Credit Administration

It is essential for evaluating and managing credit risk in financial institutions.

What is Credit Administration?

Credit administration is an essential function in financial institutions, encompassing the oversight of credit portfolios, evaluating credit risk, and ensuring the efficient utilization of credit resources. Its significance lies in maintaining the stability and profitability of the institution.

Firstly, it is crucial for evaluating and managing credit risk. Financial institutions face various credit risks, including default risk and concentration risk.

Effective credit administration (ECA) involves assessing the creditworthiness of borrowers, setting appropriate credit limits, and establishing robust risk management processes.

Through thorough credit assessments and risk mitigation strategies, it minimizes potential losses resulting from defaults or adverse credit events.

Secondly, it ensures compliance with internal policies and regulatory requirements. Financial institutions must adhere to regulatory guidelines and internal credit policies to uphold prudential standards and protect stakeholders' interests.

Credit administrators are critical in aligning credit decisions with these policies and regulations. They establish and enforce underwriting standards, credit approval processes, and monitoring mechanisms to ensure compliance and mitigate non-compliance risk.

Furthermore, it contributes to the effective utilization of credit resources. Financial institutions must efficiently allocate limited capital to maximize profitability.

Credit administrators evaluate credit applications, assess the risk-return trade-off, and determine optimal credit terms and conditions. They monitor credit utilization, review loan covenants, and proactively address potential credit issues.

By optimizing credit allocation and monitoring utilization, the administration enhances profitability and minimizes non-performing assets.

Key Takeaways

- Credit administration is essential for evaluating and managing credit risk in financial institutions.

- It ensures compliance with internal policies and regulatory requirements.

- It contributes to the effective utilization of credit resources.

- It plays a crucial role in portfolio management and monitoring.

- It facilitates effective communication and collaboration within the institution.

- It is vital for maintaining stability, profitability, and long-term success in financial institutions.

Understanding Credit Administration

Credit administration plays a crucial role in portfolio management. Financial institutions maintain diverse credit portfolios comprising different types of loans and credit facilities. ECA involves ongoing portfolio monitoring, identifying deteriorating credits, and implementing appropriate remedial actions.

Credit administrators collaborate closely with loan officers, credit analysts, and stakeholders to detect credit issues early and mitigate potential losses. This proactive approach ensures a healthy credit portfolio and reduces the risk of significant credit losses.

Additionally, it facilitates effective communication and collaboration within the institution. Credit administrators serve as a bridge between departments such as lending, risk management, and operations.

They facilitate information sharing, coordinate credit-related activities, and provide insights to support decision-making. Fostering collaboration and ensuring a smooth flow of information enhances overall operational efficiency and effectiveness.

Note

It is a critical function in financial institutions. It involves managing credit risk, ensuring compliance with policies and regulations, optimizing credit resource utilization, and monitoring the credit portfolio.

ECA enables informed credit decisions, mitigates credit risks, and enhances profitability. Moreover, it promotes communication and collaboration, supporting the institution's smooth operation.

It is vital for maintaining stability, profitability, and long-term success in financial institutions.

Importance of Credit Administration

Credit administration plays a vital role in the financial services sector as it oversees the management of a lending institution's credit portfolio and ensures the efficient and effective administration of credit facilities.

The significance can be viewed from multiple perspectives:

1. Risk Management

It is crucial to manage and mitigate credit risks that lending institutions face, such as default, concentration, and fraud risks. These risks can be identified, assessed, and addressed through ECA practices using suitable risk mitigation strategies.

Furthermore, continuous portfolio monitoring enables early detection of potential credit issues, helping institutions minimize the likelihood of defaults and resultant losses, thus ensuring their financial stability.

2. Compliance and Regulation

It ensures adherence to regulatory requirements and internal policies. Lending institutions must comply with legal and regulatory frameworks, including lending limits, capital adequacy ratios, and reporting obligations.

Note

Robust credit administration processes ensure that loans are originated and managed following these requirements, preventing potential regulatory violations and associated penalties. Moreover, ECA promptly identifies and addresses any instances of non-compliance.

3. Portfolio Quality and Performance

Sound credit administration practices contribute to maintaining a high-quality loan portfolio.

