Consumer Surplus

It measures the additional value consumers receive from their purchases when the market price is lower than their maximum willingness to pay.

What is Consumer Surplus?

Consumer surplus calculates the discrepancy between what consumers are willing to pay and what they ultimately pay for a good or service. It is a key component of welfare economics and provides insights into the benefits that consumers receive from their purchases.

Essentially, it represents the monetary value of the satisfaction or utility consumers gain beyond what they have to spend.

The formula for measuring:

Consumer Surplus = Total Willingness to Pay - Total Amount Paid

Let's consider a hypothetical scenario for a better understanding of the concept. Suppose a consumer is able and willing to pay $50 for a concert ticket, but the market rate of the ticket is only $30. In this case, the consumer experiences a surplus of $20.

This surplus arises because the consumer values the concert experience at $50 but can acquire it for a lower price.

The demand curve slopes downward, indicating that the quantity demanded increases as prices decrease. It can be visualized as the area below the demand curve but above the market price. The larger the consumer surplus, the greater the benefit to consumers.

Several factors influence consumer surplus. Individual preferences and valuations play a crucial role, resulting in varying levels of consumer surplus among individuals.

Moreover, changes in market situations, including a decrease in manufacturing prices or a boom in opposition, can cause lower prices, resulting in larger consumer surpluses.

Key Takeaways

- Consumer surplus measures the additional value consumers receive from their purchases when the market price is lower than their maximum willingness to pay.

- Consumer surplus is calculated as the difference between the total willingness to pay and the total amount paid.

- Consumer surplus provides several benefits, including increased consumer welfare, value for money, increased purchasing power, promotion of competition and efficiency, informing policy decisions, and acting as a feedback mechanism in the market.

Example of Consumer surplus

Let's consider an example involving a popular smartphone that consumers are interested in purchasing.

The demand for this smartphone is represented by a downward-sloping demand curve, indicating that as the price decreases, the quantity demanded increases.

Suppose the market price of the smartphone is $800. At this price, the quantity demanded is 1,000 units per month, as indicated by the demand curve. However, consumers have different individual valuations and are willing to pay varying amounts for the smartphone.

Now, imagine that a consumer named John values the smartphone at $1,200. Since the market price is lower than John's maximum willingness to pay, he experiences a consumer surplus. To calculate, we subtract the market price from his maximum willingness to pay:

$1,200 - $800 = $400

$400 represents the additional value he gains from purchasing the smartphone at a price lower than his maximum willingness to pay. It is the monetary measure of the satisfaction and utility he receives beyond what he has to spend.

In this example, John is not the only consumer who benefits from the surplus. Other consumers in the market may have a different maximum willingness to pay and therefore experience different consumer surpluses.

Note

The overall surplus in the market can be calculated by summing up the individual surpluses of all consumers. It is affected by several variables, including purchaser preferences, market situations, and the availability of substitutes.

If the smartphone price were to decrease to $600, more consumers would find it affordable and willing to purchase it, resulting in a larger quantity demanded.

For those consumers who were ready to spend more than $600 but were able to buy it at a lower price, this would result in a rise in consumer surplus.

