EBITDA Margin

It helps in comparing the relative profitability of two or more businesses of various sizes operating in the same sector.

What is EBITDA Margin?

EBITDA margin is a financial metric that measures a company's profitability as a percentage of its revenue, specifically looking at its earnings before interest, taxes, depreciation, and amortization (EBITDA) as a proportion of total revenue.

The formula to compute the ratio:

EBITDA Margin = (EBIT + Depreciation + Amortization) / Total Revenue x 100

Or simply

EBITDA Margin = EBITDA/ Total Revenue x 100

EBITDA margin provides insights into how much money the company makes from its core operations before considering the impact of non-operating expenses.

Investors, analysts, and business stakeholders often use EBITDA margin to compare the profitability of different companies within the same industry or to track a company's financial performance over time.

A higher EBITDA margin generally indicates better operating efficiency and profitability, while a lower margin may suggest lower profitability or higher operating expenses.

Key Takeaways

- The EBITDA margin helps in comparing the relative profitability of two or more businesses of various sizes operating in the same sector.

- The formula to calculate is: EBITDA margin= EBITDA / total revenue x 100

- When computing the EBITDA, excluding costs related to depreciation and amortization from the revenue is essential.

- The improvement in the EBITDA margin and the variation in this metric may suggest that the company has taken measures to reduce costs, increase efficiency, and improve its operation.

EBITDA Margin Example

Consider the case below:

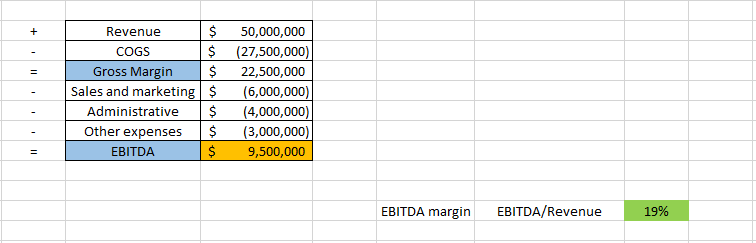

The following Excel sheet illustrates a small table highlighting how we compute the EBITDA based on items from the income statement.

The EBITDA is determined by subtracting all the variable costs (COGS) and SG&A, representing fixed costs such as marketing, administrative, and other related expenses.

The EBITDA margin can be obtained by dividing the EBITDA by the revenue.

Here:

9,500,000 / 50,000,000 x 100 = 19%

A business's operating cash profit margin is defined as its EBITDA margin when expenses, taxes, and organizational structure are excluded.

By eliminating the impact of non-cash expenses, investors and analysts can gauge the profit generated for each unit of sales.

They can then utilize the margin as a comparison point with other companies in the same sector.

A popular way of computing the valuation of a company is by employing the comparable analysis, which relies mainly on the EBITDA.

However, some companies exclude debt during the process of valuation, which can have drawbacks when assessing overall performance.

A corporation will occasionally draw attention to its EBITDA margin to deflect attention from its debt and improve the perception of its financial performance.

Interpretation of EBITDA Margin

The EBITDA margin is a ratio that highlights the portion of profits coming from the operation of the activities compared to the total revenue.

This metric is essential for investors seeking to buy a company as it gives a general viewpoint on whether the business can generate profits based on the core business.

Witnessing a higher EBITDA margin from one year to another could indicate that the company is effectively cutting costs.

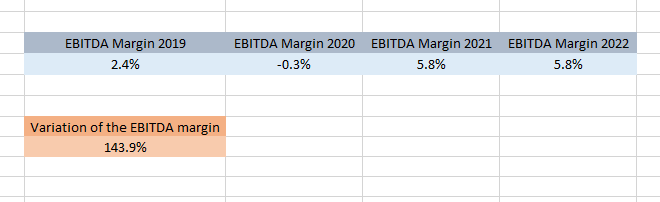

In this case, the EBITDA margin decreased from 2.4% in 2019 to -0.3% in 2020, suggesting a negative EBITDA during the pandemic crisis.

As is apparent, the EBITDA margin surged in 2021 to 5,8% and stabilized in 2022.

This resurgence may be attributed to a new cost-cutting policy adopted following the COVID-19 pandemic. This policy may have involved employee layoffs, negotiations with suppliers, rent negotiations, or higher sales volumes without proportionally increasing expenses.

Another factor to consider would be the variation of the EBITDA margin from 2019 to 2022.