By conducting thorough credit analysis, due diligence, and ongoing monitoring, credit administrators can assess borrowers' creditworthiness, determine appropriate loan structures, and ensure compliance with loan covenants.

Monitoring borrower performance, financial ratios, and other key indicators facilitates early detection of potential issues and allows for timely intervention to protect the lender's interests.

Note

ECA also identifies opportunities for portfolio optimization, such as refinancing or restructuring existing loans to enhance overall performance.

4. Customer Relationship Management

It is vital for fostering healthy relationships with borrowers. Lending institutions strive to deliver exceptional customer service while safeguarding their interests.

Transparent communication channels, accurate and timely information provision, and support throughout the credit lifecycle establish strong relationships built on trust and mutual understanding.

This customer-centric approach enhances customer satisfaction, improves the institution's reputation, and enhances competitiveness in the market.

5. Financial Performance and Profitability

ECA directly impacts the financial performance and profitability of lending institutions. Minimizing credit losses, optimizing the loan portfolio, and ensuring timely repayments contribute to profitability.

It maximizes interest income, minimizes provisions for loan losses, and optimizes capital allocation. Additionally, effectively identifying and managing credit risks helps maintain a healthy balance between risk and reward, enhancing the institution's long-term financial stability.

Note

Implementing robust credit administration practices allows lending institutions to safeguard their interests, maintain a strong reputation, and contribute to the stability and growth of the overall financial system.

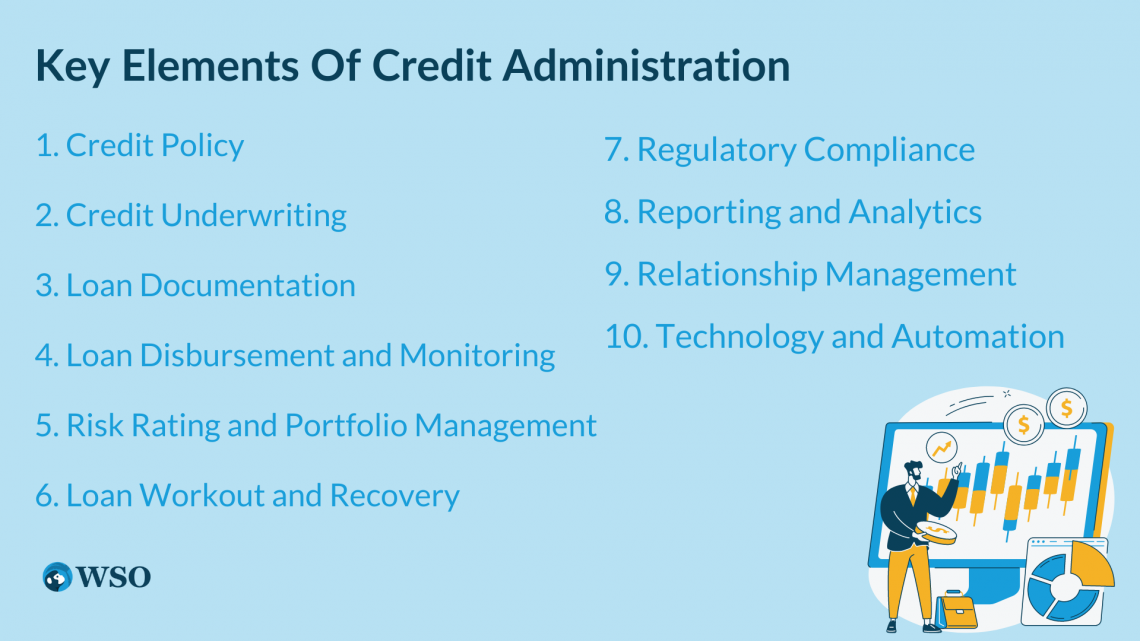

Key Elements of Credit Administration

It comprises essential components necessary for effectively managing a lending institution's credit portfolio and efficiently administrating credit facilities.

These elements are vital in mitigating credit risks, maintaining portfolio quality, and driving overall financial performance. The key elements of credit administration can be summarized as follows:

1. Credit Policy

The credit policy is the foundation of credit administration, outlining the lending institutions' approach to credit risk management. It establishes the risk appetite, lending criteria, loan approval processes, and loan pricing guidelines.

