Credit Report Analysis

It is an organized list containing details of a person's credit activity.

What is Credit Report Analysis?

Credit reports are often considered when a business or credit institution decides it is willing to lend money to an individual. They are composed of different sections containing information corresponding to an individual's credit history and ability to pay back debts.

Credit reporting is done through financial measures that calculate different aspects of a person's borrowing and spending. Such patterns are taken into account when determining a person's credit score.

Specifically, a credit report is a record of an individual's current and previous credit accounts, as well as the status of those accounts, whether open or closed. This record serves as a tool for better insight into a person's financial situation.

These reports are prepared by a credit bureau using a scoring model for an approximate measure of a person's creditworthiness.

The analysis process is done by examining credit information in every section and checking that the data is correct.

Although mistakes are unlikely to arise on reports delivered by brokerages or institutions, it is always important to check just for safety.

Analyzing a credit report can help both parties make the best decision because it ensures that information is correct and accurate for both the broker and the individual.

Credit Report analysis Purpose

A credit report is an organized list containing details of a person's credit activity. It factors into a person's credit score and potential for being approved for a credit card and/or loan.

Credit bureaus gather financial information about a person, which lenders use to create reports about your creditworthiness.

Financial information and records play a role in a person's financial choices.

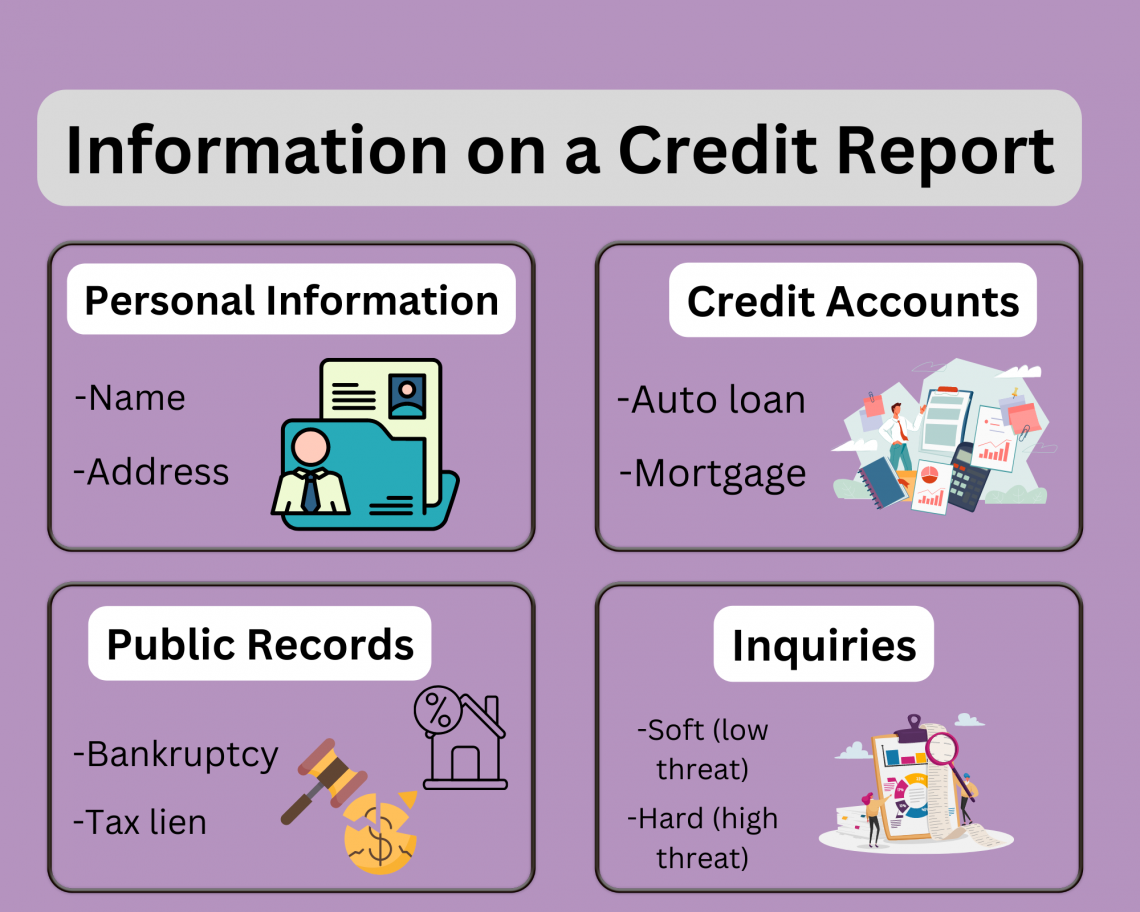

Credit statements organize an individual's information into different sections, which include personal data, credit accounts, public records, and inquiries.

The personal information section lists an individual's main identifying information, such as name, phone number, email, address, social security number, etc.

The credit accounts section lists the lines of credit that an individual has borrowed, paid back, or what is still owed. It also shows which accounts are open and which have been closed off.

Public records show individuals' legal documents about financial transactions such as bankruptcies or tax liens. This section does not show non-financial records, such as an arrest.

Inquiries on a credit report show any significant financial transactions that took place, such as taking out a mortgage or applying for a credit card. They can affect your credit score, and hard inquiries can last up to a few years.

Understanding and analyzing your credit data is important because it helps you to understand your credit rating, which determines your ability to borrow money in the future or to continue with any current loans.

