Hawala

It is an informal method of transferring money based on trust between included parties.

What Is Hawala?

Hawala is an informal method of transferring money without physical money moving from one place to another.

This system is often used as an alternative to the conventional banking system, wherein instead of going through banks, it makes use of a network of money lenders or “hawaladars.”

The term is derived from the Arabic term “transfer or trust.” This is because this entire system revolves around trust and maintains the anonymity of parties rather than relying on official records.

The system is based on an honor system between the lender. It often utilizes the relationships in its network, which may be based on familial connections from the same village, ethnic ties, etc.

The system is often used in Middle Eastern countries, African countries, the Indian Subcontinent, or countries where the traditional banking sector is not very strong or may be very time-consuming, expensive, etc.

It is often categorized as underground banking due to the absence of official records and anonymity. This is why this system is often associated with illegal activities such as money laundering.

Key Takeaways

- Hawala is an informal method of transferring money without physical money moving from one place to another. It relies on a network of money lenders or "hawaladars" rather than traditional banks.

- The system operates on trust and maintains the anonymity of parties involved, which makes it associated with illegal activities such as money laundering.

- Hawala transactions are based on a trust system between money lenders and utilize relationships within the network, such as familial connections or ethnic ties.

- The benefits of hawala include speed, avoidance of cumbersome banking processes, and lower costs compared to traditional banking, especially in countries with weak banking systems.

- Due to its anonymous nature, hawala is susceptible to misuse for illicit activities, including money laundering and funding of terrorist organizations.

- Hawala operates without central authority and relies on trust, while traditional banking is highly regulated, involves official documentation, and can be slower and costlier.

Understanding Hawala

This system originated in India during the 8th century and has continued to be used worldwide, especially in Middle Eastern and African countries. It had arisen to help finance long-distance trade and to act as a protection against theft.

Over the years, the system evolved into a complex trading system that was utilized for trade along the Silk Road and subsequently evolved into a full-fledged money market instrument in South Asia.

It was only in the mid-twentieth century that it was supplanted by the more typical and formal banking institutions found in Western countries.

Since ancient times, the process is still used today, especially by workers in the Middle East and Arab countries, who use it to send remittances to family and friends. It allows them to avoid the stringent, time-consuming, and often expensive process of going through the conventional banking sector.

In place of the usual approach of employing bank wire transfers, this system of transactions provides its users with an alternative for making fund transfers across geographical borders using the elaborate network of the money lenders involved.

The system is based on the trust between these lenders and the faith that the money they owe each other will be paid off in the future.

Example of Hawala

Let's understand the process of such a transaction with the help of a hypothetical example:

Step 1: Tony, who lives in the US, has to send $1000 to his friend Pepper who lives in a faraway town in the UAE. They don’t want to go through the process of a regular bank as it's often time-consuming.

Step 2: Tony approaches the hawaladar in his city, Rhodey. He will have to provide Rhodey with the details like the recipient's name, the city she lives in, and a password. After this has been done, Tony will provide Rhodey with the amount he wants Pepper to receive, $1000.

Step 3: Rhodey then contacts the hawaladar in Pepper’s city, Nick. Nick will be asked to give Pepper $1000, provided Pepper correctly states the password. Thus, Nick will pay the amount to Pepper, deducting the commission to be charged.

Step 4: Rhodey ultimately pays off the $1000 “debt” to Pepper. However, as no official documents are signed, Nick trusts that Rhodey will settle his dues by paying Pepper. This process takes place over the span of a couple days.

How does Hawala work?

