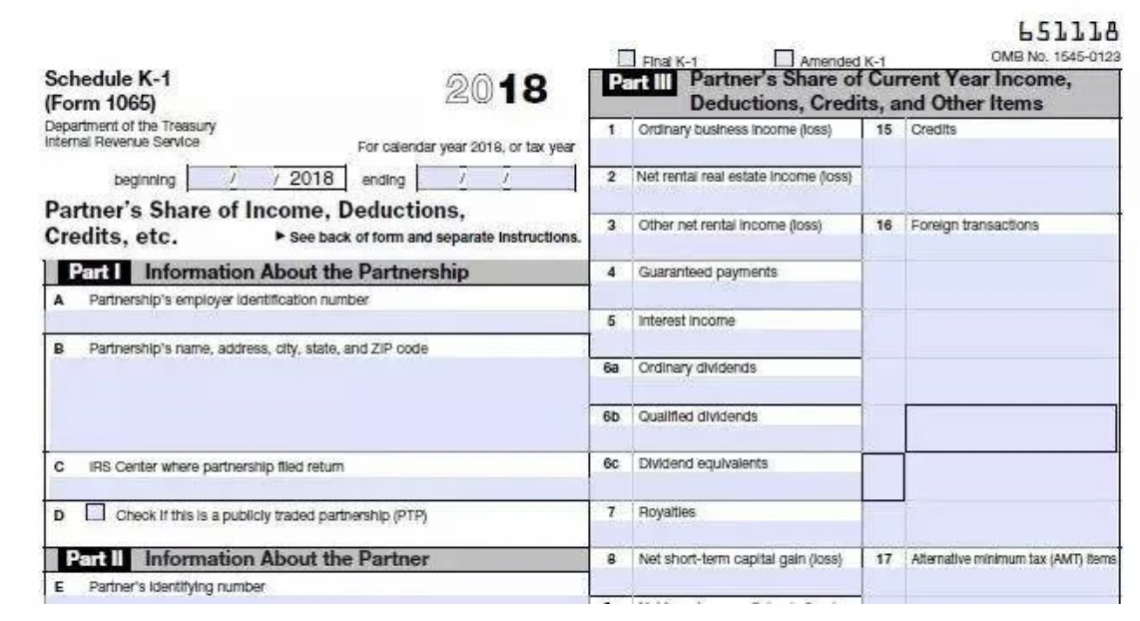

Schedule K-1

An IRS tax document issued by US limited partnerships (LPs) or limited liability companies (LLCs) to summarize gains or losses for partners, facilitating pass-through taxation.

What is Schedule K-1?

For foreign individuals applying for investment immigration in the United States, the K-1 form is a significant and non-negligible tax declaration content. Most of the project companies that handle investment immigration are limited partnerships.

Schedule K-1 (Form 1065) is an Internal Revenue Service (IRS) tax document. It is a US limited partnership (LP) or limited liability company (LLC) that issues a summary of gains or losses to partners.

Simply put, it is an IRS tax document issued by US limited partnerships (LPs) or limited liability companies (LLCs) to summarize gains or losses for partners, facilitating pass-through taxation.

Limited partnerships are generally treated as pass-through entities for tax purposes, meaning they pass on income and losses to their partners.

On the contrary, all these incomes can be returned to the partners, who can declare their income and pay corresponding taxes. Partnership companies typically do not pay corporate income tax; instead, income and losses are passed through to partners for tax purposes.

They only need to provide the 1065 tax form to the IRS to disclose the company's P&L results for the whole year and, at the same time, distribute the income and expenses according to the proportion of the partners' shareholding and share them among the partners.

Partnerships must provide each partner with a Schedule K-1 before March 15, following the end of the tax year, starting from the 2016 tax year.

Key Takeaways

- Schedule K-1 is an IRS tax document issued by US limited partnerships (LPs) or limited liability companies (LLCs) to summarize gains or losses for partners, facilitating pass-through taxation.

