EBITDARM

It stands for Earnings Before Interest, Taxes, Depreciation, Amortization, Rent, and Management Fees.

EBITDARM is a financial metric for “earnings before interest, taxes, depreciation, amortization, rent, and management fees.” It is used to evaluate the performance of certain companies with high operating costs related to rent and management fees.

On the other hand, EBITDA represents “Earnings Before Interest, Taxes, Depreciation, and Amortization.”

By adding these four expenses to net income, EBITDA provides a measure to compare companies across different industries and sectors, as it eliminates the effects of financing and accounting decisions and tax environments.

It measures the profitability of a company's core operations without considering the effects of its capital structure, tax strategy, or depreciation policy.

There is also a term called “LTM EBITDA.” LTM (Last Twelve Months) EBITDA measures earnings before interest, taxes, depreciation, and amortization in the last twelve months. It is also known as the Trailing Twelve Months (TTM).

TTM provides a snapshot of a company's financial performance over the most recent twelve-month period, usually from the last May to the current year's May.

By utilizing these financial metrics and their variations, businesses and investors gain valuable insights into a company's financial health and operating efficiency, allowing for better decision-making and comparisons within the industry.

Key Takeaways

- It stands for Earnings Before Interest, Taxes, Depreciation, Amortization, Rent, and Management Fees.

- It is useful when a company’s rent and management fees represent a larger-than-normal percentage of operating costs.

- It is similar to EBITDA but accounts for rental and management fees.

- It is useful in the airline industry, where rental costs are high.

- It can be computed starting from the top (sales) or the bottom (net income) line.

What are SG&A and COGS?

SG&A stands for Selling, General, and Administrative expenses. These expenses are considered indirect as they are incurred by remunerating parties indirectly involved in the main operating activity.

Let’s define each category of SG&A (Selling, General & Administrative expenses):

- Selling expenses represent advertising, marketing, and travel charges. It also includes the salaries of a direct salesforce, payroll taxes, and benefits. It can be both direct and indirect.

- General expenses represent utilities, office equipment, renting costs for offices or headquarters, and insurance.

- Administrative expenses represent consulting fees and internal indirect staff costs, such as salaries for support functions like finance and HR teams.

On the other hand, COGS (Cost of Goods Sold) regroups all direct costs incurred to produce a company’s products. Expenses for raw materials, subcontractors, and labor are examples of COGS.

Operating costs can also be put into categories:

1. Fixed costs

They don’t depend on the level of production. These costs are incurred independently of producing one unit or one million. They include insurance payments, wages for support functions, leases, and rent.

As the name indicates, these costs depend on how much you produce. They include raw materials costs, marketing, advertising, or packaging.

What is D&A (Depreciation & Amortization)?

D&A stands for Depreciation & Amortization. Depreciation is an accounting measure to record the loss of the book value of a company's long-term fixed assets over their estimated useful life. It is a non-cash expense (no cash inflows or outflows).

Amortization is a term used in finance and accounting separately:

1. In Finance

In finance, amortization refers to paying off a debt over time with regular payments that cover both principal and interest. An amortization schedule is a table that shows how much the remaining balance of the loan is after each payment.

2. In Accounting

The process of distributing an intangible asset's cost throughout its useful life is known as amortization in accounting.

Non-physical assets with value are known as intangible assets, such as patents, trademarks, goodwill, or software.

Amortization is similar to depreciation. However, it's worth noting that depreciation is typically applied to physical assets like property, plants, and equipment, except land.

At the same time, amortization is used for intangibles like copyrights, licenses, trademarks, patents, customer lists, etc.

EBIT is often reported on the income statement as operating profit, operating income, or profit before interest and taxes. However, EBITDA and EBIT are useful for comparing companies' operating performance without accounting for the capital structure and tax regime.

However, D&A reflects differences among companies in capital spending and depreciation methods (straight line or accelerated). Therefore, EBIT is also a less precise metric of the operating cash-flow proxy because it is affected by the non-cash expense D&A.

Now that you understand EBITDA's meaning, calculating EBITDARM is no longer a magic trick.

How is EBITDARM calculated?

It is calculated by adding back rent and management fees to EBITDA. Alternatively, it can be calculated by adding back interest, taxes, depreciation, amortization, rent, and management fees to net income.

The formula is:

EBITDARM = net income + interest + taxes + depreciation + amortization + rent + management fees

or

EBITDARM = EBITDA + rent + management fees

It is not a standardized or regulated measure under GAAP, and different companies may use different definitions or calculations.

It is important to understand how a company derives its EBITDARM and compare it with other companies that use the same methodology. Furthermore, it should not be used in isolation but rather in conjunction with other financial metrics that reflect a company's full costs and liabilities.

NOTE

EBITDARM is useful for analysts, investors, creditors, and rating agencies who want to assess the operating performance and debt servicing ability of companies with high rent and management costs.

However, EBITDARM has its constraints. For example:

- It does not reflect the actual cash expenses a company incurs for rent and management fees, which may reduce its liquidity and solvency.

