Cash Turnover Ratio (CTR)

It is a ratio that describes how many times cash can be converted into revenue or sales for a business.

What Is The Cash Turnover Ratio (CTR)?

The Cash Turnover Ratio (CTR) is an efficiency ratio that describes how frequently a company's cash was used to produce sales or revenue over the course of an accounting period.

Businesses that operate on a cash basis rather than a credit basis typically employ it. Revenue is divided by cash and cash equivalents to get CTR, the formula is as follows:

CTR = Revenue/ Cash and Cash Equivalents

Cash is necessary for every business to survive. A company has to have enough cash flows (cash inflows - cash outflows) to sustain itself in the long run. Cash efficiency always shows that a business is running smoothly.

Hence, this ratio illustrates how to generate revenue from cash and cash equivalents in order to sustain working capital or daily operations of the organization.

Key Takeaways

- The Cash Turnover Ratio (CTR) is a ratio that describes how many times cash can be converted into revenue or sales for a business.

- Cash is the most liquid asset of a company, and it is necessary to assess whether the business has cash efficiency or not.

- CTR has two essential components: revenue and cash and cash equivalents.

- Generally, a high CTR is considered a good indicator, but it also depends on the achievement of a company's goals and should also be compared with firms operating within the same industry.

- CTR is used by firms having transactions based on cash.

Components Of The Cash Turnover Ratio

CTR mainly consists of two elements - revenue and cash and cash equivalents. This information can be found in the financial statements of the company. A company releases its financial statements every year, and hence information can be obtained easily from there.