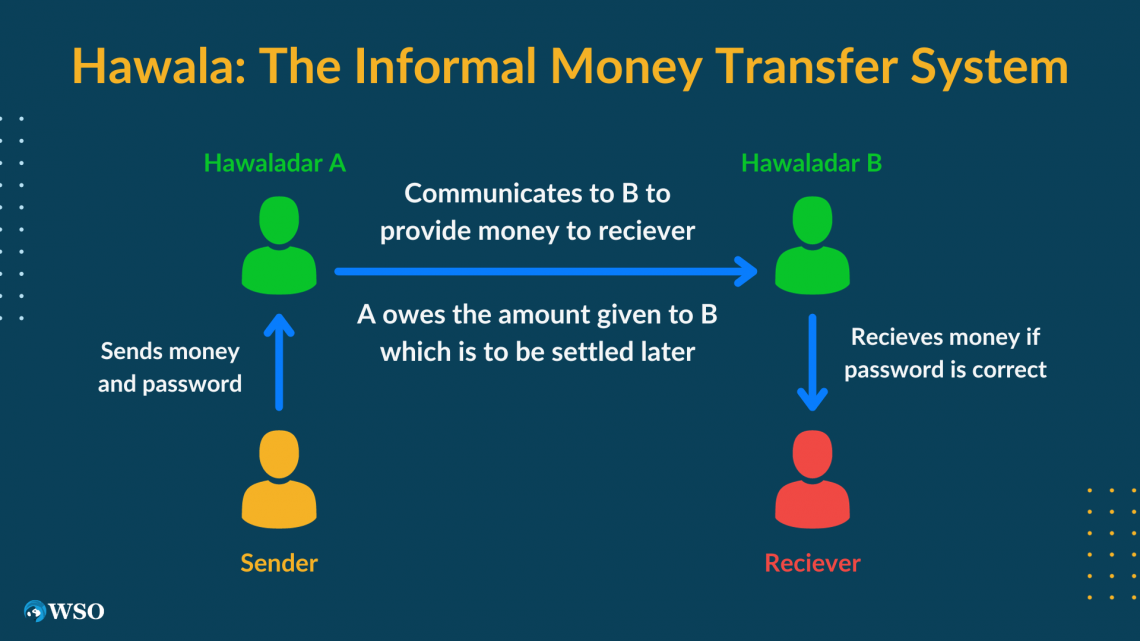

The hawaladars play the most critical role in this system. The entire system relies heavily on trust in these money lenders, family relationships, and connections. The movement of money in this system mainly occurs between 4 entities:

-

The person sending the money, which was Tony

-

The sender’s money lender, was Rhodey

-

The receiver’s money lender, which was Nick

-

The receiver, which was Pepper

Hawala transactions consistently follow three steps, which are:

-

The sender contacts a hawaladar to send money to the receiver after providing lenders with the receiver's details, like their name, address, and password.

-

The money lender then makes use of the network of money lenders to get in touch with another lender living in the city of the receiver and asks that lender meet up with the receiver to provide him with the amount owed after the deduction of the commission.

-

To confirm the receiver's identity, the receiver would often have to confirm the password provided.

In these transactions, no money moves across borders. In the example, even though the money was to be transferred from someone in the US to UAE, the money didn’t move across borders.

It was simply one money lender directing another to pay a certain sum of money, trusting that he would be paid later.

The sender's money lender thus owes money to the receiver’s money lender, where the trust system comes in. As there are no formal records and hence no legal enforceability, the lender has to trust that the other lender will settle the debt later.

To keep track of all the debts, these lenders may maintain informal journals to keep track of the debit and credit transactions. The actual debt between two lenders can be settled in cash, services, property, bets, smuggling of gold, etc.

A hawaladar who cheats and doesn’t uphold the trust or implied contract is often tagged as someone who has lost their honor and will be excommunicated from the network of lenders.

Benefits of hawala

Let us take a look at what are the benefits of Hawala below:

1. Speedy Transactions

One of the major benefits of such transactions is speed. As seen in these transactions, the entire procedure may take only a couple of days and doesn’t require any paperwork or legal formalities for the sender and receiver. One only has to find a trustworthy hawaladar, as this helps to ensure an easy procedure.

2. Informal Systems

Compare Hawala to a transaction through the regular banking system, where one might have to go through many formalities. This is even more evident in emerging countries or countries where the formal banking system is prohibitively expensive.

In such countries, people may find it more advantageous to use such informal systems. This can be seen through remittances by thousands of migrant workers, who send money to family and friends from poorer countries.

For them, the conventional banking system might be too time-consuming or expensive; hence, it can be of assistance.

Dubai, for example, has long been a place where these transactions are legal. Thus, a lot of businesses set up shops in Dubai to take advantage of these regulations, transferring money through these transactions to save money.

3. Avoiding Foreign Exchange Rates

Another reason these systems may be beneficial is the absence of foreign exchange rates. Funds enter the system in one currency and leave in another currency without an actual exchange through a money changer or on the forex market.

This means these deals can be made at rates other than the official foreign exchange rates. This is another reason why they may often be cheaper, as the money lenders may waive this fee. The main users of such systems are underbanked or unable to access conventional financial systems.

