Forward Dividend Yield

It predicts the firm's yearly dividend as a percentage of its current stock price.

What Is a Forward Dividend Yield?

The Forward Dividend Yield, also called the "forward yield" or "leading" dividend yield, predicts the firm's yearly dividend as a percentage of its current stock price. Tips are how companies share their net profits with investors.

The forecasted dividend for the year is obtained by using the stock's most recent dividend payment and annualizing it. The forward dividend yield can be calculated by dividing the projected dividend payment by the current stock price.

Forward Yields are usually used when the yield can be predicted based on previous cases. If this is not the case, then the trailing creation is used, which is also generally calculated for a year.

For many investors, the dividends paid out to them by firms are an essential source of income aside from a rise in stock prices. To an investor, dividend yields can even mitigate the loss from a stock price fall.

The dividend yield is not to be confused with the dividend payout ratio. The dividend payout ratio is the percentage of the firm's net profits which are paid out. In contrast, the dividend yield is the percentage of the share price paid in dividends.

A low payout ratio is indicative that the firm is using most of its income to grow its operation. A payout over 100% can mean the company is paying more dividends than the profits can support.

Key Takeaways

- The Forward Dividend Yield, also called the "forward yield" or "leading" dividend yield, predicts the firm's yearly dividend as a percentage of its current stock price.

- When deciding on an investment strategy, a promising direction might be to invest in businesses with a track record of reasonable dividend payments.

- These portray the estimated payment to be paid out in a given period in the future.

- The trailing dividend yield is the opposite of a forward dividend yield.

- The dividend policy of a company is decided by its board of directors.

- A standard dividend policy is a stable dividend policy wherein the company issues dividends regardless of the profit level.

- In a consistent dividend policy, a dividend is issued annually per the firm's profit percentage.

- In a residual dividend policy, anything is paid after the company's capital expenditures and needs for working capital are met.

- By and large, dividend yields between 2% to 4% are considered good, and anything above 4% can be a great buy, but it can be risky too.

Understanding dividend yields

When deciding on an investment strategy, a promising direction might be to invest in businesses with a track record of reasonable dividend payments. However, a firm's former track record of paying exorbitant dividends does not guarantee that it will continue to do so in the future.

When deciding on dividend shares, it may help to have a decent understanding of dividend yields. It can estimate how much money you might be given for each unit of currency invested in the business.

In some circumstances, some individuals may waste all their efforts on dividend yields rather than focusing on the stability of the stock price, company performance, etc.\

Dividends are how companies share their net profits with investors, but the board must first approve these payouts of directors.

The board must approve any dividend payouts even if a company has earned an obscene amount of profits in a given period. Dividends can officially be paid out at any time but are generally paid yearly.

Forward Dividend Yield Formula

The formula is:

Forward Dividend Yield = Future Dividend Payment/ Existing Market Share Price

A common way for dividends to be paid is quarterly. When quarterly reports are posted, investors and analysts need the information to compare, analyze and make decisions.

An investor could compare the dividend payment of a quarter to the same quarter the previous year or even to other quarters in the same year, and the change in the dividend payments can help him or her make an investing decision. Analysts can compare these figures to other companies in the industry to assess the firm's performance.

Firms in specific industries, such as real estate, are known to increase dividend rates slowly over time. It can be because the company is doing well and income is rising; there is more room to pay shareholders higher dividends. A dividend spike shows that the company is performing well in this situation.

The current yield could be small, 3 percent, for example. Still, suppose the dividend is raised yearly by more than the inflation rate.

In this situation, the shareholder is provided with an increasing stream of revenue, which is more valuable than the current dividend yield because it protects him against inflation. A growing dividend makes a stock more valuable to investors and may cause the share's price to appreciate.

How to calculate Forward Dividend Yield?

Since firms that pay dividends generally have good liquidity, they may be financially stronger than companies that don't. The formula for calculating dividend yields is pretty straightforward, and the numbers required to calculate them can easily be found on websites such as Bloomberg and yahoo finance.

Forward dividend yields portray the estimated payment to be paid out in a given period in the future. Investors use it to calculate returns for a particular stock or portfolio of supplies.

Companies distribute their profits as dividends while retaining the remaining portion to reinvest in the business. Rewards are paid out to the shareholders of a company.

