Revolver Debt

A short-term credit facility that allows a firm to access funds up to a specified limit for operating expenses or one-time transactions

What is Revolver Debt?

A firm's revolver, also known as revolving credit facilities, is a line of short-term credit which it can access when it needs short-term funding to pay for operating expenses or one-time transactions.

Credit cards are considered a revolving line of credit, where the bank offers the individual the ability to draw money up to a specified amount, in return for them making minimum periodic payments for the interest and the principal amounts are drawn.

Having a revolving credit line means that the borrower can borrow as much credit as they want, up to a maximum limit. This facility is almost always used for short-term financing and is generally repaid very quickly. It can be thought of as a credit card for companies.

Key Takeaways

- Revolving credit facilities provide short-term funding for businesses, functioning like credit cards.

- Advantages of revolving debt include ready access to funds, addressing cash flow issues, and flexibility in repayments.

- Disadvantages of revolving debt include lower credit limits, higher interest rates, and potential commitment fees.

- Common uses of revolving debt include managing cash flow and securing flexible funds for day-to-day operations.

- Fees associated with revolving credit include upfront, interest, utilization, and commitment fees.

Understanding how a revolver work

A business that is currently facing issues with its cash flow, and would find it helpful to take advantage of utilizing a revolving line of credit that it is able to access, would apply for a revolving line of debt.

Different lenders may have different requirements in terms of credit score, but most would require the business to have been under current ownership for a certain amount of time.

The stronger the credit history, the lower the interest rate on the revolving line that the business can acquire, which is why it is extremely important to continue strengthening its credit score before applying for a revolving credit line (or really any type of loan).

After being approved for the revolving line of credit, which may or may not be secured, and depending on the size of the credit, the funds could be drawn from either a business checking account or a business credit card.

The business owners could then draw on the funds continuously, until the maximum credit limit is reached, with the requirement of making minimum monthly repayments on the principal and the interest of the debt.

It is also important to note that there are many fees associated with acquiring this kind of debt, which will be discussed later in this article.

Advantages of revolver Debt

Revolver debt has various advantages, some of them are as follows:

Funds Are Readily Available

Having access to ready funds means that businesses have much more flexibility in terms of what they want to use the funds for when the funds will be received, and whether or not they want to use the line of credit.

Addresses Issues With Cash Flow

Many businesses have the issue of uneven cash flow, and hence for certain periods, they might not have enough cash flow to cover expenses. A revolving line of credit will allow them to fix this issue by making up for the short-term cash-flow shortage and then being able to repay once cash flow levels have stabilized.

Flexibility Of Repayments

With a revolving line of credit, the lender gives the borrower a certain period of time they want the debt to be paid back, which gives the borrower flexibility of when they want to repay their debt, which is especially useful when they’re currently in a period of cash flow shortage.

Potentially Lower Interest Expense

As revolving lines of credit can be secured on assets, such as inventory and equipment, and are only used when there is a need for funds, they essentially lower the cost of utilizing credit.

Disadvantages of Revolving Line of Credit

The disadvantages of revolving line of credit are as follows:

Lower Credit Limits

As revolving lines of credit are utilized for short-term needs and no fixed tenure, the credit limit allowed is much less than that of a traditional loan. So if a business is expecting to finance a large project, it would be much better off securing a traditional loan, such as a mortgage.

Higher Interest Rates

The fluid nature of revolving debt means that a much higher interest rate is imposed on the debtor than traditional loans due to the increased credit risk. This might make a revolving line of credit less attractive due to the increased interest expense.

The Commitment Fee

A major disadvantage of using a revolving line of credit is that it generally comes with a commitment fee, which the business will be charged if they do not draw on the funds they have available.

Why use a revolving line of credit?

There are many common uses for businesses to use a revolving line of credit. Some of these uses have been outlined below.

If a business is facing a rough patch in terms of cash flow, a revolving line of credit would be a great solution for it, as the availability of the funds will allow it to stimulate cash flow into the business and then pay off what is owed in a period where there is more stable cash flow.

Because a revolving line can potentially be secured, or collateralized, against the company’s assets, it can borrow funds that are flexible and easily available to manage the day-to-day operations and to minimize its interest rate exposure, it can choose to take on a revolving line of credit that is secured against its assets, such as inventory, to decrease the credit risk to the lender.

Instead of using the firm’s cash to fund day-to-day operations, it can take on a revolving line of credit, as the interest payments would be tax-deductible, paying less overall tax and having more free cash flow (FCF) for debt holders and equity holders.

Fees associated with a revolver

The revolver is found on the Balance Sheet under Current Liabilities for borrowers.

The firm usually has to pay several fees for setting up one. Some of these fees include:

- Upfront fees

- Interest fees

- Utilization fees

- Commitment fees

An upfront fee is a fee the borrower pays equal to a certain percentage (%) of the maximum revolving credit amount at a specified time.

The interest fees refer to the cost of having a revolving credit line and being able to draw on these funds immediately. The interest rate that is charged is usually based on a benchmark interest rate, such as LIBOR, as well as a certain spread.

