Capital Adequacy Ratio (CAR)

The measurement of an organization's available capital in proportion to its risk-weighted assets

What is the Capital Adequacy Ratio (CAR)?

The Capital Adequacy Ratio is the measurement of an organization’s available capital in proportion to its risk-weighted assets. CAR sets standards for the organization to pay for its liabilities, and the firm’s ability to the credit and operational risks.

A healthy CAR is an indication of stability in the bank’s financial system and is a benchmark for depositor protection. It shows the organization’s available capital holds the potential for absorbing potential losses

Indicating that the organization is sound and has relatively less risk of becoming insolvent than the organization that has a weak CAR. A good CAR may also indicate that the organization is capable enough of protecting its depositors' money.

CAR is measured by using 2 types of capital:

- Tier 1 capital: This is the highest quality of regulatory capital, and it absorbs losses immediately as they occur without the bank being required to stop functioning.

- Tier 2 capital: Also known as the going concern, capital will absorb losses at a time when the bank fails.

After the Great Financial Crisis of 07-08, the Bank of International Settlement (BIS) made the CAR norms stricter with the introduction of the Basel III norms for international regulators framework for banks.

The framework was implemented in 2013 making the minimum CAR requirements for the bank at 8% of their Tier 1 & 2 capital.

The CAR also makes it easier to compare banks of different countries as the ratio is standardized.

Key Takeaways

- Capital Adequacy Ratio (CAR) measures an organization's financial stability and ability to absorb losses.

- Higher CAR indicates a safer and more stable institution.

- CAR is calculated by dividing risk-weighted assets by Tier 1 and Tier 2 capital.

- Basel III made CAR requirements stricter, ensuring a minimum CAR of 8%.

- CAR provides depositor protection, system stability, and risk assessment.

The cAR formula

CAR is calculated by dividing the risk-weighted assets of a bank by the sum of its Tier 1 and Tier 2 capital.

CAR = (Tier 1 capital + Tier 2 capital) / Risk weighted assets

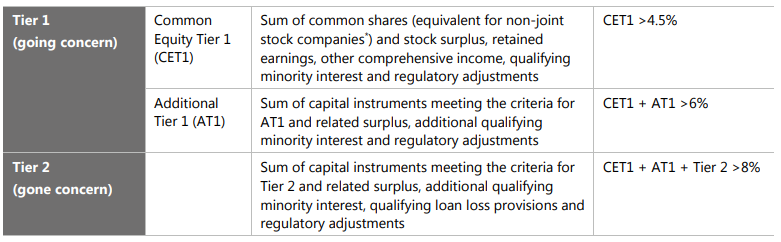

1) Tier 1 Capital

Tier 1 Capital is composed of, shareholder's equity and stock surpluses, retained earnings, other comprehensive income (OCI), qualifying minority interests, and regulatory adjustments. These types of capital sources are listed on the financial statement.

Instruments with a maturity date are not included in the tier 1 capital as it is set up to absorb immediate losses. Tier 1 Capital is the primary indicator of a bank’s financial health, and they are the primary source of funding for banks

2) Tier 2 Capital

Tier 2 Capital is composed of, undisclosed reserves, revelation reserves, additional qualifying minority interest, general provision and loss reserves, hybrid debt capital instruments, subordinated debt, and investment reserve accounts.

Tier 2 capital is used as a cushion when the bank is winding up. As the regulatory norms are much less strict for Tier 2 capital instruments with a maturity date are allowed to be included in a bank's tier 2 capital.

Generally, considered to be supplementary source capital and is less reliable than Tier 1 capital. Tier 2 capital is difficult to assess accurately due to the presence of capital from undisclosed and unreliable sources.

3) Risk-Weighted Assets

Risk-weighted assets are utilized for determining the amount of minimum capital that must hold on to by the banks and financial institutions to minimize the risk of insolvency.