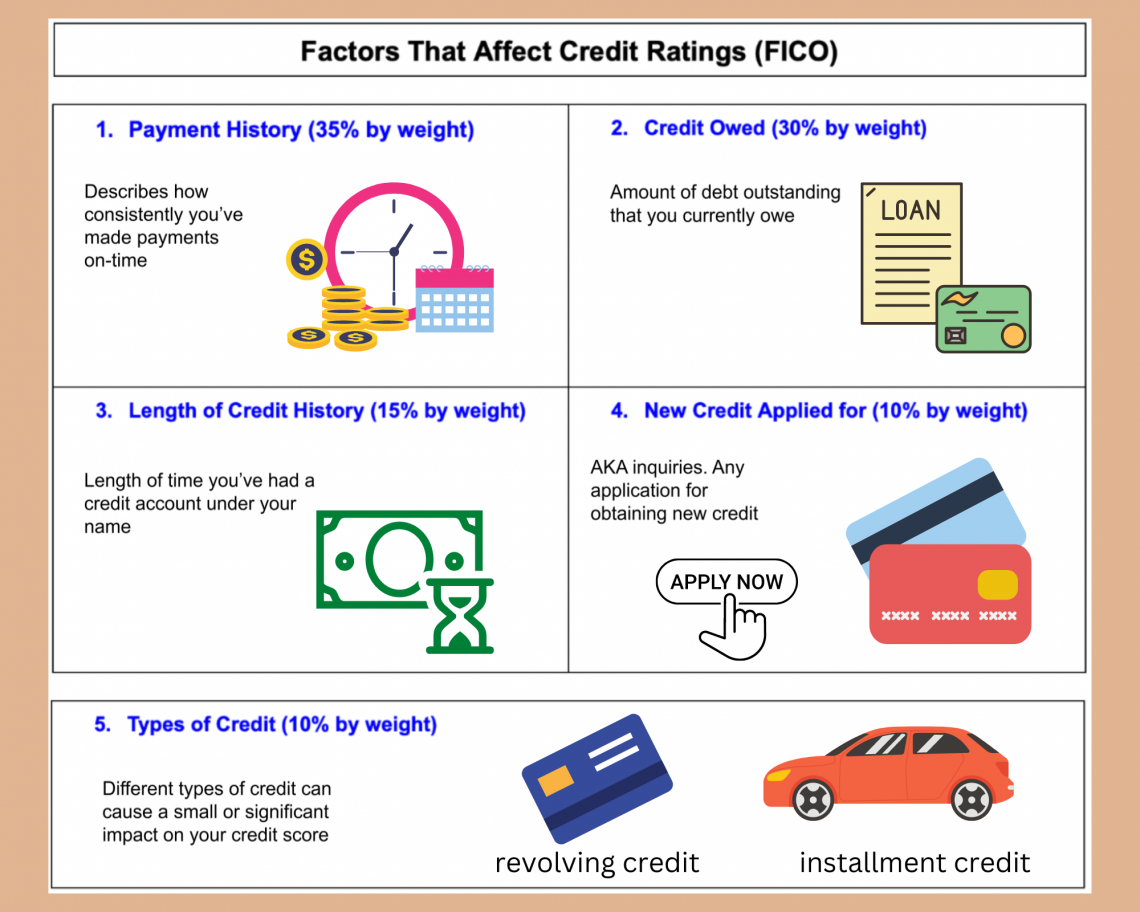

Credit scores are based on several factors, each having a specific weight or impact.

A credit rating is a quantified assessment of a borrower's creditworthiness concerning a financial obligation, such as a debt. It is usually expressed as a credit score and can be useful, especially for investors.

A person with a history of consistently on-time payments will have a higher score. On the other hand, if they always pay back debts late, their credit score will be negatively impacted.

The amount of credit owed also impacts a person's credit score. The more credit that is still owed, the lower that person's credit score, and vice versa.

A person's length of credit history is useful for observing payment patterns and proof of ability or inability to pay back any dues. In addition, having a longer credit history will likely boost a person's chance of obtaining credit from an institution.

Where to Order a Credit Report?

Credit reports are issued by credit bureaus that use personal financial data to compose records of lending and paying back borrowed money.

Once a month at the beginning of the accounting period, creditors usually report

data and information back to credit bureaus; however, they are not required by law.

Credit reports and scores are kept as data information by the government, and those data are collected by credit institutions.

A creditor is an individual, or financial institution owed money by another party for lending it out. Some examples of creditors are credit card issuers, mortgage lenders, or auto financiers.

A credit bureau is a financial agency that collects and analyzes credit information about individuals. They use this information to determine one's credit score and other financial data.

Even though there are plenty of credit bureaus in the United States, the three most notable and commonly used institutions are Experian, Equifax, and TransUnion.

Although they do not weigh every factor into a person's report, in the same way, the weight methods are very similar.

You can also get a free credit report from the US government annually. Not all free reports will contain your credit score, but they will list your debts and other credit information for review.

Why do I Need a Credit Report?

It is necessary to have if you intend to borrow money or owe it.

