Audit Sampling

The process of selecting and examining a representative subset of items to obtain evidence for auditing purposes.

What Is Audit Sampling?

Audit sampling is the use of audit methods/techniques on less than 100% of the items in an account balance or class of transactions, helping the auditor obtain audit evidence on which he bases his audit opinion.

Sampling helps the auditor obtain audit evidence for the whole population, as the auditor can't check the entirety of all the financial statements, given constraints on time and money.

The auditor applies audit techniques to a chosen sample within a population and obtains audit evidence. The sample taken from the people is representative, and the evidence obtained is for the whole population.

If the sample is not representative, the auditor will not be able to come to an accurate conclusion, raising the possibility of high audit risk.

Before proceeding into what audit sampling is and how it takes place, let us first understand the term audit.

An audit examines financial statements that assure the entity's reported state is accurate and fair. It aims to ensure the financial statements are free from any material misstatements due to error or fraud.

There are many different reasons for firms and companies to undergo an audit. For example, a public company undergoes an audit to ensure regulatory compliance and allows users of financial statements to make sound economic decisions.

Key Takeaways

- Audit sampling is a technique used to obtain evidence on a subset of items in an account balance or class of transactions, saving time and resources.

- Sampling helps auditors gather evidence for the entire population when checking financial statements, which is not feasible to do for every item.

- Choosing a representative sample is crucial for accurate conclusions and minimizing audit risk.

- Audit sampling is important in all types of audits to ensure financial statements are free from material misstatements and provide reliable information to stakeholders.

- Auditors follow a systematic process to plan the sample, determine sample size, define errors, and select the sampling method, whether statistical or non-statistical.

the two types of Audit

An audit assures the accuracy of your financial records and transactions. Chartered Accountants are responsible for carrying out external audits; however, for internal audits, companies may employ people in their company who have sound knowledge.

Audits may take longer if companies do not follow accounting policies or preserve significant documentation and invoices for legitimizing transactions. Auditing methods may vary from one firm to another. Here are two types of audits:

1. Internal audits

Internal employees of an organization carry out the internal audit of a company or a firm, and the results are not usually distributed outside the company. Internal audits help a company recognize its areas of deficiency where possible errors or fraud could occur.

2. External audits

External parties, such as chartered accountants or a firm of chartered accountants, carry out the audit of a company as they provide an opinion independent of their interests. Therefore, they must be impartial in these procedures.

Importance of Auditing Sampling

Audits are necessary to ensure that companies do not falsify financial statements and that relevant stakeholders and users of financial statements do not make choices based on false information.

There is an increasing need for management to instill confidence in the stakeholders and users of the financial statements in the company's operations. Financial statements are created by accounting regulations and are intended to provide helpful information to key decision-makers.

However, the data in the statements must be presented accurately. The test of controls and substantive audit methods are ways the auditor tests the data and obtains evidence.

Auditors utilize the sampling approach in the test of controls to determine whether the client's internal controls are effective in identifying errors of fraud that could result in a possible material misstatement.

The sampling approach is then further used in substantive audit procedures to estimate the level of inaccuracy in an account balance and classes of transactions.

It is also frequently designed so auditors can judge the population from which the sample was drawn. Compared to auditing an entire population, it saves them a lot of work and time.

It is a critical component of auditing. Therefore, auditors must employ audit sampling in all types of audits, whether financial, internal, or other types of audits.

Auditing standards guide an auditor's performance and assist the auditor in achieving audit objectives with the given resources.

Objectives And Purpose

It is an essential aspect of the auditing process. It can assist auditors in achieving their objectives with less effort, assuming they must complete the audit within a specific time frame.

The auditor's goal when using audit sampling is to give a fair basis for concluding the population from which the sample is drawn. The following are the objectives and purposes:

Objectives

- We are obtaining audit evidence to issue an audit opinion on time.

- Demonstrate that the auditor completed the audit thoroughly and professionally in compliance with auditing standards.

- Reduce work by assigning tasks to audit assistants and assisting the engagement partner in obtaining evidence and reaching findings about the financial statements.

Purpose

- The sampling serves as the foundation for the auditor's audit opinion.

- To detect any inaccuracy or fraud in a business or its financial statements.

- The audit sampling investigation technique selects a subset of the total items within the population of objects to be audited. Thus, it can be used as an investigative tool.

