Cost of Production

Cost of production refers to the total expenses involved in manufacturing goods or providing services.

In economics and commerce, understanding the intricacies of production costs is vital for organizations aiming to thrive in a competitive market.

The cost of production represents the cumulative expenses incurred during the creation of goods or services. They serve as a cornerstone for pricing strategies, profit analysis, and long-term sustainability.

In this article, we will dive deep into the world of production costs, unraveling its complex facets and shedding light on the fundamental elements that shape the economic landscape for businesses.

At its core, the cost of production encapsulates a multifaceted tapestry of expenses. These costs encompass the charge of labor, raw materials, equipment, utilities, and different inputs to convert inputs into finished goods or services.

Consequently, comprehending and effectively managing these expenses become paramount to achieving optimal efficiency and profitability.

Production costs are influenced by various factors, making it a nuanced area of study. For example, market dynamics, technological advancements, and government policies all play a role in shaping the cost landscape.

Fluctuations in input prices, currency exchange rates, or shifts in consumer demand can significantly impact production costs, requiring businesses to adapt and optimize their strategies accordingly.

Moreover, different industries and sectors exhibit unique cost structures. For example, in the production sector, expenses are heavily influenced by the efficiency of production methods, equipment renovation, and supply chain management.

Conversely, service-oriented industries primarily rely on skilled labor, technology investments, and customer-centric factors, such as personalization and quality assurance, all contributing to the overall service cost.

Understanding production costs empowers businesses to make informed decisions. In addition, accurate cost analysis allows for effective pricing strategies, balancing the need for competitiveness with profitability.

Organizations can optimize resource allocation, minimize waste, and enhance operational efficiency by identifying cost drivers and evaluating cost-performance ratios. It also aids in budgeting, forecasting, and strategic planning, providing a comprehensive framework for sustainable growth.

Moreover, the manufacturing cost significantly stimulates an enterprise's break-even point and earnings margins.

Businesses must strike a delicate balance between achieving economies of scale and maintaining profitability, as excessive cost reduction efforts can compromise quality, customer satisfaction, and overall brand value.

The cost of production encompasses the intricacies of financial investments, resource utilization, and operational efficiency.

By exploring this topic, organizations may get important insights into their operations, adjust to shifting market conditions, and improve their performance in a constantly changing business environment.

Recognizing the importance of cost analysis and management will undoubtedly guide businesses toward strategic decision-making, enhanced competitiveness, and long-term success.

- The cost of production encompasses various components such as raw materials, labor, machinery, and utilities, representing the cumulative expenses incurred during the creation of goods or services.

- Understanding and dealing with production pricing efficiently is critical for agencies to achieve the desired efficiency, profitability, and long-term sustainability.

- Manufacturing costs are influenced by market dynamics, technological advancements, and government regulations, necessitating flexibility and intelligent decision-making.

- Each industry has its cost structure, with manufacturing stressing production processes, supply chain management, and service-oriented sectors prioritizing skilled personnel and technological investments.

- Accurate cost analysis enables businesses to develop effective pricing strategies, optimize resource allocation, and increase operational efficiency, contributing to sustainable growth.

- The value of manufacturing plays an essential position in determining an organization's break-even point, earnings margins, and normal financial health, necessitating a sensitive balance between cost reduction and retaining quality.

- Recognizing the significance of cost analysis and management enables firms to make educated decisions, adjust to market changes, and improve their competitiveness in a volatile business environment.

Various Types of Production Costs

Costs play a fundamental role in any business operation, serving as the financial foundation upon which organizations build their strategies and make critical decisions. By categorizing costs into distinct categories, businesses can gain deeper insights into their financial structure and allocate resources more effectively.

The various types of costs are:

1. Fixed Costs

Fixed costs are expenses that remain unchanged regardless of the level of production or sales. These costs are incurred regularly and do not fluctuate with output. They include items like rent, salaries of permanent staff, insurance premiums, and lease payments.

Fixed costs provide a foundation for business operations and are essential for maintaining infrastructure and support functions, regardless of the business's production volume.

Variable costs are expenses that fluctuate in direct proportion to the level of production or sales. Raw materials, direct labor, commissions, and packaging charges are examples of variable costs.

Variable costs are closely related to the manufacturing process and may be managed effectively through supply chain management and cost-cutting techniques.

3. Direct Costs

Direct costs are expensed directly related to the production of a specific product or service. These expenses are incurred for materials, labor, and other resources directly engaged in manufacturing a certain product or service.