The utilization fee refers to a fee based on the funds that have already been used from a revolving credit line, which the borrower must pay if they do not meet the minimum monthly payment requirements.

The commitment fee refers to the fees related to the funds that are not currently being used, which is to incentivize companies to draw on the facility. The fee is charged to the borrower to compensate the lender for the risks associated with keeping a credit line open. More about the commitment fee will be discussed below.

What is a revolver commitment?

A revolver commitment is a fee imposed on the borrower and charged by the lender for keeping a revolving credit line open.

The lenders charge the fee because they provide the borrower with access to a potential revolving debt, which they have to set aside funds for the borrower, despite any market conditions, which doesn’t earn any interest.

A commitment fee is charged when a borrower, who has taken out a revolving credit line, is not utilizing the entirety of the credit available.

This imposes major risks for the lender, as they have to keep the funds available for the borrower, and are not able to charge interest on the credit that is not being used, essentially losing value.

Hence, a commitment fee helps lenders protect against the loss in time value of money (TVM) that is sitting idly.

It is important to note that it is different from interest payments. Interest is the cost of borrowing and is calculated by applying an interest rate on the funds that have already been borrowed but not repaid and is paid on a periodical basis, depending on the terms of the agreement.

However, a commitment fee is a fee charged for part of the credit line that has not been used yet, to compensate the borrower for the risks of keeping an open credit line and not being able to charge interest. In terms of debt, the commitment fee is also paid on a periodical basis.

Although the cost of the commitment fee may vary based on the lender and the amount of unused credit, generally, a commitment fee is between 0.25% and 1% of the total credit available on the revolving credit line.

The formula to calculate the commitment fee on such loans is calculated as:

Commitment Fee = Unused credit x Commitment fee rate

For a revolving credit line, the commitment fee is charged periodically for the amount of credit the borrower has not used in that period. Let us illustrate this concept with an example.

Example of a Revolver Commitment

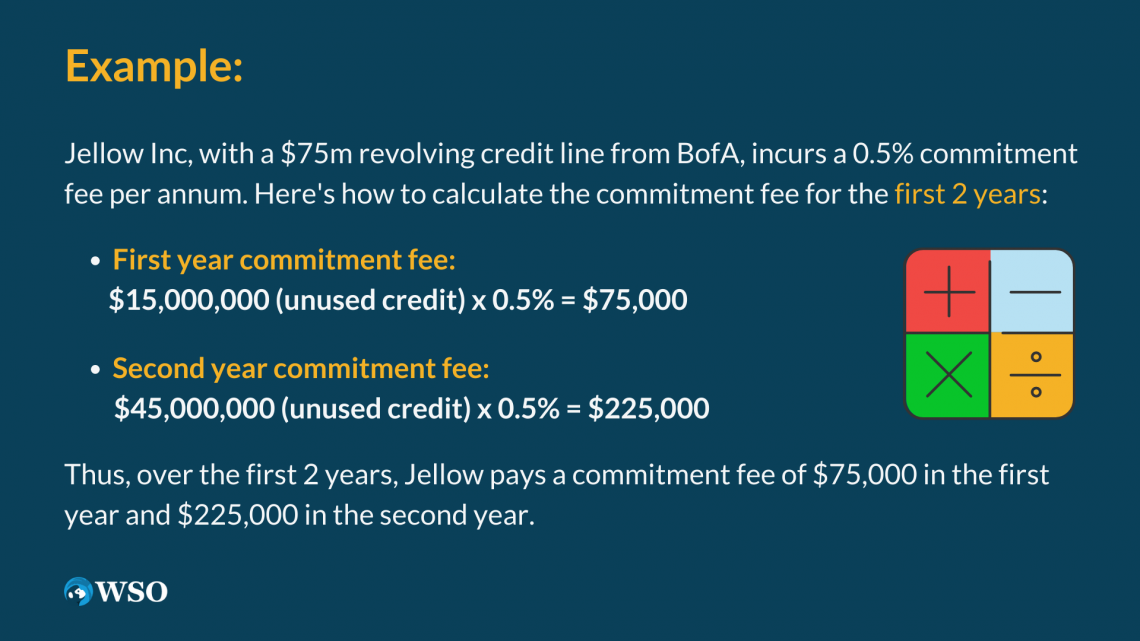

Jellow Inc. has acquired a $75m revolving credit line from the Bank of America (BofA). The terms of the agreement are that there will be a 0.5% commitment fee per annum, and this fee will be charged and paid yearly.

Jellow used $60m of the credit line in the first year and $30m of the credit line in the second year. How would we calculate the commitment fee that will be imposed in the first 2 years?

To calculate the commitment fee for the first year, we multiply the unused credit, which was $15m, by the commitment fee rate, which is 0.5%. Therefore, $15,000,0000 x 0.5% = $75,000. In the second year, the commitment fee is equal to $45,000,000 x 0.5% = $225,000.

Therefore, in the first 2 years of acquiring the revolving credit line, Jellow had to pay a commitment fee of $75,000 and $225,000 in the first and second year, respectively.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?