Narrow Money

A subset of the money supply that refers to all the actual cash the central bank has issued, demand deposits, and any other liquid assets held by the central bank

What Is Narrow Money?

"Narrow money" is a subset of the money supply and refers to all the actual cash the central bank has issued, demand deposits (money placed in a bank account that is retrievable at any time), and any other liquid assets held by the central bank.

In the US, "narrow money" is called M1 (M0 plus demand accounts). M0 is referred to as "narrow money" in the UK. The narrowest definition of money in the UK is the number of notes and coins in circulation.

It is a method of measuring and classifying the money supply in an economy. It includes certain liquid forms of money which is readily available and suitable for immediate spending due to its liquidity.

In addition to the elements of base money like currency, it also includes the majority of liquid bank deposits.

It is a crucial indicator of an economy's money supply and can help to assess a country's economic success. Its main benefit is that it makes quick monetary transactions possible; as a result, it is a crucial indicator of the purchasing power of the general populace in an economy.

Monitoring M1 aids authorities in implementing monetary policies that control the overall money supply in the economy. The range of the entire money supply includes both wide and narrow money. The other type of money is broad money, which consists of less liquid financial assets.

Key Takeaways

- Narrow money is a subset of the money supply comprising cash issued by the central bank, demand deposits, and other highly liquid assets.

- In the US, narrow money is denoted as M1, including M0 (physical currency) and demand deposits. In the UK, M0 represents narrow money, referring to physical notes and coins.

- Narrow money is a crucial indicator of an economy's money supply and can reflect its economic performance and purchasing power.

- Monitoring M1 helps authorities in implementing monetary policies to regulate the overall money supply, influencing economic stability.

Understanding Narrow Money

Only the most liquid financial assets are present in the narrow money supply. This requirement restricts the category to cash in the form of tangible notes and coins and money kept in the most easily accessible bank accounts.

The United States has the world's greatest stock of narrow money as of December 2020, according to the Organization for Economic Co-operation and Development (OECD), followed by Hungary, Poland, Israel, and New Zealand.

Usually, a country's ability to access the liquid money supply, whether on a long- or short-term basis, directly affects the state of its economy. However, a decoupling of that direct relationship has occurred due to developments in the economy and the financial sector.

The money supply is not the main way to carry out a central bank's monetary policy. Instead, it concentrates on interest rates.

However, to determine how to react to the economy's current status, it keeps track of changes in narrow and broad money.

According to the CIA's Factbook, the European Union holds the most narrow money globally, followed by China and Japan. Regarding this money stock, the USA is in fourth place, and Germany comes in fifth.

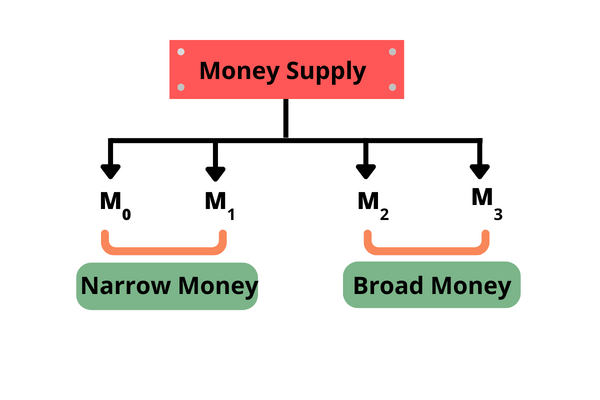

M1/M0 is used to describe narrow money, M2/M3/M4 is considered broad money, and M4 is the most general definition of the money supply.

Many deposit-based accounts that take longer than 24 hours to withdraw from can be included in broad money. Since their output is limited by a specific period, these are frequently referred to as long-term deposits. M2, M3, and M4 represent these.

Any immediate kind of money used to make purchases in the real world will be regarded as limited cash. It doesn't matter if it is beneath the sofa, in a bag, or in a pocket. It is irrelevant where the money ends up after being spent; the important point is that it is in circulation.

Note that this includes consumer demand or checking deposits in their bank accounts. This is because customers can make on-demand withdrawals from them or make payments using checks. This qualifies these balances to be included in this class as they are essential as liquid as coins and notes.

Components of narrow money

The money supply is measured and classified on a narrow to broad scale. Although the classification varies nationwide, it is commonly done using an "M" scale, where M0 represents the smallest, and M4 describes the largest definitions of the money supply.

The most restricted form of money, M0, is a subset of M1 that is only recognized in a few nations.

For instance, the United States does not classify items using M0 or M4. Only M1–M3 are used, with M1 encompassing all varieties of thin money. In this instance, M1 consists of more liquid currency, like coins or bills. M2 or M3, such as money market funds, are less liquid, on the other hand.

Broad money is referred to as M2, M3, and M4, the most inclusive version of an economy's money supply. The M1 money supply is considered when calculating the M2 and M3 money supplies, but not the other way around.

To determine the money supply in an economy, monetary authorities divide the whole stock of money into monetary aggregates. These designations are MB/M0, M1, M2, and M3.

Monetary base (MB/M0) = Currency in circulation + Central bank balances

M1 = Currency + Demand deposits + Other checkable deposits

M2 = M1 + Term deposits

M3 = M2 + Large term deposits (not measured by the Federal Reserve anymore)

Narrow money is denoted by M1/M0, broad money by M2/M3/M4, and the greatest concept of the money supply by M4. Various deposit-based accounts that take longer than 24 hours to mature and be regarded as accessible may be included in broad money. Due to the fact that their activity is constrained by a set time period, these are frequently referred to as longer-term time deposits.

or Want to Sign up with your social account?