Direct costs are traceable and provide a clear link between inputs and outputs. For example, for manufacturing companies, direct costs include raw materials and direct labor. In contrast, for service-based businesses, direct costs may include labor costs specific to a particular project or service offering.

Types of costs encompass a broad spectrum of expenses incurred in different areas of business operations. Each category holds unique characteristics and implications for decision-making.

4. Indirect Costs

These costs, commonly referred to as overhead costs, are expenses that support general operations but are not directly related to a particular good or service. Instead, these costs are incurred for activities or resources shared among various departments or products.

Indirect costs include rent for shared office spaces, utilities, administrative salaries, and marketing expenses. Indirect costs are necessary to sustain a business's infrastructure and administrative functions.

5. Semi-Variable Costs

Semi-variable costs, or mixed costs, have both fixed and variable cost components. These costs have a fixed portion that remains constant over a specific range of production or sales levels and a variable portion that fluctuates based on output.

Examples include utilities with a fixed monthly charge and a usage-based component like electricity or phone bills. Semi-variable costs require careful analysis to separate the fixed and variable components for accurate cost estimation and decision-making.

6. Opportunity Costs

Opportunity costs represent the value of the next best alternative foregone when deciding. It is the cost of not choosing the alternative with the highest potential benefit.

For example, if a company decides to invest in Project A, the opportunity cost is the potential profit or advantages earned by investing in Project B instead. Businesses may use opportunity costs to analyze trade-offs and make choices based on the most promising options.

7. Marginal Costs

Marginal costs are the additional cost incurred for producing one additional unit or serving one additional customer. It represents the change in total cost resulting from a change in production or output.

Marginal costs are essential for determining the optimal production or service provision level. Businesses can make decisions that maximize profitability and efficiency by comparing marginal costs to the additional revenue generated from each unit.

Components of Cost of Production

Understanding the components that represent the cost of production is similar to interpreting the DNA of economic operations. Every organization embarking on the journey of making goods or services encounters a complicated interplay of factors that contribute to the overall expenditure.

The components include various factors, each with particular characteristics and ramifications. Therefore, organizations may additionally examine a lot about the complicated net of expenditures that determines their financial surroundings by dissecting the production cost components.

Each element plays a critical function in determining the general price structure, presenting a unique lens through which organizations can understand and manipulate their financial resources.

By delving into the depths of those components, companies can optimize their manufacturing techniques, enhance operational efficiency, and strike a sensitive balance between high quality and profitability.

The components of the cost of manufacturing encompass a numerous array of inputs, starting from raw materials and labor to machinery, utilities, and beyond.

Exploring the nuances of every element of the cost of production allows agencies to benefit from a complete understanding of the complex net of economic investments that underpin their operations.

Every component contributes to the overall cost equation, from the tangible costs of raw materials and labor to the intangible costs of power consumption and system renovation.

Furthermore, spotting the impact of marketplace dynamics, technological improvements, and regulatory requirements on these components allows businesses to navigate the ever-changing landscape of cost management with agility and foresight.

Various Components of Cost of Production

Understanding the components that make up the cost of production is crucial for organizations to manage their financial resources effectively. Various components of production costs are:

1. Raw Materials

The fundamental components utilized in manufacturing are wood, metals, polymers, or chemicals. These are typically purchased from suppliers and incur procurement, transportation, and storage costs. Effective management of raw material costs involves balancing quality and cost while minimizing waste.

2. Labor

Labor costs encompass wages paid to the employees involved in the production procedure of goods, including direct or indirect labor. Factors including employee productivity, training, and the availability of competent workers can influence labor expenses.

3. Overheads

Overheads refer to indirect production costs, including rent, utilities, equipment maintenance, insurance, and tax expenditures. These costs can be fixed (e.g., rent) or variable (e.g., utilities), and effective management involves balancing these costs against production output.

4. Equipment

Equipment costs include capital expenses (e.g., purchasing new machinery) and ongoing maintenance and repair expenses associated with the machinery and tools utilized in production.

Effective management of equipment costs involves balancing the need for reliable machinery against acquisition and maintenance costs.

6. Packaging

It includes materials (such as boxes and labels) and labor (such as assembly and labeling) involved in the packaging of the finished product. Effective management involves balancing the need for attractive and functional packaging against production costs.

