Cost Accounting

Process of allocating costs to various objects

What Is Cost Accounting?

The reporting and analysis of a company's cost structure are known as cost accounting (CA). It is the process of allocating costs to various objects, including a business's products, services, and other activities.

CA is useful because it can show where a company spends money, how much it earns, and where it loses money. The goal is to report, analyze, and improve internal cost controls and efficiency.

It is a management system for operational analysis. The reporting and analysis of a company's cost structure are known as cost accounting. Also, the process of allocating costs to cost objects such as a company's products, services, and business activities.

Even though CA is referred to as a costing method, its scope is much broader than just cost. Its elements include traditional bookkeeping, system development, creating measurable information, and input analysis.

The benefits of this method spread to other industries as well. Modern CA methods first appeared in the manufacturing industry by assisting in the organic creation and measurement of business strategy for many businesses.

Understanding Cost Accounting

Cost accounting tracks and analyzes a company's expenses to manage costs, improve efficiency, and make informed decisions about pricing and operations.

Companies interested in expanding their product line should be aware of their cost structure. Knowing the business's costs allows management and high-level decision-makers to determine if an expansion is feasible and how much it will cost to implement.

Also, it aids management in planning future capital expenditures. Such as large plant and equipment purchases. These future costs can be accounted for before they occur, reducing the impact of the costs on the firm.

This accounting method is required for businesses in all sectors, whether they are manufacturing, trading, or providing services. It has long been used to assist managers in comprehending the costs of running a company.

The complexities of running large-scale businesses led to the development of these recording and tracking costs to assist business owners and managers. These system developments aided in increased decision-making during the Industrial Revolution.

Standard costing and variance analysis, marginal costing, and cost volume profit analysis budgetary control are used by accountants. Also, uniform costing inter-firm comparisons are other commonly used techniques.

Types of Cost Accounting

Cost accounting encompasses several types, including job costing, process costing, activity-based costing (ABC), and standard costing. These methods help businesses understand and control expenses, aiding in pricing, budgeting, and strategic decision-making.

Let us take a look at some of the types below:

Standard Costing

Standard costing assigns "standard" costs to the cost of goods sold (COGS) and inventory rather than actual costs.

Budgeted costs are standard costs. This is because labor and materials are utilized. This implies operations are performed under standard operating conditions.

Even though standard costs have been assigned to goods, the company still has to pay actual costs. The difference between an efficient cost and the actual cost incurred is determined by performing variance analysis.

Variance is unfavorable if the variance analysis determines that actual costs are higher than expected. Variance is favorable if it determines that actual costs are lower than expected. A favorable or unfavorable variance can be caused by two factors.

The first factor is input cost which includes items such as labor and materials. A rate variance is what this is called. There's also the efficiency or quantity of the input used.

The second factor is referred to as a volume difference. If, for example, XYZ company is expected to produce 400 widgets in a given period but ends up producing 500 widgets, the total cost of materials would be higher.

Activity-Based Costing

ABC allocates overhead costs from each department to specific cost objects, such as goods or services.

The ABC cost accounting system is based on activities. Activities refer to any event, unit of work or task with a specific goal. Some activities include setting up production machines, designing products, distributing finished goods, or operating machines.

These activities are also referred to as cost drivers and serve as the foundation for allocating overhead costs. Overhead costs are assigned based on a single generic measure, such as machine hours.

An activity analysis is carried out under ABC, and appropriate measures are identified as cost drivers. As a result, when managers review the cost and profitability of their company's specific services or products, ABC is much more accurate and helpful.

Cost accountants using ABC may distribute a survey to production line workers. The workers then account for the amount of time they spend on various tasks. These costs are only assigned to the goods or services that were used in the activity.

This provides management with a clearer picture of where time and money are being spent. As an example, imagine a company that makes both trinkets and widgets.

The trinkets are time-consuming to make and need a lot of hands-on work from the production team.

Widget production is automated, which entails feeding raw materials into a machine and waiting several hours for the finished product.

It wouldn't make sense to overhead both items using machine hours because the trinkets hardly used any. The trinkets have more overhead related to labor. The widgets have more overhead related to machine use under ABC.

Lean Accounting

Lean accounting's main goal is to improve an organization's financial management practices. Lean accounting is an extension of the lean manufacturing and production philosophy. This philosophy aims to cut waste while increasing productivity.

For instance, if the accounting department can minimize and reduce time spent on non-value-adding operations, that time is then open for new and increased value-added tasks.

Accounting methods are based on value. Lean performance measures traditional costing methods based on value. Financial decisions are based on the overall profitability of the value stream.

Value streams are a company's profit centers, any branch or division contributing to its bottom-line profitability.