Insolvency is usually described as a situation where a person(the debtor) is unable to pay the debt he owes. Generally speaking, a company may become insolvent in a situation where it is unable to pay back its creditors

Risk-weighted assets are essential to the minimum capital requirement needed to protect banks and other financial institutions during the insolvency period.

The assets and loans that a bank holds are given weightage according to the risk profile of the security. High-risk instruments are given a higher weight and safer instruments are given a lower weight.

E.g. unsecured loans and debentures credit card debts will have a higher weightage compared to mortgage loans.

Assets of the safest category like Government Bonds may not hold any weightage in the calculation.

Off-balance sheet loans are also taken into consideration during the calculation of risk-weighted assets.

Thus, institutions with riskier assets on their books will have a higher CAR. This encourages banks to avoid loans riskier than their risk profile and encourages them to keep liquid assets on their books.

Advantages Of Capital Adequacy Ratio

The CAR offers a snapshot of a bank's capacity to absorb losses and meet its obligations.

The capital adequacy ratio has many advantages, and here are some of them:

- This is enforced to ensure that the bank has a minimum capital available in order to cushion uncertain losses. The CAR also acts as a safety rail for the depositor funds.

- The CAR is an essential ratio to ensure the functioning of banks and lending institutions and, by proxy ensure the efficiency and stability of a nation's financial systems.

- A high CAR ensures that the bank/financial institution is safe and will be able to meet any forthcoming financial obligations and unforeseen events.

- As the capital adequacy ratio also includes off-balance sheet exposures like forex contracts and operating leases, the CAR covers every kind of risk exposure giving a complete idea of the bank's position.

- The CAR also ensures that the depositors' funds have a higher priority than the regulatory capital, so in the event of insolvency, the tier I and tier II capital will have initial exposure before tapping into the bank deposits. Banks usually have the CAR significantly higher than the minimum requirement of 8%, as they need to be positioned more safely in the event of a liquidity crisis for the bank.

- A higher than minimum CAR is always preferred as it gives more safety to the depositors and is a reflection of strong internal controls and risk framework.

Basel III Capital Adequacy Ratio Minimum Requirement

The great financial crisis revealed a lot of inefficiencies and irregularities in the lending system, to tackle those Basel III norms were established by the Basel Committee on Baking Supervision (BCBS).

Under Basel III, the minimum capital adequacy ratio is to be maintained at 8%. Basel III is an accord, whose primary purpose is to set reforms to improve the regulation, supervision, and risk management in the banking and financial institution industry.

Basel III is the third Basel accord, they dictate a framework setting international standards for liquidity requirements, stress testing, and capital adequacy.

Basel III made the capital adequacy norms more stringent by increasing the required level of regulatory capital. In addition to that BCBS also instituted more stringent disclosure requirements.

Making the regulatory capital more high-quality, predominantly in the form of equity shares ad retained earnings that can absorb losses was the primary focus of Basel III.

Going concern and gone concern framework was introduced by Basel III, stating the role of Tier I(going concern) and Tier II(gone concern) capital.

The main goal of the Basel III accords was to improve transparency thus by proxy increasing market discipline and reducing inconsistencies.

Examples of Capital Adequacy Ratio (CAR)

Under the Basel III accords, banks should have a minimum capital adequacy ratio of 8%, and the higher the capital adequacy ratio safer the banks are cushioned to absorb losses before insolvency.

Capital

| Tier 1 Capital (going concern) | $25 Million |

|---|---|

| Tier 2 Capital (gone concern) | $55 Million |

Risk-weighting of assets

| Type of Assets | $ Amount | Weightage |

|---|---|---|

| Mortgage Loans | $300 Million | 40% |

| Credit Card Loan Assets | $150 Million | 88% |

| US 10Y Treasury Bonds | $200 Million | 0.5% |

Assuming Bank A has $25 Million in tier I capital and $55 Million in tier II capital, the risk-weighted assets come to $262 Million, the CAR will come to 30.5% [($25 million + $55 million)/($262 million)].

