Auction Market

Refers to the market where trade occurs when a bid and offer match

What Is an Auction Market?

An auction market is where trade occurs when a bid and offer match. Both parties, the seller and the buyer, simultaneously submit competitive offers and bids.

The highest bid determines the price of the trade a buyer is willing to make and the lowest offer a seller is willing to accept. However, there are times when requests may not be matched.

If a bid and offer are not matched, then what happens? If there is no overlap in the offer and recommendations, a trade is pending and will not occur until that happens. Once there is a matching bid and offer, then the work is completed.

This market does not have direct communication or negotiations between the buyer and seller. Furthermore, such markets differ from other types like dealer markets or OTC (over-the-counter) markets.

Examples include the New York Stock Exchange (NYSE), NYSE American - formerly known as the American Stock Exchange (AMEX), and the London Stock Exchange (LSE), to name a few.

Key Takeaways

- An auction market for securities has many potential buyers and sellers.

- Buyers are the individuals who make bids, and sellers refer to the individuals who put out offers.

- Some examples include the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE).

- Trades on securities are executed when a bid and offer match, but until a game is found, the bid remains open.

- The highest bid determines the price of the trade a buyer is willing to make and the lowest offer a seller is willing to accept for that security.

- This market has no direct communication or negotiations between the buyer and seller.

- This market has a physical location, and no intermediary facilitates the bidding like dealers' markets.

- Governments hold auctions for securities to raise capital and finance initiatives.

- Government auctions have two types of bids -

- Competitive bids

- Non-competitive bids.

How Auction market work

These markets efficiently connect buyers and sellers, especially with technological advancements. Previously, before technology made it possible to enter an auction electronically, professionals executed trades on the floor.

Thus, before advancements, these markets were conducted through a process known as open outcry. This was a form of communication between professionals on the stock exchange, usually on the trading floor.

Here, buyers and sellers, or professionals representing them, would call out or use hand gestures to communicate information and complete trades.

The open outcry has become more of an obsolete method of trading as not many exchanges use this method anymore. Instead, many businesses opt for electronic trading, claiming it is easier, cheaper, and more efficient.

Thus, most of these markets, including the NYSE, use electronic trading.

Many traditional auctions have one seller and multiple buyers or bidders, but an auction market for securities has many potential buyers and sellers who are then matched. However, depending on the safety, there can be only one seller.

Thus, buyers input their bids, and sellers input their offers. Then, recommendations and suggestions are reviewed to see if there is a match. If a match is found, the trade will be executed. If a game is not found, the work is ongoing, and we will continue to review bids and offers until there is one.

Example of an auction

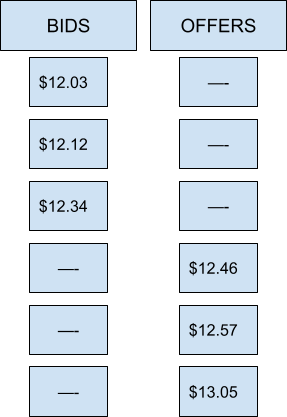

Here is a comprehensive but simple example of how bids and offers are matched. The process on stock exchanges is much more complex.

Imagine Company ABC Inc., a public company, trades shares on the New York Stock Exchange (NYSE). Currently, three buyers wish to buy shares of ABC Inc., and three sellers want to sell their shares. Thus, the buyers have placed bids, and sellers have imputed offers.

The buyers placed bids at $12.03, $12.12, and $12.34. On the other hand, sellers offered their shares at $12.46, $12.57, and $13.05. In this example, none of the bids match the offers, and no trade is executed.

Thus, those bids continue to be open until a match is found. For simplicity's sake, all three buyers' and sellers' recommendations and offers are matched the next day.

A few days later, more bids and offers were placed on shares of ABC Inc. This time there were two potential buyers and three potential sellers.

The two buyers placed bids at $12.24 and $12.40. The three sellers place their offers at $12.40, $12.44, and $13.02.

Therefore, the buyer who bid and the seller who offered shares of ABC Inc. at $12.40 will have their trades executed. This determines the price of the company.

In this example, the remaining sellers and the one buyer do not have any matches. Thus, the remaining buyers and sellers will not have their trades executed yet, and will still be pending.

Auction Market vs. Dealers Markets

There are two main differences between an auction market and a dealer's market. The first difference is that an auction market has a physical location. An example of this would be Wall Street.

Second, someone does the buying and selling in a dealer's market. Compared to an auction market, where trade occurs directly between buyers and sellers, the market maker or middleman executes the transactions in a dealer's market.

The market marker or middleman, usually known as a broker, helps create liquidity and transparency in the market. A market maker is a person or organization who deals on both sides of the transaction for given securities.

In a dealer's market, dealers get the benefit of the bid-ask spread. A bid is what the buyer offers to buy the security at, and the ask is what the seller is willing to sell that security at.

The bid-ask spread is the difference between the bid and ask prices. When the bid exceeds the ask, the broker gets the difference, thus benefiting.

Bid - Ask spread = Bid price - Ask price

Furthermore, dealers post prices for that securities can be bought and sold. A dealer's market is quote-driven, while an auction market is order-driven.

Some examples of a dealer's market are the NASDAQ (National Association of Securities and Dealer Automated Quotation System) and other over-the-counter security markets.

Dealer markets are not the same as online trading platforms like Robinhood. Robinhood would be an example of a broker.

Treasury and Government Securities Auctions

Governments also have auction markets for their securities open to the public. Here, anyone from individuals to big firms can be a buyer. Bids are submitted electronically and are into two categories depending on the person who made the bid.

When governments conduct an auction market, there are two types of bids, categorized by the type of bidder you are.

1. Non-competitive Bid

Non-competing bids are given preference and reviewed first. This is because non-competitive bidders have either a predetermined number of securities they are guaranteed or entitled to receive.

The maximum amount guaranteed to non-competitive bidders is $5 million for the US treasury. However, this amount can fluctuate depending on the government releasing the security.

Individuals or small entities make up a large portion of this bid.

2. Competitive Bid

Competitive bids, however, are reviewed once the auction period has closed. After the submissions are reviewed, the winning price will be determined, which is the price securities will be sold at.

Based on this price, securities are sold from highest to lowest until none remain.

After all of them have been sold, there will be competitive bidders who do not receive any securities.

For example, the US treasury holds security auctions to help finance government expenditures and activities.

or Want to Sign up with your social account?