Marginal Costing

The effect of adding one more unit into production on the cost of a product is known as marginal costing. (Also known as cost-volume-profit analysis). It's useful for making quick financial decisions.

Management can use marginal costing to see how different levels of costs and volume affect operating profit.

Management can use this type of analysis to learn about profitable new products, sales with prices to be set for existing products, the impact of marketing campaigns, the break-even point, or the point at which total revenue for a product equals total expense.

It is calculated by dividing a company's total fixed costs by its contribution margin.

Break Even Point = Total Fixed Costs / Contribution Margin

The contribution margin is calculated as sales revenue minus variable costs. It can also be calculated per unit to determine how much a specific product contributes to the company's profit.

Contribution Margin = Sales Revenue - Variable Costs

Types of Costs in Cost Accounting

Let's understand the types of costs that are involved in Cost Accounting below:

1. Fixed costs

Fixed costs are costs that remain constant regardless of production volume. These are items like a building's mortgage, lease payment, or a piece of equipment with a fixed monthly depreciation rate. These costs would not change if production levels increased or decreased.

2. Variable costs

Variable costs are linked to a company's production level. For example, a floral shop increasing its floral arrangement inventory for Valentine's Day will pay more when purchasing more flowers from the local nursery or garden center.

3. Operating costs

Operating costs are expenses related to a company's day-to-day operations. Depending on the circumstances, these costs can be fixed or variable.

4. Direct costs

Direct costs are expenses incurred directly in the production of a product. The direct costs of the finished product in a coffee shop include the roaster's labor hours and the cost of the coffee beans if a coffee roaster spends five hours roasting coffee.

5. Indirect costs

Indirect costs are costs that cannot be traced back to a specific product. The energy cost of heating a coffee roaster, for example, would be indirect because it is inexact and difficult to trace to individual products.

Characteristics of the Cost Accounting System

Accounting systems are intended to calculate the full, true cost of goods. In contrast to traditional cash flow accounting, a full-cost accounting system takes into account a wider range of costs.

Full cost accounting has the advantage of allowing financial planning and decision-making to take into account a larger number of cost factors. Here are the characteristics of this system:

1. Correctness

In terms of cost determination and presentation, this system should provide accurate data. Otherwise, the users will be misled.

2. Ease

A detailed cost analysis is part of its system. An elaborate costing system should be avoided to avoid complications in the costing procedure, and every effort should be made to keep it as simple as possible.

For example, while producing these statements, the computation labor should be kept to a bare minimum. The size of the assertions should be kept to a minimum.

The number of columns utilized to provide information should also be reduced. This will increase time savings when drafting the statements.

3. Elasticity

Adaptability should be built into the cost accounting system so that it can adapt to changing business environments. Depending on the business' needs, it must be able to expand or adapt.

For instance, it cannot be rigid. It should be able to deal with heavy workloads and adapt to any changes in the business environment.

4. Cost-effectiveness

The costs of running the system must be reasonable and cost-effective. The advantage should outweigh the cost.

For example, adding a product feature to a product design is cost-effective if the gain in sales outweighs the costs of the item. Alternatively, a little investment in a bottleneck manufacturing activity may be justified if it permits a company to boost throughput.

5. Comparisons

To facilitate comparisons over time, records must be maintained. These records should be used to guide future decisions.

For instance, if many oil and gas companies consistently use the same industry-specific accounting rules for their financial statements, there should be a high level of comparability within that sector.

6. Promptness

An effective costing system provides management with cost data in an analytical format. As a result, all departments in the factory must quickly analyze and record the relevant cost items to provide cost information to various levels of management regularly.

This aids in regularly monitoring the progress of the business.

7. Periodical preparation of accounts

It is preferable to prepare accounts regularly to facilitate frequent comparisons of results. Constant comparison of actual results with standard results allows for identifying inefficiencies. This can be remedied by taking corrective action.

For instance, a store may automatically total its cash sales at the end of each day and record them at one time. In this textbook, journal entries will be prepared individually for each transaction to aid in the understanding of the accounting process.

8. Reconciliation with financial accounts

To ensure the accuracy of both systems of accounts, the system must be capable of reconciling with financial accounts. To ensure that the purchase of assets will be properly reflected on the balance sheet and the income statement, a reconciliation may involve the purchase of certain assets as revenue generators for a business.

9. Uniformity

The various forms and documents used in the costing system must be consistent in size and paper quality. To avoid delays in report preparation, printed forms must be used.

For example, with the same preparation techniques in place, it is feasible to compare the financial results of a large number of organizations with confidence. However, the principle of consistency does not always work since some managers seek to bend the accounting standards to better their financial presentations.