This type of report helps lenders understand the financial background of the borrower and measures a person's ability to pay back any money borrowed on time.

Pieces of information on financial documents directly impact a person's chance of credit approval. Conversely, denial of credit can result from an unreliable financial record.

For instance, if a person has a record of paying bills past due or does not have enough money to pay anything back at all, their credit score will be hurt, and it will be more difficult for them to borrow money.

This information informs the lender that that person is at high risk for return and will likely lose more money than earn back.

Credit reports serve as a benchmark of your financial standing and ability to borrow money. Your account can impact your ability to purchase a car, pay rent, take out a student loan, and even be hired for certain occupations.

It is important to regularly check your report and look for any mishaps or patterns affecting your credit score.

Regularly checking your report will better help you evaluate your financial decisions and goals, like a school report card or employee evaluation.

Thus, understanding what areas you are doing well in and what areas you lack provides a clearer and more feasible plan for spending, saving, borrowing, or investing.

What is a Credit Score?

A credit score is a numerical measure of a person's ability to pay off debts based on information in their payment history and credit history.

It is one of the most important measures of your creditworthiness and usually ranges between 300 and 850 (depending on the scoring model).

Credit scores are scaled by their numerical range, putting them into a "good" or "bad" range.

This score is a prediction based on evidence of your likelihood to pay back a debt on time. It is used by creditors and other institutions as a benchmark for what an individual can obtain in finance.

Data from the report is constituted in calculating a person's credit score, which then reflects that person's financial standing. Therefore, credit scores can increase and decrease depending on your financial actions and new data on your report.

For instance, say you were to take out a mortgage loan on a new house but then realize you cannot pay back the monthly debt expense. The inability to pay back borrowed money on time would show up on your report and negatively affect your credit score.