7. Transportation

The costs associated with delivering goods from the production site to customers or distributors, including shipping fees, fuel costs, and vehicle maintenance. Effective management involves optimizing transportation routes and minimizing costs while ensuring timely delivery.

Calculation of Cost of Production

An essential component of financial analysis for organizations is determining the manufacturing cost. It involves determining the expenses incurred while creating goods or services and providing insights into profitability, pricing strategies, and overall financial health.

By accurately calculating the cost of production, businesses can make informed decisions, optimize resource allocation, and enhance operational efficiency.

Let's explore the various calculations involved in determining the cost of production, demystifying complex formulas, and providing real-life examples.

By employing these calculations, businesses gain a comprehensive understanding of the cost of production, enabling effective pricing strategies, informed decision-making, and financial analysis.

It allows organizations to lessen expenses, increase income, and ensure long-term sustainability in a cutthroat industry.

Let us go through the methods of calculating the cost of production:

1. Calculation of Total Cost

Total Cost is calculated by adding direct and indirect costs incurred during the production process. It offers a thorough overview of all costs spent during production, including labor, overhead, raw materials, and other related expenditures.

Understanding the total cost is crucial for businesses to evaluate the overall financial impact of production activities and make informed decisions regarding pricing, profitability, and resource allocation.

It can be calculated using the formula:

Total Cost = Direct Costs + Indirect Costs

2. Unit Cost Calculation

The unit cost calculation determines the cost incurred to produce a single unit of a product or provide one unit of service. Businesses may determine the cost per unit by dividing the total cost by the number of units produced.

This allows them to develop suitable pricing strategies, gauge profitability, and analyze cost efficiency. The unit cost calculation is essential for pricing decisions, setting profit margins, and comparing production costs across different products or services.

Unit Cost = Total Cost / Number of Units

3. Average Cost Calculation

The average cost calculation provides insights into the average expense per unit produced. It is obtained by dividing the total cost by the total number of units produced.

Understanding the average cost allows businesses to assess the efficiency of their production processes and evaluate cost fluctuations over time.

By monitoring average costs, organizations can identify opportunities for cost optimization, streamline operations, and enhance overall financial performance.

Average Cost = Total Cost / Total Number of Units

4. Marginal Cost Calculation

Marginal cost calculation focuses on determining the additional cost incurred by producing one additional unit. It helps businesses assess the incremental expenses associated with increasing production volume.

Organizations can decide whether to increase production or change their pricing strategies by comparing the entire cost of producing a certain number of units with the total cost of producing one more unit.

The marginal cost calculation is crucial for understanding the financial impact of scaling operations and optimizing production levels.

Marginal Cost = Total Cost of n units - Total Cost of (n-1) units.

5. Standard Cost Calculation

Standard cost calculation involves setting predetermined standards for various cost components such as materials, labor, and overhead. It enables businesses to establish benchmarks for expected costs and facilitates the evaluation of cost variances.

By comparing actual costs with predefined standards, organizations can identify areas of inefficiency, track cost performance, and implement corrective measures. Standard cost calculation is essential for cost control, variance analysis, and improving operational efficiency.

Cost Variance = Actual Cost - Standard Cost

6. Absorption Cost Calculation

Absorption costing is a method that allocates direct and indirect costs to individual units of production. It includes all production-related expenses, such as direct materials, direct labor, and variable and fixed overhead costs.

This approach provides a comprehensive view of the total cost per unit, considering all costs incurred in the production process.

Absorption Cost per Unit = (Total Direct Costs + Total Overhead Costs) / Number of Units Produced

7. Activity-Based Costing (ABC)

Activity-Based Costing allocates costs based on the activities that drive those costs. It involves identifying cost drivers (activities) and assigning costs to products or services based on their consumption of those activities.

This method provides more accurate cost information by linking costs to the activities that generate them.

Cost Allocation = (Cost of Activity / Total Activity) * Activity Consumption by Product

In a manufacturing company, if machine setup activities drive costs, ABC would assign a higher proportion of overhead costs to products requiring frequent machine setup changes than those requiring minimal setup changes.