Dividend yield measures the quantum of earnings through total dividends that investors make by investing in that company. It is usually expressed as a percentage. The formula for computing the dividend yield is

Dividend Yield = Cash Dividend per share / Market Price per share * 100%

If a company pays a first quarterly dividend of $0.59 per share and shareholders believe this will continue for the coming quarters, the firm is expected to pay $2.36 per share as dividends within a year.

As in the formula above, the forward yield would be 14.75%, given that the share price is $16.

Importance of dividend yields

The dividend yield is a hot topic in investing!! Examples of industries where dividend yields have traditionally been high are oil, telecommunications, and commercial real estate. These industries are relatively stable, have been for a long time, and are known to pay high dividends.

In the current low-interest rate environment, you make very little return putting your money in treasury bonds or savings accounts. It is why many investors turn to high dividend yield industries with relatively low share price volatility.

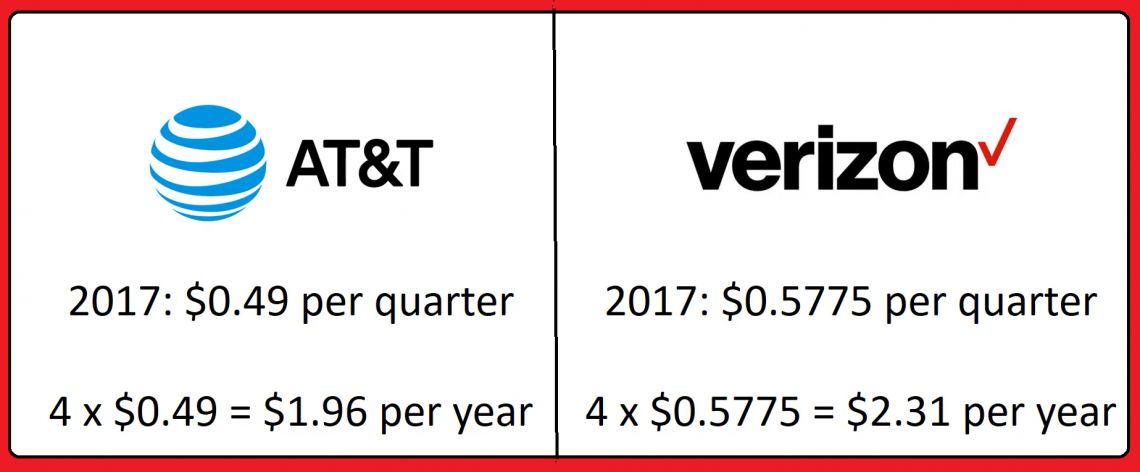

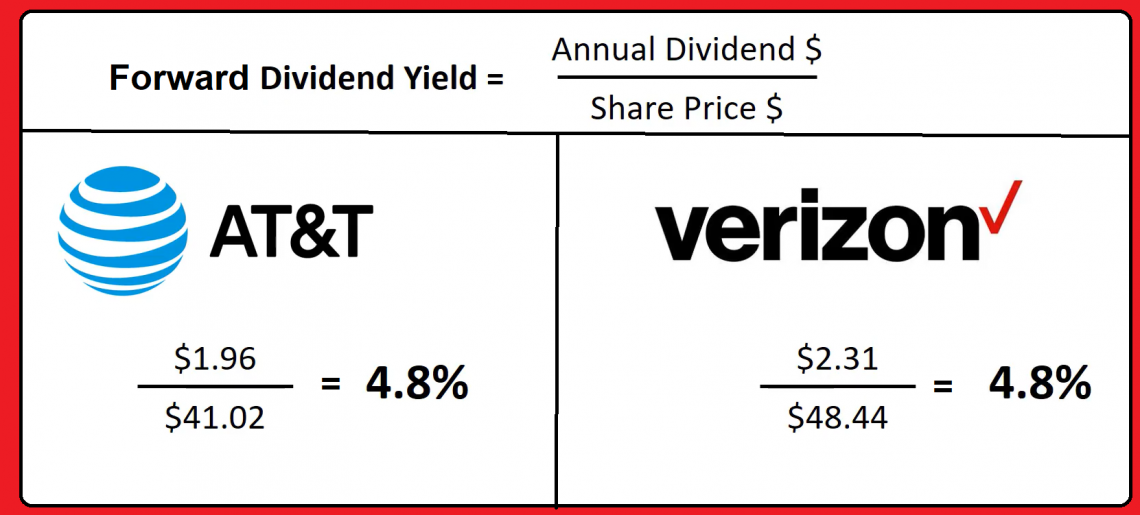

Consider two telecom companies, AT&T and Verizon, to show the significance of dividend yields.