Credit scores are computed by not just one but several credit bureaus that treat credit similarly. However, the main three credit bureaus in the United States are Experian, Equifax, and TransUnion.

In addition to different credit bureaus, there are other credit scoring models, such as FICO or Vantage scores.

However, the three major credit bureaus- Experian, Equifax, and TransUnion all measure a person's credit history with Vantage scores.

Both companies compose credit scores that lenders and creditors can use to evaluate applicants and manage customers' accounts; however, VantageScore and FICO models use slightly different criteria for determining scores.

Credit Bureaus and Scores

As stated previously, the three central credit bureaus are

- Equifax,

- Experian, and

- TransUnion.

All three companies compete with each other for the business of creditors, who then construct credit documents.

Credit companies are gatekeepers to your credit, meaning they organize and maintain your credit file and score.

The three main credit institutions weigh and measure credit information and scores. There are similar criteria for measurements, but different.

The difference occurs when these companies use different data factors to create scores. A common misconception is that these companies calculate individual scores; however, this is only partially true.

Each credit bureau uses a scoring model to compute a person's data into a score. The main two models for scoring credit are VantageScore 3.0 and FICO.

Originally, all three bureaus used the FICO scoring model, but now there are more technological tools to measure scores.

Having more than one score can be useful because it allows you to use your highest score to show to a lender when getting a loan.

If a lender reviews your report, you are entitled to report the score and bureau of your choosing. The two main scoring models for credit reports are VantageScore 3.0 and FICO score (Fair Isaac Corporation).

Another important thing to remember is that no "most important" bureau exists because they all compute scores based on their criteria. This is why it is common for your credit score to vary slightly depending on which bureau calculates your score.

FICO (Fair Isaac Corporation) Score

FICO, short for Fair Isaac Corporation, is one of the main methods for calculating credit scores.

Those scores are then used by lenders to determine the creditworthiness of each client and decide whether credit applications should be approved.

The numerical range of scores given by FICO.

This model uses the following factors to determine an individual's score:

-

Payment history

-

Length of credit history

-

Credit utilization

-

A mix of credit or credit accounts

-

Most recent credit applications or inquiries

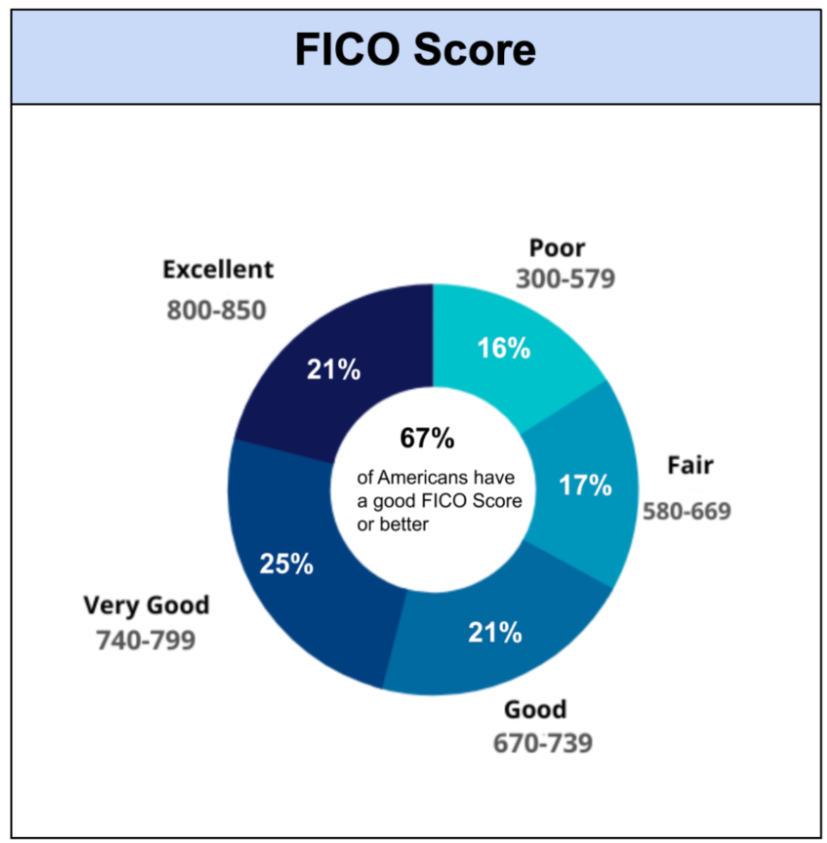

The typical FICO credit score range is 300 to 850.