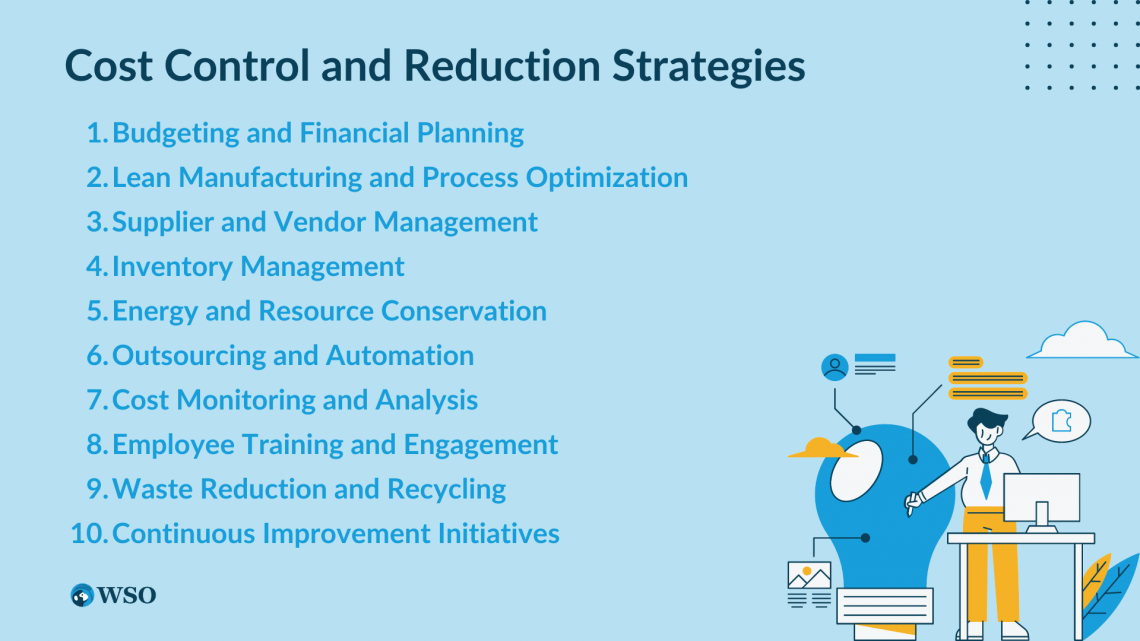

Cost Control and Reduction Strategies

Cost control and reduction methods are critical for firms to improve profitability, financial stability, and market competitiveness.

These strategies involve analyzing and managing expenses effectively to optimize resource allocation, eliminate wasteful practices, and maximize cost efficiency.

Organizations can mitigate financial risks, improve operational performance, and achieve sustainable growth by implementing cost control and reduction measures. The following are the Cost Control and Reduction Strategies for our better understanding:

1. Budgeting and Financial Planning

Creating detailed budgets and financial plans allows organizations to set cost objectives, distribute resources effectively, and track spending against certain benchmarks.

2. Lean Manufacturing and Process Optimization

Adopting lean manufacturing concepts and optimizing operational processes aids in the elimination of waste, reduction of production costs, increased productivity, and overall efficiency.

3. Supplier and Vendor Management

Negotiating advantageous contracts, investigating competitive bidding, and developing good connections with suppliers and vendors can result in cost savings through volume discounts, better terms, and enhanced supply chain management.

4. Inventory Management

Implementing efficient inventory control methods, such as just-in-time (JIT) inventory systems, eliminating surplus stock, and optimizing reorder points, reduces carrying costs and eliminates stockouts.

5. Energy and Resource Conservation

Energy-efficient practices, using sustainable technology, and optimizing resource use all contribute to cutting utility costs while minimizing environmental effects.

6. Outsourcing and Automation

Assessing non-core activities and considering outsourcing options or implementing automation technologies can reduce labor costs, enhance productivity, and improve overall operational efficiency.

7. Cost Monitoring and Analysis

Regularly monitoring and analyzing costs through financial reports, cost accounting systems, and variance analysis helps identify cost-saving opportunities, inefficiencies, and areas for improvement.

8. Employee Training and Engagement

Training programs and fostering a culture of cost consciousness among employees can encourage them to contribute to cost-saving initiatives and generate innovative ideas for process improvement.

9. Waste Reduction and Recycling

Implementing waste reduction methods, encouraging recycling activities, and encouraging sustainable behaviors reduce environmental effects and save money on trash disposal and raw material utilization.

10. Continuous Improvement Initiatives

Adopting a culture of continuous improvements, such as applying Total Quality Management (TQM) or Six Sigma approaches, aids in identifying and eliminating process inefficiencies, reducing defects, and optimizing costs.

or Want to Sign up with your social account?