The CAR of Bank A is much higher when compared with the minimum requirement of 10.5%, so Bank A is much less likely to become insolvent in an event of unexpected losses.

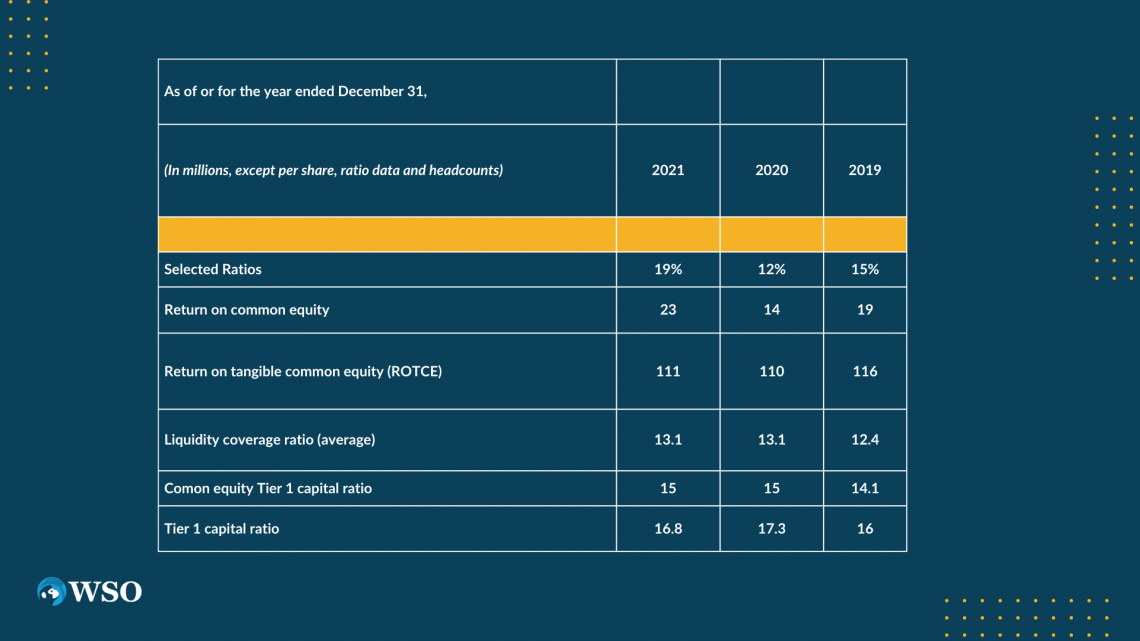

Following are the Annual Reports for JP Morgan Chase and Bank of America showcasing how capital ratios are reported.

| (In millions, except per share information | 2021 | 2020 | 2019 |

|---|---|---|---|

| Capital ratios at year end (b) | |||

| Common equity tier 1 capital | 10.6% | 11.9% | 11.2% |

| Tier 1 capital | 12.1 | 13.5 | 12.6 |

| Total capital | 14.1 | 16.1 | 14.7 |

| Tier 1 leverage | 6.4 | 7.4 | 7.9 |

| Supplementary leverage ratio | 5.5 | 7.2 | 6.4 |

| Tangible equity (2) | 6.4 | 7.4 | 8.2 |

| Tangible common equity (2) | 5.7 | 6.5 | 7.3 |

As seen in the annual reports for JP Morgan Chase and Bank of America, the most commonly reported ratios are the

-

Common Equity Tier 1 Capital Ratio (CET1)

-

Tier 1 Capital Ratio

-

Total Capital Ratio i.e. Capital Adequacy Rati

As per the federal reserve, any bank with more than $100 Billion in consolidated assets should follow these guidelines for their capital adequacy requirements.

-

A minimum CET1 capital requirement of 4.5%

-

The stress capital buffer (SCB) requirement of at least 2.5%

-

And if applicable, a capital surcharge for global systematically important banks (G-SIBs), which should be at least 1%.

