Bond Pricing

A way of calculating a bond's issue price.

What is Bond Pricing?

Governments and businesses issue bonds as a type of debt when they need to raise money.

Like other types of debt, they pay interest on the principal to compensate for both the risk of lending and the time value of money on these bonds.

These installments are paid on a fixed basis and often include only interest income, with the principal repaid upon the maturity of the bond.

Investors often speculate on the value of this type of debt and buy and trade bonds incredibly often. In 2021, the bond market held a value of $119 trillion. This is even larger than the stock market, which at the end of 2020 was valued at $93.7 trillion.

Aside from its astronomical price, the bond market may be a terrific place to invest and can forecast numerous economic trends and tell us a lot about the state of a country.

On Wall Street, knowing how bonds are priced and the bond market generally is a very useful skill. A knowledgeable investor understands how to use the numerous factors that go into bond pricing to determine the bond's worth.

Key Takeaways

- Bonds are debt instruments that pay interest and are used by governments and businesses to raise money.

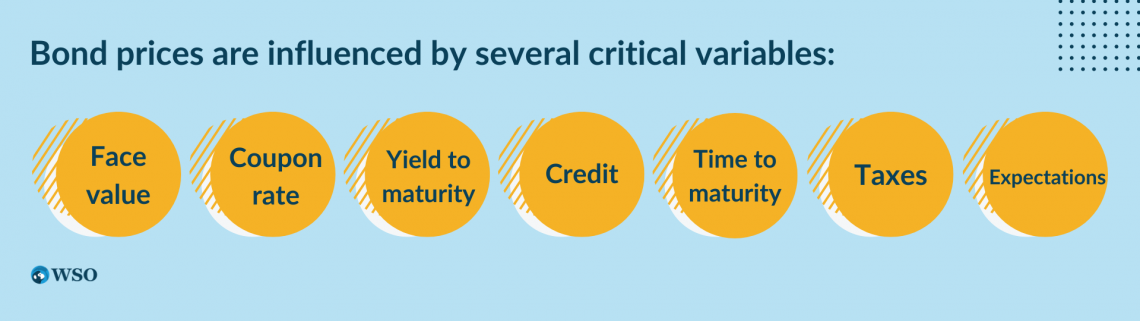

- Bond prices depend on factors like face value, coupon rate, yield to maturity, creditworthiness, time to maturity, taxes, and expectations.

- Bond valuation is essential for making informed investment decisions by calculating the bond's fair market value based on cash flows and present value.

- Callable bonds can be recalled by the issuer, while convertible bonds can be converted into equity.

- Types of bonds include Treasury, corporate, municipal, agency, and savings bonds, each with different risks and prices.

Variables in Bond Pricing

Bond prices rely on a number of variables.

These factors include:

1. Face value

The bond's price is expressed as face value, sometimes referred to as par value or principal. Depending on the various variables that influence bond prices, it might trade at a premium or a discount to the par value.

2. Coupon rate

In essence, the coupon rate is the amount of interest that is paid on the bond as a proportion of its par value.

Note

Bonds are viewed as fixed income since their value is constant, notwithstanding the possibility that other components are not.

3. Yield to maturity

The yield to maturity is the Internal Rate of Return (IRR) of the returns that the bond produces. As interest rates fluctuate, bond prices fluctuate inversely to produce a yield to maturity that is in line with the market rate.

4. Credit

The price of a bond is significantly influenced by the creditworthiness of the entity issuing it. For example, governments and corporations also issue bonds, and the yield on the bond will vary depending on how reliable the debtor is.

Because they do not have to repay the lender for the same level of risk, the more reliable an organization is, the lower return it can afford to pay.

In other words, because investors are more certain that they will get their money back, they will purchase bonds with lower returns, and institutions will only charge as much interest as necessary to raise debt.

5. Time to maturity

Another element that impacts the price of bonds is time to maturity. The cost of the bond increases as the remaining time to maturity decreases. This is because holding a bond for a longer length of time entails greater risk because the debtor may experience financial difficulties during that time.

As a result, long-term bonds are riskier than short-term bonds.

Note

On a yield curve, the yield at particular maturities can be observed.