Law of diminishing marginal utility and Consumer Surplus

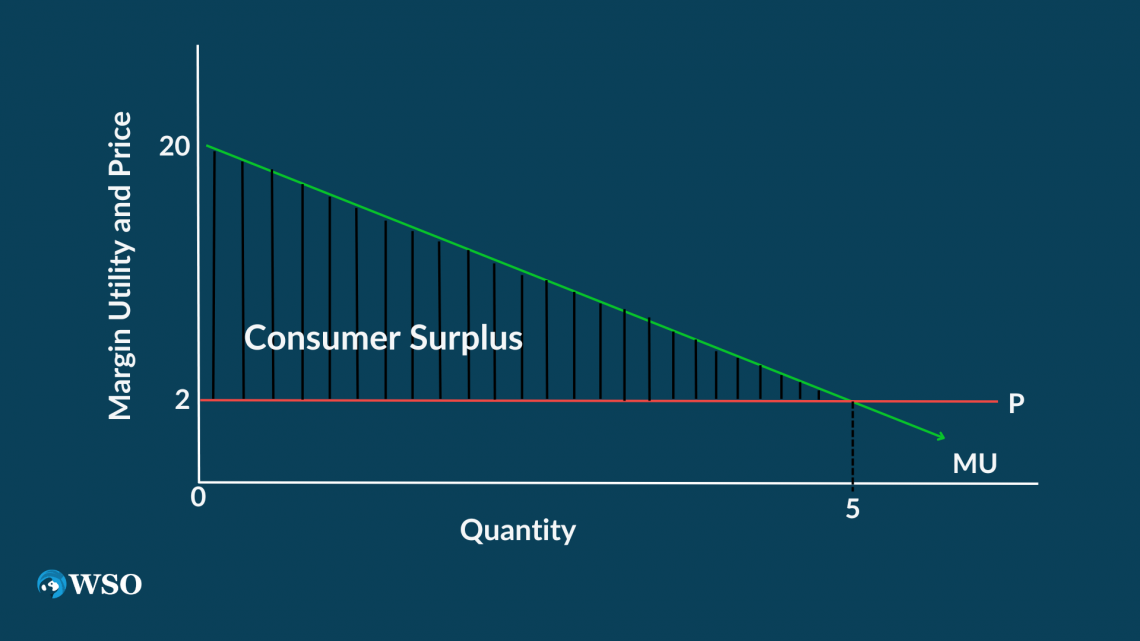

To explain the concept using the law of diminishing marginal utility, let's consider a hypothetical scenario of a consumer purchasing cups of coffee. We will create a table to illustrate the concept.

Assumptions:

- The consumer's utility is derived solely from consuming cups of coffee.

- The consumer is rational and seeks to maximize utility.

- The prices of the cups of coffee remain constant.

- The consumer's income is not a limiting factor in purchasing cups of coffee.

| Quantity | Total Utility | Marginal utility | Price per cup | Consumer surplus |

|---|---|---|---|---|

| 0 | 0 | - | - | - |

| 1 | 20 | 20 | $2 | $18 |

| 2 | 35 | 15 | $2 | $13 |

| 3 | 45 | 10 | $2 | $8 |

| 4 | 50 | 5 | $2 | $3 |

| 5 | 52 | 2 | $2 | $0 |

| 6 | 53 | 1 | $2 | -$1 |

For instance, when the consumer purchases the first cup of coffee, they gain $18 ($20 - $2). This means they value the first cup of coffee at $20, but they only have to pay $2.

As more cups are consumed, the consumer surplus decreases, indicating that the consumer's willingness to pay for each additional cup of coffee decreases.

This aligns with the law of diminishing marginal utility, which states that the value or satisfaction derived from each additional unit of a good tends to decrease as more units are consumed.

The table and assumptions illustrate how it can be calculated and how it changes with the law of diminishing marginal utility.

It showcases the diminishing value consumers place on additional units of a good as they consume more, resulting in a decrease in consumer surplus over time.

Pros of Consumer surplus

It offers several advantages that contribute to the well-being of consumers and the overall functioning of markets. Here are some of the key pros of consumer surplus:

1. Increased consumer welfare

CS directly contributes to consumers' well-being and satisfaction. Allowing them to obtain products or services at a price lower than their maximum willingness to pay enables individuals to enjoy greater utility and satisfaction from their purchases.

2. Value for money

It represents the additional value consumers receive beyond what they actually pay. It gives customers the effect that they get true value for their money.

Note

Customers are more likely to trust and believe the market when they believe they are getting more for their money. This, in turn, promotes increased consumption and business activity.

3. Increased purchasing power

It effectively increases consumers' purchasing power. By paying less than their maximum willingness to pay, customers have extra disposable earnings available to spend on different goods and offerings.