The ratio fluctuation can be computed using the following formula:

EBITDA Margin Fluctuation = (EBITDA margin 2022 - EBITDA margin 2019) / EBITDA margin 2019 x 100

Consequently, the ratio has surged to a +143.9% increase during the described period. These results suggest that the operating profitability of the company has enhanced.

This increase can be associated with a better cutting-cost policy and might result from higher revenues generated by sales.

Advantage of the EBITDA Margin analysis

Always remember that the EBITDA margin ratio measures the profitability of the operational side of the activity. Here are some advantages of EBITDA margin analysis:

- Operational Performance: Leaving out interest, taxes, depreciation, and amortization concentrates on a business's operational characteristics. It helps analysts and investors evaluate how successfully a company performs its main business operations.

- Comparability: These margins help evaluate a company's performance over periods and compare the profitability of businesses in the same industry. It offers a more uniform metric for comparison because it does not include non-operating costs.

- Simplicity: It is a relatively simple metric to calculate, making it easy for investors, analysts, and other stakeholders to understand a company's profitability without delving into complex accounting details.

- Cash Flow Proxies: Since EBITDA does not include non-cash costs like amortization and depreciation, it is frequently used as a stand-in for cash flow from operations. EBITDA might be very important when evaluating a company's capacity to produce enough cash to meet its operational and financial responsibilities.

- Useful for Capital-Intensive Industries: EBITDA provides a clearer picture of the company's ability to generate cash and profit in industries where depreciation and amortization expenses are significant, such as manufacturing or infrastructure.

- Mergers and Acquisitions: EBITDA is commonly used in valuation and acquisition analyses. Buyers may focus on this because it provides a clearer picture of a company's earnings potential without the impact of financing decisions, accounting methods, or tax strategies.

- Strategic Decision-Making: It can be a useful tool for management in making strategic decisions. By focusing on operational profitability, management can identify areas for improvement and make informed decisions to enhance overall performance.

Drawback of the EBITDA Margin analysis

However, relying too much on a single indicator may distort the assessment of the financial situation. In reality, the EBITDA may hide financial burdens. It has several drawbacks and limitations that should be considered, such as:

- Exclusion of Interest and Taxes: Interest and taxes are not included. Disregarding interest costs and taxes can be deceptive, particularly when contrasting businesses with various capital structures or evaluating a company's capacity to repay loans.

- Exclusion of Depreciation and Amortization: Ignoring depreciation and amortization expenses can lead to overestimating a company's cash flow and profitability, particularly in industries with significant capital expenditures.

- Ignores Changes in Working Capital: A company's cash flow and profitability may be underestimated in industries where significant capital expenditures are typical if depreciation and amortization charges are overlooked.

- Non-Standardized Calculations: Due to variations in what is included or omitted from the computation, the EBITDA calculation may fluctuate between firms. It may be difficult to compare EBITDA margins between businesses or industries due to a lack of standardization.

- Misleading Profitability Picture: It focuses on operating profitability and may not accurately represent a company's overall financial health. A company with a high EBITDA margin may still face financial challenges if it has high-interest payments, substantial debt, or other non-operating issues.

- Inappropriate for Certain Industries: It is unsuitable for industries with high capital expenditures or where depreciation is a significant factor. Industries such as manufacturing, utilities, and infrastructure may have large depreciation expenses that significantly impact their true profitability.

- Lack of Cash Flow Information: While EBITDA is often used as a proxy for cash flow, it does not provide a complete picture of a company's cash flow. EBITDA excludes changes in working capital and may not accurately reflect a company's ability to generate free cash flow.

- Focus on Short-Term Performance: It may encourage a short-term focus on profitability without considering the long-term sustainability of a company's operations.

Conclusion

A higher EBITDA margin ratio over a certain period might indicate that the company is performing well regarding the operational side of its activity.

However, it is important to note that profitability ratios such as the EBITDA margin do not consider the net debt and the tax liabilities, which are crucial metrics in a company valuation assessment.

A low EBITDA margin compared to other companies in the same industry suggests that its activity is underperforming.

In the long run, the management team would eventually face liquidity problems as they cannot follow the rhythm of the competitors.

The EBITDA margin should not be used to evaluate companies with significant debt loads. Instead, the ratio analysis should take large interest payments into account.

It is important to remember that a positive EBITDA doesn't always imply that a company is making money and should only be considered a tool and not the only means to analyze a company’s financial situation or valuation successfully.

Everything You Need To Master Financial Statement Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?