4. Fintech Advancements

Many fintech companies are basing their concepts on such systems to increase financial inclusivity. One example of this is M-Pesa, in Kenya.

Hawala and illegal activities

A major attraction of these transactions is that they are anonymous. As no official records are maintained, tracking a transaction back to an individual or a business is extremely tough.

However, its biggest drawback is the very fact that makes it attractive. The anonymous nature of these transactions gives rise to illegal activities. It is, therefore, often also referred to as underground banking.

As money laundering often aims to hide the source of money, this system is almost perfect. Criminals may try to hide their wealth from illegal activities by using these transactions.

As there is no paper trail, these transactions are also used to fund terrorist organizations globally. A report by the United Nations believed that over $150 million was collected annually in drug profits through these transactions.

Hawala and Government Regulation

Due to the unregulated nature and the potential illicit activities that can be hidden through these transactions, many countries, including India and Pakistan, have systems in place to deter the use of hawala.

Let's look at different countries and their regulations regarding Hawala:

1. United States

In the U.S., hawala is typically illegal due to limited government oversight. Financial institutions must follow anti-money laundering laws enforced by FinCEN to curb illegal activities.

Hawala transactions without proper reporting can result in heavy fines, imprisonment, and potential tax evasion charges. Given changing regulations, it's vital to consult current government sources or legal experts for the latest information on hawala regulations in the U.S.

2. India

In India, the Foreign Exchange Management Act (FEMA) and the Prevention of Money Laundering Act (PMLA) are the two main systems in place to counter hawala. Similarly, many other countries have laws to curb the negative aspects of such informal fund transfer systems.

This is often done by specifying what entities are allowed to make foreign remittances and requiring registration with certain bodies to become foreign exchange corporations.

3. African Countries

Despite the regulations, however, many fintech companies are providing financial inclusion to the underbanked populations of the world. For example, companies like M-Pesa and Paga have been providing financial inclusion in many African countries.

M-Pesa is a mobile banking service introduced in Kenya, allowing people to store and transfer money through their mobile phones. Similar to the hawala system, a person could send and receive money through M-Pesa.

The entire process of sending money to the agent and informing the receiver about a passcode is done by simple text messages. Again, this is to boost the ease of transactions.

However, it removes the anonymous and unregulated nature of the underground banking system. This ultimately leads to illicit activities having proper records that law enforcement can track.

An article by the International Monetary Fund (IMF) details these transactions and their effects on organizations like the IMF and the world. It also specified how the countries where these transactions occur should try to regulate them and, most importantly, look into improving their financial systems.

Hawala Vs. Traditional Banking

Hawala and Traditional Banking are not one and the same thing. There are some differences between both the structures which are listed below:

| Hawala | Traditional Banking |

|---|---|

| This system is mostly unregulated by the government, and there isn’t any form of central authority. | This system is highly regulated and is overseen by the government, central banks, and other financial institutions. |

| There isn't any official paperwork, making legal action impossible in the case of fraud. These transactions are thus based on trust between the parties. | All the transactions are official with documentation and, therefore, legal obligations. |

| The transactions are completed quickly as people do not need to go through a lot of regulations and formalities. | International money transfers may take several days to complete due to the regulations involved. |

| These transactions may offer lower fees and better exchange rates, as the money never actually enters the official forex system. | The fees and exchange rates are fixed and tend to be higher. |

Hawala FAQs

These transactions are illegal in many countries like India and Pakistan, with specific regulations to deter such transactions. For example, in India, the Foreign Exchange Management Act (FEMA) and the Prevention of Money Laundering Act (PMLA) are the two main systems in place to avoid using these transactions.

In countries like Dubai, however, such transactions are legal, provided that the hawaladar is registered and abides by the regulations set by the central bank.

It is the money transferred through this system, in which there is no actual movement of funds from one account to another, no paper trail, and no promissory notes.

These transactions are usually a cheaper alternative to transacting through the traditional banking system. The commission rates are often as low as 0.2-0.5%, in contrast to banks, where the rates can be as high as 12-15%.

This is partly due to the fact that there is no official exchange of currency in the hawala system, meaning that the forex rates aren’t fixed.

Researched and Authored by Soumil De

Reviewed and edited by James Fazeli-Sinaki | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?