-

300 to 579 is considered poor credit. Most lenders will reject applicants from borrowing money with a score in this range.

-

580 to 669 is considered fair credit. Some lenders will work with customers with a score in this range. On the other hand, interest rates will be higher, and the loan amounts will usually be lower.

-

670 to 739 is considered good credit. The average consumer with good credit can qualify for most loans or credit cards. The interest rates will be middle-of-the-line.

-

740 to 799 is considered very good credit. Consumers with very good credit can qualify for most loans with a lower, more decent interest rate.

-

800 to 850 is considered excellent credit. Only about one-fifth of people have a credit score in this range, but the ones that do are eligible for the best loans and interest rates on those loans. They are also rarely rejected from borrowing.

Vantage 3.0 Score

The other scoring model widely used among the main three credit institutions is VantageScore 3.0.

Each credit reporting agency uses the same formula given by this method for calculating scores; however, they measure an individual's information based on their specific credit record with each organization.

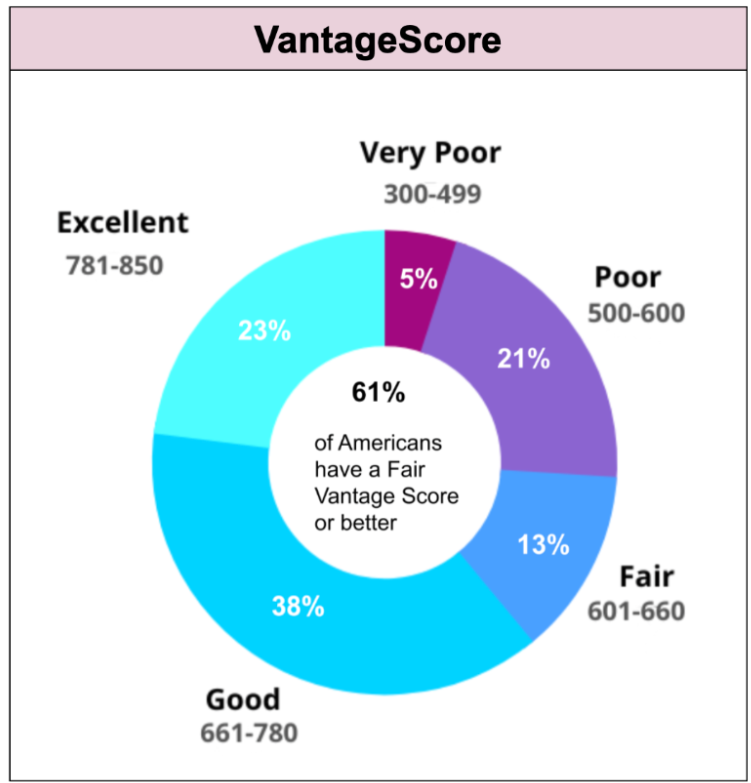

VantageScore 3.0 is quite similar to the FICO scoring model, except for the fact that this method of scoring runs approximately 50 points lower.

The numerical range of scores given by VantageScore.

This model uses the following factor to determine an individual's score:

-

Credit usage

-

Credit mix

-

Payment history

-

Credit history length

-

Recent activity about credit card or loan applications

The original Vantage Score used a scoring range of 501 to 990. However, VantageScore 3.0 and 4.0 both use a scoring range of 300 to 850, like the FICO scoring model.

In contrast to the FICO scoring model, this one categorizes a person's credit score based on the following system:

-

300 to 499: Very poor

-

500 to 600: Poor

-

601 to 660: Fair

-

661 to 780: Good

-

781 to 850: Excellent

Only around a quarter of people have an excellent Vantage Score. Therefore, they will only be accepted from a loan or credit card application.

