Job Market

A marketplace where people exchange their labor in return for payment.

What Is the Job Market?

The job market, in its simplest form, is a marketplace where people exchange their labor in return for payment. Laborers are the supplier in this market (supplying their labor), and firms are the consumers in the market (demanding people’s labor).

The job market behaves similarly to how any other supply & demand market acts.

Some other factors interact in the market, like economic activity levels, industry trends, the need for certain skill sets or education levels, etc. An example is the medical industry, which demands highly educated and skilled workers.

Although the job market is referred to as a “market”, there is no physical place where this "exchange of labor" for pay happens. It’s just a concept demonstrating competition and interplay between different labor forces.

This market may be also known as "the labor market", as labor is the service being demanded.

Throughout an economic cycle, the job market will grow and shrink depending on the demand for labor. The number of available workers willing to offer their labor will also change the job market size.

Some other factors that affect the size of the labor market are:

- The needs of specific industries

- The need for a particular level of education or skill set

- The need for required job functions

Since the economy needs people to work, the labor market status is extremely important and directly related to the demand for goods and services.

At a macroeconomic level, international and domestic market dynamics influence supply and demand, as well as factors such as level of education, the population’s age, and immigration.

Relevant measures for the labor market are:

- Unemployment

- Productivity

- Participation rates

- Total income

- Gross domestic product (GDP).

Individual companies interact with laborers. They hire fire people, as well as raise or cut wages and hours. The relationship between supply and demand affects the employee’s hours and their compensation in wages, salary, and benefits.

Key Takeaways

-

The job market operates based on supply and demand like any other market.

-

Factors like economic activity, industry trends, and skills influence it.

-

The labor market size changes with demand, industry needs, and worker availability.

-

The unemployment rate is related to the job market; high unemployment favors employers, and low unemployment benefits workers.

-

Equilibrium is reached when demanded workers match the available labor force, and minimum wage policies can impact this.

The relation between the unemployment rate and the job market

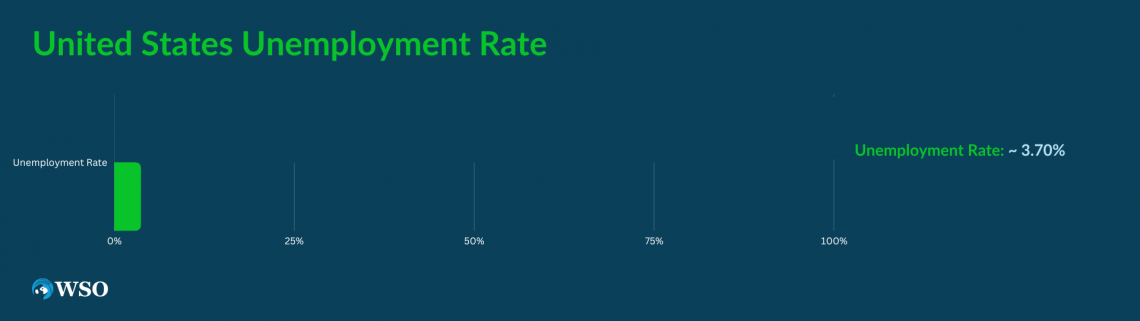

The labor market is directly related to the unemployment rate. The unemployment rate is a figure to measure the percentage of the labor force that doesn’t have a job but is actively searching for one.

When the unemployment rate is high, the job market faces an abundance of available labor. This situation gives employers the advantage of being selective in their hiring decisions and allows them to negotiate lower wages, benefiting from the relatively inexpensive labor.

However, when the unemployment rate drops, the labor supply becomes limited, making it challenging for firms to be as choosy. They must now compete for workers, shifting the bargaining power in favor of the labor force. As a result, wages increase, even for lower-skilled occupations.

During challenging economic times like recessions or depressions, employers may resort to layoffs to save costs. This further increases unemployment and intensifies the competitiveness of the labor market for workers.

High unemployment rates can prolong economic stagnation, causing financial hardships for individuals and forcing them to make careful financial decisions. This period of minimal growth in the economy adversely affects both sides of the labor market, making it a challenging situation for everyone involved.

The U.S. Bureau of Labor Statistics takes a monthly statistical survey called the Current Population Survey to measure the state of the job market.

The survey uses a representative sample of around 60,000 households to try and find the unemployment rate in specific regions of the country, earnings of those surveyed, hours the respondents worked, and plenty of other demographic factors.

Supply and demand in the job market

The job market experiences a similar supply-demand mechanism as regular goods and services markets. The only real difference is that labor is a commodity.