This additional buying power can stimulate demand in numerous sectors of the economic system, leading to increased manufacturing, process creation, and economic growth.

4. Promotes competition and efficiency

It is closely tied to market competition and efficiency. When consumers have options and choices in the market, they can compare prices and quality to maximize their consumer surplus.

Note

This competition promotes efficiency in resource allocation, leading to optimal resource utilization and improving overall economic efficiency.

5. Basis for policy analysis

It serves as a useful tool for policymakers and economists to analyze the potential impacts of policies, regulations, or market interventions on consumer welfare.

By estimating the potential changes in consumer surplus, policymakers can make informed decisions that consider the well-being and interests of consumers. It helps ensure policies are designed to enhance consumer welfare and minimize adverse effects on consumer surplus.

6. Feedback mechanism

It provides feedback to producers and suppliers about the value and satisfaction consumers derive from their products or services.

If customers consistently experience high consumer surplus, it indicates that they're inclined to pay extra for the service or product, which may incentivize manufacturers to invest in high-quality improvements or innovation.

Note

The feedback mechanism encourages businesses to continuously strive for better products and services that align with consumer preferences and maximize consumer surplus.

Cons of Consumer surplus

While consumer surplus is generally seen as a positive concept, it has some cons and potential drawbacks as well. Here are a few to consider:

1. Misallocation of resources

It can lead to the misallocation of resources if it distorts market signals.

When customers are willing to pay more than it costs to produce a good or service, it motivates producers to invest greater sources in that specific product's manufacturing, even if some other goods or services could have larger social benefits.

This can result in an inefficient allocation of resources within the economy.

2. Distribution inequality

It can make income disparity worse. It may be more advantageous for higher-income people who can afford to pay more for a product since they are more likely to have a greater maximum willingness to pay.

Note

Distribution Inequality can result in a distribution of surplus that favors the wealthier consumers, widening the income gap and potentially leading to social disparities.

3. Market power and exploitation

In markets with limited competition or monopolistic tendencies, consumer surplus can give firms with market power the ability to extract more surplus from consumers.

When consumers have limited alternatives and face high switching costs, firms can charge higher prices and capture a significant portion of the consumer surplus, reducing consumer welfare.

4. Lack of producer incentives

It can reduce producer incentives to invest in innovation, quality improvements, and efficiency gains.

Note

Producers may lack the incentive to invest in R&D or other value-adding activities if consumers are already pleased with the present level of product quality and are unwilling to pay more for upgrades. This can hinder overall economic growth and technological progress.

5. Externalities and public goods

It does not consider externalities or benefits and costs, such as environmental pollution or public health risks that extend beyond the individual consumer.

Additionally, it may not adequately reflect the value of public goods that are non-excludable and non-rivalrous, leading to underinvestment in their provision.

Conclusion

In conclusion, consumer surplus is an important economic concept that measures the additional value consumers receive from their purchases when the market price is lower than their maximum willingness to pay.

The demand curve determines it and reflects the utility consumers gain beyond what they pay.

While potential drawbacks and considerations are associated with consumer surpluses, such as the misallocation of resources and distributional inequalities, it remains a valuable tool for policymakers and economists in understanding consumer benefits and making informed decisions to promote efficiency and well-being in the economy.

It has numerous benefits, including:

- Increased consumer welfare

- Value for money

- Increased purchasing power

- Promotion of competition and efficiency

- Informing policy decisions

- Acting as a feedback mechanism in the market

Note

Individual preferences, market conditions, and the overall efficiency of markets influence it.

It is a valuable concept for understanding consumers' benefits from their purchases. It highlights the positive impact of market transactions by allowing consumers to obtain goods or services at prices lower than their maximum valuations.

It signifies the value and utility consumers gain beyond what they have to pay, contributing to their overall welfare and satisfaction.

or Want to Sign up with your social account?