Applying information for financial measurements and predictions can take on plenty of different steps. Learn more about financial statement modeling with a WSO Financial Statement Modeling Course.

Contents of a Credit Report

The factors that are accounted for in most credit reports are an individual's personal information, the record of businesses that lent out credit, any bankruptcies or inquiries, any late payments, the total amount of money borrowed, etc. These data are organized into different sections on a file.

The four main sections include personal information, public records, credit accounts, and inquiries.

Personal Information

This section consists of identification information. It includes facts about an individual that differentiates them from others. Such as:

-

A person's name (or nickname they've used with a credit account)

-

Address (current and previous)

-

Date of birth

-

Social security number

-

Phone number(s)

-

Current and previous employment information

Credit Accounts

Under this report, the section will likely find information about your borrowing and repayment history.

A credit account is an open account that a customer has with a supplier or business, in which that customer can make purchases and pay for them later.

These accounts represent the amount of money owed by one party to another. Examples of credit accounts include auto loans, mortgages, credit card bills, or any other expense that lowers the overall balance.

The accounts listed will likely include other details as well, such as:

-

Type of account

-

Name of the lender

-

Credit limit (or loan amount)

-

Payment history

-

Date of opening and closing

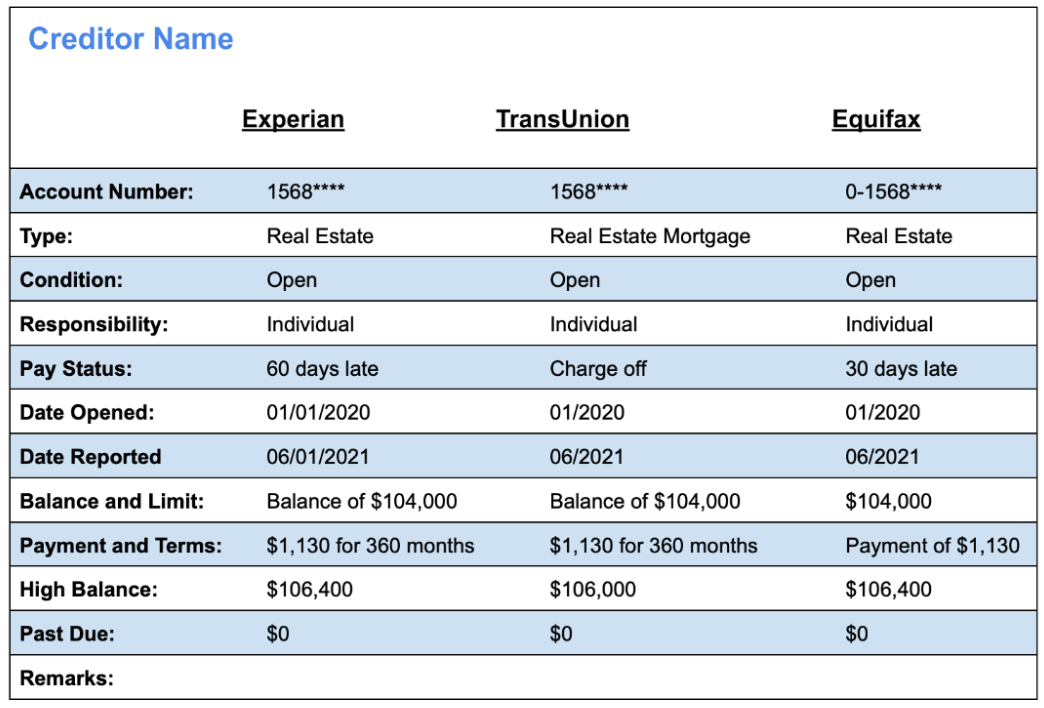

Here is an example of what information may be shown under the "credit accounts" section of the statement. Information in this section may vary depending on the source of the report.

When examining credit accounts, it is important to keep track of used credit vs. available credit.

Used credit is the money the borrower owes to the lender, and available credit is the amount of credit the borrower owes to the supplier but still needs to be spent or used up.

Public Records

These records are public; therefore, they are files of information that anyone can look up and aren't private.