- Partnerships must provide K-1 forms to partners by March 15th, or they can apply for an extension until September 15th to ensure accurate tax filing for investors, especially in immigration-related investments.

- Investors should coordinate with project parties to obtain K-1 forms before filing their tax returns, utilizing previous years' losses to offset future profits, particularly for EB-5 immigrant investors.

- Non-resident investors handle K-1 income differently based on their residency status, ensuring compliance with US tax regulations and timely filing to avoid penalties.

- Tax declaration involves downloading forms from the IRS website, accurately reporting income and deductions, and submitting forms and payments before the deadline, with federal and state tax jurisdictions considered.

Understanding Schedule K-1

Although the IRS stipulates that partnerships must provide K-1 forms to partners by March 15, but they can apply for an extension until September 15. This is because many new immigrants often file their tax returns before the personal income tax filing deadline of April 15.

However, if the K-1 form is not obtained before filing the tax return on April 15, the income from the immigrant investment project company may not be reported on the personal income tax return as required by the IRS.

This will result in inaccurate tax returns and may result in fines from the tax office.

Therefore, if the investor has not received the K-1 form of the partnership enterprise by April 15, he needs to ask a tax accountant to apply for a half-year extension of the deadline for his personal income tax declaration until October 15.

Note

To avoid penalties and interest associated with insufficient withholding tax, investors are advised to consult with a tax professional for accurate estimation and payment of taxes based on their K-1 income.

Whether the profits are returned to the partners or left in the company for operational use, each partner will receive a share of the profits and losses at the end of the year, which they will declare on their Income tax form.

How Does Schedule K-1 Work?

Initially, investors should ensure timely receipt of the K-1 form from the project party handling immigration or coordinate with the immigration company for assistance before tax return filing.

Investors should ideally receive the K-1 form from the investment project company before March 15 to ensure timely filing.

In addition, due to the long waiting time for foreign individuals to apply for EB-5 immigration procedures in the United States, some clients' investment immigration projects have been carried out for two or three years. Still, investors need to obtain immigrant visas.

This allows for using previous years' accumulated losses to offset future profits through Form 1040NR in case of a loss reported on the K-1 form.

In this way, if there is a loss on the K-1 form, the accumulated loss of the previous year can be used to offset the following year's profit through 1040NR. In addition, it should be noted that personal tax returns in the United States are generally calculated at progressive tax rates after the sum of income.

EB-5 investment immigrants are generally limited partnerships, and most are passive investments.

Note

Passive investment involves investing in a project company for purposes such as investment immigration, where the investor does not engage in operational activities.

If the business behavior is a passive investment and does not participate in actual operation, then the profit and loss of the investor are also passive. Therefore, ordinary income (such as wages or service fees, etc.) and passive investment losses cannot be offset when reporting.

However, this does not imply that the losses are unrecoverable.

Conversely, timely declaration of personal income tax allows for offsetting accumulated losses against profits from passive investment in subsequent years.

How do EB-5 investors file tax returns on Form K-1?

Generally, the EB-5 project party is a Limited Liability Company, LLC. This enterprise generally includes a General Partner (GP) and many Limited Partners (LP).

The limited partnership in the United States does not pay corporate income tax itself, but all the income and expenses of the enterprise flow to the partners according to P&L distribution rules stipulated need to report according to their respective conditions.

Note

The K1 form is used to report to the Internal Revenue Service (IRS) the income, expenses, dividends, and all capital and possible liabilities of the partnership to each partner. Partnerships are required to aggregate this form with other tax filing-related forms and file it with the IRS.

Limited partnerships must distribute K1 forms to all partners based on the partnership's capital account balance, irrespective of whether partners receive any income, gains, losses, or deductions during the year.

Therefore, because some projects have not yet had income and expenses in the first year or the investor funds have not yet entered the project from the escrow account, the K1 form received by many investors only shows the basic information of the project investor, and the income is blank.