CAR vs. the Common Equity Tier 1 (CET1) Ratio

Both the CAR and CET1 are capital ratios used by banks and other lending institutions and are a safeguard measure during a crisis.

CET1 capital is a component of the CAR that just includes the common shares and retained earnings, it essentially is the core capital of the bank i.e. the bank's equity. CET1 is the highest quality of regulatory capital as it absorbs losses immediately.

According to the Basil III norms should be more than 4.5% of the risk-weighted assets of the bank. The CET1 capital usually makes up about 60 - 70% of the tier 1 capital.

Usually while reporting CET1 and CAR ratios are both reported alongside each other in the annual financial statements of a company.

The total regulatory capital or CAR is the summation of CET1 + Additional Tier 1 making Tier 1 Capital and Tier 2 capital.

The major difference bet CAR and CET1 are that the CET1 ratio only tells us how the firm is positioned itself to absorb immediate losses as it is a part of the tier 1 capital and does not cover liquidation events.

CAR Vs. Tier-1 leverage ratio

The leverage ratio, also referred to at times as the Supplementary Leverage Ratio (SLR), is a ratio derived by the Basel III Accords during the aftermath of the great financial crisis.

A low leverage ratio indicates a bank has high levels of debt in relation to its Tier 1 capital. Like the CAR, the Leverage Ratio is designed such as it is also comparable across countries and jurisdictions so regulators can have a clear picture of the financial health of the leading sector.

Leverage Ratio = Capital measure / Exposure measure

The formula comprises 2 variables.

Capital Measure is nothing but tier 1 capital but after corresponding transitional agreements are accounted for.

Exposure Measure is also more or less similar to risk-weighted assets, including both on and off-balance sheet (OBS) items included at their accounting value with a slight change in the treatment given to derivative transactions.

Furthermore, exposure measure is also agnostic to the risk of the assets and are weight according to their value.

BCBS set the minimum requirement of the leverage ratio at 3% over a full credit cycle.

The SLR is usually considered a backstop to the risk-weighted capital requirements, this will restrict the excessive build-up of leverage in the banking sector.

CAR vs. Liquidity Coverage Ratio

The liquidity coverage ratio (LCR) is designed to ensure that banks hold sufficient levels of High-Quality Liquid Assets (HQLA). The LCR ensures the banks' ability to meet their short-term obligations

The liquidity coverage ratio is applicable to banks with over $250 Billion of consolidated assets or has on-balance sheet forex exposure of a minimum of $10 Billion.

HQLAs are necessary to keep banks afloat during a period of significant liquidity stress lasting 30 calendar days.

30 calendar day stress period is the minimum period deemed necessary before corrective action is taken by the bank's management.

The Capital Adequacy Ratio shows the bank's ability to fulfill any uncertain liquidity crisis without tapping into the depositor's funds while the LCR focuses only on fulfilling how effectively the bank can meet its short-term obligations as it only focuses on highly liquid assets.

A limitation of the LCR is it is not possible to tell if it can provide a strong enough cushion as the calculations are modeled by taking the great financial crisis as a benchmark, so it can fail if a different type of liquidity crisis arises.

The formula for calculating LCR is:

Stock of HQLA / Total net cash outflows the next 30 calendar days ≥ 100%

The formula has 2 components HQLA and Total net cash outflows

1. Estimating Cash Outflows over the next 30 days

Total net cash outflows are what remains when the total expected cash inflows are deducted from the total net cash outflows.

Total expected cash outflows are calculated by multiplying the outstanding balances of various liabilities and off-balance sheet items by the estimated supervisory rates

Total expected cash inflows are estimated by applying inflow rates to o/s balances of contractual receivables

2. HQLA

HQLA are essential cash or highly liquid assets that can be converted into cash without any significant value loss.

Whether an asset can be included in HQLA or not depends if it meets minimum liquidity criteria and its operational factors demonstrate that it can be disposed of quickly to generate liquidity.

Researched and authored by Aditya Salunke I LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?