In 2017 AT&T was paying a dividend of $1.96 annually, whereas Verizon was paying $2.31 annually. So it might seem like Verizon is the better investing choice.

We can see a different investing scenario after calculating the yield.

AT&T has an annual dividend of $1.96 and a closing share price on April 5th, 2017, of $ 41.02, making the forward dividend yield 4.8%.

Verizon has an annual dividend of $2.31 and a closing share price of $ 48.44, which means its forward yield is also 4.8%. Thus, in this case, the dividend yield does not help us in our investing decision.

Higher dividend yields make a company more attractive to investors. However, they limit the growth potential of a company. It is because the money paid out in dividends could have otherwise been used to reinvest and grow the company.

Generally, startups and smaller firms pay fewer dividends as they need more funds to sustain and grow their business.

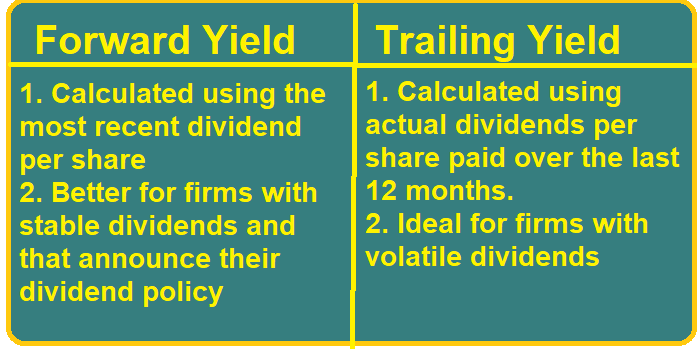

forward Vs. trailing dividend yields

The trailing dividend yield is the opposite of a forward dividend yield. When the payment amount and timings are very volatile, the most reasonable calculation involves taking the last year's dividend payouts and dividing that number by the company's existing share price.

It is called the trailing dividend yield. The trailing dividend yield is beneficial when the dividend payment for the coming year is uncertain.

On the other hand, when a company has announced a regular dividend payout for the subsequent one-year period, the forward dividend yield is a more accurate reflection of what the shareholders might receive.

If a company has announced a rise in dividends for the forward dividend yield, even though no payments have been made, this may be considered payment for the following year.

Similarly, if a business declares that it will stop its dividend payment, the yield would be assumed to be zero.

Trailing dividends are the simplest way of looking at and calculating a company's annual dividend amount. They are calculated from actual dividend payments made by the company over the last year.

To calculate a company's TTM dividends, all dividend amounts from the last 12 months are combined to arrive at the total dividends paid over the previous year.

Forward dividend yield and corporate dividend policy

The dividend policy of a corporation is chosen by its board of directors. Usually, large firms issue dividends, but smaller businesses often use profits for research, development, and business growth.

A few common types of dividend policies are explained below.

1. Stable dividend policy

A standard dividend policy is a stable dividend policy wherein the company issues dividends regardless of the profit level.

The dividend paid to shareholders depends on how well the business fares in the long term. A company that churns out higher profits over several accounting cycles is more likely to pay higher dividends.

If a company has a stable dividend policy, it will align its payouts to shareholders with how it is doing in the long term rather than basing it on short-term fluctuations.

For example, if a firm decides to set a stable dividend policy of 2%. The stockholders will receive 2% of the company's net profits as dividends regardless of how well the company did that year.

2. Constant dividend policy

In contrast, for a consistent dividend policy, a dividend is issued annually as per the percentage of the firm's profit.

Investors in constant dividend policy scenarios are exposed to the risk of dividend volatility.

Under this dividend policy, a company pays its shareholders a fixed portion of earnings as dividends. For example, a company may pay out 7% of its profits as dividends to the shareholders yearly.

3. Residual dividend policy

Finally, in a residual dividend policy, anything is paid after the company's capital expenditures and needs for working capital are met.

A residual dividend policy lets a company focus on development and growth. It's a more secure policy focusing on long-term stability rather than immediate profitability.

This model allows a company to have a more straightforward form of accounting because basic operational expenses are paid out of cash flow.