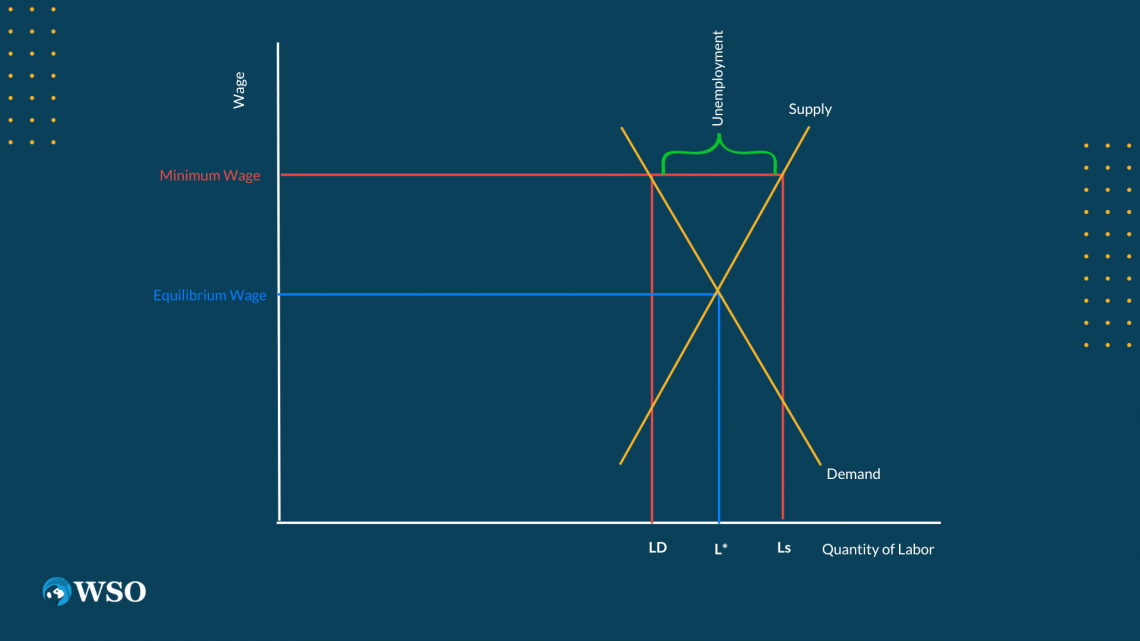

So just like in a market of goods and services, when the quantity of workers demanded by firms is equal to the available labor force, the job market will be in equilibrium.

When firms desperately try to hire workers (a shortage of available workers), wages will increase. On the other hand, when firms don’t demand workers and large numbers of people are unemployed (a surplus of available workers), wages will decrease.

In most economies, wages can’t move freely due to price controls. Many countries implement a minimum wage, which is a price floor. Just as the name implies, a minimum wage is a minimum price employer can legally pay their workers.

Just like with a normal price floor, when the market equilibrium price is above the minimum wage, the minimum wage does not affect the job market. When the market equilibrium price is below the minimum wage, then problems arise. The minimum wage would cause a surplus here.

Firms wouldn’t be able to justify paying a lot of workers over the equilibrium wage, which will result in firms hiring fewer workers.

Even though minimum wage is supposed to protect workers and increase the wage of workers, it can cause fewer people to experience these benefits because of unemployment.

There are benefits to minimum wage, as it provides a better income for unskilled workers. Due to this increase in wages, the government can reduce its spending on social programs to support these individuals and reduce economic inequality simultaneously.

Job Market FAQs

As we know, the effects of minimum wage on the economy and labor market are controversial. Many economists agree that minimum wage, and any other price control, can reduce the number of openings in lower-wage jobs.

Some economists hold another opinion and disagree that minimum wage is detrimental to the economy. They think that a minimum wage can cause an increase in consumer spending, leading to a rise in overall productivity and a net gain in employment.

The effects of Immigration are difficult to quantify. Many economists would agree with the classical economics model and argue that high levels of immigration could lead to wages falling.

The immigrants would add to the already existing labor pool, creating an increased supply of labor for the same amount of job positions.

On the other hand, some studies and economists suggest that immigration can positively affect the job market.

Depending on the skill set of the immigrants, immigration can lead to a positive effect on aggregate demand. Because the new workers are also customers, immigration can increase labor demand.

The Bureau of Labor Statistics surveys 60,000 representative homes in the United States. This survey provides the data needed to create a monthly employment report. The survey is used to estimate the employment figures for the whole country.

The unemployment rate is calculated by measuring the percentage of the unemployed labor force actively looking for work. If an unemployed person is not actively looking for a job, they will not be included in the unemployment figure.

or Want to Sign up with your social account?