If the investor hasn't been to the US and lacks any US taxable income

In this case, the investor is not considered a US tax resident, so according to the specific content of the K1 form, the investor can handle it as follows:

- If there is no income on the K1 form, The investor only needs to keep the K1 form

- If income is in the K1 form, the project partnership will usually prepay the income tax for foreign investors as per the tax law requirements. However, if the amount of prepaid income tax is not large, the investor can only keep the K1 form

- If there is income on the K1 form and a higher prepaid Tax amount, The investor can consider whether a tax refund is calculated at the US income tax rate

Note

If eligible for a tax refund, non-US tax residents can apply for it by filing the appropriate forms and obtaining a tax identification number.

If the investor has lived in the U.S. on an F1 student visa for less than five years and lacks any other taxable U.S. income

In this case, due to the exemption clause of the F1 visa, the investor is not considered a U.S. citizen for the time being but a tax resident.

If the investor doesn't have a green card but earns income in the U.S., such as rental income from a property, there

In this case, although the investor is not recognized as a tax resident of the United States, the investor still needs to pay U.S. tax; therefore, the income from Form K1 should also be included in the personal income tax form and declared together.

As for the K1 form itself, it should be kept together with other declaration materials for verification.

If the investor hasn't got a green card but has lived in the U.S. for an extended period

If the investor hasn't got a green card but has lived in the U.S. for an extended period, such as living in the United States with a student visa (F1) for more than five years or living in the United States for more than 30 years in 2018 with a work visa (H1B) or business/travel visa (B1/B2) days.

Then, the weighted average sum of the time of entering the United States in 2016, 2017, and 2018 exceeded 183 days, etc. The weighted average calculation method for the 2018 tax year is:

the number of days of residence in 2016 x 1/6 + the number of days of residence in 2017 x1/3 + the number of days of residence in 2018 x 1)

In this case, the investor meets the conditions for becoming a U.S. tax resident due to the residence time, so he should declare the U.S. personal income tax as a U.S. tax resident.

After receiving the K1 form, the investor should include the income in the K1 form in his income and expenditure information and file a tax return by the due date.

If the investor is a student, they may have no other income or less income

Therefore, at this time, it needs to be treated differently according to the year's actual income.

If the sum of K1 form income and other income exceeds the standard deduction amount for the year (the standard deduction amount for a single declaration in the 2018 tax year is $12,000):

In that case, you must follow the normal personal tax declaration process and declare it before the deadline.

Note

If the sum of K1 income and other income is less than the standard deduction amount for the year, there is no need to declare.

If the investor has obtained a green card

According to U.S. tax law, the foreigner obtains U.S. tax resident status from the green card date.

For U.S. tax residents, the K1 form serves as one component of the filing process, and investors must declare their income using standard personal tax declaration procedures before the deadline.

Conclusion

Tax declaration, in simple terms, is to report personal income to the tax department of the U.S. government on an annual basis and pay personal income tax accordingly.

The operation steps are generally:

- Go to the official website of the tax department to download the form for tax declaration

- Follow the instructions for filling out the form, and fill in all the personal income of the previous year and the income deduction items that meet the tax exemption clauses. The form will calculate your tax return. The amount of personal income tax payable

- Submit the form and money to the tax department by mail or online submission (e-filling) before the tax filing deadline

As of the last update, the tax filing deadline for the previous calendar year in the United States was April 15th, but verifying current deadlines with the tax authorities is advisable.

Tax filing in the United States is divided into federal and state reporting due to the separate jurisdictions of the federal and state governments.

Among them, the tax department responsible for federal tax is the IRS (Internal Revenue Service), the Internal Revenue Service of the United States. Taxpayers must typically file separate tax forms and submit payments to the IRS and their state's tax department before April 15th.

Due to the complex tax regulations in the United States, please consult tax experts for relevant tax issues encountered during investment in partnership companies and immigration, and make corresponding tax declarations under professional guidance.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?