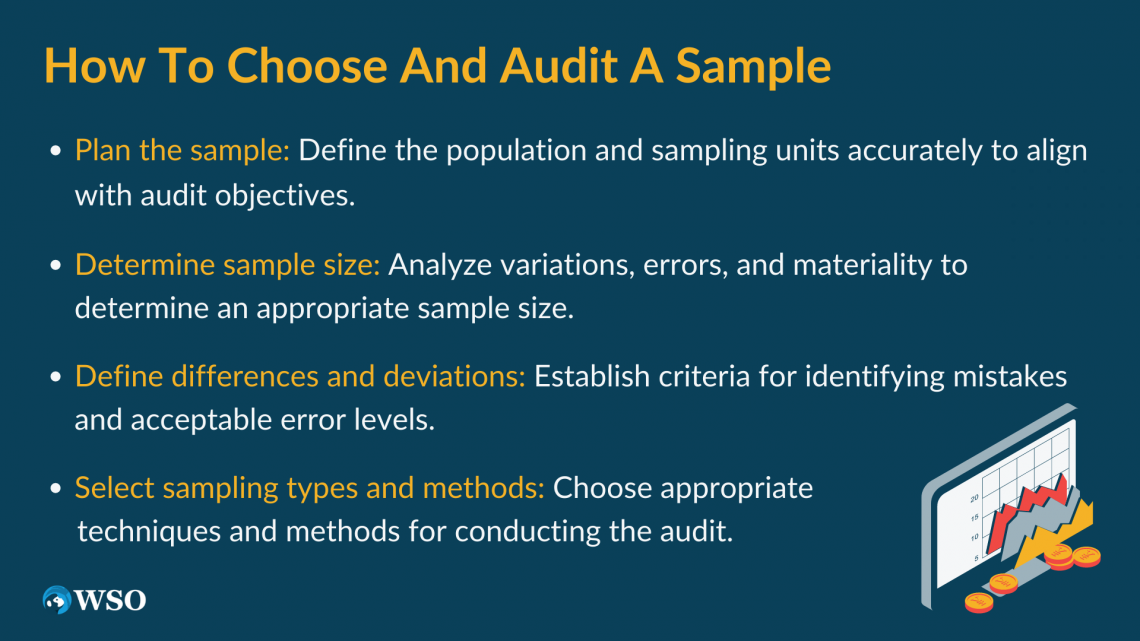

How to choose and audit a sample

After defining the audit objectives and the audit methodologies that are most likely to be achieved, the auditor should select the items. The auditor must also choose a sampling procedure, compute the sample size, and define what constitutes an analytical mistake.

Step 1: Plan the sample

The population is the whole data set from which the sample will be drawn. A transaction, account balance, or monetary unit are examples of things (sampling units) that must be defined for the population.

The population must be appropriate, thorough, and accurate for what the auditor wants to achieve.

Following are some of the names of the accounts from which the auditor draws samples:

- Pre-financing

- Accumulated charges cut-off

- Invoices to be paid, guarantees, and so on;

- Appropriations

- Commitments

- Payments

- Recoveries

- RAL ("reste à liquid") are among the accounts or groups of funds to be assessed in a financial audit.

Example

The balance-sheet header "Short-term pre-financing" has more than 20 general ledger accounts. The number of final individual amounts that make up the year-end balance of those numerous accounts during the year might be referred to as the population.

Step 2: Determine the sample size

Auditors examine the degree of variation in population items and the errors in the population (kind, frequency, and distribution) and determine if there are any trends (e.g., more errors at year-end were owing to increased effort to spend commitments).

Auditors should analyze whether the sample population is large enough to be regarded as typical for a specific company, as well as whether the items in the sample are relevant to the auditing year or the level of materiality set by the auditor, i.e., what is considered acceptable for analysis.

Step 3: Define the differences and deviations ("errors")

Auditors use different criteria for defining what constitutes a mistake. Depending on the audit type and purpose, what constitutes a "tolerable error" can be set for an entire population.

To calculate the sample size, the auditor should analyze the expected error rate (for control tests) and the estimated quantity of mistakes (for substantive testing of details). In making such assessments, an auditor uses their best judgment.

For example, suppose the tolerated misstatement in a $1 million account balance is $50,000, and the total projected misstatement based on an adequate sample is $10,000. In that case, he may be convinced that the population's real monetary misstatement has an acceptably low sampling risk.

