouldn't lower the current level of profitability the company is experiencing. Instead, it ought to preserve or, even better, enhance it.

Researched and authored by Tamanna Hassan | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?