6. Taxes

Taxes are also taken into account. However, depending on the type of the bond, the interest income may be exempt from federal taxes, state taxes, or both. This reduces the interest rate paid on these bonds or raises their price.

7. Expectations

Expectations are the final piece of the puzzle. As a result, expectations play a big role in the price of a bond, as investors will invest in what they are predicting rather than what has already happened.

Bond prices, for instance, will react to events before they really occur, such as when many investors anticipate rising inflation or a Federal Reserve interest rate increase.

Because the earlier you're right, the more money you can make, investors try to place their bets before other investors.

How to Price a Bond?

Bonds are a crucial component of the world financial system, providing investors with a comparatively low-risk alternative to equities and other assets like commodities while also providing businesses and governments with a simple means of borrowing funds.

Financial institutions, analysts, or individual investors must be able to determine a bond's fair value to decide whether it is a good investment. An informed investment decision would be nearly impossible to make without this knowledge.

Establishing a bond's fair market value, or "value," is the process of bond valuation.

This usually involves figuring out the bond's cash flow, the present value of its future interest payments, and its face value, or par value, which refers to the bond's worth when it matures.

A few terminologies that can assist in bond valuation include:

This is the interest payment that an investor receives on his investment. It's often expressed as a set portion of the bond's face value.

Depending on the details of the bond, payments may be made annually or semi-annually.

2. Maturity

This is the time frame for when the principal of the bond is expected to be paid back to the bondholder. The maturity date may be immediate or distant.

The bond issuer—whether corporate or government—must pay the bondholder its whole face value after the deadline.

3. The current price

Whenever the term "bond valuation" is used, it usually refers to the bond's current value. The price of a bond at the moment may be equal to, greater than, or less than its par value depending on a variety of variables, including market conditions.

The equation for valuing a bond can be found below:

Bond Price = CF1 / (1 + r)T1 + CF2 / (1 + r)T2 + CFn / (1 + r)Tn

where,

- CF = future cash flows

- T = year

- r = yield to maturity/market interest rate

- n = number of years

Example of bond pricing

It may be easier to understand bond pricing with an example.

Imagine a scenario where you are looking for a bond to purchase but wondering if it’s a fair price. The market interest rate is 6% for 10-year bonds in this market. Now imagine the following bond:

- Face value of the bond = $100

- Coupon = 5%

- Semi-annual interest payments

- Price = 85.87

- Yield spread = 100 basis points

Bond prices are typically stated as a percentage of their face value. The handle is the whole number part of the percentage. In this example, the handle is 85, and we can tell that the bond is being sold at 85.87% of its face value.

We can find the yield to maturity based on the market rate and the yield spread. The yield spread represents the credit of the issuer in comparison to Treasury bonds.

In this scenario, Treasury bonds have an interest rate of 6%, and the issuer of the bond we are looking to purchase has a yield spread of 100 basis points or 1%. This means that the fair yield to maturity should be 7% (6% + 1%).

First, let’s find out what the coupon payment is:

Coupon Payment = (0.05 / 2) * 100 = $2.50

In this calculation, the coupon rate is divided by 2 to represent the semi-annual coupon, and this is multiplied by the face value of the bond. The coupon payment comes out to $2.50.

To find this, we can discount all the coupon payments amounting to $2.50 twice per year, along with the $100 repayment of principal at the bond’s maturity date by a discount rate of 7%.

The formula for doing this can be found below:

Bond Price = 2.50 / (1.07)0.5 + 2.50 / (1.07)1 + … 2.50 / (1.07)9.5 + 102.50 / (1.07)10 = 86.56

The last payment, which totals $102.50, covers the principal repayment in full and the interest payment.

The equation above shows that the maximum price you should be prepared to pay for this bond is $86.56, which is the sum of the discounted cash flows.

Now let’s compare this theoretical bond price to what the bond is being sold for.

Seeing as the price for the bond is 85.87, and we calculated the intrinsic value of the bond to have a price of 86.56, it appears that the market thinks the bond carries greater credit risk than we calculated.

According to our analysis, the bond is actually being sold at a discount. Therefore, it would be a great idea to purchase the bond.

Callable Bonds Pricing

Callable bonds are a type of bond that allows the issuer to recall the bond before its maturity. Typically these have higher interest rates, although they provide less security and information for the investor.