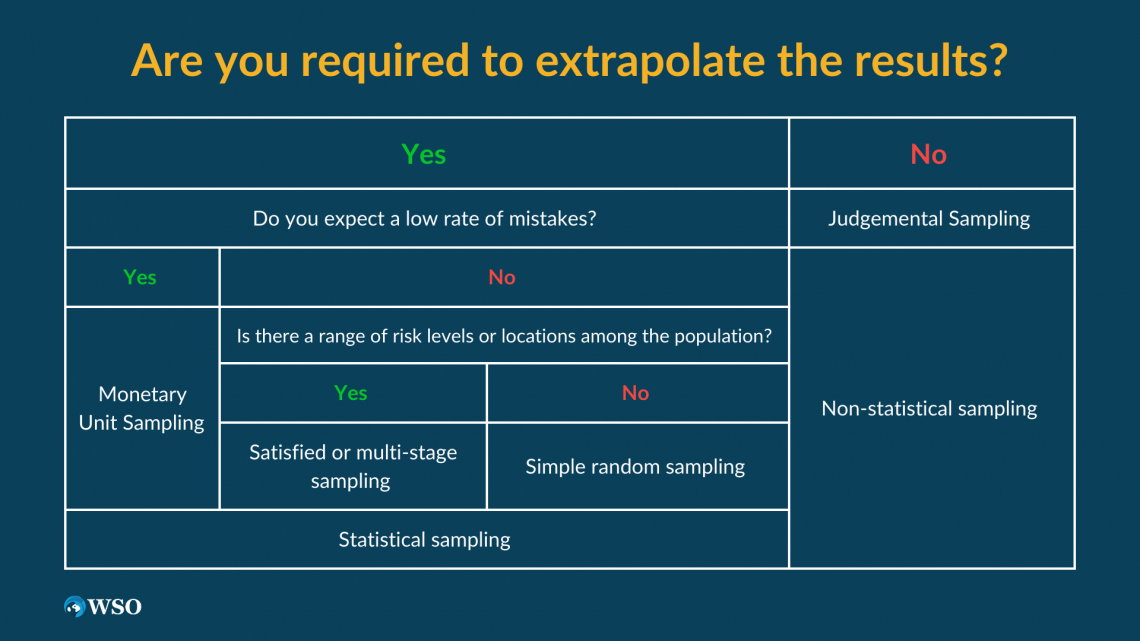

Step 4: Select the sampling types and sampling method

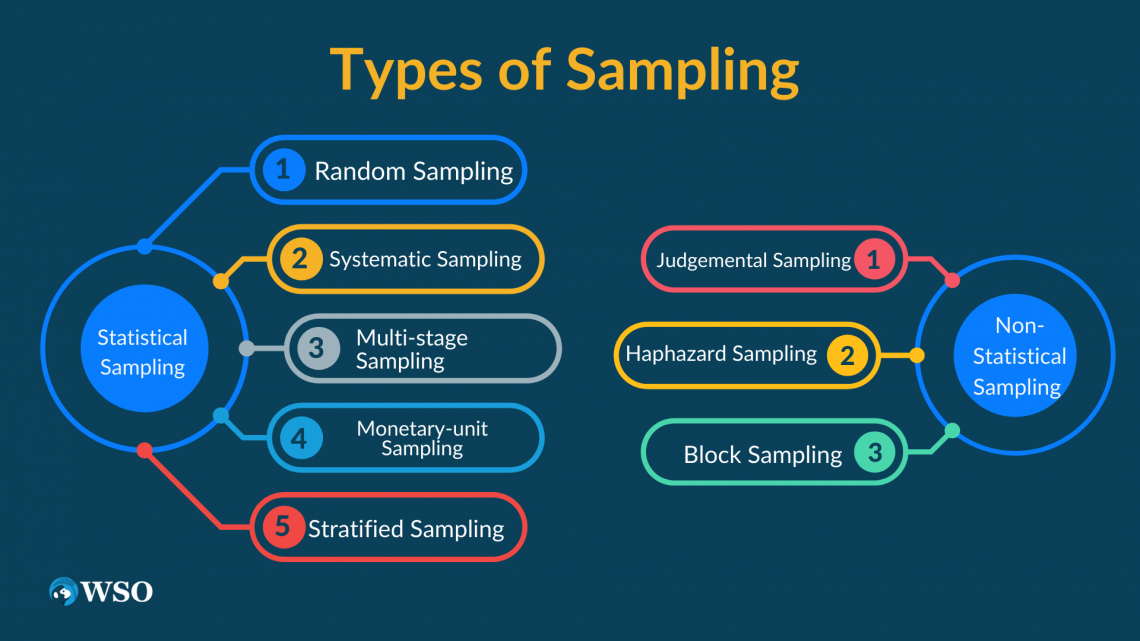

Types of Sampling in Audit Sampling

The following are the types of sampling that can be used in an audit sampling:

