Profit and Loss (P&L) Statement

A Profit and Loss (P&L) Statement, also known as the income statement, is one of the three financial statements that companies prepare.

What Is A Profit and Loss (P&L) Statement?

A Profit and Loss (P&L) Statement, also known as the income statement, is one of the three financial statements that companies prepare. It contains information pertaining to a company’s revenue and expenses over a given period.

Profit and loss are two financial terms that are probably the most common in the world of finance and business. Hence it is very important to understand them. It also allows investors to measure not just the efficiency of the company, but also its performance.

There are many ways to obtain information about the profit and loss of a company. Among them, the most important one is the Profit and Loss Statement (also called the income statement).

The Profit and Loss statement is one of the financial statements a public company is required to file with the Securities and Exchange Commission (SEC), which outlines its revenue, expenses, profits, and losses. Even if the company does not trade publicly, tax laws require preparation of a profit and loss statement to ascertain the amount of taxable income.

Understanding the P&L Statement requires an understanding of what it contains.

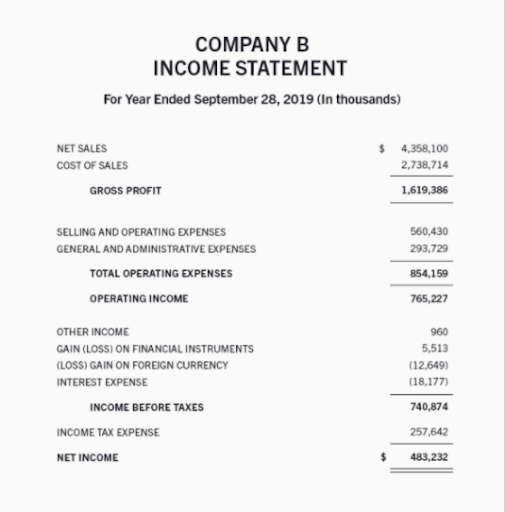

A typical income statement would start off with the company name, as well as the period it covers. Although some companies use slight variations in naming and structuring their income statement, most start off with sales and cost of goods sold (COGS) to arrive at the gross profit.

Operating expenses of the company are deducted from the gross profit to arrive at the operating profit. Any other gains or losses, such as gains or losses from sale of fixed assets are accounted for, which leads to the EBIT.

Interest and tax expense are finally deducted from the EBIT to arrive at the final net profit figure.

Please check out our video on the income statement from our Financial Statement Modeling Course below!

What Is Gross Profit?

Gross profit refers to the portion of revenue available after subtracting the cost of goods sold (COGS). The formula to calculate gross profit is:

Gross Profit = Revenue - COGS

Gross profit is useful to investors as it allows them to understand how efficiently the business produces and sells its goods and services. A higher gross profit means that the business is able to charge higher GP margins which in turn means that they either have a very efficient system of production or operate in a low competition space (leading to higher sales price).

The gross profit margin is a formula that uses gross profit and revenue to help companies understand how much of their revenue equates to gross profit. The higher the gross profit margin is, the more efficient and profitable the business is at the production stage.

The formula for the gross profit margin is

Gross Profit Margin = (Revenue - COGS) / Revenue

Or

Gross Profit Margin = Gross Profit / Revenue

Let us understand this with the help of an example.

Example of Gross Profit

Monkey Inc is a company that is focused on creating devices that peel bananas by themselves. In 2020, they reported $2,400,000 in revenue by selling 100,000 units of their devices from an inventory of 120,000 units. It costs them $6 to produce each of their banana peeling devices.

In order to determine gross profit, we must determine what the revenue and COGS are. In this example, revenue is reported at $2,400,000. COGS, on the other hand, is not given outright.

The example tells us that COGS is $6 per unit, they sold 100,000 units, and had a total inventory of 120,000 units.

Despite having a total inventory of 120,000, COGS is only concerned with the units they actually sold, which turns out to be 100,000 units.

Therefore,

COGS = 100,000 x $6 = $600,000.

This means that

Gross Profit = $2,400,000 - $600,000 = $1,800,000

Now that we have derived the gross profit, we can also determine Monkey Inc's gross profit margin.

Gross Profit Margin = $1,800,000 / $2,400,000 = 75%

A gross profit margin of 75% is a really good indicator for the management and investors, as it shows them that for each dollar they make on revenue, they receive 75 cents, with only 25 cents incurred as production costs.

Operating Expenses

Operating expenses cover most of a company’s expenses other than that of the directly attributable cost of goods sold.

A company usually incurs many other expenses other than COGS. Most of these expenses are made up of selling, general, and administrative (SG&A) expenses, depreciation, and amortization. Operating income can be calculated as:

Operating Income = Gross Profit - Operating Expenses

Operating income is a company’s income before taking into account the effect of non-operating expenses or gains, taxes, and interest expenses. Non-operating expenses include things like inventory write-offs, restructuring costs, and legal expenses.

They usually have a small effect on a company’s overall earnings. Subtracting non-operating expenses from operating income leaves us with the company’s earnings before interest and taxes (EBIT).

Interest and Taxes

Interest expense is the cost of borrowing money. A company that has taken on debt incurs interest expense on the borrowings that it needs to pay periodically.

In many cases, investors use EBIT to measure a company’s value because it measures income without considering the capital structure of the company.

Deducting interest expense from EBIT leads us to the EBT. This is the pretax earnings that is available to the shareholders of the company.

EBT excludes the effects of taxes. It is helpful to understand how the company has performed ignoring the effect of taxes, especially while comparing companies that are domiciled in geographies with different tax rates.

Taxes are then reduced from the EBT to arrive at net income.

There are only two certainties in life: death and taxes. While companies may be able to stave off the former on account of lack of mortality, the latter still applies. Companies must pay taxes on income as well as on activities like sales. Many taxes are industry-specific and vary from company to company.

What Is Net Profit?

Net profit, or net income, refers to the actual realized profit a company generates after deducting all expenses of the company. The formula to calculate net profit is:

Net Profit = Gross Profit - Expenses including tax and interest

OR

Net Profit = Revenue - COGS - Expenses including tax and interest

Equity investors are primarily interested in a company's net profit as it measures how much income the business is generating that is attributable to them.

Also, the net profit margin is used in conjunction with net profit as it shows the proportion of how much a company's revenue will actually result in profit available to owners of the company.

The formula to calculate net profit margin is given as:

Net Profit Margin = Net Profit / Revenue

Let us illustrate the concept of net profit with an example.

Example of Net Profit

Monkey Inc has been operating since 2018. In 2019, they reported a revenue of $1,000,000 and sold 42,000 units. Their cost of production was $12 per unit sold in 2019. They incurred a total of $350,000 in expenses.

In order to determine net profit, we must first calculate gross profit. We know that the revenue is $1,000,000 and COGS is $12 x 42,000 = $504,000. Therefore,

Gross Profit = $1,000,000 - $504,000 = $498,000

As expenses were $350,000, we can calculate net profit using the formula:

Net Profit = $498,000 - $350,000 = $148,000

Now that we have net profit, we can also determine the net profit margin.

Net Profit Margin = $148,000 / $1,000,000 = 14.8%

A net profit margin of 14.8% is a positive indicator for investors, as it indicates that for every $1 made in revenue, the amount the company will generate a profit of 14.8 cents.

The net profit is the conclusion of the Profit and Loss Statement. It is the figure that represents the total profit or loss the company has generated over the period, which is available to its owners.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?