Objectives of Cost Accounting

There is a connection between management information needs, objectives, and techniques and tools used for analysis.

It has the following main objectives to serve:

1. Ascertainment of cost

In the first step, cost ascertainment entails collecting and categorizing costs. Those expenses that can be charged directly to the manufactured products are allocated.

The remaining expenses that cannot be allocated directly are then apportioned on a suitable basis. As a result, the cost of manufacturing goods is determined.

2. Controlling cost

It assists in achieving the goal of cost control through the use of various techniques such as budgetary control, standard costing, and inventory control.

At the start of the period, each cost item [material, labor, and expense] is budgeted, and actual expenses incurred are compared to the budget. This improves the enterprise's efficiency.

3. Ascertainment of Profitability

It assists in determining the cost, profit, or loss of each product, process, job, operation, or service rendered on an objective basis by matching cost with activity revenue. The profit and loss statement and the balance sheet are also submitted to management regularly.

4. Classification of Cost

It divides costs into components such as materials, labor, and expenses. It has been further subdivided into direct and indirect costs for cost control and recording.

5. Fixation or Selling Prices

It directs management in the determination of product selling prices. It is also useful in the preparation of tenders and quotations.

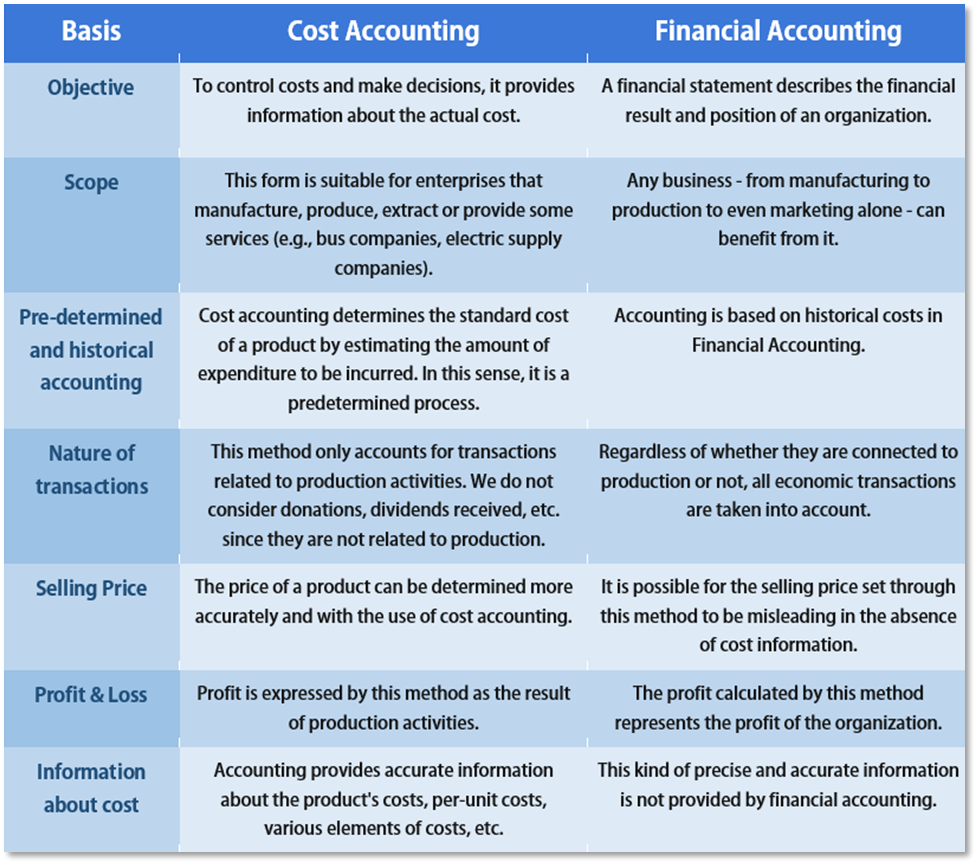

Cost Accounting vs. Financial Accounting

While cost accounting is frequently used by company management to aid in decision-making, financial accounting is typically seen by outside investors or creditors.

Financial accounting uses financial statements to communicate a company's financial position and performance to outside sources, including information on revenues, expenses, assets, and liabilities.

Cost accounting is most useful as a tool for management in budgeting and establishing cost control programs that can help the company's net margins in the future.

One significant distinction between cost accounting and financial accounting is that whereas financial accounting classifies costs according to the type of transaction, cost accounting classifies costs according to management's information needs.

Cost accounting does not have to meet any specific standard, such as generally accepted accounting principles (GAAP), because it is used as an internal tool by management. It thus varies in use from company to company or department to department.

or Want to Sign up with your social account?