Note

The credit policy ensures consistent decision-making and sets the parameters for administration activities.

2. Credit Underwriting

This element involves evaluating the creditworthiness of potential borrowers. Credit administrators assess borrower financials, credit history, collateral, and other relevant factors to determine their ability and willingness to repay the loan.

Underwriting establishes appropriate loan structures and terms aligned with the institution's risk tolerance and objectives.

3. Loan Documentation

Accurate and comprehensive documentation is crucial for ECA. Loan agreements, security documents, and other legal contracts outline the rights, obligations, and responsibilities of both the lender and the borrower.

Note

Credit administrators ensure the proper preparation, execution, and maintenance of these documents throughout the loan lifecycle.

4. Loan Disbursement and Monitoring

This element involves disbursing approved loans to borrowers and continuously monitoring their performance. Credit administrators ensure adherence to approved terms and conditions during loan disbursement.

Ongoing monitoring entails tracking borrower financials, covenant compliance, collateral valuation, and other relevant factors to identify any signs of potential credit deterioration.

5. Risk Rating and Portfolio Management

The risk rating is a critical element in credit administration. It involves the assignment of risk ratings based on their inherent credit risks by quantifying and aggregating credit risks within the loan portfolio.

Note

Credit administrators regularly review and update these ratings based on borrower performance, economic changes, and other relevant factors. This information guides portfolio management decisions, such as loan loss provisioning, portfolio diversification, and risk mitigation strategies.

6. Loan Workout and Recovery

When borrowers face financial distress or default, the administration implements strategies for workout and recovery of loans.

Credit administrators collaborate with borrowers to develop restructuring plans, renegotiate loan terms, or facilitate asset liquidation to minimize losses. Effective workout and recovery efforts aim to maximize recovery rates and minimize credit losses.

7. Regulatory Compliance

It ensures compliance with applicable laws, regulations, and internal policies. Credit administrators stay updated on regulatory requirements related to lending practices, consumer protection, anti-money laundering, and data privacy.

Note

Compliance with these regulations is critical to avoid penalties and reputational damage.

8. Reporting and Analytics

It involves generating accurate and timely reports on loan portfolio performance, credit quality, and key risk indicators. Credit administrators analyze portfolio data to identify trends, potential risks, and improvement opportunities.

These reports support decision-making, strategic planning, and regulatory reporting requirements.

9. Relationship Management

Building strong relationships with borrowers is essential in credit administration. Credit administrators maintain regular communication, provide support, and address concerns or queries from borrowers.

Note

Strong relationships foster transparency, trust, and collaboration, contributing to better borrower engagement and the timely resolution of credit-related issues.

10. Technology and Automation

Technology plays a crucial role in It, enabling efficient and streamlined processes.

Credit administrators utilize loan origination systems, credit scoring models, document management systems, and other digital tools to automate credit administration tasks, enhance data accuracy, and improve operational efficiency.

Summary

Creditor administrators manage credit-related tasks and provide electronic solutions for credit transactions. They collaborate with various departments to achieve credit objectives within a specified timeframe.

The credit administration department in a bank or lending institution oversees the entire credit process. Credit administrators conduct background checks on potential customers to assess their ability to repay the principal and interest.

They must stay updated on the latest regulatory laws to ensure compliance with industry standards.

A creditor administrator is in charge of overseeing the complete credit process. This includes approving credit for borrowers, evaluating potential customers' creditworthiness, and reviewing existing borrowers' credit status.

They are also responsible for establishing a credit policy for the bank, which helps manage the level of credit risk exposure. This policy outlines guidelines on the amount of credit to be extended to customers, collection procedures, and acceptable levels of bad debt losses.

Credit administrators must stay informed about regulatory laws governing the credit industry. They should also be knowledgeable about current industry trends to make informed decisions regarding the approval of specific types of loans and their potential benefits for the bank.

Preparing and submitting periodic reports to senior management is another crucial aspect of the credit administrator's role.

These reports provide updates on the status of all loans extended to creditors. They may include information such as the total amount of approved loans, bad debt losses, and the actions taken by the credit department to recover payments from delinquent accounts.

or Want to Sign up with your social account?