Establishing a dividend policy is one of the most important things you can do regarding your company's finances. It communicates your company's financial strength and value, creates goodwill among shareholders, and drives stock demand.

What Is a Good Dividend Yield?

Investors will often look for firms that offer high dividend yields, but it is essential to understand the circumstances leading to the high product. In many cases, a high dividend yield can be misleading, and other factors must be considered.

By and large, dividend yields between 2% to 4% are considered good, and anything above 4% can be a great buy, but it can be risky too. From its introduction in 1957 till now, the average dividend yield of the S&P 500 companies is 4.25%.

High dividend yield stocks offer more earnings, but higher yield often comes with a higher risk. Conversely, lower-yielding dividend stocks equal fewer earnings, but more stable companies usually provide them with a history of consistent growth and steady payments.

A high dividend yield may be a bad sign since the company returns so much of its profits to investors rather than reinvesting it.

A stock offering a substantially higher dividend yield than the market average might be financially unstable.

The higher dividend yield could be because of the company's share price plummeting. If a stock priced at $20 a share is paid at a $2 annual dividend, that would equal a 10 percent return. But if the stock price drops to $10 a share, its dividend yield rises to 20 percent.

Analyzing Dividend Payout Ratios

When deciding between a high or low-yielding low-dividend stock as the better investment, one can look at the payout ratio to diagnose the financial conditions of the companies offering them. The payout ratio is the proportion of a company's profits that are being paid as dividends.

A proper benchmark is 60 percent or less. Anything above that is likely to be unsustainable and could mean that the company is in a financially unstable position.

Companies with low payout ratios are usually high-growth; they use the money to invest in other projects and research. In addition, companies that do not have positive cash flow or positive earnings might also have low payout ratios.

Companies with high payout ratios might be value-oriented companies.

In these businesses, management favors shareholders with consistent dividend payout regulations and probably has few prospective projects to invest in.

The higher the payout ratio, the higher the risk that the firm thinks it won't be able to avoid a dividend cut if a terrible situation arises.

In some cases, companies pay out more than they make in profit; this can be indicative that the company is in a financial very unstable position,

There are various ways one can use the dividend payout ratio to help reveal traits about a corporation, like its financial situation.

Limitations of using Forward dividend yield

If you only look at dividend yields to make investing decisions, you might see only some of the picture. Dividend yields can often be misleading for various reasons, such as Fluctuations within the stock market.

There are limitations to using dividend yields can be for various reasons, and some noteworthy ones to take into account while making investment decisions could include the following:

1. Strategic Risk

A company producing horse-drawn carriages must have been doing very well in the 1880s. It is probably churning high earnings and paying hefty dividends.

Unfortunately, the product was at the end of its cycle and would soon be superseded by cars. When investing, it is essential to look into what stage a company is in its industry's life cycle.

A cash flow statement is a financial statement that shows how changes in balance sheet accounts change cash and cash equivalents.

The cash flow statement is essential to investors as it helps them understand where a company stands regarding liquidity.

The operating activities section of a cash flow statement can reveal whether a company is generating cash via business operations or selling business units.

3. Turkey Problem

Imagine a turkey that has been fed very well for thousands of years. This bird has extrapolated this to a very bright future ahead and will be surprised to find out that it will soon have its head chopped off.

The same principle falls to companies. The CEO of a massive global company can promise that its stocks will be secure only to repeal the statement the following day and have to cut down dividends.

In essence, a company that has shown to pay high dividends for a very long period might not be able to hold onto this, and change might be upon it.

4. Payout vs. investment

Some mature companies offer a higher proportion of their income as dividends because they lack profitable reinvestment opportunities.

Stocks in such firms can offer a high dividend yield but could be very bad regarding stock price appreciation. So only a higher dividend yield does not mean the company is doing well. Other metrics and criteria for your analysis must be used along with this.

5. Math is the only math

The forward dividend yield is the company's annualized dividend divided by the stock's current market value.

The company might be paying $4 as dividends, and $100 might be the share price making the maximum yield of 4%. In the future, the reward might be $8 and the share price $ 200, leaving the leading work still 4%.

Due to market fluctuations, the current market value of the share may increase or decrease. When prices fall, the dividend yield ratio increases, and vice versa.

A company might have improved by offering higher dividends and showing capital appreciation, but this might not be noticed if the dividend yield is the only metric used to make an investing decision.

or Want to Sign up with your social account?