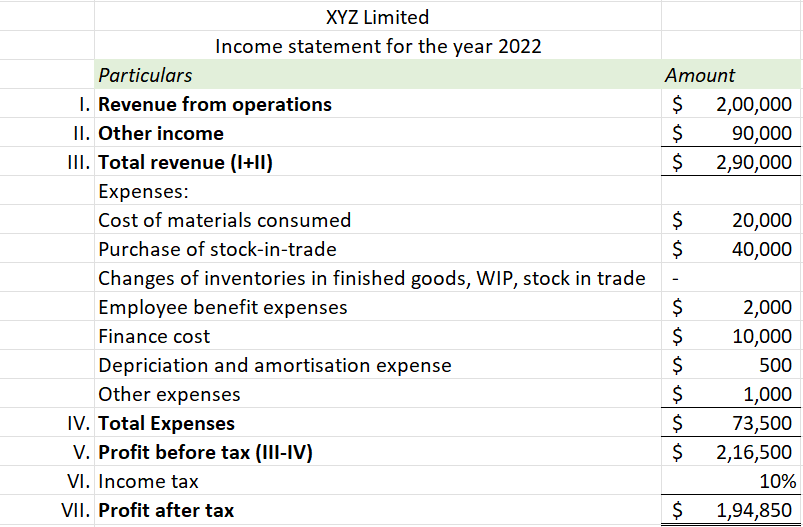

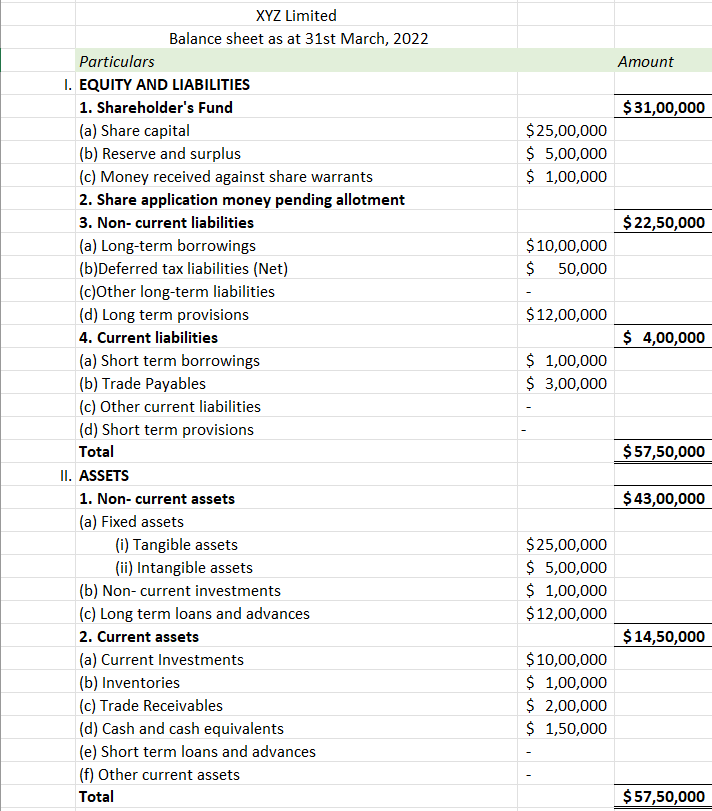

Below revenue and cash and cash equivalents are explained with the help of an example of financial statements:

- Revenue: It is the company’s sales or revenue, which can be found in the Profit & Loss Statement Or Income Statement

- Cash and cash equivalents: These are the most liquid assets found in the balance sheet of a company. Here, average cash and cash equivalents are calculated so the amount of the last accounting period and current accounting period is taken into consideration.

Example Of the Cash Turnover Ratio

ABC is a cloth manufacturing company. It wants to calculate its cash efficiency. The company wants to know how much cash is spent to generate revenue or sales.

| Particulars | 2019 | 2021 | 2022 |

|---|---|---|---|

| Revenue | $ 90,000 | $ 1,20,000 | $1,50,000 |

| Cash & Cash equivalents | $ 40,000 | $ 50,000 | $ 52,000 |

CTR = Revenue/ Cash & Cash Equivalents

For the period 2021,

Revenue = $1,20,000

Cash & Cash eq. (Average) = (40,000 + 50,000)/ 2= 45,000

CTR = 120000/ 45000 = 2.67 times

For the period 2022,

Revenue = $1,50,000

Cash & Cash eq. (Average) = (50,000 + 52,000)/ 2= 45,000

CTR = 120000/ 102000 = 1.176 times

In the above example, for the period 2021, CTR was 2.67 times, and in the accounting period 2022, it was reduced to 1.176 times.

Interpreting the Cash Turnover Ratio

The ratio represents how much cash has been used or spent to generate revenue or sales for a business. CTR can be considered a good ratio or bad ratio.

It is considered a good ratio as it measures the profitability and efficiency of a business. If a business has enough cash, it shows that the company has good liquidity.

Generally, the higher the CTR, the more efficient and profitable a business is. A higher CTR is good as it implies a business has enough cash flows for its daily operations.

However, higher CTR may not always be a good indicator because companies might use excess cash for everything and not keep enough cash for future use, i.e., cash reserves. Cash reserves are necessary to meet the short term needs and any emergencies of the business.

Furthermore, the ratio should be compared with that of different companies of the same industry to reach a better conclusion.

Drawbacks Of The Cash Turnover Ratio

CTR is a good indicator of the efficiency and profitability of a business. It shows how much cash management is there in the company and how cash is used to generate revenue.

Cash management is one of the basic requirements of any business’ short term and long-term survival. Cash crunch can pose serious problems in the flow of daily business operations.

Therefore, having liquidity is of tremendous use to any business or any industry. The drawbacks of CTR are as follows:

- Companies working on a credit basis cannot use CTR as a metric to judge their efficiency and profitability.

- A higher CTR may or may not represent a good status. It should always be analyzed with the company’s goals and objectives and also compared with different companies within the same industry to provide accurate analysis.

Cash Turnover Ratio (CTR) FAQs

CTR describes how often cash has been used to generate revenue or sales for a business. Generally, a high CTR is considered good for a business, and a low CTR indicates less liquidity and shows that the company cannot turn over its cash quickly.

Although there is no such thing as a good or bad CTR, it depends from business to business. A high CTR may also have negative consequences for a business, such as more reliance on cash and difficulty to maintain cash reserves. Therefore, the CTR must be compared with the company's objective and with firms of the same industry.

CTR is calculated using two elements:

- Revenue

- Cash and Cash equivalents (average of last and current accounting period)

Information regarding these items are present in the company’s financial statements.

No, in fact, this is the biggest disadvantage of CTR. It cannot be calculated for firms that work on a credit basis. It is only used for companies that have cash transactions.

Everything You Need To Master Financial Statement Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Researched and Authored by Chhavi Gupta | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?