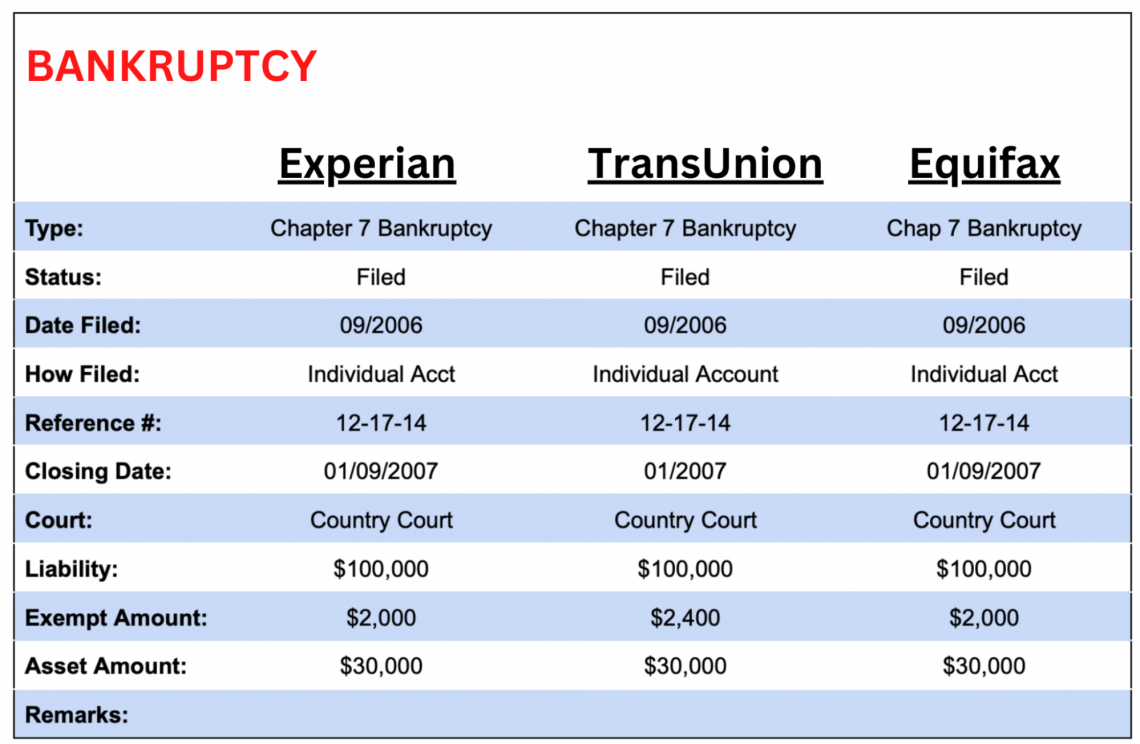

In other words, they are documents of information that are not considered confidential. Some examples include arrest records or court records. However, in this context, some good examples include:

-

Tax liens

-

Bankruptcies

-

Civil judgments and/or suits

-

Foreclosures

-

Overdue child support

Bankruptcies and foreclosures can show up on a report for up to ten years and seven years, respectively.

If a person is denied a loan by a credit institution due to poor credit history, the institution must send that person an adverse action notice with an explanation behind the denial.

Inquiries

Inquiries appear on a report when a legally authorized organization or person accesses your credit information. They are the result of a credit application.