1. Statistic sampling

For a large number of goods and transactions, random sampling takes place. The two most crucial aspects of statistical sampling are that the auditor chooses the items randomly, and inferences are reached based on the test results.

This sampling ensures that every item in the population has an equal probability of being chosen.

- Random sampling

- Systematic sampling

- Multi-stage sampling

- Monetary-unit sampling

- Stratified sampling

For example: If the auditor follows the rule of a sample size of less than 10%, then, if there are 500 items in the population to inspect, the auditor should choose a sample of, at most, 50 items.

2. Non Statistical Sampling

Non-statistical sampling is the method where the auditor uses judgment rather than statistical methods to select samples, often due to practical considerations or expertise.

This method is often chosen due to its practicality, flexibility, and the need for specific expertise, although it can be subject to personal bias.

- Judgemental sampling

- Haphazard sampling

- Block sampling

Methods of Statistical Sampling

Using non-statistical sampling in audit sampling effectively eliminates this probability theory, leaving the auditor solely reliant on his or her judgment.

Maintaining the sampling purpose of providing a fair basis for the auditor to derive correct conclusions can prevent bias.

1. Random sampling

Random sampling gives all units in the population an equal chance of selection. For example, while sampling physical goods, such as sales invoices, every invoice has a fair chance of choice to be included in the sampling.

The auditor will then perform audit techniques on said sample to identify possible misstatements. For selecting the items, the auditor uses a random number generator.

2. Systematic sampling

This method divides the number of sampling units within a population into the sample size to generate a sampling interval. When using systematic selection, auditors must ensure that the sampling interval corresponds with a particular pattern in the population.

For example, purchase orders for the previous fiscal year are serialized from 1 to 50,000 (N = 50,000). Therefore, a sample of 100 (n=100) purchase orders is needed for an audit.

k= 50,000/100 = 500

Where n is the sample size, N is the number of items in the population, and k is the sample interval.

The first sample element is randomly selected from the first 500 purchase orders. For example, assume the 55th purchase order was established. Following the sample, parts are 555, 655, 755, and so on.

3. Monetary unit sampling

The objective of monetary unit sampling (MUS) is to determine the accuracy of financial accounts. Monetary unit sampling is a kind of systematic audit sampling. The monetary amounts used will determine:

- Sample size

- Choice

- Evaluation

of the outcome.

For example, the audit client's accounts receivable have a book value of $500,000, and the sample size is 80 records. To compute the sampling interval, the auditor divides the book value by the sample size (500,000/80), equalling 6,250.

Using an ordering sequence, they arrange the client's invoices in an ordered list by the following:

- An alphabetical sequence

- By client name

- Numerically by customer number.

At random, he selects a number between 1 and 6,250. For this strategy to work effectively, the random number must be smaller than the sample interval but greater than the smallest sampling unit.

4. Multi-stage sampling

A multi-stage sampling includes cluster sampling. Cluster sampling involves drawing a random sample from one or more pre-selected clusters.

For example, if the scope includes ten minor projects, you may utilize cluster sampling to choose four projects as representatives for the audit randomly. This strategy can be handy when transactions or records are held in numerous locations.

The sample's quality can be increased by increasing the number of clusters. This method can be applied to any model.

For example, a survey was conducted by the ACCA of the 50,000 practicing chartered accountants in a particular state.

This 50,000 is divided into males and females, 25,000 per group. This 25,000-person sample is further divided into another subset of people who have completed nine papers. The ACCA used cluster sampling in this case.

5. Stratified sampling

The population is divided into multiple subgroups in stratified MUS (monetary unit sampling). The strata must be pre-defined according to the population's varied characteristics, such as risk.

On the other hand, stratification inhibits conclusions based on each sample. In each layer, MUS selects a small number of items.

For example, total accounts receivable (population) are divided into high and low values and picked from each section for confirmation purposes.