It is a fixed-rate instrument with the option for the issuing business to return the security's face value at a predetermined price before the bond matures.

A bond's issuer simply has the right to call the bond before it is issued; he is not required to buy back the security. Bonds are typically issued by businesses and governments to raise funds that are then applied to specific initiatives or expansions.

In exchange for the issuer's/assurance that they would pay interest on the bond and the principal amount when the bond reaches maturity, the bond buyer is obligated to pay the bond's principal.

Callable bonds may be subject to different conditions. For example, many callable bonds have a grace period when they are unable to be recalled. However, certain conditions must be met before the bond is recalled in other situations.

To value this type of bond, investors find the value of the bond as though it were a straight bond and then subtract the price of the option to call. The formula looks like this:

Callable Bond Price = Straight Bond Price - Call Option Price.

The price of the call option depends on the terms of the specific callable bond.

Convertible Bonds Pricing

Bonds that have the potential to be converted into equity are known as convertible bonds. Although these bonds often have lower interest rates, the ability to convert them into equity can be quite valuable to investors.

A hybrid debt product with elements of both equity and debt is a convertible bond. This bond allows the buyer the option to convert it into equity shares of the issuing business or the obligation to do so.

The offer document contains predefined quantities and share prices at the time of issuance. Additionally, the bondholder becomes a shareholder in the issuing corporation if these bonds are converted into stocks.

An investor may convert a bond into stock during the bond's term. This bond resembles a typical corporate bond in other ways. Additionally, it provides periodic interest payments with a fixed duration at predetermined intervals.

It might be quite difficult to value these bonds. However, due to the stock's close relationship to the equity of the company issuing the bond, investors must accurately predict the stock's future value.

Investors value these bonds as straight bonds, and their market value is then calculated by adding the predicted discounted value of the equity to this price.

The equation is as follows:

Convertible Bond Price = Straight Bond Price + Convertible Equity Value.

Types of Bonds

Various types of bonds exist at different levels of risk and at different prices that one can purchase.

The most common types of bonds typically include :

- Treasury bonds

- Corporate bonds

- Municipal bonds

- Agency bonds

- Savings bonds

1. Treasury bonds

Government-issued debt securities include Treasury bonds. Buying a bond at a fixed interest rate is essentially lending money to the government. The government will repay you with a fixed interest rate over a predetermined period of time.

You are then paid back the face value of the bond when the loan reaches its maturity date.

Since the government backs them, Treasury bonds provide a far lower risk than other investment vehicles. The strength of the national currency, the rate of inflation, and interest rates are all factors that are reflected in their prices.

2. Corporate bonds

By purchasing corporate bonds, investors are making a loan to the corporation issuing the bond. In exchange, the business agrees in writing to pay interest on the principal when the bond matures and, in most situations, to return the principal.

The U.S. bond market, which is regarded as the largest securities market in the world, includes corporate bonds as one of its major subsectors.

The interest rate these bonds offer is based on the credit of the company issuing them and the interest rate that Treasury bonds offer.

Note

Corporate bonds are subject to both federal and state taxes

3. Municipal bonds

These bonds, sometimes known as "munis," are debt instruments that are issued by local, state, and federal governments.

Municipal bonds are used to finance ongoing costs such as sewage treatment systems, construction projects, and road development.

When you purchase one of these bonds, just like any other bond, you usually are giving money to the bond's issuer in return for recurring interest payments. At expiration, the principal amount is also refunded.

4. Agency bonds

Bonds known as "agency bonds" are those that are issued or backed by a federal agency or a government-sponsored enterprise (GSE).

Investing in agency bonds, or “agencies,” can aid with diversification that delivers tax advantages. It can be easier to make a decision about whether to incorporate agency bonds in your portfolio if you are aware of how they operate and their benefits and drawbacks.

5. Savings bonds

The US Department of Treasury issues savings bonds, which typically help the federal government meet its borrowing requirements.

These bonds are also usually considered a very safe investment as a government would not typically default on its debt obligation. However, financial institutions have not issued savings bonds since January 1, 2012.

Two different types of savings bonds can be bought online. However, according to the regulations, an individual can only invest up to $20,000 in a single calendar year or just a maximum of $10,000 in each series.

or Want to Sign up with your social account?