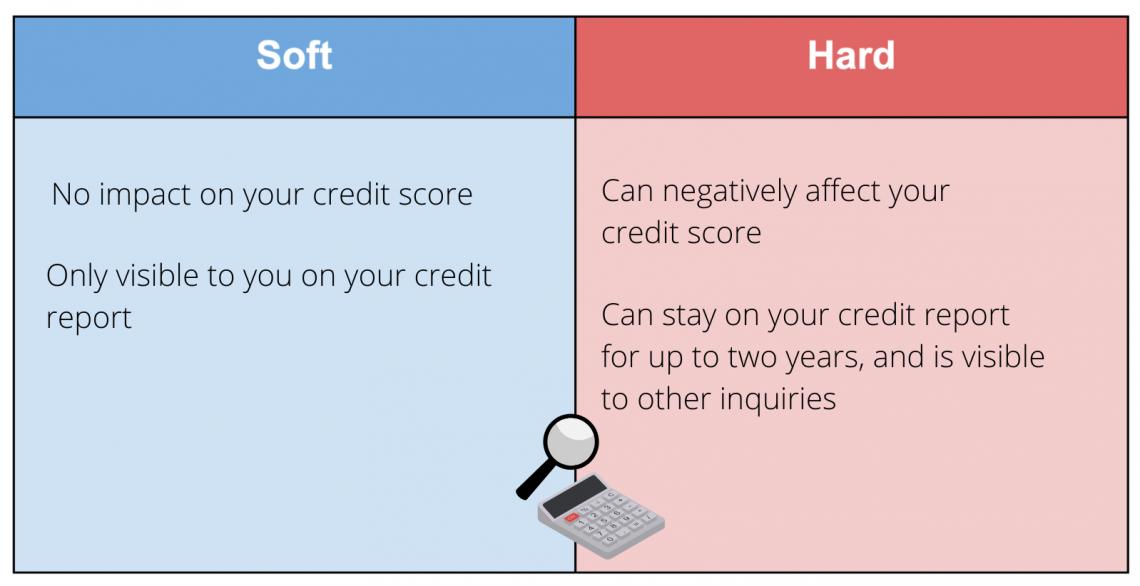

The subcategories of this section are hard inquiries and soft inquiries. Soft inquiries don't impact your credit score, but hard questions can lower your score.

Different types of inquiries can appear in your report. As a result, they can play different roles in affecting your score.

When companies are granted permission to check your credit, hard inquiries appear on your statement. They can happen if you apply for a student loan, mortgage, personal loan, or refinance a loan.

Your credit score can drop from a hard inquiry, which can often take months to rebound. But, unfortunately, they can also remain on your credit report for two years.

Even though hard inquiries compose a small percentage of your credit statement, they can be a hazard since they show lenders that you could be a potential risk.

A soft inquiry is also a preliminary review of an individual's credit history by a lender or financial institution and can be done without the person's consent. The assessment can determine if that person should be approved for a credit card.

For example, if you apply for a job and have a background check on you, including your credit history, it will not affect your credit score.

Credit Reporting Analysis Errors

According to a study by the Federal Trade Commission, one in five people has an error in at least one of their credit statements.

Errors are important to watch out for because they can lower your credit score, ultimately hurting your ability to obtain new lines of credit or get lower interest rates on borrowings.

It could also cost you more money if you dispute these errors immediately with the institution that issued the report.

People more commonly encounter reporting errors than most would think. However, there are several ways to analyze false or unfamiliar statements so that your score is not detrimental.

To get any mistakes disputed, you must contact the credit reporting company and the company that provided that information to the credit reporting company (also known as the "information furnisher").

Three of the most common errors on credit statements are inaccuracies regarding an individual's personal information, mistaken accounts, and error reporting account data.

When reviewing your personal information for errors, some of the details that you should keep track of are:

-

Incorrect name or incorrect spelling of your name

-

Incorrect middle initial

-

Incorrect contact information (e.g., phone number, email, address)

Ensure your basic personal information is always updated whenever you move to a new house or change your phone number or email. If it is shown incorrectly on your statement, report any updates to your reporting institution.

Looking for mistakes in a report is essential for ensuring accuracy.

You can check your report for unknown accounts by auditing the number of open accounts recorded.

There can be instances where an account for a credit card or loan may be under your name; however, you were not involved in the process. For example, this can occur if someone coincidentally has the same name as you and opens up an account.

In addition to any mistaken accounts, there can also be errors in the actual status of your accounts. Some of the most common problems that could occur in account reporting are:

-

An opened account that is reported as closed, or vice versa

-

On-time account payments are reported as late

-

Incorrect dates of late payments or dates of opening or closing an account

-

Incorrect account balance(s)

-

Incorrect credit limit

Researched & authored by Anna Ratnavale | LinkedIn

or Want to Sign up with your social account?