Non-statistical audit sampling

Non-statical sampling, as the name suggests, does not use statistics to create a sample. Instead, the auditor uses their judgment based on past experiences to create a model from a whole population.

Unlike statistical audit sampling, the findings of this study are not exactly representative of the entire population.

Example

Auditors at auditing companies usually can check up to 100 documents, but if the control risk is low, they can examine 20 to 50. A firm's policy, for example, may require auditors to pick between 100 and 150 documents, depending on the organization's level of risk.

Methods of Non-Statistical Sampling

Non-statistical sampling selects a test group at the examiner's discretion rather than through a rigorous statistical technique.

An examiner may use his or her own discretion to determine one or more of the following:

- The number of samples in total

- Items are chosen for the test group

- How the outcomes are assessed

1. Judgemental sampling

Judgemental sampling is when an auditor selects items from a population based on judgment. Auditors must be careful not to encourage readers to believe that the results represent the entire population when publishing results.

For example, they pick from a list of privileged access accounts when the account names appear generic.

2. Haphazard sampling

The term "haphazard sampling" refers to a sampling methodology that is not organized. When using haphazard sampling, the auditor must exercise caution to avoid conscious bias or predictability.

For example, credits are traced from AR (account receivables) to CR (credit)/other sources in search of fictitious credits. This is a less expensive and more straightforward method but is open to risks of inaccuracy.

3. Block sampling

Selecting a set of contiguous objects from a population is known as block sampling. Through this method, samples may not be representative of the whole population.

Auditors should avoid broad generalizations about the entire population based on a sample.

Example

Rather than selecting 30 single cheques throughout the year, an auditor may choose a sample of 30 consecutive cheques to determine whether authorized individuals sign the cheques.

Types of Risks in Audit Sampling

When auditing a company's books and records, an auditor may encounter sampling risk. It occurs because it is impracticable and expensive to examine all of a client's journals or books.

1. Sampling risk

An auditor may see a range of risks during an audit, including sampling risk. Audit sampling arises because it is impractical and costly to check all of a client's records or books.

An auditor, thus, relies on a sample since they do not have the time to investigate the entire population. An auditor may confront a range of risks, including sample risk, when performing the necessary procedure of audit sampling.

Sampling risk is the possibility that the items chosen in a sample are not representative of the population being examined.

2. Non-sampling risk

Non-sampling risk is the possibility that the auditor may produce an incorrect result unrelated to the sampling risk. For example, assume the auditor used ineffective audit procedures. The non-sampling risk may be kept to a bare minimum with proper planning and monitoring.

Even if an auditor follows the same approach for all transactions or balances, he or she may overlook a significant deception. The risk of non-sampling is the danger of selecting ineffective audit methodologies to achieve the specified goal.

Even if an auditor reviews every item, he may overlook faults in the documents he examines, rendering the system ineffective.

It attempts to ensure that all objects in a population have an equal probability of being selected.

The sample should be bias-free and representative of the population. This goal will be impossible if the auditor avoids difficult-to-find goods or specific things.

Audit Sampling FAQ

A few of the types are:

- Random selection sampling

- Systematic selection sampling

- Monetary unit sampling

- Multi-stage sampling

- Stratified sampling

- Judgemental sampling

- Haphazard sampling

- Block sampling

The steps involved are as follows:

- Plan the sample

- Determine sample size

- Select the items to be tested

- Test the items

- Evaluate the results of the tests

This allows auditors to draw inferences and give unbiased views based on preset goals without having to verify all of the items in financial accounts.

The auditors will only verify a few items and can deduce their view on the whole population of things by sampling. This saves them time and money.

ISI in auditing stands for 'Individually Significant Items.' The sample population is produced through the process of selecting individually significant items. Separately significant items must be thoroughly examined.

S = (Z2 * P * Q) / E2

where,

Z is the Z-score

P is the proportion of the population

Q is (1 - P)

E is the margin of error

The sampling error is expressed as a percentage of the sample size.

When populations are significant, it is required since studying the entire population would be wasteful. It can be done in various ways, including the ones listed above.

Some auditors use the rule of thumb of testing a sample size of 10% of the population for populations of 52 to 250 items. However, the size is subject to professional judgment, which would incorporate particular engagement risk assessment concerns.

As long as the sample size does not exceed 1000, the decent maximum sample size is generally approximately 10% of the population. So, for example, in a population of 5000 people, 10% is 500.

or Want to Sign up with your social account?