- It does not account for the quality or efficiency of the assets or managers that a company uses or hires.

- It may overstate a company's profitability and cash flow by ignoring significant non-operating costs.

- It may be manipulated by changing the terms or timing of rent or management contracts.

- It may not be comparable across industries or sectors with different operating characteristics or capital structures.

Therefore,it should be used cautiously and supplemented with other financial measures that capture the full impact of rent and management costs on a company's performance.

Comparing EBITDA and EBITDARM in the Airline Industry

Airlines face high fixed costs, volatile fuel prices, cyclical demand, and regulatory constraints. As a result, analysts often use different metrics that adjust for these factors to evaluate airlines' financial performance and profitability.

Comparing both in the airline industry provides valuable insights into the financial performance of airlines, particularly due to the industry's unique characteristics and challenges.

Both are useful for airlines because they allow analysts to compare the operating performance of different airlines without being affected by their financing, accounting, tax, and capital structure decisions.

Here's how both are useful and differ across airlines:

1. Usefulness of both for Airlines

- Comparable Operating Performance

- Focus on Core Operations

- Adjustment for Rent and Management Costs

2. Differences in both across Airlines

- Rent and Management Fees

- Variations in Expenses

- Margin Comparisons

For example, some airlines may have more debt than others, affecting their interest expenses and net income. Some airlines may have different depreciation methods or tax rates than others, which would affect their operating income.

By using both, analysts can focus on the core operations of airlines and how efficiently they generate revenue from their assets.

EBITDARM is especially useful for airlines because it also adjusts for the differences in renting and managing assets. For example, airlines often lease the aircraft they use instead of owning them outright, which means they have to pay rental fees to the lessors.

Apart from that, how do EBITDA and EBITDARM differ across airlines?

As mentioned above, by using it, analysts can compare the profitability of airlines without being affected by their rent and management costs.

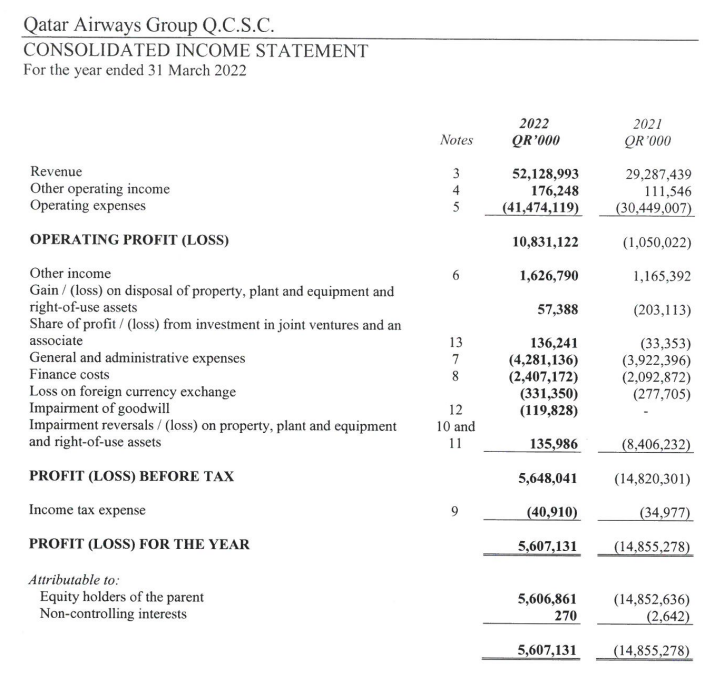

For example, as shown in the picture below, both can differ significantly in airlines.

(Look at the huge numbers in front of general and administrative expenses!!!)

IATA estimates that the global airline industry had an average EBIT margin of 5.5% in 2019.

This indicates that for every $100 in airline revenue, $5.5 remained as operating profit before interest and taxes in 2019. However, this average masks significant variations across regions and individual airlines.

Look at the table below, which compares the EBIT margin, EBITDA margin, and EBITDARM margin for some of the major airlines in 2019:

| Airline | Region | EBIT margin | EBITDA margin | EBITDARM margin |

|---|---|---|---|---|

| Delta Air Lines | North America | 14.9% | 24.4% | 28.8% |

| American Airlines | North America | 7.4% | 15.8% | 23.4% |

| United Airlines | North America | 9.8% | 18.6% | 24.0% |

| Southwest Airlines | North America | 13.7% | 22.3% | N/A |

| Lufthansa Group | Europe | 5.6% | 14.1% | 19.4% |

| Air France-KLM Group | Europe | 4.8% | 12.7% | 18.3% |

| IAG Group | Europe | 9.8% | 18.0% | 23.1% |

| Ryanair Group | Europe | 16.2% | 25.3% | N/A |

| Emirates Group | Middle East | 4.2% | 13.8% | N/A |

| Qatar Airways Group | Middle East | -0.4% | N/A | N/A |

Source: Statista

or Want to Sign up with your social account?